- Correlation between the OI, value and, energetic addresses indicated a possible fall to $4.93

- Late shorts won’t get any reward as TON would possibly start a gradual restoration quickly

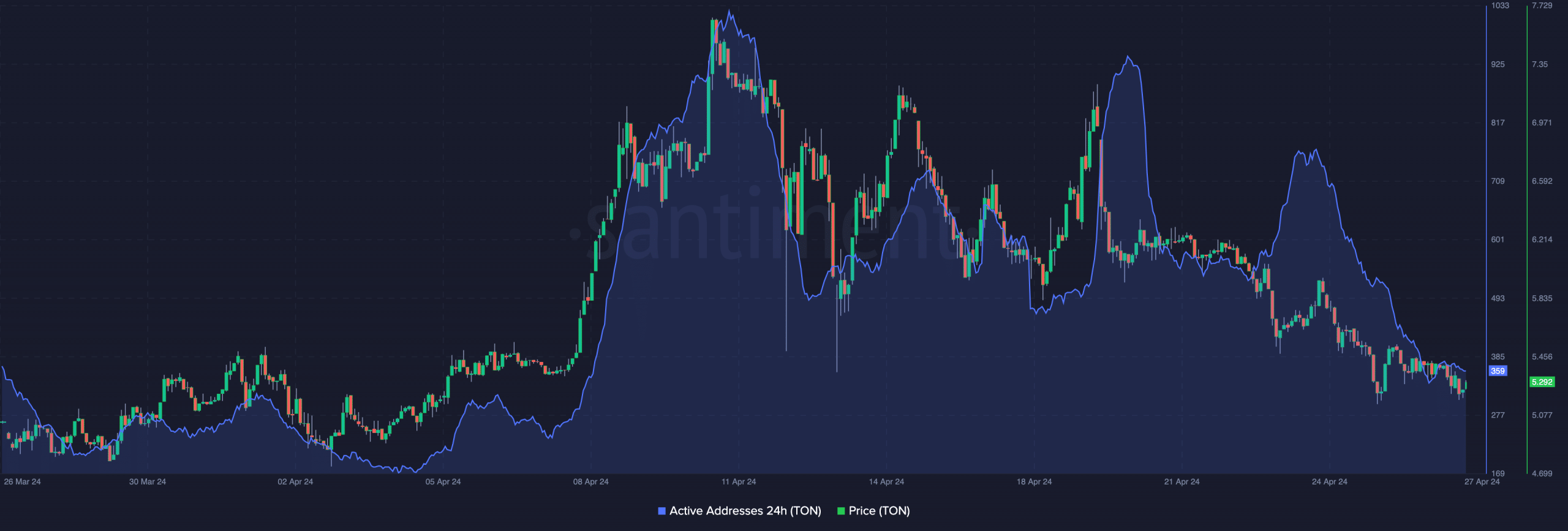

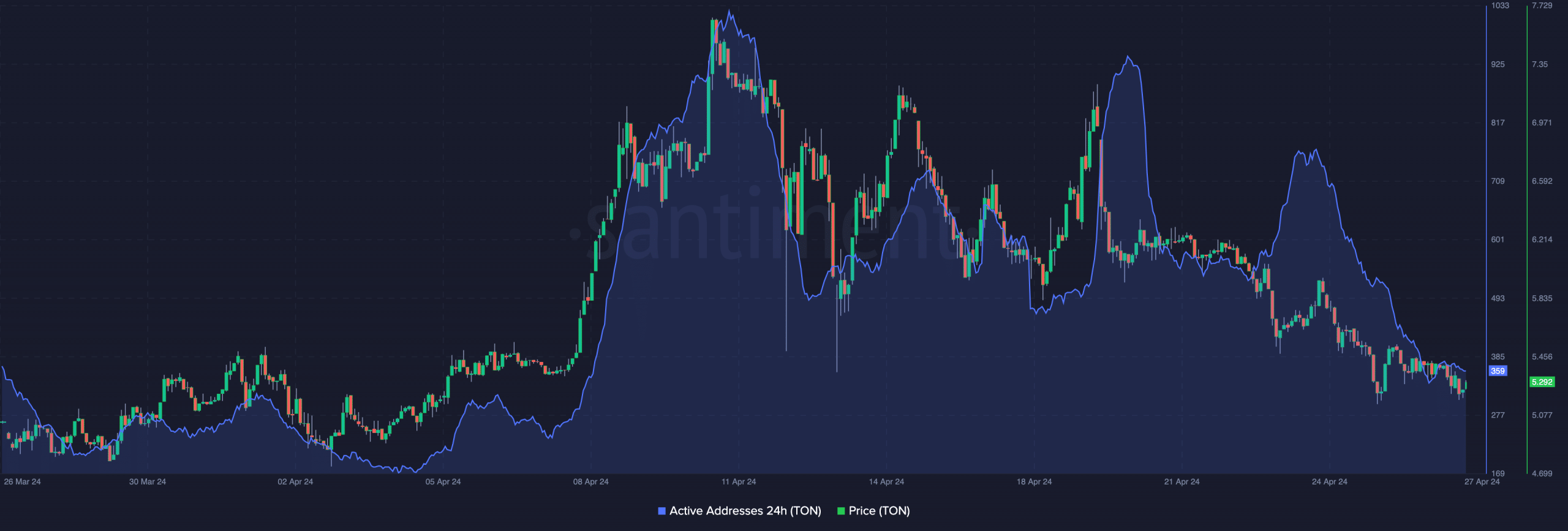

The variety of energetic addresses on the Toncoin [TON] community has fallen from the notable peaks it hit on quite a few events, in response to AMBCrypto’s evaluation. At press time, the 24-hour energetic addresses rely was 359. On 24 April, nonetheless, the rely was double this quantity, whereas the metric was at a a lot greater degree on 11 April.

A hike in energetic addresses implies a surge within the variety of distinctive addresses transacting on the community. Thus, this decline could also be an indication that deposits and withdrawals on Toncoin fell.

Curiously, TON’s value and community exercise appear to have a robust correlation. The truth is, based mostly on the chart under, one can assert that TON’s value jumps virtually each time the metric hikes on the charts.

Supply: Santiment

Indicators spot a fall under $5

It additionally did in any other case as quickly as exercise on the community dropped. With this connection, it won’t be misplaced to foretell an additional drop in TON’s worth. If that is so, the worth of TON would possibly hit $4.93. Right here, it’s value noting that the Open Curiosity (OI) recorded a decline on the charts too.

