In a put up on X, one analyst has picked out a key on-chain metric that might sign the start of a powerful leg up, much like the explosive positive factors 2017. At present, Bitcoin costs stay regular and edging larger. Nonetheless, the coin did not register sharp upswings, as most merchants had predicted earlier than the Halving occasion on April 20.

Move Indicator Dips: A Bull Run In The Making?

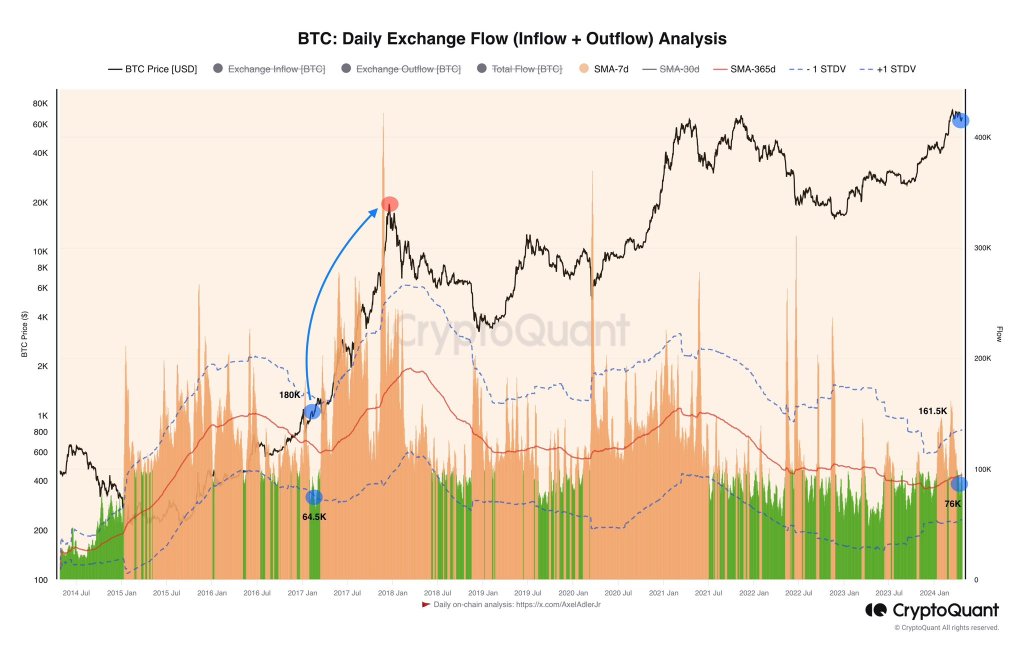

Taking to X, the analyst mentioned there was a pointy drop within the 7-day common Move indicator at main crypto exchanges like Coinbase and Binance. When this was highlighted, the Move indicator pointed to a decline from 161,000 to 76,000 BTC, an almost 50% drop.

Apparently, an analogous sample emerged in 2017 earlier than Bitcoin launched into a historic bull run.

The analyst mentioned the Move indicator dropped to 64,500 BTC throughout exchanges days and weeks later earlier than costs exploded to round $20,000 in December 2017.

For now, solely time will inform if Bitcoin is getting ready for a powerful leg up. The coin stays inside a bear formation, trying on the candlestick association within the every day chart. Although costs rose after Halving Day on April 20, sellers are in cost. As it’s, the April 13 bearish engulfing sample continues to outline worth motion. Technically, an in depth above $68,000 is likely to be the muse for a rally in direction of $74,000 within the days forward.

Bitcoin Provide Quickly Shrinking

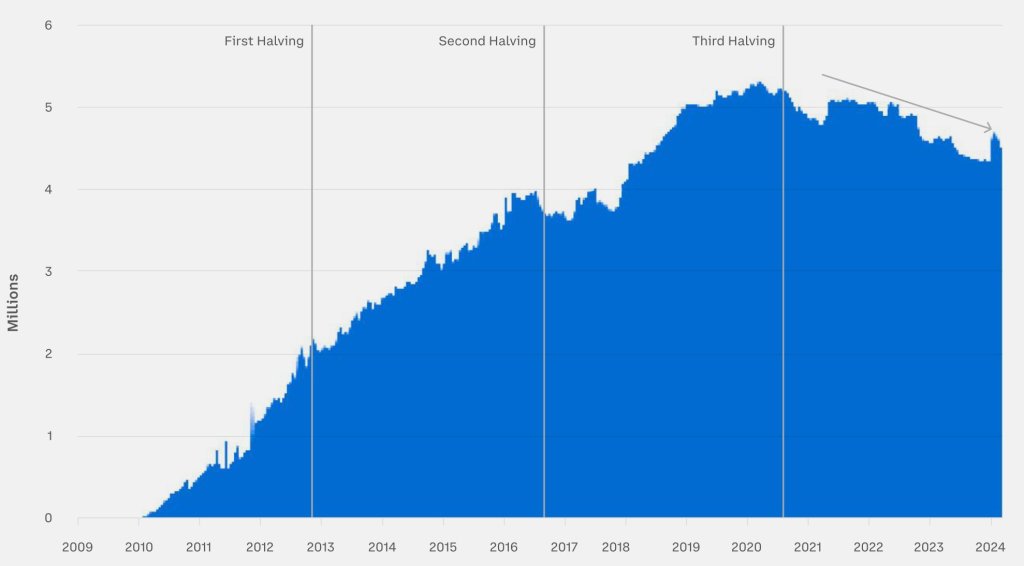

Whereas the Move indicator factors to declining BTC throughout exchanges, one other analyst has found an attention-grabbing growth. Taking to X, one other analyst noted that the out there Bitcoin provide dipped beneath 4.6 million for the primary time earlier than April 20, when the community halved miner rewards.

Since Halving reduces every day emissions by half, even when the present demand is sustained, the analyst says a provide squeeze will drive costs larger. Even so, as talked about earlier, whether or not BTC will rally is determined by the tempo at which quick resistance ranges are cleared.

Traditionally, costs are likely to rally a number of months after Halving Day. Nonetheless, previously few months, there have been notable deviations. As an example, costs soared to all-time highs earlier than Halving Day. That is the primary time this has occurred.

Past technical formations, america Securities and Alternate Fee (SEC) accredited the primary spot Bitcoin ETFs in January 2024. By way of this product, establishments are free to realize publicity by shares. These shifting dynamics will form worth motion within the present epoch, probably resulting in new deviations from historic performances.