The evolution of Decentralized Finance (DeFi) has introduced among the most modern options for monetary providers, each on- and off-chain. Lending, buying and selling, staking, and tokenization are simply among the hottest DeFi traits which have collected billions of {dollars} in complete worth locked (TVL).

In 2024, DeFi is seeing a number of rising traits which can be remodeling the panorama. They’re reshaping the ecosystem by enhancing liquidity, safety, and scalability, driving broader adoption of decentralized purposes (dApps) and new monetary instruments.

This text will information you thru among the hottest DeFi traits in 2024. As at all times, let’s begin with the fundamentals: the definition of DeFi and its core ideas.

Fast Navigation

- What’s DeFi

- High DeFi Tendencies in 2024

- Liquid Staking: Maximizing Yield and Sustaining Community Safety

- High Liquid Staking and Restaking Initiatives

- Lido Finance

- EigenLayer

- Solayer

- Jito Restaking

- High Liquid Staking and Restaking Initiatives

- Actual-World Property and Bond Tokenization (RWA)

- Forms of RWA Protocols

- High RWA Initiatives

- The Rise of Layer-1s

- The Rise of Layer-2s

- High Layer-1 and Layer-2 Chains

- Aptos

- Sui Community

- Base

- Arbitrum

- Optimism

- Cross-Chain Bridges

- High Cross-Chain Bridges

- Stargate Finance

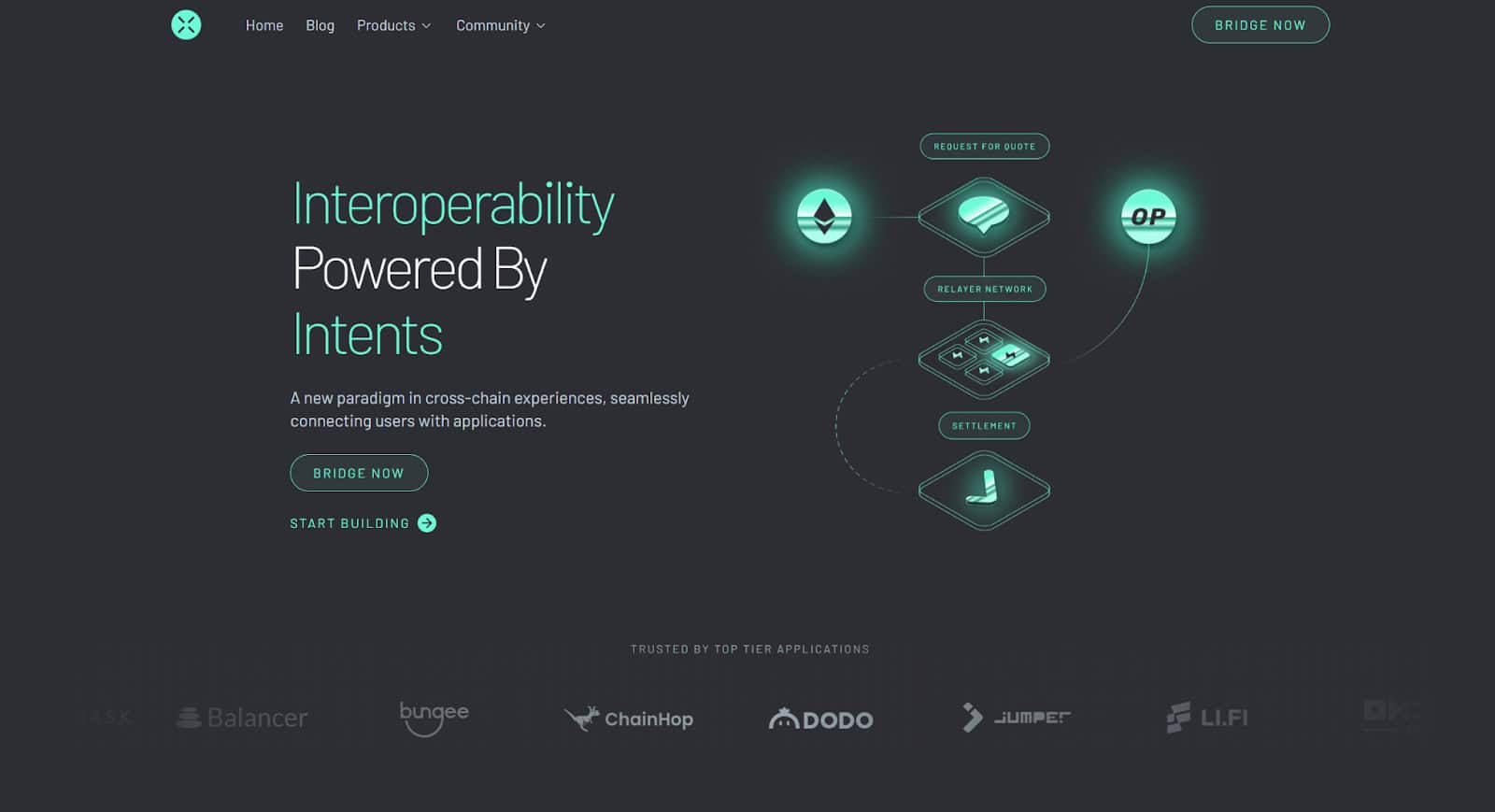

- Throughout Protocol

- Synapse Protocol

- High Cross-Chain Bridges

- The Rise of Prediction Markets

- Closing Ideas: The High DeFi Tendencies in 2024

What Is DeFi?

