Authored by Melissa Davies, chief economist at Redburn Atlantic, op-ed via The FT,

The Fed has already began down the trail to resuming quantitative easing.

The query is whether or not they achieve this earlier than, or after, upending the highly-leverage hedge fund foundation commerce that has been supporting the Treasury market.

Again in 2018, quantitative tightening – the undoing of Fed asset purchases – was a easy affair. As bonds matured on the asset aspect of the Fed stability sheet, banks would draw down reserves on the legal responsibility aspect to purchase bonds. The query then was how low reserves might go earlier than they’d grow to be ‘scarce’ and the Fed must cease QT. Ultimately, the Fed went too far, inflicting strains in in a single day markets. They reversed the ship in 2019 and resumed QE to keep up a ‘ground’ system for setting charges.

This time round, QT has been sophisticated by the presence of enormous quantities of cash market fund money sitting within the Fed’s In a single day Reverse Repurchase Facility, or ON RRP.

In 2023, it was the ON RRP that declined alongside Fed belongings, and financial institution reserves truly rose.

The belief has been that ON RRP drainage was defending financial institution reserves and that, solely as soon as these reserves began to fall would we’ve got to fret a couple of rerun of 2018. The Fed additionally now has a backstop for the banks – the Standing Repo Facility – that may be drawn down within the occasion of surprising liquidity squeezes.

However the ON RRP might have been enjoying an altogether riskier function in bond markets – financing the proliferation of the so-called hedge fund ‘foundation commerce’, whereby hedge funds borrow to purchase Treasuries and promote Treasury futures to make a tiny return, leveraged up a number of occasions.

This commerce has caught the eye of regulators on either side of the Atlantic.

The issue is that the idea commerce is financed within the non-public repo markets, and it’s cash market funds – drawing down their ON RRP money – which might be financing this commerce.

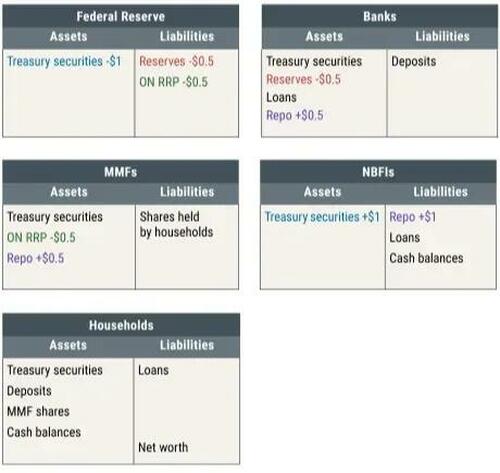

The field diagram beneath, from the New York Fed, reveals how ON RRP cash can find yourself financing hedge funds (“Non Financial institution Monetary Establishments”) repos:

Levered NBFIs Buy New Treasury Securities © New York Fed

This has created the opportunity of a worrying chain response – from the Fed’s stability sheet, by way of the cash market funds and the non-public repo market, by the idea commerce and on to the demand for Treasuries, at a time when the US authorities is coming to market with huge quantities of issuance.

As a substitute of scarce financial institution reserves creating liquidity issues and forcing the Fed to cease QT, it might be the exhaustion of the ON RRP and the upending of the hedge fund foundation commerce that causes issues in 2024. The worrying distinction now could be that there isn’t any Fed backstop for hedge funds and the excessive diploma of leverage used within the commerce might result in liquidity issues proliferating much more rapidly by the monetary system.

It appears unlikely that the Fed is unaware of this subject.

Certainly, it might be no coincidence that Fed messaging on QT is already shifting, with Dallas Fed President Lorie Logan already suggesting that QT ought to taper as soon as the ON RRP runs dry.

This can be too late to avert a extreme bout of bond market volatility, although.

Both method, the Fed is on target to finish QT and restart QE within the coming months, in opposition to a backdrop of free fiscal coverage and a still-resilient economic system, opening the door to a reappearance of inflationary pressures that the Fed might have little urge for food (or means) to restrain.

Loading…