Stephen Wair/iStock through Getty Photos

With the OSV market within the midst of a super-cycle, Tidewater (NYSE:TDW) seems the easiest way to play this development.

Firm Profile

TDW operates a fleet of offshore service vessels (OSV) which might be used to assist numerous features of the offshore crude oil and pure gasoline business, in addition to the windfarm business. Its vessels present numerous providers together with towing and anchor dealing with for cellular offshore drilling models; transporting provides and personnel; offshore building assist; geotechnical survey and seafloor analysis; and different specialised providers.

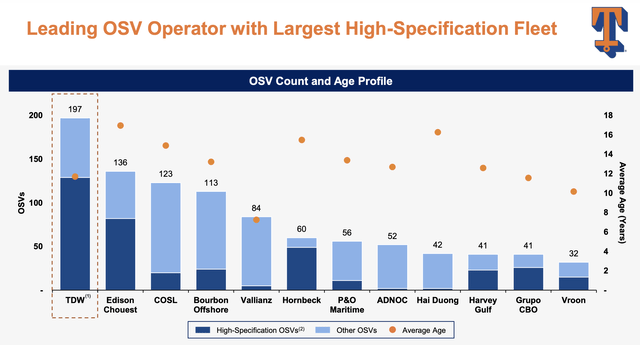

The corporate at the moment has 223 vessels, together with 197 OSVs. Of its vessels, 141 are platform provide vessels (PSV) which might be designed to hold a wide range of cargo, together with gas, water, drilling fluids, and phase in beneath deck tanks, in addition to carry supplies akin to casings, drill pipes, and tubing on an open deck. It additionally has 56 anchor dealing with provide vessels (AHTS) which might be used for towing, anchoring and different subsea operations. It additionally has 17 crew boats, 6 offshore tug boats, and three specialty vessels.

TDW Fleet (Firm Presentation)

Alternative & Dangers

One of many greatest alternatives for TDW is benefiting from rising day charges for its vessels. The corporate has seen a robust enhance in day charges over the previous few years. In 2021, it was getting a day charge of $10,950, which went as much as $12,803 final yr. Vanguard time period contracts, in the meantime, have been $21,186 in Q1 of this yr and $23,498 for Q2.

Charges, in the meantime, are solely anticipated to proceed to go up and probably hit all-time records in 2024. It is a outstanding turnaround for the business, which regarded on its deathbed not too way back. Nonetheless, the pressured interval for the business earlier than the pandemic led to elevated scrapping and lay-ups, and virtually no newbuild exercise. With vessels laid up for greater than 5 years now, reactivating them turns into more and more time and price intensive and thus much less probably. With oil costs excessive and offshore drilling returning, that is beginning to go away a supply-demand imbalances in some areas as there may be immediately now a scarcity of vessels. That is resulting in larger day charges in addition to higher contract phrases, akin to no cancellation for comfort clauses.

Discussing the present state of the OSV market on its Q2 earnings name, CEO Quintin Kneen mentioned:

“As we have mentioned ceaselessly, day charge enchancment is the first driver of accelerating profitability of our enterprise, significantly as we have a look at the intermediate to long-term offshore cycle unfolding. As such, we stay targeted on a wide range of ways to proceed to drive international common day charges. We have been profitable in our ways to proceed to push day charges globally. This technique did have a short-term utilization impression. We consciously selected to forego sure instant contracts to pursue larger day charge alternatives. And in some circumstances, we incurred frictional unemployment associated to relocating vessels and ready on prospects for tasks to start. The mixed alternative value to income for this technique was roughly $8 million from loss utilization through the second quarter. We’re assured that this chartering technique is true for the intermediate and long-term profitability of the enterprise, as we not solely achieved larger day charges within the brief time period, however proceed to push the baseline day charges for sure vessels that may show helpful as we progress by way of the rest of ’23 and into 2024 and past.”

With no newbuilding exercise and day charges robust, TDW has turned to acquisitions to extend its fleet and enhance outcomes. For the reason that begin of 2022, the corporate has made two acquisitions. In March 0f 2022, it acquired Swire Pacific Offshore for $190 million, consisting of $42 million in money and eight.1 million Jones Act warrants, which was 15.6% of TDW’s shares excellent on the time.

