The Solana blockchain is dwelling to a whole lot of decentralized purposes (dApp) that leverage the blockchain’s excessive throughput, scalability, and composability.

There’s a cause it’s one of many largest DeFi ecosystems, with billions in whole worth locked.

Decentralized exchanges (DEXs) underpin this bustling neighborhood and account for the lion’s share of the TVL on Solana. They supply customers with the mandatory instruments to commerce on-chain, swap between totally different tokens, provide liquidity, and rather more.

Within the following, we try to offer complete info on the very best Solana DEXs, together with necessary details about their protocols, but additionally:

- Key options

- Buying and selling charges: important element when buying and selling on-chain

- Supported self-custody wallets and extra

Solana has a number of features that make it a super chain for DEXs. It has given start to among the best-known decentralized buying and selling platforms, not simply inside its personal ecosystem however throughout the complete trade.

Fast Navigation

- Ought to You Commerce on a DEX?

- Benefits of Decentralized Exchanges

- Disadvantages of Decentralized Exchanges

- Comparability of the High Solana DEXs

- High 5 Finest Solana DEXs

- Jupiter: Most Common Solana DEX

- Raydium: Veteran Solana DEX

- Drift Protocol

- Orca

- Zeta Markets

- Future Outlook for Solana DEXs

- Is Buying and selling on DEXs Protected?

- Continuously Requested Questions

- Finest Solana DEXs – Ultimate Ideas

Ought to You Commerce on a DEX?

Decentralized exchanges (DEXs) provide a number of benefits over conventional exchanges, like enhanced privateness and autonomy, in addition to entry to a broader vary of tokens.

Not like centralized exchanges (CEXs), DEXs are non-custodial and don’t must individually confirm tokens for compliance with rules earlier than itemizing them. This implies you possibly can discover new initiatives on DEXs far earlier than they’re listed on a centralized alternate, providing merchants alternatives for early entry.

Decentralized exchanges can provide progressive buying and selling options and incentive mechanisms not discovered of their centralized counterparts, similar to yield farming, automated buying and selling swimming pools, and rather more.

In the event you prioritize safety, privateness, and management over your crypto, DEXs is perhaps an excellent match. They’re additionally helpful for buying and selling area of interest tokens unavailable on CEXs. There’s, nevertheless, a studying curve to DEX buying and selling, so be sure you’re nicely conscious of the intricacies.

Be aware: One factor to contemplate, although, is that you will want a self-custody pockets if you wish to use a DEX. We have now a complete information on the highest Solana wallets you could learn and select the one which greatest serves your wants.

Let’s have a condensed take a look at their benefits and drawbacks as a result of there are some.

Benefits of Decentralized Exchanges (DEXs)

DEXs have a number of execs and cons to them, and it’s necessary for customers to take a look at either side of the image to make an knowledgeable choice.

Possession & Enhanced Safety

DEXs mitigate safety dangers related to centralized exchanges by not having centralized methods aware of inside points or exterior exploits. A centralized alternate holds customers’ funds, making them weak to sure dangers, together with:

- Cybersecurity assaults

- Custodial dangers, censorship, and account banning

- Your funds may very well be uncovered or trapped within the platform.

- Privateness is severely compromised since exchanges retailer and handle your private info.

As an alternative, DEXs leverage sensible contracts for commerce execution and recording on the blockchain, guaranteeing trustless transactions. Furthermore, you’re solely accountable for your cash because you handle your pockets.

Privateness

DEXs provide elevated privateness since customers keep management of their crypto wallets externally. This eliminates the necessity for merchants to reveal personal keys and relieves DEXs of legal responsibility for funds.

Moreover, DEX customers aren’t sometimes required to endure Know Your Buyer (KYC) or Anti-Cash Laundering (AML) procedures, which will be handy however could pose authorized challenges in sure contexts.

In essence, DEXs present the potential for heightened safety by means of decentralization and provide higher privateness by not mandating customers to reveal delicate info similar to emails, addresses, cellphone numbers, and many others. Nonetheless, this may occasionally increase regulatory issues in sure international locations with unclear crypto rules.

