Abstract: NFT Market Rebound Indicators Danger-On Sentiment

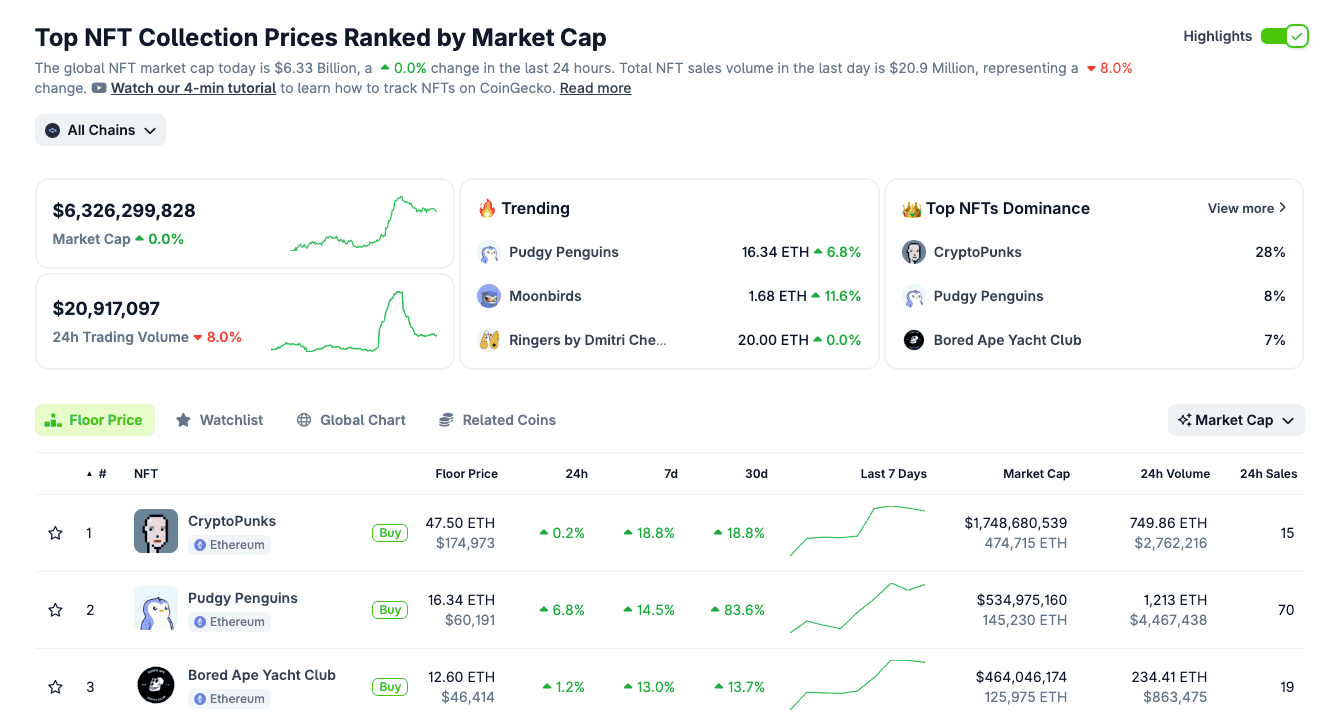

The non-fungible token (NFT) market has staged a outstanding comeback, with its complete market capitalization hovering previous $6.3 billion, almost doubling from $3.2 billion a month in the past. Main collections like CryptoPunks (+14% in 24 hours), Moonbirds (+31.1%), and Azuki (+9.2%) are driving the rally, defying a broader crypto market pullback. In the meantime, Bitcoin’s dominance has dropped to roughly 61%, suggesting merchants are shifting capital into higher-risk belongings like NFTs and altcoins. Yuga Labs co-founder Garga.eth’s latest trace at “NFT treasury corporations” has sparked hypothesis about institutional adoption, probably fueling additional progress. This text explores the NFT market surge, top-performing collections, and the way merchants can capitalize on this pattern utilizing platforms like Phemex.