DeFi refers to a monetary ecosystem consisting of decentralized purposes (dApps) constructed on blockchain networks, particularly Ethereum. Whereas there’s no actual date marking the beginning of DeFi, its emergence is attributed to the gradual growth of blockchain elements and improvements addressing numerous monetary challenges.

DeFi operates on decentralized blockchain networks, that means no single entity controls the system, not like conventional finance, the place establishments handle transactions. As a substitute, DeFi depends on sensible contracts—self-executing agreements triggered by particular circumstances.

DeFi affords quite a lot of monetary providers—lending, borrowing, buying and selling, and incomes curiosity—with out the necessity for intermediaries. Should you’re , take a look at among the greatest DeFi initiatives which can be at the moment dominating the market.

A few of DeFi’s core ideas are:

- Decentralization: Direct user-to-user transactions, no intermediaries or middlemen.

- Transparency: All transactions are recorded on a public blockchain, making them verifiable and auditable. Nonetheless, you may see permissioned (personal) blockchains like Hyperledger Cloth and permissionless (public) blockchains like Ethereum.

- Inclusivity: DeFi is (principally) accessible to anybody, no matter geographic location or monetary standing. That is particularly necessary for unbanked populations or the place entry to worldwide transfers is sophisticated.

- Programmability: Sensible contracts automate processes like transactions and knowledge storing and allow the event of latest monetary merchandise.

What about management and decision-making? Effectively, DeFi initiatives are sometimes ruled by decentralized autonomous organizations (DAOs), which set up governance buildings which will embrace voting mechanisms and protocol growth.

High DeFi Tendencies in 2024

Okay, now that the fundamentals are out of the best way, dive into this information to discover among the high DeFi traits in 2024. The next traits shouldn’t have a correct order.

Liquid Staking – Maximizing Yield and Sustaining Community Safety

Liquid staking has emerged as a key innovation inside DeFi, providing you the pliability to handle your staked belongings throughout different dApps.

The thought is easy—you deposit your crypto belongings right into a liquid staking protocol, which then stakes the belongings in your behalf. In return, you obtain tokenized variations of your belongings, appearing as representations of your staked funds.

The attraction of liquid staking lies within the capacity to keep up liquidity whereas incomes rewards. You should utilize these tokenized belongings in numerous methods, corresponding to posting them as collateral in lending protocols, buying and selling on decentralized exchanges, and even restaking them on different platforms for added rewards.

With the evolution of liquid staking, restaking quickly emerged as the brand new game-changer. Because the title suggests, includes staking already staked tokens. It was a solution to the restrictions of conventional staking mechanisms.

Restaking turned one of many hottest DeFi traits in mid-2023—and nonetheless is right now—due to protocols like EigenLayer. The idea of a mechanism that might enhance yields for stakers but additionally heighten the safety of blockchain protocols opened new alternatives within the Ethereum ecosystem for each DeFi builders, crypto initiatives, and ETH stakers.

High Liquid Staking and Restaking Initiatives

Lido Finance

Lido is the main liquid staking protocol. This protocol has been so profitable within the sector that it reached a TVL of almost $40 billion in early 2024.

It’s the biggest decentralized liquid staking protocol. It permits you to stake ETH whereas receiving a liquid staked token referred to as stETH, which is a illustration of your already staked ETH which you need to use via different dApps on the Ethereum ecosystem.

EigenLayer

EigenLayer is a decentralized protocol on Ethereum that introduces the idea of restaking, the place customers deposit staked Ethereum (stETH) or liquid staked tokens (LSTs) into the protocol’s liquidity swimming pools. These tokens are then restaked throughout numerous decentralized protocols on Ethereum, known as Actively Validated Companies (AVS).

AVS consists of a variety of providers, corresponding to oracles, sidechains, Layer-2 networks, knowledge availability layers, and cross-chain bridges—primarily any system that depends on distributed validation to safe its community. EigenLayer acts because the middleware, distributing staked tokens throughout totally different DeFi protocols, enhancing their mainnets’ safety.

Ethereum shouldn’t be the one blockchain with restaking protocols (different restaking options are Symbiotic and Karakc, each exceeding one billion USD in TVL). A number of gamers within the Solana community have determined to capitalize on the rising development of restaking belongings.

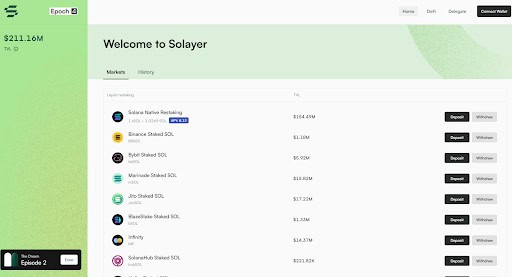

Solayer

Solayer is a restaking protocol on the Solana blockchain, co-founded by Rachel Chu and Jason Li. It permits you to restake their SOL tokens or liquid staking tokens (LSTs) to safe bandwidth for dApps, enhancing efficiency and incomes further rewards.