Accessibility

DEXs provide world accessibility, permitting customers worldwide to entry them so long as they’ve an web connection and a appropriate pockets. There are often no jurisdiction-based restrictions.

Asset Variety

Likewise, DEXs boast a bigger desk of cryptocurrencies than their centralized counterparts. They’re extra open to smaller or lesser-known initiatives, enabling customers to discover a broader vary of belongings.

Disadvantages of decentralized exchanges (DEX).

Let’s discover the cons of DEXs beneath, beginning with sensible contract safety.

Sensible Contract Vulnerabilities

Whereas sensible contracts create a trustless atmosphere and remove third events, they are often topic to code bugs or vulnerabilities that hackers can exploit.

Complexity

DEXs will be difficult for rookies to navigate, with much less intuitive consumer interfaces and a requirement for higher technical data to execute trades.

Fewer customers additionally means there’s a smaller pool of patrons and sellers for any given token, making it more durable to discover a good match on your commerce. Whereas DEXs use AMMs, these in the end can’t replicate the effectivity of matching particular purchase and promote orders immediately.

Liquidity Points

DEXs could undergo from decrease liquidity, notably for much less in style tokens, probably hindering commerce execution at desired costs. Decrease liquidity on DEXs can result in larger slippage, that means you may find yourself paying extra (or receiving much less) than you anticipated.

Comparability of the High Solana DEXs

The next is a summarized and complete visible illustration of their options and different traits.

The 5 Finest Solana DEXs

With all the above out of the way in which, let’s discover the very best Solana DEXs.

The protocols had been chosen based mostly on buying and selling quantity, foundations, aggressive options and costs, TVL, market capitalization, and different necessary elements.

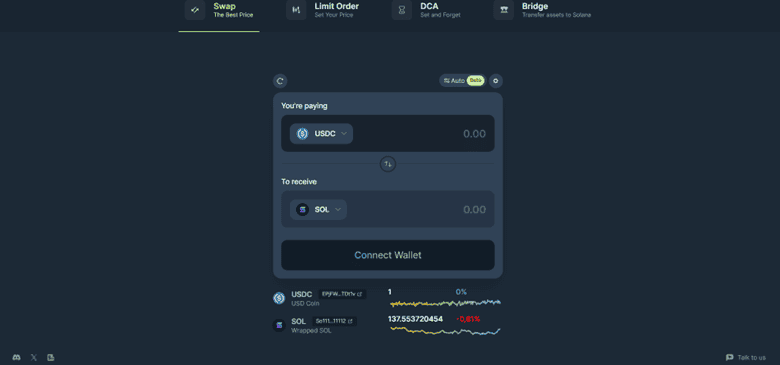

Jupiter: Most Common Solana DEX

Fast abstract:

- The most well-liked DEX on Solana. It’s behind one of many largest airdrops in crypto historical past: the JUP token.

- Main DEX by whole worth locked (TVL).

- Main DEX by derivatives quantity.

Jupiter is a decentralized alternate aggregator. Which means it cross-checks and gathers costs throughout totally different DEXs to offer customers with the very best costs available in the market. Its recognition is such that quite a lot of Solana DEX trades undergo Jupiter, highlighting the protocol’s effectivity, low swap charges, and liquidity.

Jupiter began as a liquidity supplier, much like 1inch on Ethereum. Nonetheless, the enterprise mannequin modified final 12 months because the protocol determined to offer derivatives buying and selling much like GMX and dYdX.

JUP is the governance token that enables customers to vote in favor or in opposition to all features and adjustments going down on Jupiter. It’s additionally used as a reduction price for merchants. The JUP token is perhaps remembered for its large airdrop, by which over 40% of the ten billion minted tokens had been allotted to the neighborhood and distributed periodically.