Key Metrics (as of July 23, 2025):

-

NFT Market Cap: $6.31 billion (+17.2% in 24 hours)

-

Bitcoin Dominance: ~61% (-6.6% from latest peak)

-

Prime Performers: CryptoPunks (48 ETH ground), Moonbirds (1.68 ETH ground)

-

Buying and selling Alternative: NFT-related tokens (APE, BLUR, PENGU, MEME) on Phemex

Because the crypto market braces for a possible altcoin season, NFTs are rising as a key indicator of danger urge for food. Whether or not you’re a seasoned dealer or a curious investor, understanding this rally may unlock important alternatives.

NFTs Break Out Amid Crypto Market Consolidation

After a strong second quarter in 2025, main cryptocurrencies like Bitcoin and Ethereum have entered a consolidation part, with costs stabilizing after weeks of positive aspects. Bitcoin, as an illustration, has hovered round $60,000, whereas Ethereum trades close to $3,350, down barely by 2.06% within the final 24 hours (as of July 23, 2025). Most altcoins have adopted swimsuit, pausing their upward momentum. Nevertheless, the NFT market has bucked this pattern, surging 9.44% in a single day and pushing its complete market cap above $6.3 billion, in response to knowledge aggregated from platforms like CoinGecko and OpenSea.

This speedy progress marks a near-doubling from the $3.2 billion market cap recorded only a month in the past, signaling a shift in investor sentiment. Not like previous NFT bull runs, which have been usually fueled by retail hype or viral meme-driven tasks, this rally seems extra calculated. Merchants are decoding the NFT surge as an indication of rising danger urge for food, akin to how buyers shift from safe-haven belongings like bonds to equities throughout bullish market phases. With Bitcoin’s dominance declining and altcoins exhibiting stability, NFTs could also be a number one indicator of the subsequent speculative wave within the crypto market.

For instance, contemplate Sarah, a 28-year-old crypto dealer from San Francisco. After months of specializing in Bitcoin, she seen the NFT market’s breakout and shifted 20% of her portfolio into NFT-related tokens like APE and BLUR. Inside per week, her portfolio gained 15%, highlighting how early movers can capitalize on these traits. Tales like Sarah’s have gotten extra widespread as merchants acknowledge NFTs as a high-reward alternative.

NFT Market Cap Hits $6.3 Billion: A Nearer Look

The NFT market’s explosive progress is backed by compelling knowledge. As of July 23, 2025, the overall market capitalization approached $6.3 billion, reflecting a major enhance in investor urge for food, in response to aggregated knowledge from analytics platforms. This surge is visibly led by blue-chip collections, with the highest 10 tasks alone accounting for over $3.5 billion in complete market worth. This momentum has constructed steadily over the previous month, outpacing different crypto sectors.

Right here’s a snapshot of the important thing market metrics driving this pattern:

-

Combination NFT Market Cap: ~$6.3 Billion

-

Bitcoin Dominance: ~61% (-6.6% from its latest peak)

-

Ethereum Value: ~$3,350

-

Prime Performing Collections: CryptoPunks, Pudgy Penguins, Bored Ape Yacht Membership (ground costs rising)

This surge comes as different crypto sectors are cooling off, suggesting capital is rotating into NFTs. The decline in Bitcoin dominance additional helps this narrative, signaling that merchants are shifting into higher-risk belongings. NFTs, with their potential for outsized returns, look like appearing as a frontier for this capital shift.

Blue-Chip Collections Are Driving the Rally

The market’s rebound shouldn’t be uniform; it’s being decisively led by a handful of established collections, which have traditionally signaled the beginning of speculative cycles.