By changing staked SOL into sSOL, you possibly can leverage liquidity throughout built-in platforms and earn yield via validator returns and restaking incentives. Since its gentle launch in Might 2024, Solayer has gained vital traction, climbing the Solana leaderboard and turning into the highest Solana initiatives with over $200M in TVL.

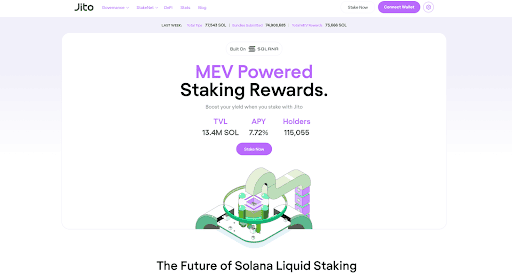

Jito Restaking

Jito, which is the biggest liquid staking protocol on Solana, can be stepping up its sport with a restaking mechanism (nonetheless within the works as of October 2024). We’re speaking about Jito (re)staking, a hybrid system that features two key elements: the Vault Program and the Restaking Program.

The Vault Program manages the creation and delegation of Liquid Restaking Tokens (VRTs) utilizing any SPL token because the underlying asset. It permits for versatile delegation methods, personalized slashing circumstances, and helps governance by way of DAOs or on-chain automation instruments like StakeNet.

The Restaking Program focuses on managing Node Consensus Operators (NCNs) and operators, dealing with reward distribution, and implementing slashing penalties, offering a strong framework for financial safety.

Actual-World Property and Bond Tokenization

Actual-world belongings (RWAs) are digital tokens representing bodily or monetary belongings, corresponding to actual property, commodities, bonds, equities, art work, and mental property. That is due to tokenization—the method of bringing these off-chain belongings onto the blockchain, utilizing cryptography to interchange delicate info with non-sensitive knowledge and create a token.

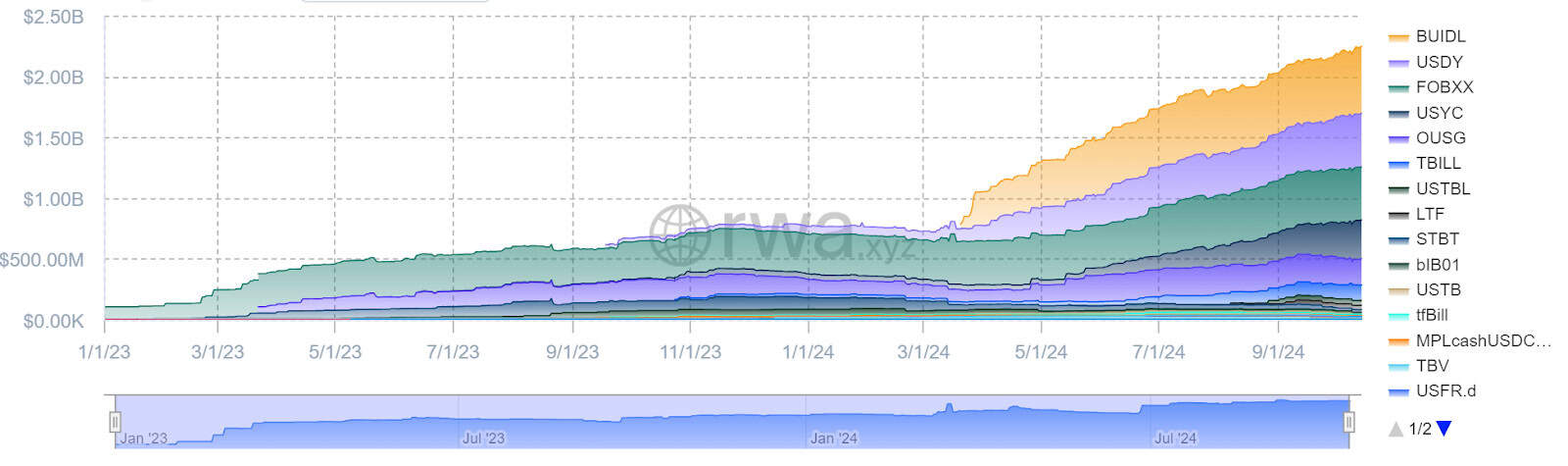

Tokenization permits historically illiquid belongings to be divided into smaller, accessible items, enhancing liquidity and broadening market participation. This technique has develop into notably engaging for US treasuries, which are actually a $2.27B market, with key leaders like BlackRock’s BUIDL and Ondo Finance’s USDY each reaching over $500M in deposited worth.

Forms of RWA Protocols

The RWA market is in depth, and it incorporates a assorted record of protocols addressing points throughout a number of industries, however the principle (hottest) fields in RWA are:

- Public Credit score/Equities (US Treasuries): These protocols tokenize monetary belongings like shares and bonds. Ondo Finance and Backed Finance, as an illustration, supply tokenized US Treasuries and fixed-income merchandise.

- Actual Property: Platforms like Tangible tokenize actual property, enabling customers to mint stablecoins backed by actual property and even supply fractional possession via NFTs, rising liquidity and reducing entry boundaries.

- Debt/Non-public Credit score: Protocols corresponding to MakerDAO and Centrifuge deal with tokenizing loans and debt devices, providing modern options for real-world lending.