Key Options of Jupiter

Jupiter is taken into account among the finest Solana DEXs, designed to facilitate token swaps with minimal slippage and reasonably priced charges. Its user-friendly interface caters to each rookies and skilled merchants, supporting over a whole lot of tokens and 1000’s of buying and selling pairs.

Right here’s a fast rundown of Jupiter’s key options:

- Restrict Order: This function allows customers to put purchase or promote orders at particular ranges, aiding merchants in avoiding slippage and securing optimum costs.

- DCA (Greenback-Value Averaging): Permits customers to buy a set quantity of tokens inside a specified value vary over a set interval, providing flexibility in time intervals (minutes, hours, days, weeks, or months).

- Bridge: Facilitates bridging tokens from EVM blockchains like Ethereum, BNB Chain, Arbitrum, or non-EVM blockchains like Tron to Solana, guaranteeing optimum routes for low slippage and transaction charges.

- Perpetual: This function permits customers to commerce futures contracts for supported tokens with a most leverage of as much as x100. It’s powered by Pyth Community, Solana’s largest oracle community.

Furthermore, the alternate additionally focuses on developer instruments, making it simpler to combine DApps and interfaces. There are dozens of instruments, documentation assets, and packages designed for builders, together with:

- Jupiter Terminal, which permits DEXs to combine the Jupiter UI

- A funds API, which permits customers to pay for something with any SPL token through the use of Jupiter and SolanaPay

- An open-source referral program to offer referral charges for initiatives integrating Jupiter Swap and Jupiter Restrict Order

What are the Jupiter Charges?

Jupiter doesn’t cost transaction charges, however sure charges apply to different necessary options throughout the protocol. Right here’s the breakdown:

- Restrict order charges: 0.2% on taker (companions integrating Jupiter Restrict Order are entitled to a share of 0.1% referral charges. Jupiter collects the opposite 0.1% as platform charges, in line with Jupiter’s documentation web page).

- Jupiter DCA price: 0.1% on order completion.

Which Wallets Does Jupiter Assist?

Jupiter is appropriate with most respected wallets, together with these from Solana and Ethereum. Some examples are:

- OKX Pockets

- Phantom

- Ethereum Pockets

- Solflare

- Coinbase Pockets

- Belief

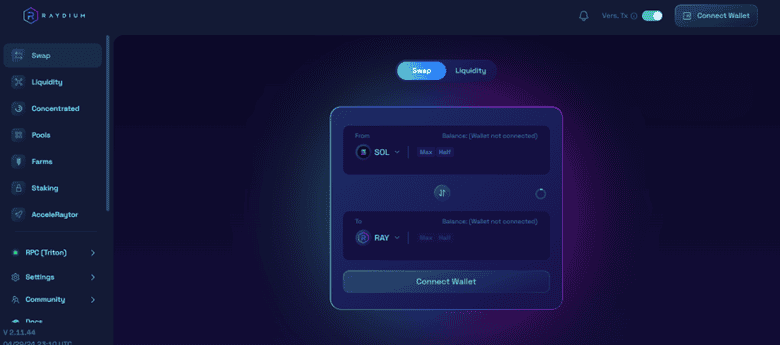

Raydium: Veteran Solana DEX

Fast abstract:

- High Solana DEX by buying and selling quantity — $109B.

- Largest DEX on Solana by TVL —$850M

- RAY market capitalization: $410M

Raydium (RAY) is a detailed contender to Jupiter by way of buying and selling quantity. Each typically surpass one another by way of each day buying and selling quantity. It’s identified for its slick, user-friendly design, low charges, and assist for a whole lot, if not 1000’s, of cryptocurrencies.

Most important Options

Raydium facilitates token swaps, liquidity provision, and yield farming for customers. The protocol facilitates asset buying and selling utilizing an automatic market maker (AMM) algorithm. It additionally options Acceleraytor, a launchpad that hosts preliminary DEX choices (IDOs) for brand new Solana initiatives.

What units Raydium aside is its integration with OpenBook’s central restrict order e book. This enables customers and liquidity swimming pools on Raydium to faucet into the broader liquidity and order circulate of your entire OpenBook ecosystem and vice versa.