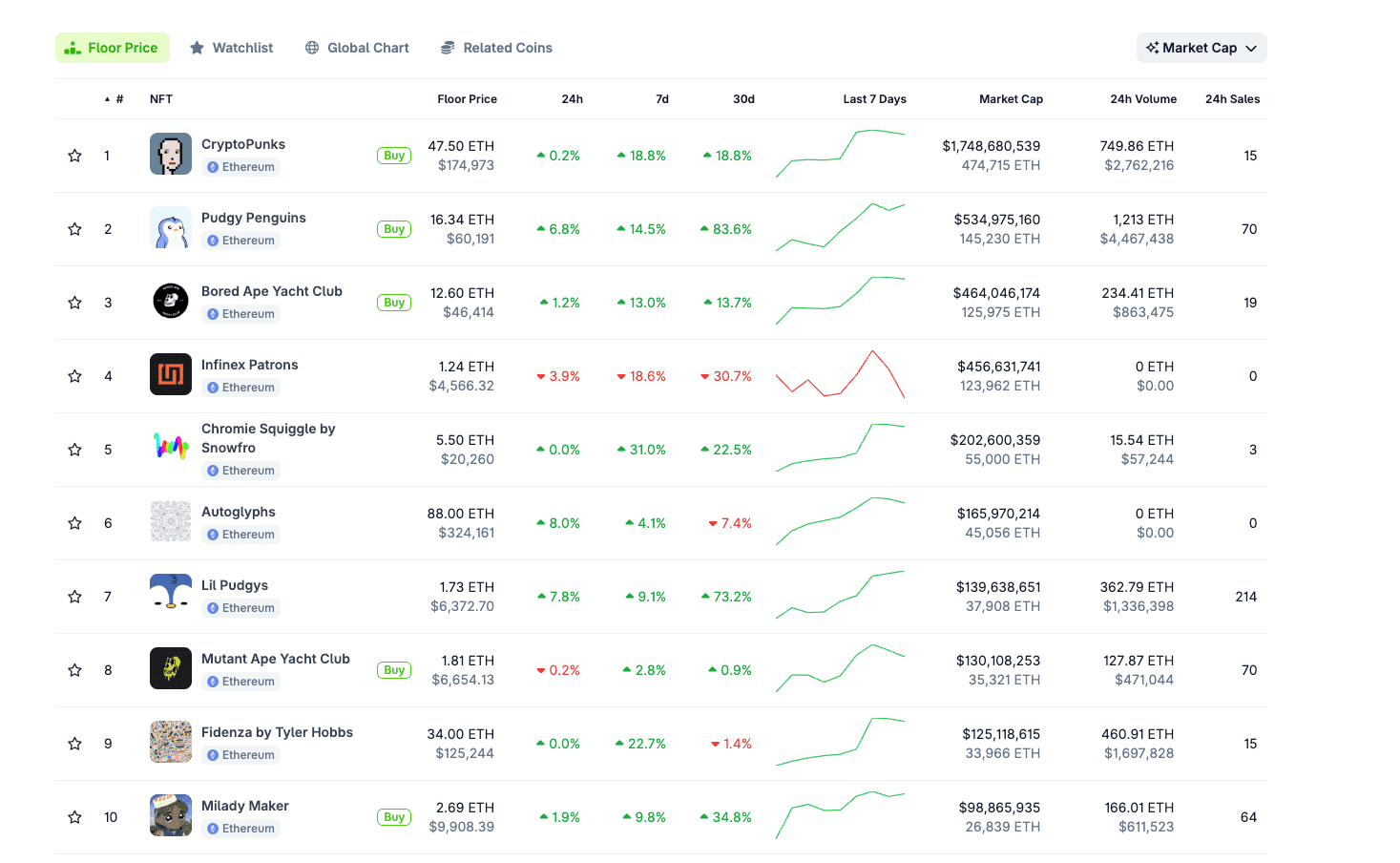

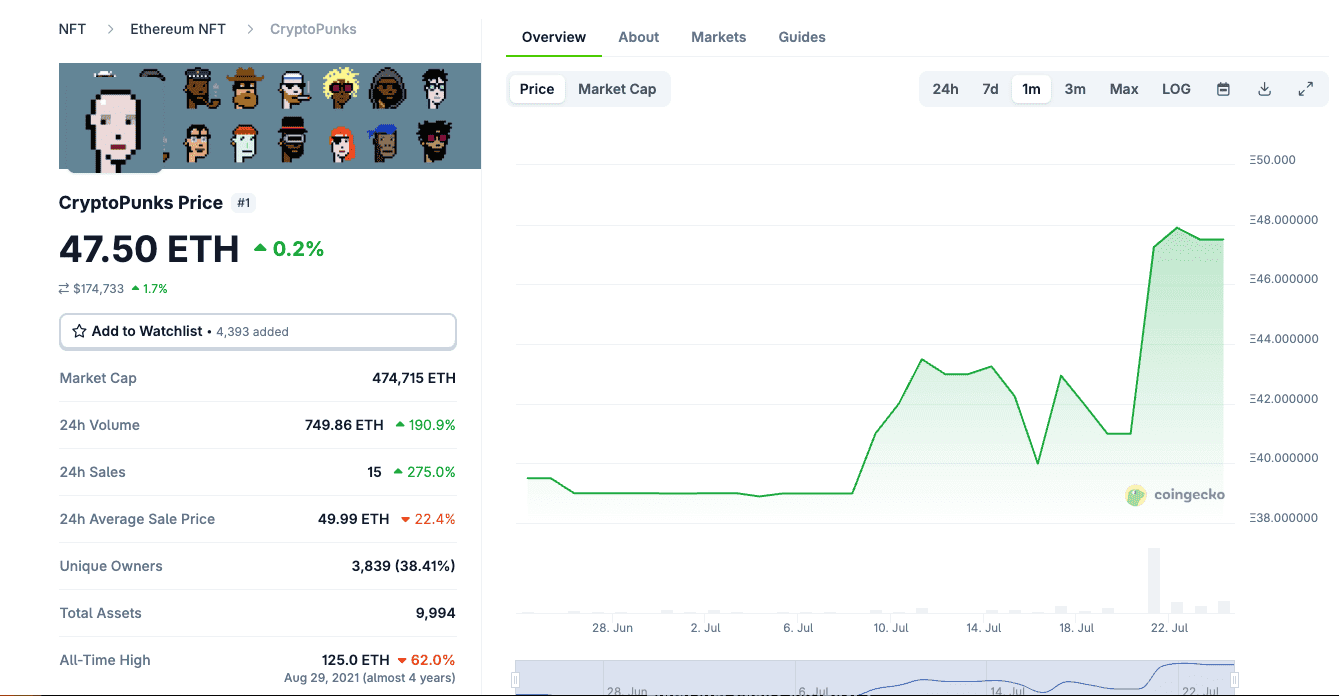

CryptoPunks

-

Flooring Value: 47.50 ETH

-

30-Day Achieve: +18.8%

Typically dubbed the “Bitcoin of NFTs,” CryptoPunks anchors the market with a staggering $1.75 billion market cap. Whereas its 24-hour acquire is modest, its highly effective 18.8% rise over the past month confirms that giant buyers (“whales”) are securing positions for the long run.

