A broadly adopted on-chain analyst thinks {that a} large value transfer is incoming for Bitcoin (BTC) following months of consolidation.

Pseudonymous analyst Checkmate tells his 91,900 followers on the social media platform X {that a} key on-chain metric for Bitcoin suggests it’s virtually time for BTC to flee its consolidation section.

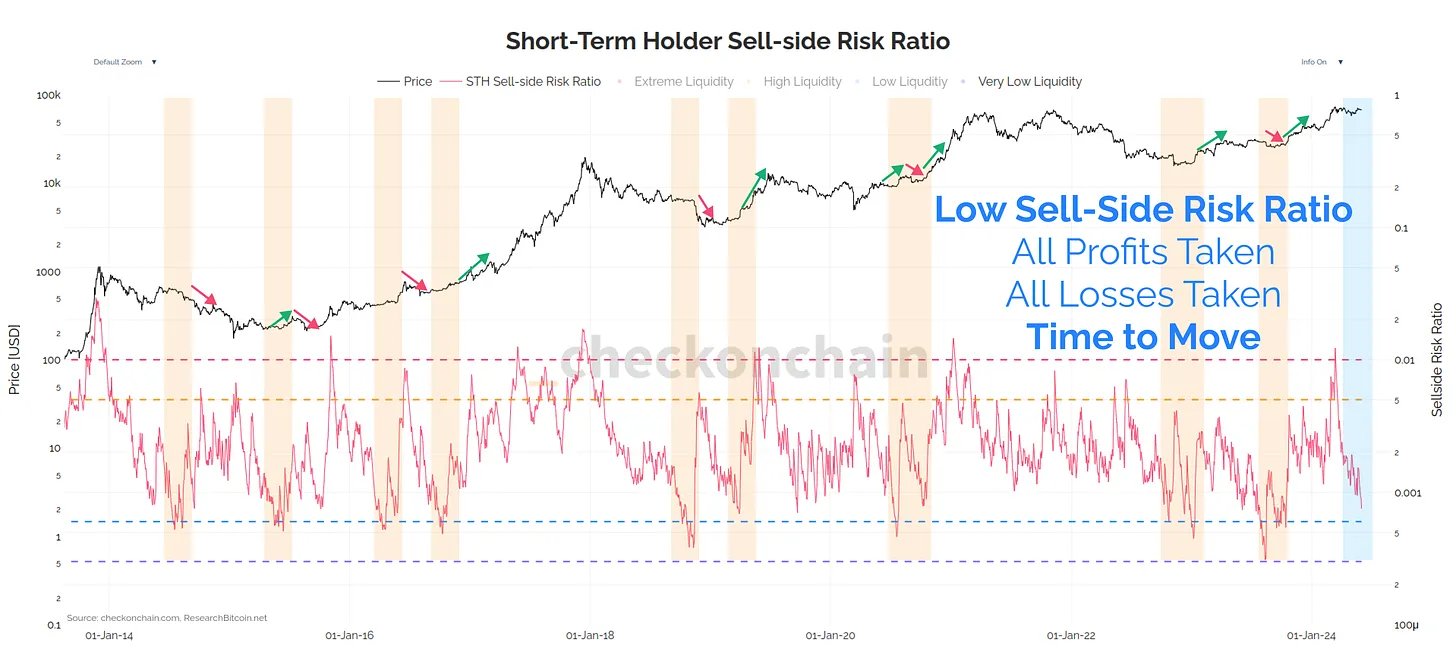

In line with the analyst, BTC’s sell-side threat ratio for short-term holders is quickly declining, indicating that sellers are dropping ammunition. Checkmate notes that he’s trying on the short-term holder cohort or entities which have been holding BTC for lower than 155 days as a result of they’re those driving near-term value motion.

“Vary contraction (consolidation) results in Vary Growth (trending).

Bitcoin is coiled like a spring, and it often doesn’t sit nonetheless like this for lengthy.

Promote-side threat ratio for short-term holders is dropping like a stone, telling us it’s time to transfer.”

As to what may catalyze the subsequent large Bitcoin transfer, Checkmate says he’s keeping track of the US bond market. In line with the analyst, the speed for 10-year yields (US10Y) is in an uptrend and situations might flip bitter for Bitcoin and crypto if it trades shut to five%.

Checkmate highlights that “larger yields imply tighter situations, much less beneficial collateral, and a decreased total threat tolerance.”

“I’ve flagged in pink the extreme sell-off we noticed in bonds between August and October 2023 on the chart under. Throughout this time, US-10y yields approached 5.0%, equities offered off by -10%, and Bitcoin offered off -12% in at some point. That stated, BTC then consolidated for 2 months, and ripped +30% larger.

10y yields buying and selling up in direction of 5% is the place the Fed and Treasury have beforehand turn out to be involved about treasury market dysfunction, and stepped in to arrest the autumn in costs. It is a cheap argument for why Bitcoin offered off initially, however then rallied larger afterwards.

The bond market is the one which will get to ‘name time’ on threat belongings and monetary stability. Ought to yields speed up larger from right here, it begins getting near the territory the place issues may get furry, and quick.”

Bond costs and yields have a tendency to maneuver in the wrong way. When yields soar, the costs of older bonds plummet as they must compete with newer bonds that supply larger curiosity.

At time of writing, US10Y is hovering at 4.394% whereas BTC is buying and selling at $68,643.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Facebook and Telegram

Surf The Each day Hodl Combine

Generated Picture: DALLE3