- Local weather/Carbon Credit: These protocols, like these tokenizing carbon credit, facilitate environment friendly buying and selling and offsetting of carbon footprints, serving to companies handle climate-related monetary devices.

- Treasured Metals/Commodities: Pax Gold, for instance, tokenizes commodities like gold, enabling fractional possession and simpler buying and selling of historically cumbersome belongings.

Why are RWAs and tokenization one of many hottest DeFi traits? Effectively, they provide new monetary alternatives by bridging the hole between conventional finance and blockchain, enabling belongings to function collateral, be included in index funds, be managed autonomously, and different perks.

This integration has the potential to create extra inclusive monetary methods, bringing conventional funding merchandise to the blockchain with the added advantages of transparency, safety, and effectivity.

High RWA Initiatives

Ondo Finance

Ondo Finance, the biggest real-world asset (RWA) protocol in 2024, affords institutional-grade monetary merchandise by tokenizing steady, yield-generating belongings from conventional finance, corresponding to treasury bonds.

Ondo enhances the accessibility of RWAs by integrating these tokenized merchandise throughout a number of blockchain networks like Ethereum, Aptos, and Solana. USDY, its flagship product, is likely one of the largest yield-bearing stablecoins.

Based by Nathan Allman in 2021, Ondo Finance has attracted vital funding, elevating over $34 million from traders corresponding to Wintermute, Founders Fund, and Pantera Capital. The protocol additionally runs KYC checks to make sure regulatory compliance. Ruled via the Ondo Basis and Ondo DAO, the platform blends the reliability of conventional finance with the transparency and effectivity of blockchain know-how.

Centrifuge

Centrifuge is likely one of the largest real-world asset (RWA) protocols, centered on decreasing capital prices for small and mid-sized enterprises (SMEs) whereas offering traders with steady revenue.

Centrifuge integrates bodily belongings into the DeFi house, enhancing collateral transparency and providing diversified, steady yields. The platform permits companies to make use of these belongings as collateral for financing by tokenizing belongings corresponding to invoices, actual property, and royalties.

Notably, Centrifuge has secured partnerships with main DeFi platforms, like MakerDAO (now rebranded to Sky). It has additionally raised over $30M in a Sequence A funding spherical.

The Rise of Layer-1s

The rise of layer-1s like Aptos and Sui displays a rising development in the direction of various blockchains that may supply a balanced diploma of scalability, safety, and a developer-friendly atmosphere.

These two blockchains are on the forefront of the layer-1 sport. Each platforms leverage the Transfer programming language—which is taken into account probably the greatest alternate options to the Ethereum Digital Machine—however differ of their structure and consensus mechanisms. Aptos focuses on a modular construction and BFT consensus, whereas Sui implements a DAG-based structure with a singular asynchronous protocol.

These improvements purpose to handle the restrictions of earlier blockchains like Ethereum and cater to the rising demand for environment friendly dApps throughout numerous industries, together with gaming, finance, and social networking.

The Rise of Layer-2s

Layer-2 scaling options are chains linked to a mainnet (a layer-1 like Ethereum). They’re designed to enhance the scalability and effectivity of blockchain networks by processing transactions quicker and at decrease prices—with out compromising the safety and decentralization of the underlying community.

There are a number of kinds of Layer-2 options, together with State Channels, which let you conduct a number of transactions off-chain, with solely the ultimate transaction state recorded on the principle blockchain; sidechains like Polygon, an Impartial blockchain that runs parallel to Ethereum; and rollups, the preferred kinds of blockchain scaling options.

Rollups bundle a number of transactions right into a single batch earlier than submitting them to the principle chain. There are two most important kinds of rollups:

- Optimistic Rollups: Assume transactions are legitimate and solely examine them if a dispute arises.

- Zero-Data Rollups (zk-Rollups): Use cryptographic proofs to validate transactions off-chain earlier than submitting them to the principle chain.