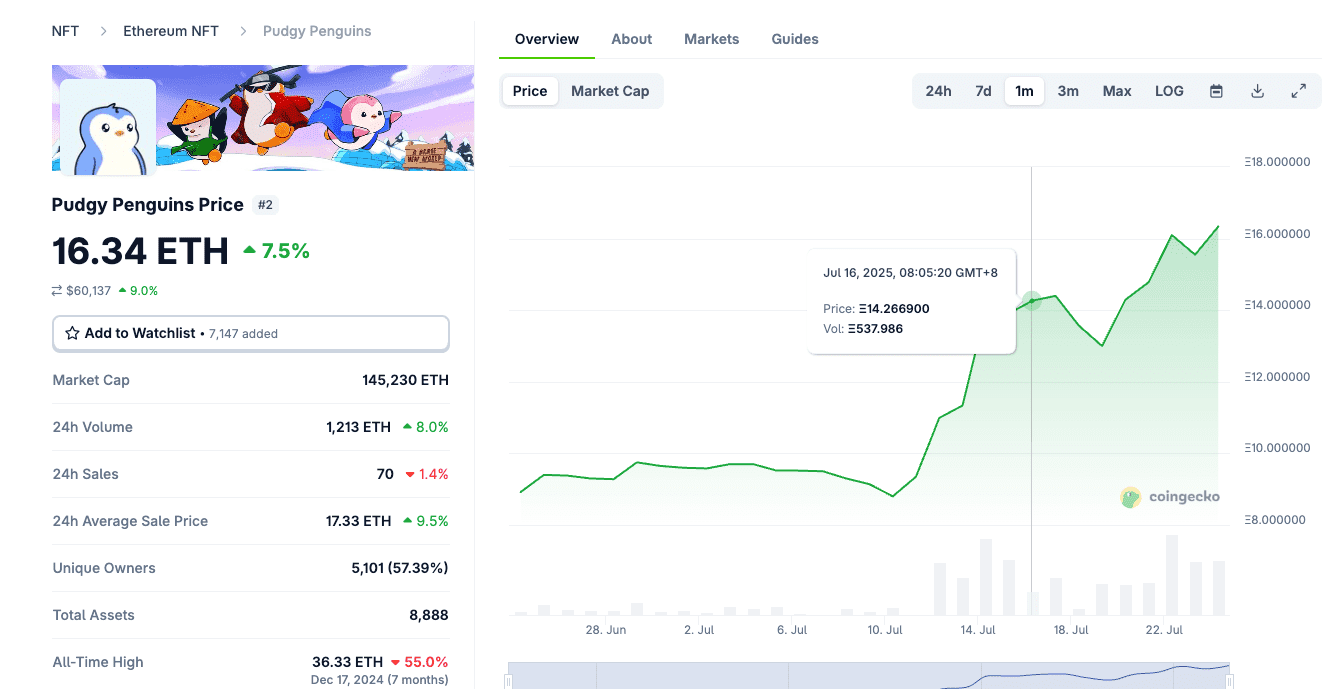

Pudgy Penguins

-

Flooring Value: 16.34 ETH

-

30-Day Achieve: +83.6%

Pudgy Penguins has emerged because the standout performer. Its ground value has seen an explosive 83.6% surge over the previous 30 days, pushed by immense buying and selling exercise. With over 1,213 ETH in 24-hour quantity, its momentum is backed by sturdy business licensing offers and a quickly rising group.

