Investor Perception

Trigg Minerals is well-positioned to grow to be a globally important provider of antimony, a essential mineral important to the protection, clear power and semiconductor sectors. Backed by a strategic focus, a supportive jurisdiction, and timing that aligns with macroeconomic urgency, Trigg is uniquely positioned to ship worth from the bottom up.

Overview

Trigg Minerals (ASX:TMG,OTCQB:TMGLF) is an rising chief within the world essential minerals house, centered completely on the event of antimony—a steel designated as important by america, Australia and the European Union for its position in nationwide protection, power transition applied sciences, and superior industrial functions. The corporate’s flagship asset, the Wild Cattle Creek deposit throughout the Achilles antimony challenge in New South Wales, is the highest-grade undeveloped antimony useful resource in Australia and one of many few large-scale, standalone antimony initiatives globally. As geopolitical and industrial dynamics shift, Trigg Minerals is uniquely positioned to supply a safe, sovereign supply of antimony to Western markets, amid a unbroken world provide crunch.

In 2024, China—liable for 83 p.c of worldwide manufacturing—imposed an entire export ban on antimony merchandise to the US, following earlier restrictions on powdered kinds. Mixed with sanctions on Russian producers and the depletion of strategic stockpiles throughout NATO and allied nations, these developments have triggered a extreme world provide scarcity. Spot costs have surged to over US$51,000 per tonne—greater than double their 2023 common—underscoring the pressing want for various sources.

Antimony spans a variety of functions. It’s a essential part in flame retardants, semiconductors, night time imaginative and prescient optics, army alloys, photo voltaic panel coatings, and battery applied sciences. Demand is accelerating, notably within the protection and renewable power sectors, with a projected CAGR of 6.1 p.c. Nevertheless, viable new provide is extraordinarily restricted exterior of China and its allies, presenting a once-in-a-generation alternative for firms like Trigg to fill the hole and anchor Western essential mineral provide chains.

Trigg’s development technique is constructed round three key factors. First, the corporate is advancing a high-impact useful resource enlargement program at Wild Cattle Creek, aiming to extend its present JORC-compliant useful resource of 1.52 million tons (Mt) @ 1.97 p.c antimony for 29,902 tonnes contained steel to greater than 100,000 tonnes—probably making it one of many prime three antimony deposits on the planet. Second, Trigg is capitalizing on the structural shift in world provide chains. With a Tier-1 jurisdiction, ESG-aligned operations, and backing from authorities incentives, the corporate is ideally positioned to serve downstream processors and strategic consumers, notably within the U.S. and allied nations in search of to scale back reliance on Chinese language-controlled provide. Third, Trigg is sustaining disciplined and centered execution. Over 90 p.c of capital and operational assets are allotted to advancing Wild Cattle Creek, guaranteeing near-term worth creation.

Firm Highlights

- Trigg Minerals is an ASX-listed firm completely centered on antimony, a essential mineral important for photo voltaic panels, flame retardants, semiconductors and army functions.

- The flagship Achilles challenge’s Wild Cattle Creek deposit hosts a high-grade JORC useful resource of 1.52 Mt @ 1.97 p.c antimony for ~30,000 tonnes contained antimony—Australia’s highest-grade undeveloped antimony deposit.

- The corporate’s aggressive enlargement plan features a near-term drilling program focusing on a threefold improve in contained antimony to over 100,000 tonnes, positioning Trigg among the many prime three antimony deposits globally.

- Trigg is attracting rising consideration as a possible associate to assist Western antimony provide chains amid rising demand and geopolitical pressure.

- Working in New South Wales—a Tier 1 jurisdiction—Trigg advantages from authorities incentives, together with co-investment, exploration assist and deferred royalty schemes.

- China controls 83 p.c of worldwide antimony manufacturing and not too long ago banned exports to the US, making a strategic opening for Western suppliers like Trigg.

