- Bitcoin, at press time, recorded features of just about 11% on the weekly charts

- Analysts are eyeing $64,300 after a attainable breakout from $61,625

Bitcoin [BTC] has defied market expectations and historic patterns to show September blue. In reality, on the time of writing, BTC was buying and selling at $60,164. This marked a 3.94% hike on the each day charts and features of 10.96% on the weekly charts.

Prior to those features, nonetheless, BTC was on a downward trajectory, with the crypto remaining beneath $60k since 29 August. And but, regardless of this uptick, BTC stays over 18% beneath its ATH of $73,937 from March.

Evidently, Bitcoin defying historical past to see inexperienced in September has many analysts speaking. Ali Martinez is one in all them, with the favored analyst now claiming that BTC will hit $64,300 citing lively addresses.

What does market sentiment say?

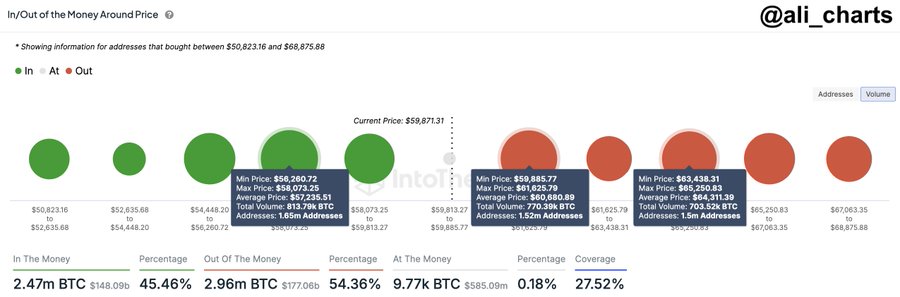

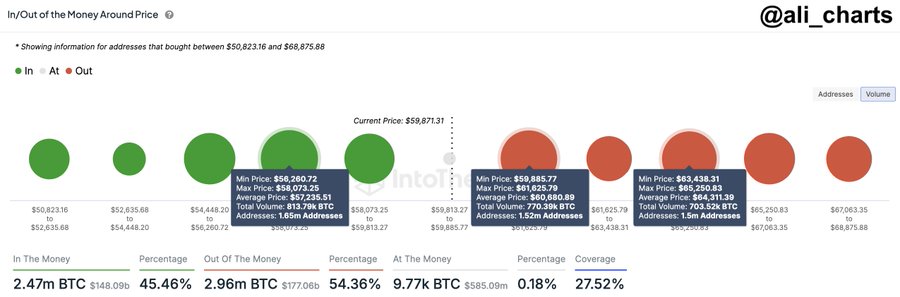

In his evaluation, Martinez cited the present 1.52 million addresses holding over 770,000 BTC at a variety between $59,885 and $61,625.

Supply: X

In context, this vary represents a resistance zone, one implying it’s the space the place many holders may select to promote and take earnings. When an enormous variety of addresses maintain property at particular value ranges, these ranges flip into resistances. It is because holders could determine to promote when the worth approaches the vary the place they purchased. Such market conduct could lead to promoting stress, which slows upward momentum.

Nevertheless, in response to the analyst, if the crypto surpasses the $61,625 resistance stage, it’ll see additional features. This might point out that any promoting stress at this stage could be absorbed, paving the best way for additional value features. On this case, the following stage shall be $64,300.

Consequently, if the worth fails to interrupt above this resistance zone and stays beneath $61,625, it might trigger a pullback. This short-term downward motion might have BTC retrace to $57,235 earlier than making an attempt one other transfer north.

What do the charts say?

Since closing on decrease lows on 7 September, BTC has famous a powerful upswing. Though the 1.52 million addresses highlighted by Martinez could determine to promote, the prevailing market situations might enable BTC to register extra features on the worth charts.