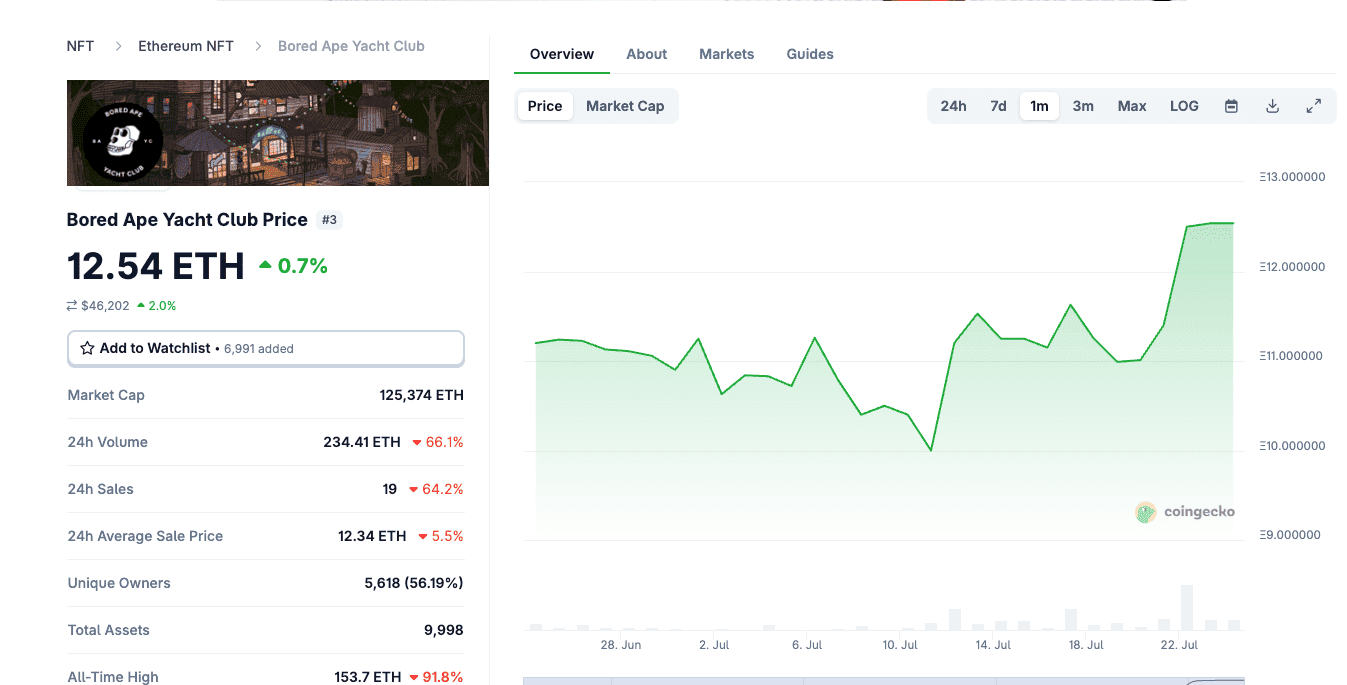

Bored Ape Yacht Membership (BAYC)

-

Flooring Value: 12.54 ETH

-

30-Day Achieve: +13.7%

Buying and selling with a strong $464 million market cap, BAYC exhibits regular and dependable progress. Its constant appreciation reinforces the enduring enchantment of blue-chip NFTs, proving their resilience even amidst unsure macroeconomic alerts.