Key Undertaking

Achilles Antimony Undertaking – Wild Cattle Creek Deposit

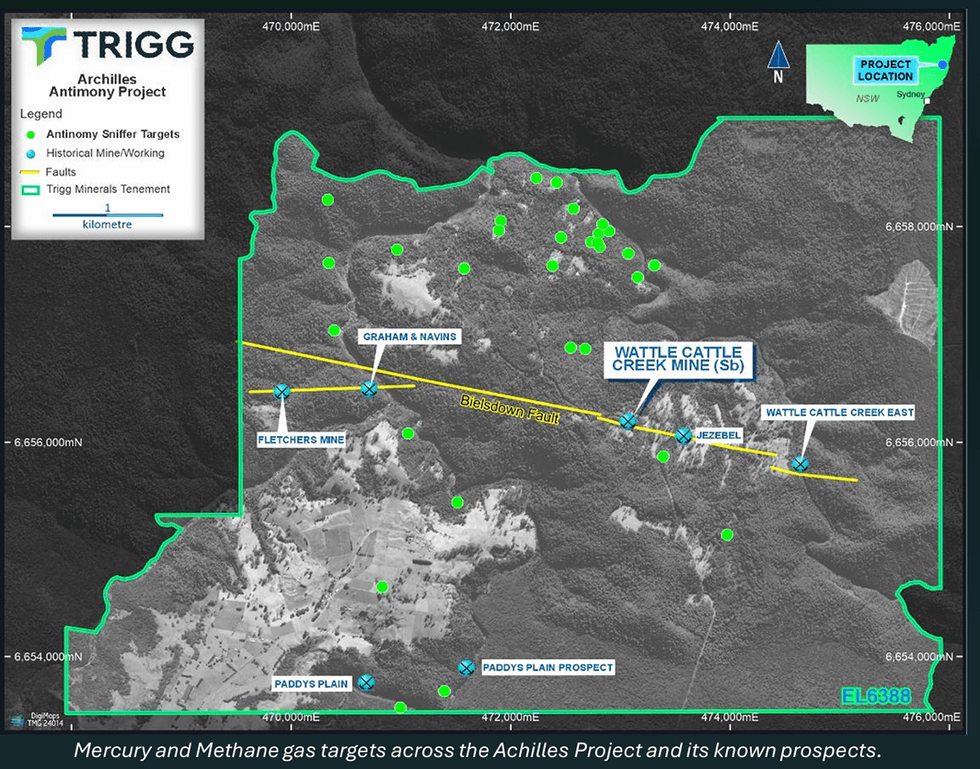

Trigg Minerals’ flagship asset is the Wild Cattle Creek (WCC) deposit, positioned inside its Achilles antimony challenge in northern New South Wales. Internet hosting a JORC 2012-compliant mineral useful resource of 1.52 Mt @ 1.97 p.c antimony for 29,902 tonnes of contained steel, WCC is Australia’s highest-grade undeveloped antimony useful resource and among the many most important globally. The deposit lies alongside the Bielsdown Fault, a 6 km underexplored mineralised hall throughout the New England Orogen—a prolific metallogenic belt.

Geologically, the deposit is hosted in a steeply dipping, silicified breccia lode bounded by metasedimentary rocks. The high-grade core (>2 p.c antimony) extends 350 metres down plunge, is uncovered at floor, and maintains a mean true width of ~20 metres—ultimate for future underground bulk mining. The present mineral useful resource estimate is conservative, centered on cemented breccia zones, however upcoming drilling will embody the broader tungsten-antimony stockwork and disseminated stibnite-bearing mineralisation, probably widening the mining envelope to greater than 15 metres. The system can also be enriched in tungsten, mercury and gold, with 30 regional gasoline and geochemical targets recognized. Historic hits akin to 1.3 m @ 11.8 p.c antimony on the Jezebel prospect underscore the broader potential.

Trigg’s near-term technique is straightforward and high-impact: safe land entry, provoke an aggressive drilling program, and develop the antimony useful resource to greater than 100,000 tonnes. Drilling contracts are in place, goal zones have been outlined, and land entry negotiations are nearing completion, with execution anticipated in mid-2025. With China’s dominance being actively challenged by the West, Trigg presents well timed, scalable publicity to a essential mineral that’s scarce in nature and more and more strategic.