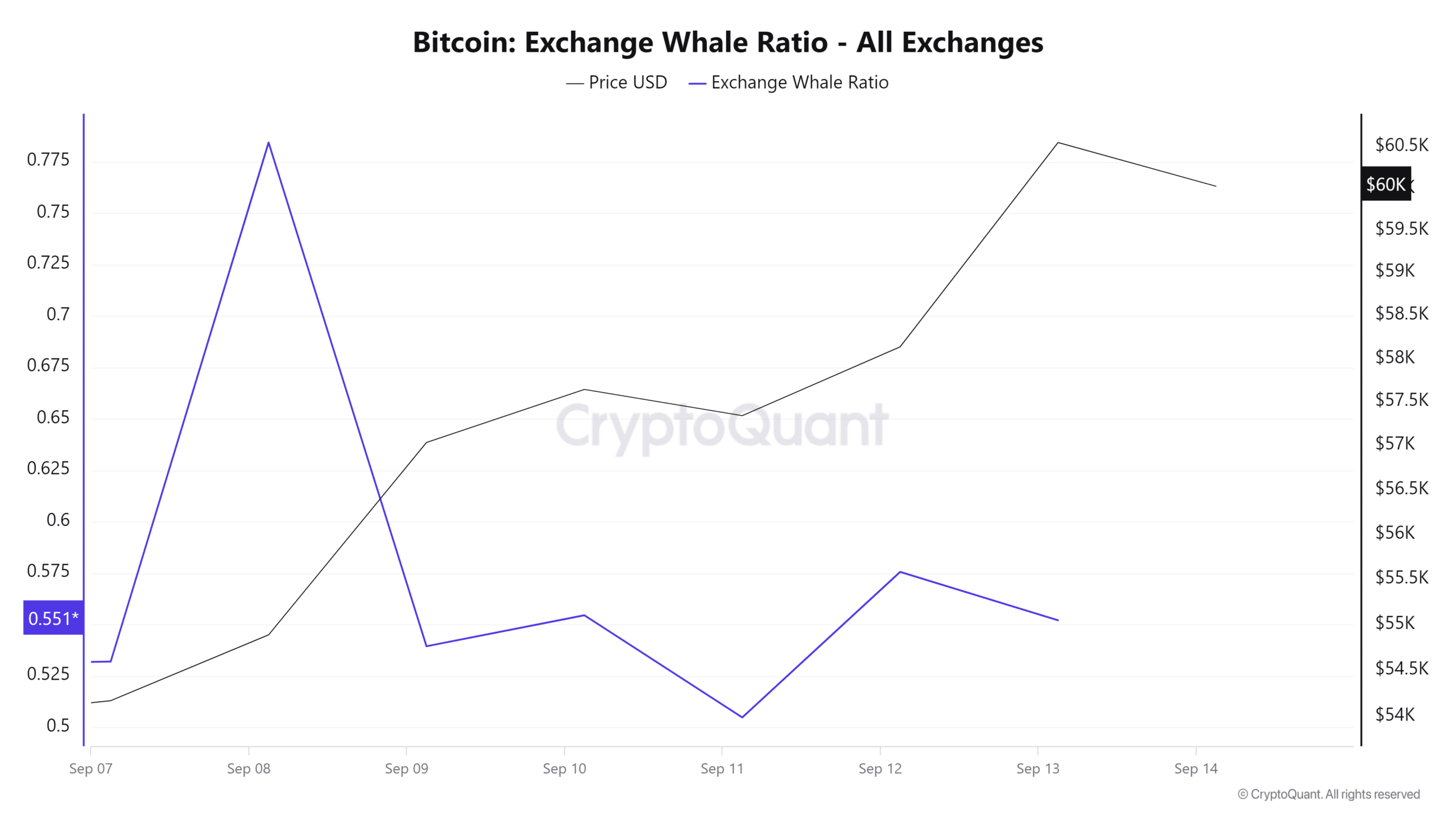

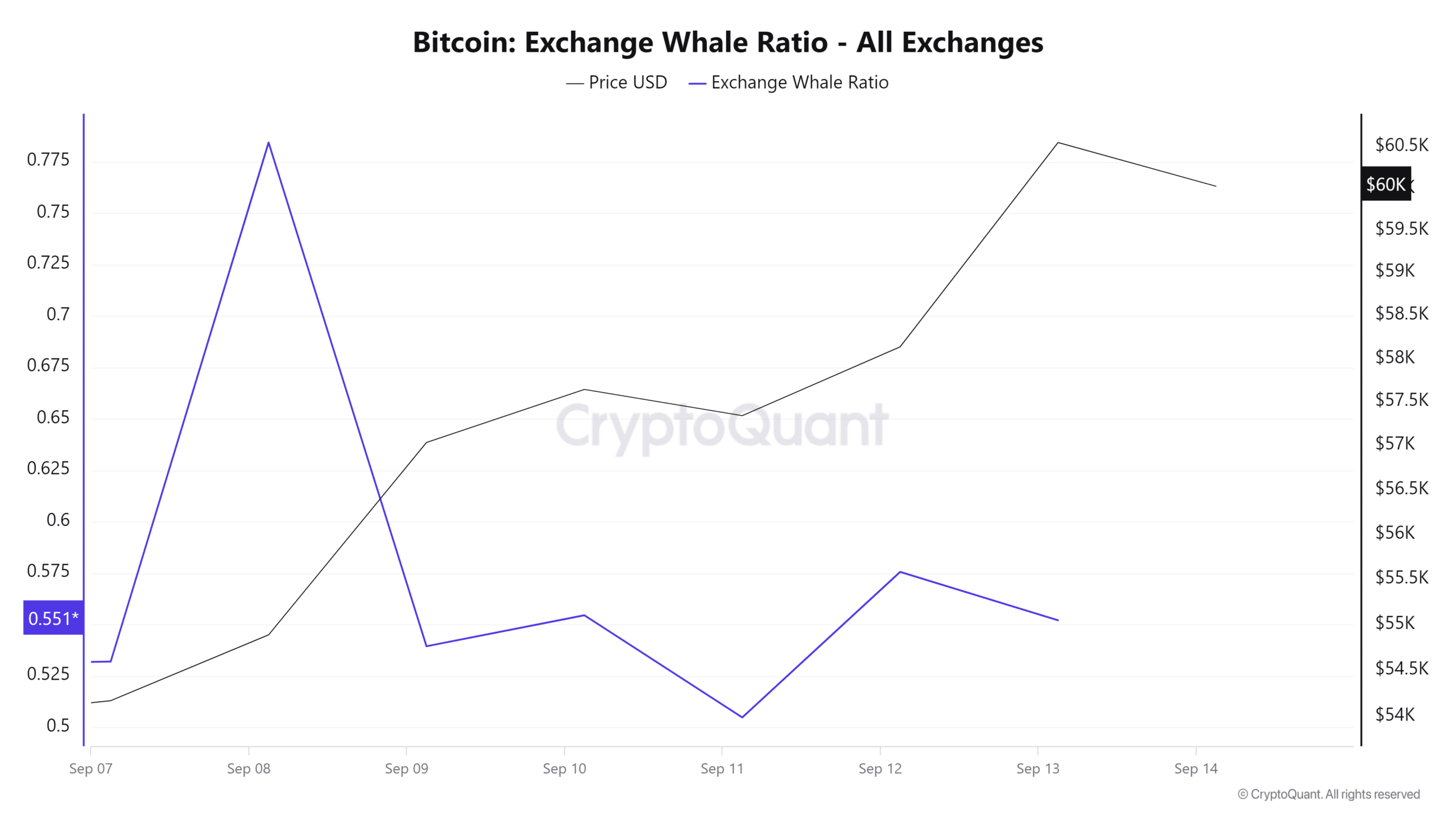

Supply: Cryptoquant

For instance, the trade whale ratio declined from 0.7 to 0.5, suggesting massive holders usually are not making ready to promote within the quick time period.

This decline signifies that whales are holding their property in non-public wallets. Such market conduct is an indication of a long-term bullish outlook from whales, particularly as they anticipate additional value features.

