gopixa

The next knowledge is derived from buying and selling exercise on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

European-Listed ETFs

Whole traded quantity

Buying and selling exercise on the Tradeweb European ETF market reached EUR 52.4 billion in October, whereas the proportion of transactions processed through Tradeweb’s Automated Clever Execution (AiEX) instrument was 83%.

Adam Gould, head of equities at Tradeweb, mentioned: “Institutional ETF volumes had been up 21% year-over-year in Europe, and purchasers are persevering with to see the worth in utilizing AiEX to execute their tickets. Market-on-close in competitors continues to realize traction as a buying and selling protocol with a document variety of purchasers using this providing. We now have additionally seen a rise in buying and selling exercise throughout mounted earnings ETFs, which is interlinked with the expansion of portfolio buying and selling.”

Quantity breakdown

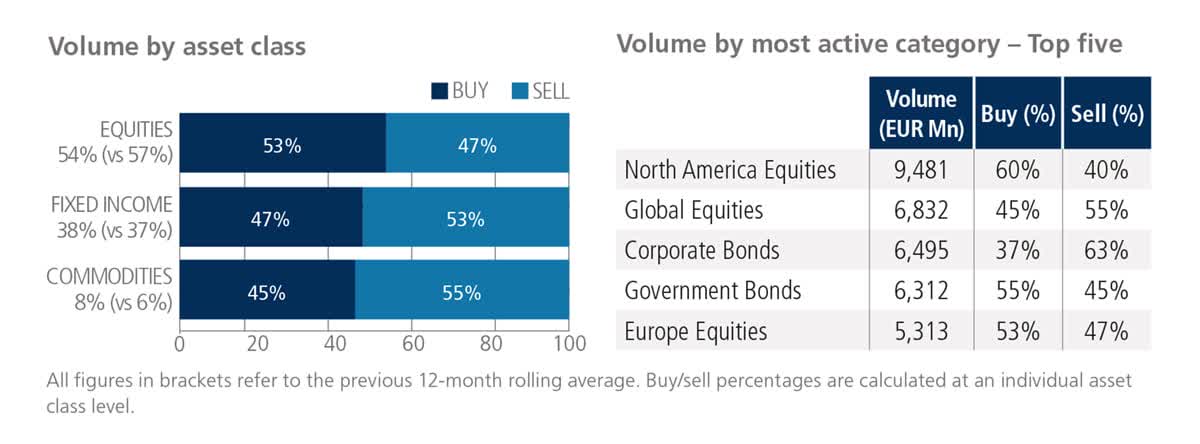

In October, the one ETF asset class to see web shopping for was equities. Conversely, ‘buys’ in commodities and glued earnings merchandise lagged ‘sells’ by 10 and 6 share factors, respectively.

The proportion of buying and selling exercise in bond-based ETFs elevated to 38% of the general platform movement, in comparison with 33% in September.

North America Equities had been as soon as once more probably the most heavily-traded ETF class, with EUR 9.5 billion in whole notional quantity, of which 60% was attributed to ‘buys’.

High ten by traded notional quantity

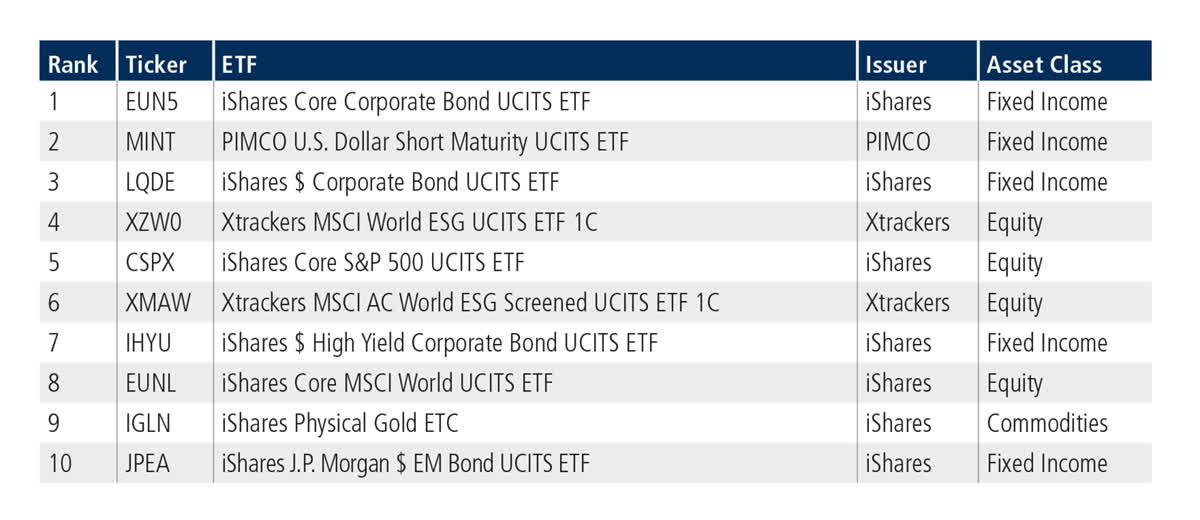

Mounted earnings merchandise occupied the highest three locations for October. The iShares Core Company Bond UCITS ETF was ranked first for the primary time since July 2023. September’s high positioned fund, the iShares $ Company Bond UCITS ETF, fell two locations to the third spot.

U.S.-Listed ETFs

Whole traded quantity

Whole consolidated U.S. ETF notional worth traded in October amounted to a document USD 71.1 billion, beating the platform’s earlier greatest efficiency in March 2023 by USD 3.8 billion.

Adam Gould, head of equities at Tradeweb, mentioned: “Traditionally, October is a busy buying and selling month and this 12 months was no exception, with institutional notional volumes on our U.S. ETF platform rising 10% year-over-year. A variety of cash managers repositioned portfolios, expressed tactical views and optimized tax administration methods on the again of extraordinarily unstable fairness and charges markets.”

Quantity breakdown

As a share of whole notional worth, equities accounted for 53% and glued earnings for 41%, with the rest comprising commodity and specialty ETFs.

High ten by traded notional quantity

Seven of the highest ten ETFs by traded notional quantity had been mounted income-based. The SPDR Bloomberg 1-3 Month T-Invoice ETF jumped one place up from September to take October’s high spot.

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.