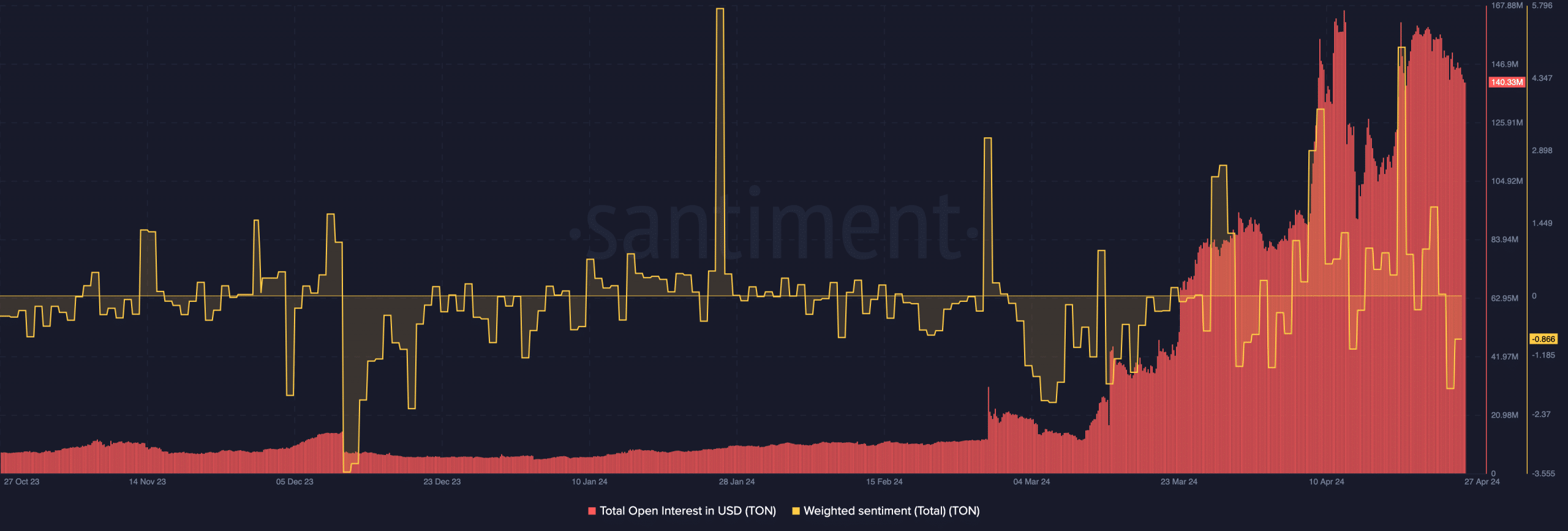

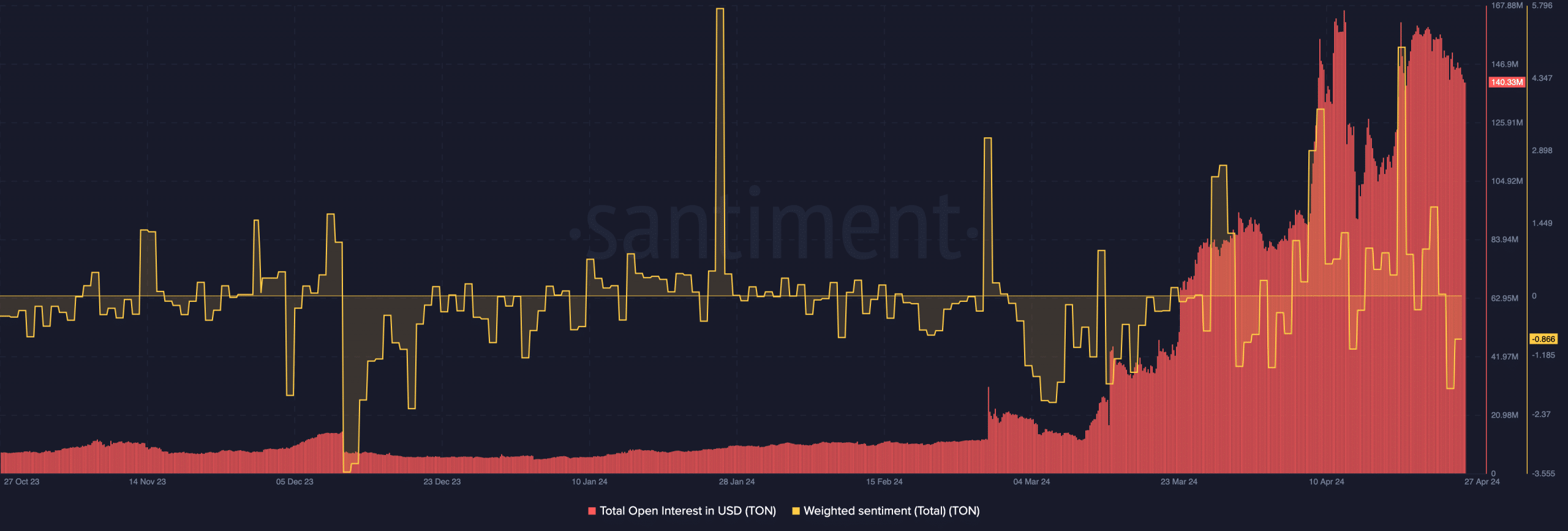

For context, OI will increase or decreases based mostly on internet place. If it will increase, it means consumers are aggressive and liquidity flowing into contracts is rising. However, a decline implies that sellers are the aggressive ones.

At press time, Toncoin’s complete OI had fallen to $140.33 million. From a buying and selling perspective, this worth may trigger the token to dump into the underlying assist. Thus, the worth of TON would possibly drop under $5 within the brief time period.

Moreover, market individuals who as soon as had confidence within the cryptocurrency’s efficiency have switched to the opposite choice. Proof of this was proven by the Weighted Sentiment. At press time, the Weighted Sentiment had a studying of -0.866. This adverse studying reinforced the aforementioned conclusion, indicating that the majority feedback involving TON had been bearish.

Supply: Santiment

TON is just not lifeless

If this lingers, demand for TON is perhaps troublesome to come back by. Nonetheless, within the occasion the place altcoins begin to transfer upwards, the sentiment across the token is perhaps in favor of a value hike.

One different technique to consider TON’s short-term potential is by trying on the liquidation ranges. Liquidation ranges present the estimated costs the place large-scale liquidation occasions would possibly happen.

If a dealer has any concept of this, it may possibly present him a bonus over others with out the information. From our evaluation, many brief positions is perhaps liquidation if Toncoin rises to $5.78. On the identical time, longs danger a wipeout if TON drops to $5.02.

In the meantime, the Cumulative Liquidation Ranges Delta (CLLD) was adverse at press time. Right here, this indicator is the distinction between open lengthy liquidations and people on the brief finish.

Is your portfolio inexperienced? Verify the TON Revenue Calculator

Because it stands, the CLLD studying means that late shorts attempting to catch the dip would possibly get punished. This, as a result of the sharp value decline would possibly gas a bullish bias in a while, and TON would possibly provoke a gradual restoration.