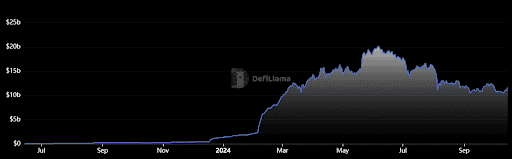

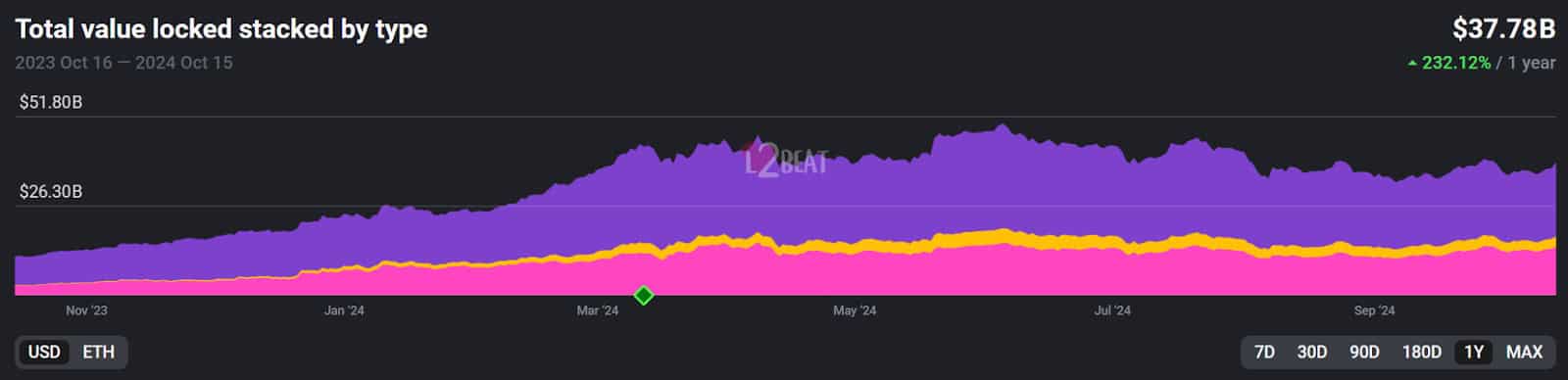

Layer-2 options are among the hottest DeFi traits in 2024. Knowledge from L2Beat reveals the whole worth locked throughout layer-2s has elevated 232% in a single 12 months, at the moment boasting over $37B.

Immediately, we have now layer-2s left and proper. Centralized exchanges like Coinbase launched Base in 2023. Its decentralized counterpart, Uniswap, not too long ago acquired into motion, too, with the launch of Unichain, promising quicker and cheaper transactions and interoperability throughout a number of blockchain networks.

High Layer-1 and Layer-2 Chains

Aptos

Aptos launched its mainnet in October 2022 after three years of growth, elevating round $350 million in enterprise capital. It positions itself as a high-performance blockchain, typically in comparison with Solana as a result of its deal with scalability and reliability. Within the Aptos neighborhood, the community is usually referred to as the Solana killer.

One factor that stands out about Aptos is its use of advanced know-how. First, it makes use of Transfer as a result of its emphasis on safety and adaptability—notably in sensible contract growth. Second, it makes use of a Byzantine Fault Tolerance (BFT) variant of Proof of Stake (PoS) to supply excessive safety and quick transaction confirmations.

Shifting on, the Aptos blockchain has a modular structure that divides numerous elements of the community—consensus mechanism, knowledge storage, transaction execution, and so forth.—into separate modules, offering quicker growth cycles, quicker enhancements, and better scalability.

Because it weren’t sufficient, Aptos’ Block-STM know-how allows parallel transaction processing, with claims of dealing with as much as 160,000 transactions per second (TPS). The platform additionally goals to implement sharding to enhance scalability by permitting a number of ledger states to work together via standardized bridges.

Its native coin, APT, has surged over 113% within the yearly chart, reflecting the protocol’s rising curiosity and community exercise.

Sui Community

Sui Community is a layer-1 launched in 2023, specializing in simplifying the creation and deployment of dApps and develop into an alternate growth atmosphere for crypto initiatives.

Like Aptos, Sui makes use of the Transfer programming language, however it takes an object-centric strategy, permitting builders to outline belongings with strict possession guidelines, enhancing the safety of dApps constructed on the platform.

Sui’s consensus mechanism can be totally different from Aptos, because it makes use of Delegated Proof of Stake (DPoS) mixed with an asynchronous protocol referred to as Narwhal and Bullshark. This setup helps parallel transaction processing, boosting the community’s effectivity and scalability.

Additional, Sui’s structure relies on a directed acyclic graph (DAG), enabling extra environment friendly transaction processing than conventional blockchain buildings. This design permits for concurrent execution of a number of transactions, offering excessive throughput and low latency for dApps.

SUI, Sui’s native coin, is likely one of the best-performing crypto belongings in 2024, having surged virtually 400% on the yearly chart.

Base

Base is a Layer-2 scaling resolution constructed on Ethereum, developed by Coinbase in collaboration with Optimism.

Formally launched on August 9, 2023, Base was created utilizing the OP Stack and is designed to enhance Ethereum’s scalability, velocity, and cost-efficiency whereas preserving its safety and decentralization.

Base processes transactions off-chain, considerably rising its transaction capability in comparison with Ethereum Layer 1. This larger throughput helps ease community congestion, guaranteeing quicker transaction processing by decreasing the computational load on the principle chain. It additionally results in decrease transaction charges, making it a extra reasonably priced possibility than transacting straight on Ethereum.

Should you’re , take a look at our picks for one of the best Base wallets in 2024.

Arbitrum

Arbitrum is the main layer-2 resolution, able to processing billions of transactions in a single week.

Arbitrum processes transactions in batches off-chain and returns solely important knowledge to Ethereum, decreasing congestion whereas guaranteeing that every one actions may be audited and verified when crucial.

Arbitrum consists of a number of elements designed to boost scalability and supply totally different options for numerous use circumstances:

- Arbitrum One is the first rollup chain that permits builders to construct scalable dApps whereas benefiting from Ethereum’s safety.

- Arbitrum Nova is a more recent chain optimized for high-throughput purposes, corresponding to gaming. It makes use of AnyTrust know-how to additional cut back prices.

- Arbitrum Nitro supplies a complicated technical stack that improves throughput and lowers charges whereas sustaining full compatibility with Ethereum.

- Arbitrum Orbit permits builders to launch their very own personalized chains that connect with the broader Arbitrum ecosystem.