Supply: CryptoQuant

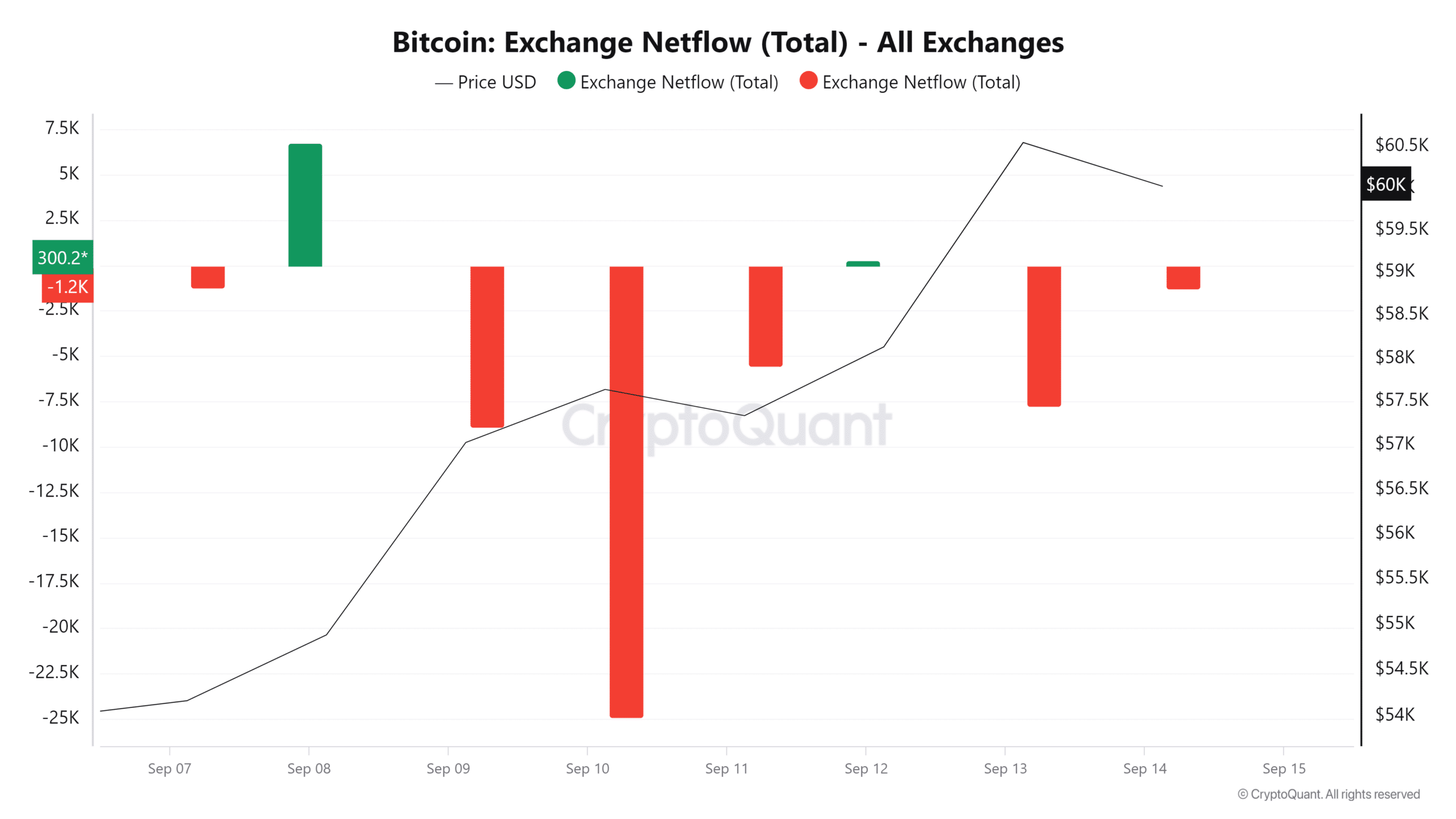

Moreover, Bitcoin’s trade netflows have been largely damaging since 9 September.

Adverse netflows counsel buyers are withdrawing their property from exchanges to retailer them in chilly wallets. That is one other bullish sign as a result of it signifies that holders haven’t any speedy intention to promote. By doing so, they’re lowering provide on exchanges, precipitating a northbound transfer.