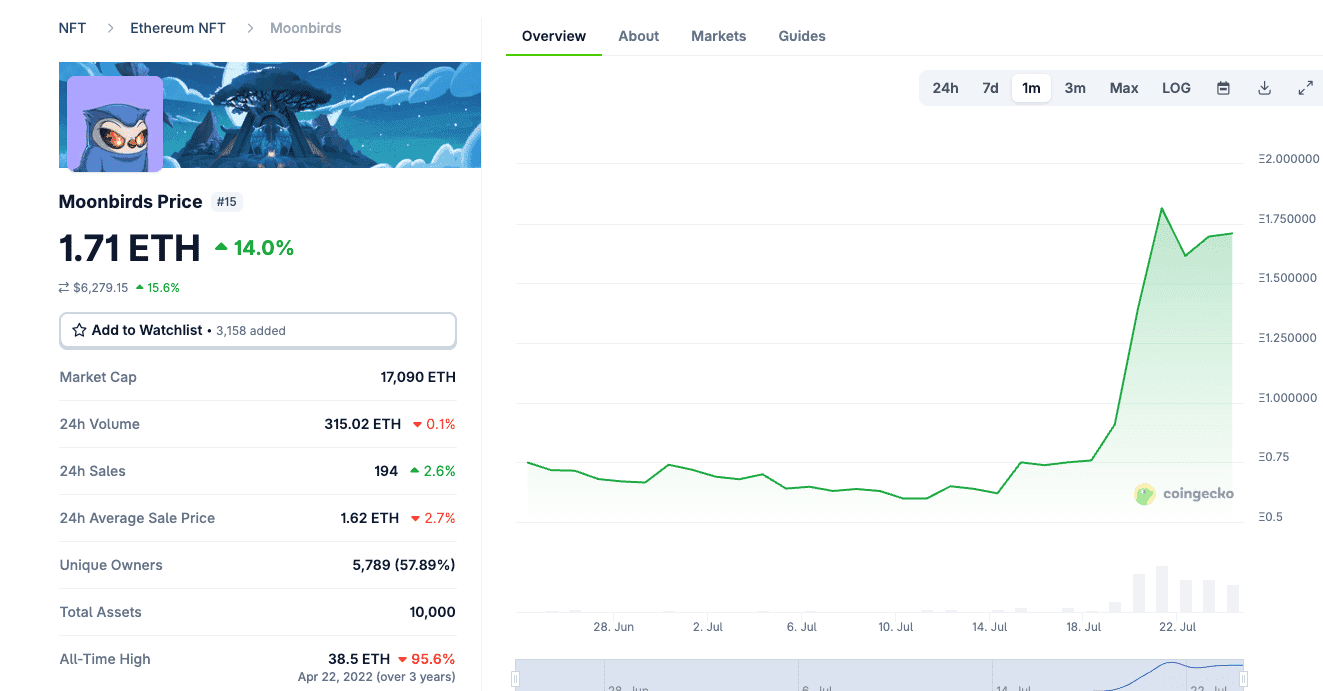

Moonbirds

-

Flooring Value: 1.71 ETH

-

30-Day Achieve: +152.4%

Moonbirds has emerged as the highest performer, shrugging off previous controversies round its management and roadmap. The sharp rise in its ground value signifies renewed confidence within the challenge, presumably pushed by group developments or strategic shopping for.

This clear management from established collections, slightly than pure retail hypothesis, suggests seasoned capital is re-entering the market. Traditionally, sturdy efficiency in blue-chip NFTs precedes broader curiosity in mid- and low-tier tasks, setting the stage for a possible market-wide increase.

Garga.eth’s Imaginative and prescient: The Rise of NFT Treasury Firms

Including to the bullish sentiment, Garga.eth, co-founder of Yuga Labs, posted a thought-provoking message on X: “The world isn’t prepared for NFT treasury corporations. However they’re on their approach.” This ignited widespread dialogue, with many decoding it as a sign of institutional-grade adoption for NFTs.

The idea of “NFT treasury corporations” means that Web3 tasks or DAOs could start holding NFTs as strategic belongings, just like how companies maintain Bitcoin. This might result in:

-

Institutional Validation: NFTs transitioning from easy collectibles to long-term strategic belongings for protocols and types.

-

Liquidity Help: Initiatives actively holding their very own NFTs to stabilize ground costs and improve market confidence.

-

Worth Accrual: DAOs utilizing NFT treasuries to sign model energy, akin to company inventory buybacks.

Whereas speculative, this imaginative and prescient aligns completely with the rising maturity of the NFT market. The very rally we’re witnessing, led by high-value belongings like CryptoPunks and BAYC, may very well be the precursor to this new part of institutional adoption, remodeling NFTs right into a extra steady and built-in asset class.

Bitcoin Dominance Decline Indicators Altcoin Season

Bitcoin’s dominance, which measures its market cap relative to the overall crypto market, has fallen from 67.6% to roughly 61% in lower than a month, in response to TradingView knowledge. This decline is a important sign for merchants, because it usually signifies a shift from safe-haven belongings like Bitcoin to riskier performs like altcoins and NFTs.

In conventional markets, the same dynamic happens when buyers transfer from bonds to equities during times of optimism. In crypto, falling Bitcoin dominance usually marks the beginning of an “altcoin season,” the place smaller cryptocurrencies outperform. NFTs, with their excessive volatility and speculative enchantment, usually lead this cost, appearing as a high-beta sector that amplifies market traits.

For instance, in early 2021, the same drop in Bitcoin dominance preceded a surge in NFT tasks like CryptoPunks and Axie Infinity, adopted by positive aspects in altcoins like Solana and Avalanche. If this sample repeats, merchants may see alternatives in:

-

Layer 1 Altcoins: Solana (SOL), Avalanche (AVAX), and others with sturdy ecosystems.