Optimism

Optimism is a Layer-2 launched in December 2021 as a solution to Ethereum’s scalability points.

One among Optimism’s core options is its use of Optimistic Rollups, a know-how that processes most transactions off-chain by bundling a number of transactions right into a single batch, which is later submitted to the Ethereum mainnet for validation.

Transactions are presumed legitimate by default (therefore the title optimistic), enabling quicker processing with out the necessity for rapid verification. Nonetheless, this has its downsides. Assuming that every one blocks are legitimate means Optimism depends on trustworthy validators to problem fraudulent transactions.

Optimism can be totally appropriate with the Ethereum Digital Machine (EVM), permitting builders to port their present decentralized purposes (dApps) onto Optimism with minimal modifications. This compatibility lowers the boundaries to adoption, as builders can simply transition to the platform.

Cross-Chain Bridges

Cross-chain bridges have gotten important in enabling seamless asset transfers between totally different blockchain ecosystems.

A cross-chain bridge is just about what it seems like—a protocol that facilitates the motion of digital belongings between separate blockchains. It really works by locking an asset on one blockchain and creating an equal token on one other.

Say, for instance, you wish to bridge Ethereum (ETH) to the Solana community. On this case, the bridge locks your ETH and mints (points) a wrapped model of it (like Wrapped Bitcoin, WBTC) on Solana. Nonetheless, take into account this technique, referred to as lock and mint, shouldn’t be the one strategy to do it. Some bridges use liquidity swimming pools to facilitate swaps between tokens straight.

There are totally different fashions utilized by cross-chain bridges:

- Lock-and-Mint: The unique asset is locked on the supply chain, and a brand new token is minted on the goal chain.

- Burn-and-Mint: A token is burned on one chain, which triggers minting on one other chain.

- Lock-and-Unlock: Tokens are locked on one chain, and equal tokens are unlocked from a liquidity pool on the opposite chain.

Cross-chain bridges convey vital benefits to the blockchain house, and so they have develop into a basic pillar of blockchain interoperability.

They permit seamless asset transfers between platforms by enabling totally different blockchains to speak with one another, which is especially helpful for customers, builders, initiatives, and so forth. These bridges additionally assist improve liquidity by permitting much less widespread chains to faucet into liquidity swimming pools from extra established networks. This results in decrease transaction charges and decreased slippage, finally enhancing buying and selling alternatives.

Moreover, cross-chain bridges contribute to blockchain scalability by distributing transaction masses throughout numerous chains, which helps alleviate congestion on older networks. As new chains emerge with quicker processing capabilities, these bridges permit them to be built-in into the ecosystem extra simply.

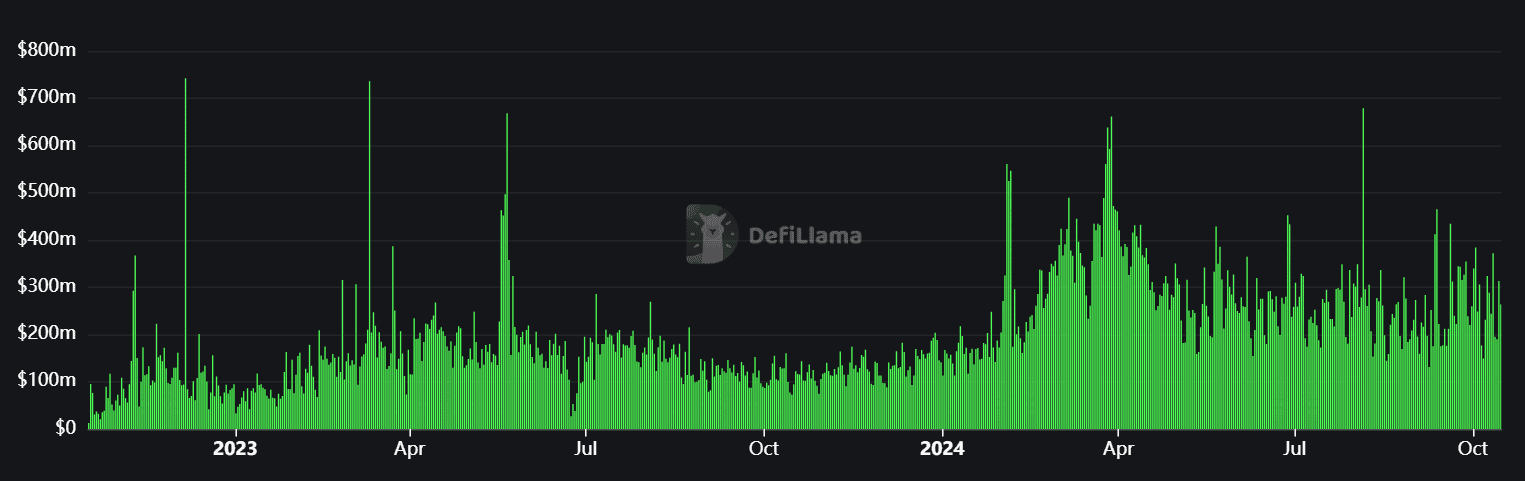

Knowledge from DeFillama reveals that buying and selling quantity throughout all crypto bridges spiked through the first three quarters of 2024. In September, buying and selling quantity surged to $8.15B.