Raydium additionally permits anybody to create a liquidity pool for a token pair, permitting for permissionless participation and enhancing liquidity throughout the ecosystem.

What are Raydium Charges?

Raydium has a posh price construction. It costs a small buying and selling price for every swap in a pool, which is usually 0.25% taken on the commerce. The price is then divided to reward liquidity suppliers, conduct RAY buybacks, and contribute to the Raydium treasury.

Treasury charges from CLMM pool trades are robotically transformed to USDC and transferred to a different designated tackle managed by the Squads Multi-sig, which is used to cowl RPC bills.

For Concentrated Liquidity (CLMM) swimming pools, the buying and selling price varies throughout 4 tiers: 100 bps, 25 bps, 5 bps, or 1 bp. Liquidity suppliers obtain 84% of the price, whereas 12% is allotted to RAY buybacks and the remaining 4% to the treasury.

Customers who need to create an ordinary AMM pool should pay a price of 0.4 SOL. That is completed to discourage pool spamming and assist the protocol’s sustainability.

What Wallets Does Raydium Assist?

Raydium helps a number of wallets, together with {hardware} wallets similar to Ledger. Right here’s a fast breakdown:

- Solflare

- Phantom

- OKX Pockets

- Belief Pockets

- Sollet

- Exodus

Drift Protocol

Fast abstract:

- It has raised over $23 million, with lead traders together with Multicoin Capital and Soar Capital.

- Concentrate on each spot and derivatives DEX Buying and selling

- Cumulative quantity of over $22B as of April 2024.

Drift Protocol is among the largest Solana DEXs. It’s designed as an open-source, non-custodial, and capital-efficient platform for these searching for spot and perpetuals buying and selling.

It affords many options: spot and perpetuals buying and selling, lending and borrowing, and passive liquidity provision. Naturally, many of the consideration gravitates in the direction of perpetuals. Customers can lengthy or quick supported belongings with as much as 10x leverage.

Key Options of Drift Protocol

Drift Protocol makes use of a cross-margined threat engine, a keeper community, and a number of liquidity mechanisms, enabling the platform to offer customers with low charges, minimal slippage, and excessive efficiency.

Furthermore, it supplies options similar to computerized deposit yield and leveraged staking with annual yields of as much as 10% (topic to fluctuations).

Drift v2 employs a sequence of complicated buying and selling and liquidity mechanisms to ship a seamless expertise for customers. A few of its key elements are:

- Drift v2 AMM makes use of an exterior Backstop AMM Liquidity (BAL), which, in easy phrases, permits customers to offer backstop liquidity to particular markets, growing the depth and collateralization throughout the market and incomes them a rebate from taker charges.

- Drift’s decentralized orderbook (DLOB): Restrict orders are executed in two methods: they both match opposing orders on the identical value or set off in opposition to the Automated Market Maker (AMM) underneath particular situations.

- Keepers: They hear for, retailer, arrange, and execute legitimate restrict orders, compiling them into off-chain order books. Every Keeper maintains its personal decentralized order e book. They execute trades by matching crossing and restrict orders in opposition to the AMM when sure situations are met. They earn charges for executing trades.

What are Drift Protocol Charges?

Drift has a posh construction that makes use of the maker-taker price mannequin. Charges are calculated on a per-trade foundation and the consumer’s place dimension. Evaluation the documentation web page for extra info.

What Pockets Does Drift Protocol Assist?

Drift Protocol helps a number of crypto wallets, together with:

- Phantom

- Solflare

- Belief Pockets

- WalletConnect

- Coin98.