Swire introduced with it 50 OSVs, comprising of 29 AHTS and 21 PSVs. The deal added extra giant vessels to TDW’s fleet and lowered its common age. Given the present worth of vessels – it prices about $65 million to construct a brand new OSV – this deal turned out to be a steal.

Extra not too long ago, the corporate purchased 37 high-specification PSVs from Solstad Offshore for $577 million in March of 2023. The deal as soon as once more high-graded TDW’s fleet with youthful, bigger vessels. Given the price of newbuild vessels, whereas at a a lot larger worth, this was as soon as once more a pleasant deal for TDW.

For newbuild vessels to get a return on capital given present excessive rates of interest, day charges must common about $38,000 a day, which ought to proceed to maintain upward stress on day charges and the variety of newbuilds ordered low.

The largest threat to TDW is a shift available in the market. OSV operators have been devastated over the past oil worth crash, with numerous corporations submitting for chapter, together with TDW. The corporate emerged from Chapter 11 with much less debt and the market has since turned, nevertheless it reveals the dangers concerned. Thus, a significant crash in oil costs can be the most important threat the corporate faces.

The OSV market tends to be very cyclical, the place robust instances are sometimes met by a rush to construct new vessels. This in flip creates provide points when the oil market turns and offshore drilling providers weaken. Proper now, although, the market remains to be on the aspect the place vessel provide is struggling to fulfill demand and day charges aren’t priced excessive sufficient to usher in extra newbuild ships.

After rising from chapter and with the day charge rising, TDW is just one.2x leverage based mostly on its projected 2023 EBITDA. Nonetheless, within the occasion of a crash available in the market, day charges can go beneath working prices.

Valuation

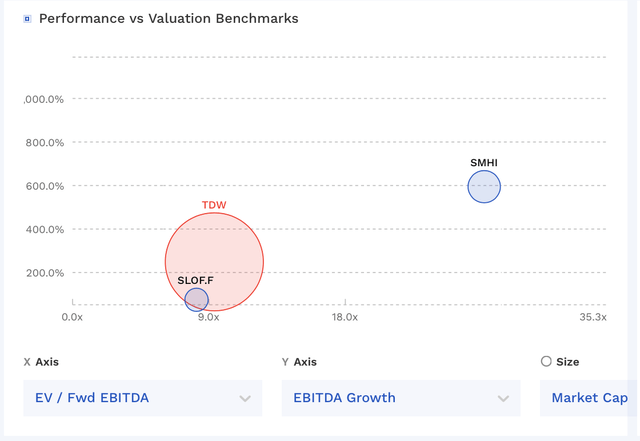

TDW inventory at the moment trades round 9x the 2023 consensus EBITDA of $393.1 million and 5.5x the 2024 consensus of $646.7 million.

It trades at a ahead P/E of 20.4x the 2023 consensus of $3.30 and 9.0x the 2024 consensus of $7.49.

It’s projected to progress income by over 56% this yr and over 33% in 2024.

There aren’t many U.S. traded OSV shares anymore, with SEACOR Marine Holdings (SMHI), the opposite notable one. TDW trades at a decrease valuation than SMHI.

On a per ship foundation, it trades at about $15.7 million per vessel based mostly on its 223 vessels. That is just about in keeping with the $15.6 million per vessel it spent buying ships from Solstad, though these ships have been newer and bigger and will command a better valuation than its total fleet. That mentioned, day charges have additionally continued to enhance.

TDW Valuation Vs Friends (FinBox)

Conclusion

TDW seems to be within the midst of an OSV super-cycle, the place day charges are going up as a result of demand is outstripping vessel provide in some geographic areas, however they don’t seem to be excessive sufficient but to justify newbuilds, particularly given the place rates of interest are, making the price to finance them excessive.

With a median contract period of below 1 yr for legacy TDW vessels and ~6 months for the ships it simply acquired from Solstad, it ought to proceed to profit from rising day charges as contracts roll off. It is a good set-up transferring into 2024.

If you happen to worth TDW off the transaction worth per ship from the Solstad deal, the inventory might be fairly near pretty valued. Given the present momentum available in the market, although, I feel the inventory can in all probability proceed to maneuver larger together with day charges. As such, I’m going to charge the inventory a “Purchase.”