-

NFT-Associated Tokens: APE (ApeCoin), BLUR, and MEME, that are tied to NFT marketplaces or communities.

-

Rising Initiatives: Mid- and low-tier NFTs that always comply with blue-chip positive aspects.

Tips on how to Commerce the NFT Surge on Phemex

Because the NFT market heats up, merchants are in search of publicity not simply by means of direct NFT purchases but in addition through liquid belongings like Ethereum and NFT-related tokens. Phemex, a number one crypto trade, gives a spread of instruments to capitalize on this pattern, together with spot and futures buying and selling with deep liquidity.

Buying and selling Methods for the NFT Increase:

-

Purchase Ethereum: Because the spine of most NFT transactions, Ethereum usually rises throughout NFT bull runs. Accessible on Phemex (spot and futures).

-

Lengthy NFT Tokens: Tokens like APE, BLUR, and MEME supply excessive volatility and liquidity, excellent for short-term trades. Accessible on Phemex.

-

Scalping Volatility: Pairs like ETH/USDT or APE/USDT enable merchants to revenue from short-term value swings.

-

Leveraged Buying and selling: Phemex’s futures markets allow merchants to amplify publicity to Ethereum or NFT tokens, although leverage carries greater danger.

Why Commerce Tokens As a substitute of NFTs?

-

Liquidity: Tokens are simpler to purchase and promote than particular person NFTs.

-

Accessibility: Phemex’s user-friendly interface simplifies coming into and exiting positions.

-

Volatility: NFT tokens usually expertise sharper value actions than NFTs themselves.

-

Capital Effectivity: Futures buying and selling permits merchants to maximise returns with smaller capital outlays.

To get began, go to Phemex’s platform to discover buying and selling pairs and methods tailor-made to the NFT market. For rookies, Phemex gives academic sources to navigate crypto buying and selling successfully.

NFTs as a Danger Barometer for Crypto Markets

The NFT market’s resurgence is greater than a fleeting pattern—it’s a possible sign of broader crypto market enlargement. As Bitcoin’s dominance wanes and NFT ground costs climb, speculative capital is flowing again into the ecosystem. This dynamic positions NFTs as a “danger barometer,” indicating when merchants are prepared to maneuver past secure belongings like Bitcoin and discover high-reward alternatives.

For merchants, this opens a number of avenues:

-

NFT Token Performs: Tokens like APE and BLUR usually surge alongside NFT collections, providing liquid publicity.

-

Ethereum Longs: NFT minting cycles usually drive Ethereum demand, making it a core holding.

-

Altcoin Hypothesis: Mid-cap altcoins with NFT ties, reminiscent of these linked to metaverse or gaming tasks, may see positive aspects if the rally spreads.

Phemex offers the instruments to behave on these alternatives, with aggressive charges, sturdy safety, and a seamless buying and selling expertise. Whether or not you’re chasing short-term volatility or constructing a long-term portfolio, staying forward of the NFT pattern may yield important rewards.

Conclusion: Positioning for the NFT and Altcoin Increase

The NFT market’s 9% surge in a single day, coupled with a near-doubling of its market cap in a month, alerts a shift in crypto market dynamics. Led by blue-chip collections like CryptoPunks and Moonbirds, this rally displays rising investor confidence and danger urge for food. Garga.eth’s trace at NFT treasury corporations provides a layer of intrigue, suggesting that NFTs could quickly play a bigger function in institutional portfolios.

For merchants, the implications are clear:

-

Monitor Bitcoin dominance for indicators of a broader altcoin season.

-

Discover NFT-related tokens like APE and BLUR for high-volatility performs.

-

Use platforms like Phemex to commerce Ethereum and NFT tokens with effectivity and leverage.

The NFT rally will be the first spark of a bigger market enlargement. By positioning early, merchants can journey the wave of speculative capital flowing into NFTs and altcoins. Go to Phemex at the moment to begin constructing your technique and keep forward of the curve.