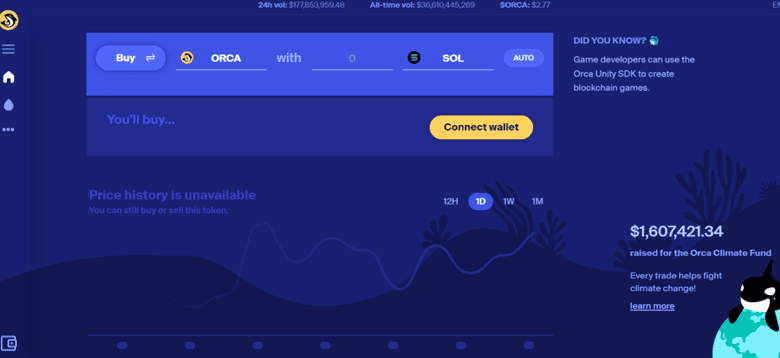

Orca

Fast abstract:

- One among Solana’s largest DEX by TVL

- ORCA’s market capitalization surpassed $133M

- Solely DEX on Solana to make use of a CLAMM (concentrated liquidity AMM)

Orca is a decentralized alternate praised for its simplicity and user-friendly interface launched in February 2021.

The DEX stands out for its deep liquidity throughout a number of swimming pools. This has been identified to draw quite a lot of merchants who want to optimize their general DEX buying and selling efficiency.

Key Options of Orca

Orca allows token swapping and supplies a share of buying and selling charges by means of its aquafarms. This idea of liquidity pooling for buying and selling originated from Ethereum’s decentralized exchanges like Uniswap.

Regardless of similarities with different Solana exchanges, Orca stands out because of a number of distinctive options.

- Orca’s interface features a Honest Value Indicator, aligning with its trader-centric design philosophy. This instrument helps merchants be sure that a cryptocurrency’s value stays inside 1% of CoinGecko’s aggregated alternate costs, providing a complete market overview inside a single interface.

- The protocol supplies a handy panel displaying consumer balances with out requiring separate browser extensions.

- One other key function is the Magic Bar, a user-friendly search function enabling fast entry to desired token pairs by typing their tickers.

It ought to be evident by now that Orca’s strategy is to simplify issues for merchants and liquidity suppliers, highlighting its user-centered strategy.

An attention-grabbing function of Orca is that each commerce made on the community contributes to the Orca Local weather Fund, an autonomous enterprise that invests in climate-friendly applied sciences and improvements.

What are Orca Charges?

Charges on the Orca DEX fluctuate, relying on the proportion every pool costs independently.

Swimming pools with a price tier of ≥0.3%:

- 87% of the buying and selling price goes to the maker (Liquidity Supplier)

- 12% is allotted to the DAO treasury.

- 1% is contributed to the Local weather Fund.

Swimming pools with a price tier of <0.3%:

- All charges are paid to the maker (aka the liquidity supplier).

Total, this price distribution mannequin goals to incentivize liquidity provision whereas supporting the platform’s governance and contributing to environmental initiatives by means of the Local weather Fund.

What Pockets Does Orca Assist?

Orca helps a number of wallets, together with {hardware} wallets like Ledger. Right here’s a fast rundown:

- Belief Pockets

- OKX Pockets

- Phantom

- Solflare

- SafePal

- BitGet

Zeta Markets

Fast abstract:

- Backed by distinguished VCs, together with Solana Ventures

- Has raised over $23M in funding

- Close to-zero fuel charges and as much as 20x leverage

Zeta Markets is a perpetuals alternate powered by the Solana blockchain. It was launched in 2021 and is backed by distinguished enterprise capital (VC) traders, together with Soar Capital, Wintermute, and Solana Ventures.

Key Options of Zeta Markets

Zeta Markets leverages the Solana blockchain to permit quick transactions and commerce orders with out compromising safety. Right here’s a rundown of the protocol’s major options:

- Safety: Customers have full management over their belongings with self-custody, and buying and selling is margined in USDC, enhancing security.

- Capital Effectivity: Merchants can entry as much as 10x leverage by means of cross-margining, optimizing capital utilization.

- Decentralized Value Discovery: The alternate employs a totally on-chain restrict order e book (CLOB), guaranteeing value discovery with out centralization.