Supply: CryptoQuant

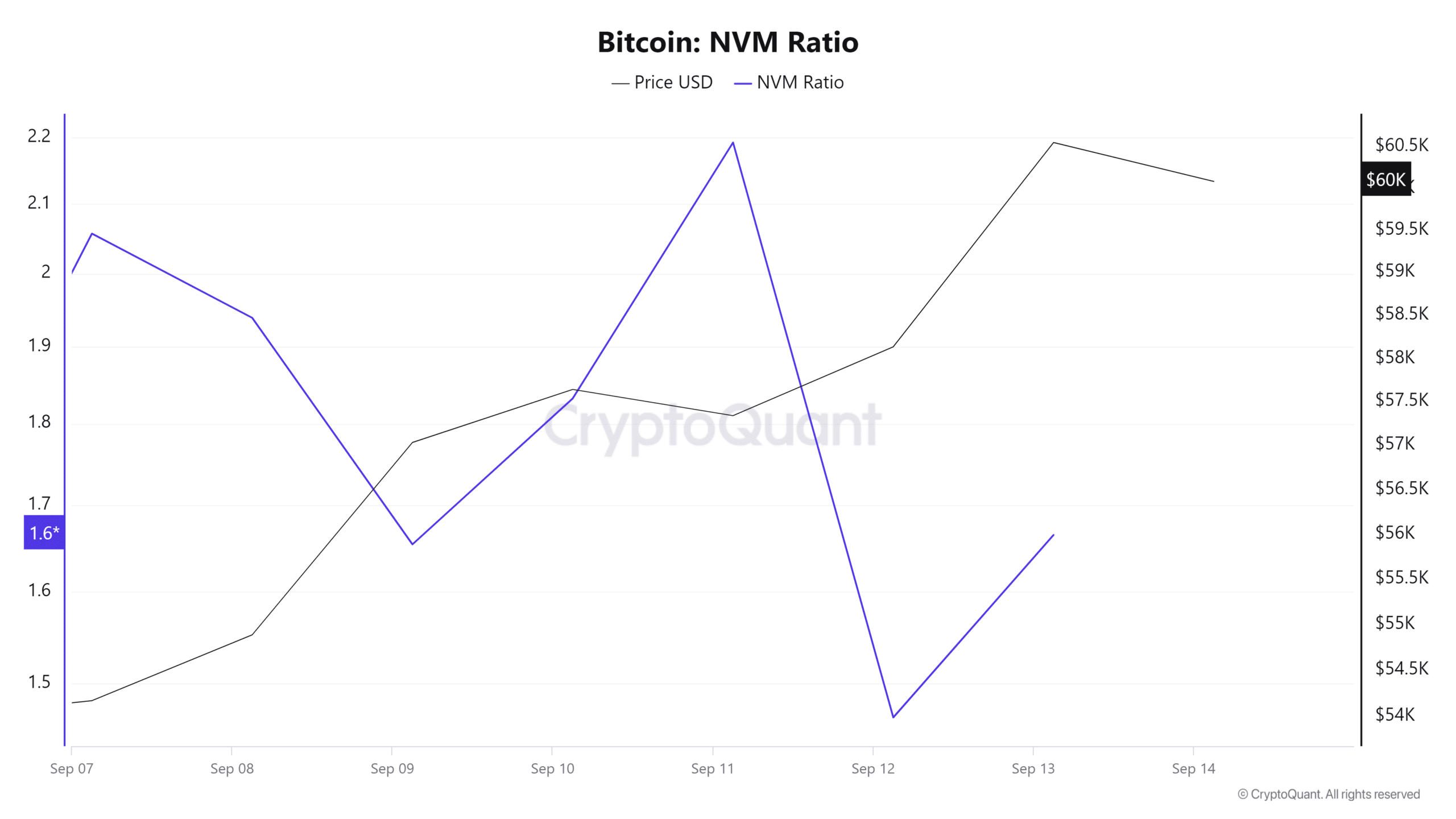

Lastly, Bitcoin’s NVM ratio has been declining – One other bullish sign because it implied the strengthening of community fundamentals.

Now, whereas the community is strengthening itself, the market is but to completely value the expansion. This might imply accumulation in anticipation of a value rally.

In mild of its optimistic market sentiment, if these market situations maintain, Bitcoin will problem the $64,300 resistance stage.