High Cross-Chain Bridges

Stargate Finance

Stargate Finance is a well-liked crypto bridge powered by LayerZero know-how, which facilitates direct native asset transfers between blockchains.

One among its standout options is unifying liquidity swimming pools throughout totally different chains, boosting transaction effectivity and serving to cut back slippage, making transfers extra dependable and cost-effective. That’s not all—the protocol ensures prompt transaction affirmation, that means belongings are assured to reach on the goal chain instantly as soon as a transaction is confirmed on the supply chain. This ends in a smoother, quicker expertise.

Moreover, Stargate employs the Delta Algorithm, which effectively manages liquidity within the swimming pools, stopping exhaustion throughout excessive transaction volumes. There’s no want for wrapped tokens—you possibly can merely ship native belongings straight throughout blockchains, making cross-chain transactions less complicated and extra intuitive.

Throughout Protocol

Throughout focuses on optimizing cross-chain transfers by maximizing capital effectivity and safety. It depends on a unified liquidity pool hosted on the Ethereum Mainnet, which reinforces capital effectivity for transactions throughout a number of networks.

Throughout makes use of a decentralized community of aggressive relayers to make sure that transactions are accomplished at one of the best velocity and value. These relayers compete to satisfy person intents, guaranteeing that your transactions are executed effectively.

UMA’s Optimistic Oracle bolsters the bridge’s safety by making a safe atmosphere for cross-chain transfers whereas sustaining excessive speeds and low transaction prices.

Synapse Protocol

Synapse Protocol is a flexible cross-chain bridge that helps each EVM and non-EVM blockchains. It affords canonical token bridging, which permits customers to bridge wrapped belongings between chains effectively. For native belongings, Synapse employs liquidity-based bridging, utilizing cross-chain steady swap swimming pools to facilitate dependable asset transfers.

Synapse additionally affords strong developer instruments, offering APIs that allow builders to combine cross-chain performance into their decentralized purposes. This flexibility fosters innovation in DeFi options, permitting builders to construct extra interconnected dApps. With almost $14 billion in complete transaction quantity, Synapse has established itself as a trusted platform for cross-chain bridging, supporting seamless operations throughout numerous blockchain ecosystems.