- Institutional Liquidity: Zeta Markets facilitates programmatic connectivity by means of its SDK/CPI packages, enabling sensible contract integration for Market Makers and different institutional gamers.

- Gamification: The platform introduces gamified components similar to leaderboards, referral packages, and buying and selling rewards, enhancing consumer engagement and interplay

What are Zeta Market Charges?

Zeta Markets makes use of price tiers. You possibly can view them on the Charge Tiers documentation web page. Be aware that charges are notably decrease in comparison with different derivatives exchanges on Solana.

What Pockets Does Zeta Markets Assist?

In comparison with different DEXs, the pockets choices are considerably restricted, because the protocol solely helps Solflare, WalletConnect, Backpack, OKX Pockets, and Phantom.

Future Outlook for Solana DEXs

Excluding Solana’s downturn in 2021 and 2022, largely induced by FTX’s downfall, the community and its token have carried out very nicely, kind of, since their inception.

Recall that FTX was a powerful backer of Solana, holding many SOL tokens. As soon as the alternate defaulted following SBF’s fiasco, many SOL traders diminished or eradicated their publicity out of concern for your entire community due to FTX’s affect.

Nonetheless, the protocol itself has since confirmed resilient. Solana has efficiently decoupled from the influence of FTX and proved that this wouldn’t have a long-term influence on it.

In consequence, the community has been thriving, as it may be seen in a number of elements, together with however not restricted to:

- SOL’s value

- Transaction rely on Solana

- New addresses on Solana

- Improvement exercise and extra

Plenty of it’s owed to the success of the groups behind the very best Solana decentralized exchanges as a result of they underpin your entire native DeFi ecosystem.

If protocol builders proceed to ship and enhance the capabilities of Solana, it’s maybe justified to imagine that the longer term for Solana DEXs is trying brilliant.

Is Buying and selling on DEXs Protected?

To reply this query, we should first make just a few necessary clarifications.

First, buying and selling on a DEX requires extra technical data and preparation, in comparison with buying and selling on a centralized alternate. You must have your individual self-custody pockets, which might current sure challenges by itself.

Nonetheless, in case you are assured in your means to maneuver in an on-chain atmosphere, buying and selling on a DEX will be safer. It’s because you, as a dealer, are in full management over your funds—there isn’t a central occasion that may censor your transactions, block your deposits or withdrawals, or influence your buying and selling actions in any approach.

All issues thought of, although, nearly all of customers aren’t as technical and may encounter challenges when buying and selling on a DEX. That’s why it’s extremely really useful to just remember to are completely conscious of their intricacies so that you don’t find yourself paying for prime slippage or worse – put your cash in jeopardy.

Continuously Requested Questions

Which Solana DEX has essentially the most quantity?

Jupiter is ranked because the Solana DEX with essentially the most each day buying and selling quantity, however the spot is extremely contested by Raydium, which is usually considered the second-largest DEX on Solana.

What’s the first DEX on Solana?

Photo voltaic Dex is the primary DEX on Solana. This has turn out to be considerably of a crypto memorabilia as a result of Photo voltaic Dex shouldn’t be amongst the highest decentralized exchanges any extra.

What’s the greatest Solana DEX?

One of the best Solana DEX is the one which serves your specific wants. If you’re in search of spot trades, maybe Raydium is your selection. If you would like extra capabilities similar to restrict orders and DCA – possibly you need to flip to Jupiter.

What’s the greatest DEX crypto?

DEX cryptocurrencies often discuss with the native cash underpinning the decentralized alternate’s ecosystem and governance

Finest Solana DEXs – Ultimate Ideas

In conclusion, the Solana ecosystem boasts a number of distinguished DEXs, every providing distinctive options and benefits.

The community continues to thrive in most measurable metrics, and DEX growth has undoubtedly been a serious a part of it.

The groups compete to deliver new and thrilling options for merchants, similar to restrict orders, on-chain derivatives buying and selling, dynamic swimming pools, and extra—all of that are certain to draw merchants because the ecosystem grows sooner or later.