Different Tasks

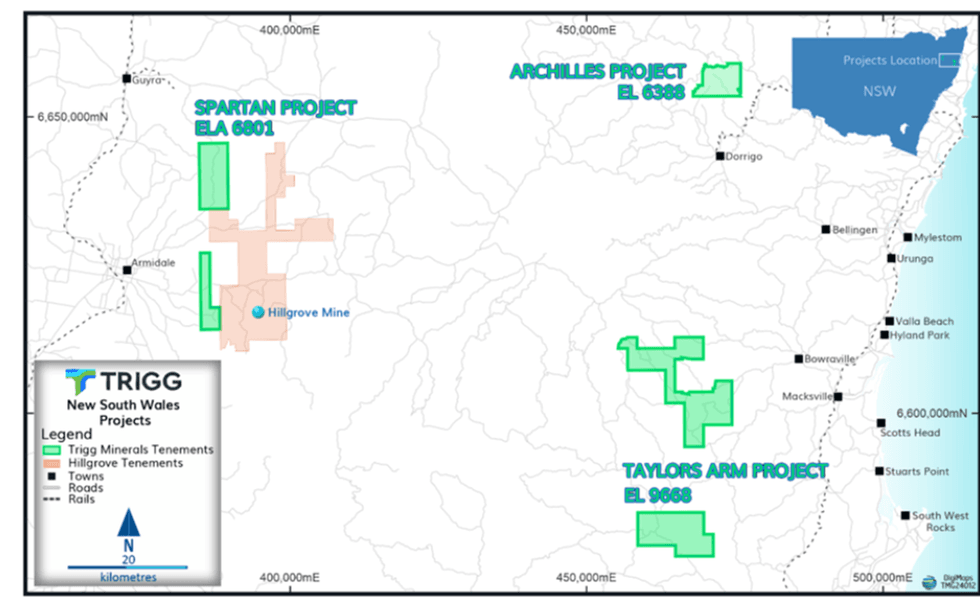

Taylors Arm Antimony Undertaking

Taylors Arm is a high-grade antimony district with greater than 80 historic workings throughout seven identified mining camps. Samples have returned grades of greater than 50 p.c antimony, together with 63 p.c on the Testers Mine—the best antimony assay on report in Australia. The challenge additionally hosts silver grades greater than 840 grams per ton (g/t0 and gold as much as 24 g/t, indicating a polymetallic system with robust exploration upside. Trigg is conducting early-stage work to refine targets for follow-up drilling.

Spartan Antimony Undertaking

Situated adjoining to the Hillgrove antimony-gold operation (Australia’s largest identified antimony deposit), Spartan is strategically located alongside the Hillgrove Fault and shares geological traits with the adjoining high-grade system. Early exploration has confirmed structural continuity and polymetallic potential, notably for stibnite-gold veining. Spartan enhances Trigg’s core challenge with near-mine development alternatives.

New Undertaking Areas – Nundle, Higher Hunter, Cobark/Copeland

Trigg not too long ago secured new exploration tenements throughout the Nundle, Higher Hunter, and Cobark/Copeland areas, all extremely potential for gold-antimony mineralisation. These initiatives, positioned inside structurally advanced terrains analogous to Achilles, will likely be progressively superior as a part of Trigg’s long-term challenge pipeline technique.

Administration Group

Timothy Morrison – Government Chairman

Tim Morrison is a extremely skilled government within the Australian useful resource and capital markets sector. With a background in legislation and funding banking, Morrison has held senior roles in each personal and public useful resource firms, together with these centered on essential minerals, base metals, and power. His management at Trigg is outlined by a transparent strategic focus: unlock worth from the Wild Cattle Creek deposit and place the corporate as a cornerstone within the world antimony provide chain. Morrison brings in depth expertise in stakeholder engagement, challenge financing, and authorities relations, having beforehand led funding rounds, IPOs, and main challenge negotiations throughout a number of jurisdictions. His imaginative and prescient for Trigg is underpinned by a disciplined development technique and sovereign provide positioning.

Jonathan King – Technical Director

Jonathan King is a seasoned geologist with over 20 years of expertise in mineral exploration and useful resource growth. He has labored throughout a broad vary of commodities together with antimony, gold, copper, and uncommon earths, and has been instrumental in main exploration groups throughout Australia, Southeast Asia and Africa. At Trigg, King is liable for designing and executing the corporate’s exploration applications, together with the upcoming high-impact drill marketing campaign at Wild Cattle Creek. His technical management ensures that useful resource enlargement is pushed by rigorous geoscientific methodology, with a concentrate on unlocking district-scale potential throughout the broader Achilles challenge space.

Andre Booyzen – Non-executive Director

Andre Booyzen is an skilled mine operator and chief and has 25+ years of expertise in operational, senior and government roles, and is a specialist in antimony mining. He brings in depth expertise in mine growth, operational technique, and off-take agreements. Booyzen beforehand served vice-president of Mandalay Sources (TSX:MND, OTCQB:MNDJF), the place he had full strategic and operational management together with product gross sales, off takes and funding negotiations on the Costerfield gold-antimony mine in Victoria, presently Australia’s solely producer of antimony focus. Booyzen additionally served on the board of the Minerals Council of Australia (Victoria) for greater than 5 years and was chairman for 3 of these.

Bishoy Habib – Non-executive Director

Bishoy Habib holds a Bachelor’s in Utilized Science (Software program Eng) and has been a world investor for greater than a decade, with a selected focus within the assets sector. He’s a professional and skilled chief, with over 15 years’ challenge supply and administration expertise in massive multinational organisations. Habib has a robust understanding of the assets sector, with entry to a wide-reaching community and challenge supply experience throughout Africa, the Center East, Europe and South America.

Nicholas Katris – Non-executive Director and Firm Secretary

Nicholas Katris has over 15 years of expertise in company advisory and public firm administration, having begun his profession as a chartered accountant. He has been actively concerned within the monetary administration of public firms throughout the mineral and assets sector, holding roles on each the board and government administration groups. His experience spans the development and growth of mineral useful resource belongings, in addition to enterprise growth. All through his profession, Katris has labored throughout Australia, Africa, Brazil and Canada, gaining in depth expertise in monetary reporting, capital elevating, and treasury administration for useful resource firms. He presently serves as firm secretary for Leeuwin Metals (ASX:LM1) and Perpetual Sources (ASX:PEC).