The ethos of Bitcoin as a decentralized cryptocurrency is underneath menace, in keeping with Kadan Stadelmann, the CTO of Komodo, who has voiced issues to BeInCrypto over the growing centralization throughout the community.

This shift from its foundational rules might redefine Bitcoin’s position within the monetary panorama.

One Enormous Mining Powerhouse

Since its inception by Satoshi Nakamoto in 2009, Bitcoin has been celebrated as a pioneering power for monetary autonomy and freedom, free from the management of centralized monetary establishments. Nevertheless, latest developments counsel a departure from this excellent, steering Bitcoin in direction of what Stadelmann phrases a “centralized paradox.”

One of the vital important indicators of this pattern is the focus of mining energy inside a handful of mining swimming pools. Foundry USA and Antpool, for instance, now control over 50% of Bitcoin’s complete hashrate. This focus is much more pronounced when contemplating that greater than 80% of mining energy is held by simply 5 swimming pools.

Such dominance by a number of undermines the decentralized nature that Bitcoin was alleged to exemplify.

The affect of presidency and regulatory our bodies additionally complicates the image. As an example, North America’s Blockseer pool not solely meets however exceeds the US Authorities’s Workplace of International Belongings Management (OFAC) compliance requirements.

Learn extra: Crypto Regulation: What Are the Advantages and Drawbacks?

This compliance introduces a stage of presidency oversight and management that was beforehand absent, diluting the decentralized promise of Bitcoin.

“In brief, a minority of miners management substantial assets, undermining the decentralized ethos that Bitcoin claims to uphold. This situation questions the egalitarian nature that Bitcoin was presupposed to symbolize and opens discussions concerning the true beneficiaries of this digital foreign money,” Stadelmann informed BeInCrypto.

American Establishments Take Over

Stadelmann additionally believes that the rising engagement of main monetary establishments in Bitcoin mining operations alerts one other shift in direction of centralization.

BlackRock has acquired important shares in two main Bitcoin mining firms, 6.71% in Marathon Digital Holdings and 6.61% in Riot Blockchain, with investments nearing $383 million. Since 2014, Constancy Group has been actively mining Bitcoin. Then again, Vanguard holds roughly 17.9 million shares in Riot Platforms and 17.5 million shares in Marathon Digital.

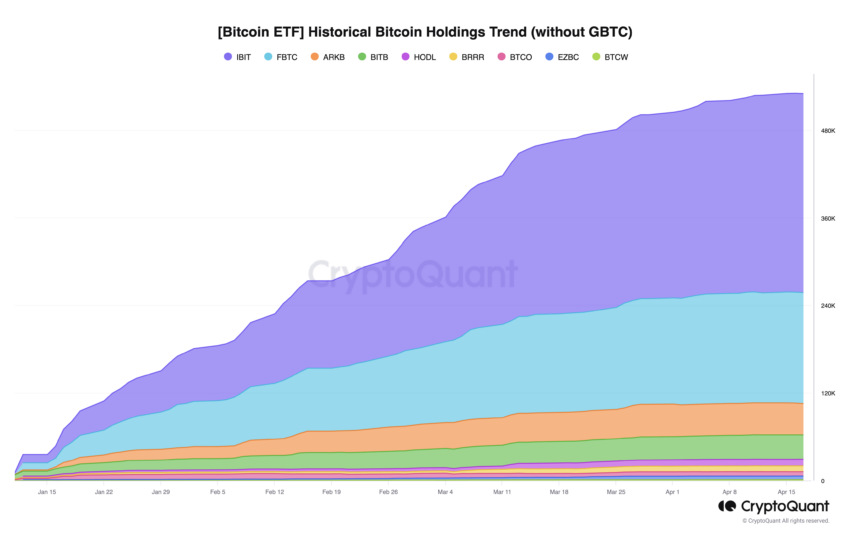

This isn’t nearly monetary funding. In January, BlackRock additional built-in Bitcoin into the mainstream monetary market by submitting paperwork with the SEC to incorporate a spot Bitcoin exchange-traded fund (ETF). This new monetary instrument now manages 272,800 BTC, valued at $17.20 billion.

This determine doesn’t even embody holdings from related merchandise managed by different entities.

“The growing affect of those monetary giants in Bitcoin mining operations might result in a situation the place the decision-making and management over the community change into concentrated within the palms of some, reasonably than being distributed amongst a various group of members,” Stadelmann added.

The core of the issue lies within the stark distinction between Bitcoin’s present trajectory and its unique goal. Bitcoin’s unique imaginative and prescient was to function as a decentralized community, unbiased of conventional monetary methods. Nevertheless, growing centralization may draw it nearer to the very methods it aimed to avoid.

Learn extra: 5 Greatest Platforms To Purchase Bitcoin Mining Shares Forward of 2024 Halving

This centralization is not only a technical challenge however a basic query concerning the nature and way forward for Bitcoin. It challenges the decentralized ethos that has been a major draw for buyers and customers drawn to the thought of a monetary system free from conventional constraints.

Due to this fact, the decision from Stadelmann for a sturdy dialogue throughout the Bitcoin neighborhood is well timed and important.

Disclaimer

Following the Belief Mission pointers, this function article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm info independently and seek the advice of with an expert earlier than making choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.