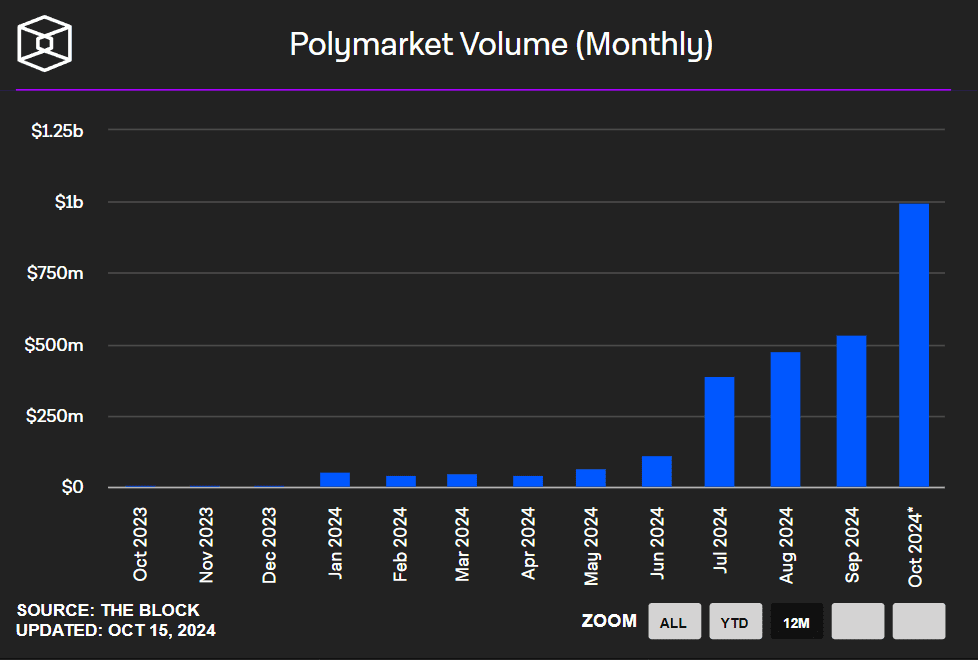

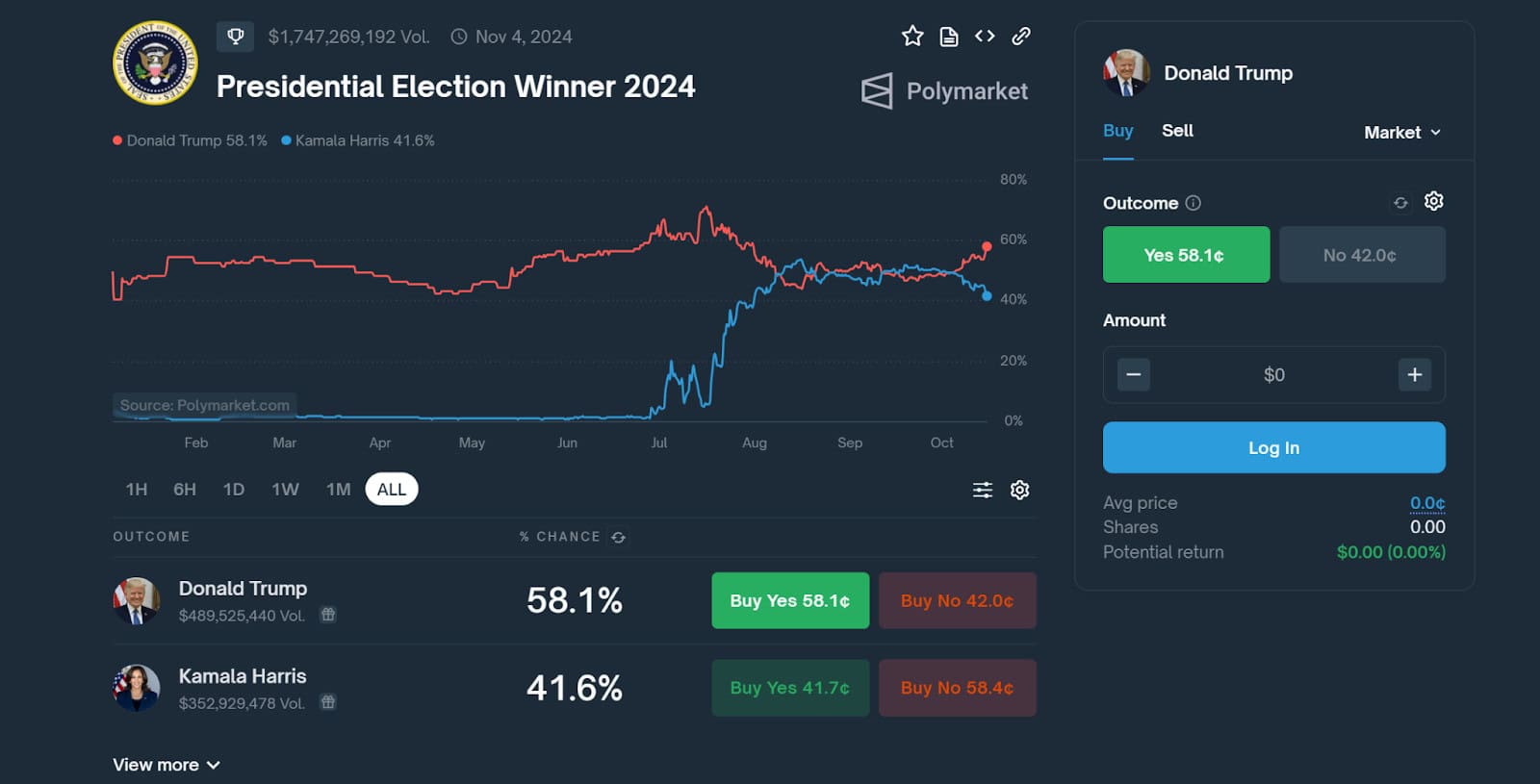

The Rise of Prediction Markets

Decentralized prediction markets have develop into one of many hottest DeFi traits, particularly because the US elections are simply across the nook. Its reputation is so large that even mainstream platforms have cited marketplaces like Polymarket to gauge US election sentiment.

How can we clarify this phenomenon? Effectively, prediction markets have develop into the go-to platforms for political and monetary polling. That is because of the idea of collective intelligence, the place the mixed enter of many individuals tends to lead to extra correct predictions than these of people.

Prediction markets let you commerce contracts primarily based on future occasions. They operate equally to exchanges, the place you should purchase or promote shares representing doable outcomes, corresponding to election outcomes or sporting occasions. The value of those shares is set by provide and demand, indicating the collective beliefs in regards to the probability of every occasion. In case your prediction is right, you obtain $1 per share; if not, the shares develop into nugatory, and also you lose your guess.

There are two kinds of prediction markets:

- Conventional Prediction Markets: These function inside regulated environments, typically require identification verification (corresponding to Know Your Buyer or KYC), and could also be insured by entities just like the FDIC.

- Decentralized Prediction Markets: Constructed on blockchain, these markets supply extra privateness and accessibility by eradicating central authority. Nonetheless, they aren’t insured and should face regulatory restrictions in sure areas, such because the U.S.

Polymarket’s Dominance

Thus far, in October 2024, Polymarket controls 99% of the prediction market. The platform has recorded almost $1B in buying and selling quantity and reached a peak of almost 100,000 merchants.

Polymarket’s most important attraction is its simplicity. You’ll be able to guess on all kinds of subjects, starting from politics and leisure to trending and even quirky occasions. So, you wager by shopping for shares that price lower than $1. In case your prediction proves right, you obtain $1 per share as a reward.

Polymarket is self-custodial, that means you management your personal funds via your private pockets. This setup gained traction throughout vital occasions, just like the US elections, the place customers may have interaction in easy binary bets, predicting outcomes with “Sure” or “No” solutions.

This explicit market has amassed over $1B in wagered funds, the very best ever in any prediction market.

Closing Ideas – The High DeFi Tendencies in 2024

As DeFi continues to develop, new traits will proceed to push the boundaries for what the DeFi sector can obtain, in addition to convey new alternatives for crypto initiatives and conventional finance. One instance of the tokenization of US treasuries turning into a $2B market, with old-school finance giants like BlackRock becoming a member of in on the enjoyable.