FrankvandenBergh/E+ by way of Getty Pictures

The tobacco sector will see the reporting season begin subsequent week with Philip Morris Worldwide (NYSE:PM) as a consequence of enter the earnings confessional on October 19. Tobacco shares underperformed the S&P 500 Index throughout Q3 because the upcoming heated tobacco taste ban in Europe, unrelenting U.S. greenback energy, excessive rates of interest, and total cooling sentiment on shopper staples shares weighed on sentiment. If there was a shiny spot throughout the quarter, it was the sturdy 2024-2-2026 steering unveiled by Philip Morris Worldwide (PM) as a part of the corporate’s Investor Day in Switzerland.

Following the Philip Morris (PM) occasion, Morgan Stanley reiterated an Obese score on PM and known as it the agency’s total high decide throughout U.S. meals and tobacco shares. Analyst Pamela Kaufman mentioned PM’s new mid-term targets bolstered a number of tenets of BofA’s bullish view, together with important additional progress alternative for IQOS in new and current markets, increasing smoke-free product, sturdy Zyn momentum with room to triple model gross sales within the US and develop internationally, important IQOS progress potential within the US market beginning in 2024 with compelling unit economics, and confidence in PM’s advantaged monetary outlook and elevated mid-term aims of 6% to eight% natural income progress, 8% to 10% natural OCI progress, and 9% to 11% EPS progress in constant-FX underscore its confidence. “We consider PM is uniquely positioned inside the Shopper Staples sector given its broad geographic diversification, sturdy pricing energy, main market share, over $10.7 bn in R&D and model constructing funding over the past 15 years to remodel its enterprise,” famous Kaufman.

The view from Wall Road is extra lukewarm on Altria (NYSE:MO) as analysts have a consensus Maintain score. Financial institution of America pointed to mushy cigarette volumes and downtrading as near-terms drags for the corporate. With the Q3 report, the agency is looking forward to indicators of progress on its smoke-free imaginative and prescient, success in balancing volumes vs. earnings, lingering FDA pressures, and inflation weary shoppers. “We predict total inflation on shopper items could weigh on premium flamable volumes over the close to time period,” warned analyst Lisa Lewandowski. “As well as, traders await extra FDA commentary concerning decreasing nicotine ranges and banning menthol in cigarettes,” she added.

Buyers could hear some tobacco firms touch upon this quarter’s spherical of earnings convention name in regards to the proposed regulation within the UK to cease kids aged 14 or youthful this 12 months ever being offered cigarettes legally in England over their lifetime. Financial institution of America thinks the influence of the potential UK cigarette ban can be sluggish and extended earlier than immediately clipping firm earnings. Imperial Manufacturers (OTCQX:IMBBY) was famous to be probably the most uncovered to the event, with British American Tobacco p.l.c. (NYSE:BTI) and Philip Morris (PM) doubtlessly benefitting from a sooner acceleration to NGPs. Imperial Manufacturers holds the biggest market share place in UK cigarettes with 45% quantity share per Euromonitor, with BAT (8%) and Philip Morris (7%) holding considerably much less. The UK market represents ~7% of Imperial Manufacturers’ income, and a better proportion of adjusted EBIT. In the meantime, UK cigarette income is immaterial to the general income for BAT and Philip Morris. The potential ban story has led to share worth declines. Because the media reviews first hit, Imperial and BAT’s respective share costs declined ~9%, with Philip Morris declining ~4% over the identical interval, though BofA famous that the strikes will not be essentially absolutely attributable to the proposal.

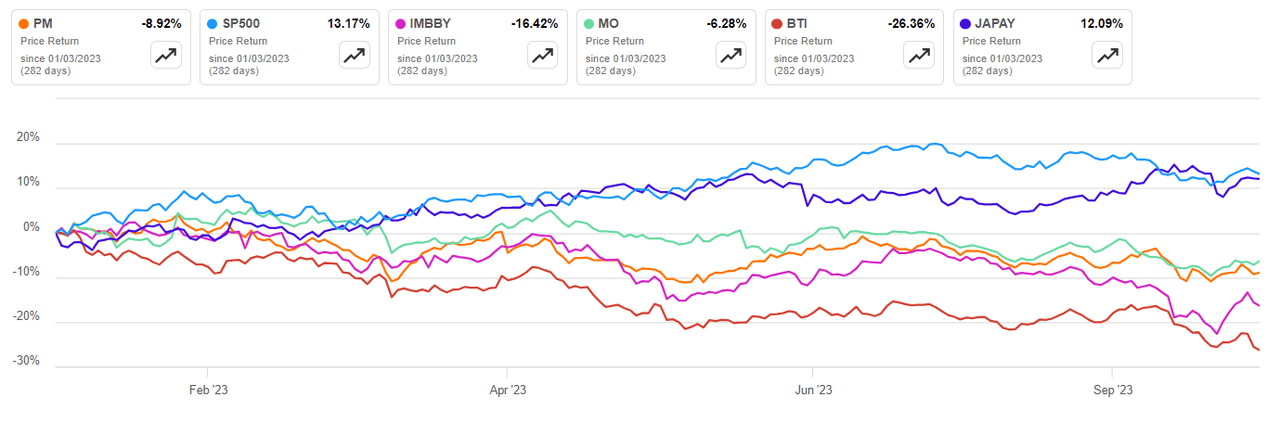

On a year-to-date foundation, main tobacco shares path the S&P 500 Index.

Imperial Manufacturers (OTCQX:IMBBY) is the tobacco inventory with the best In search of Alpha Quant Score, whereas British American Tobacco (BTI) has the highest dividend yield for brand new consumers. In search of Alpha analyst Dan Victor has a Purchase score on Vector Group (VGR) as a tobacco sleeper decide as a consequence of engaging valuation and decrease publicity to menthol cigarettes.