The US Securities and Trade Fee’s (SEC) latest postponement of Bitcoin ETF (Trade Traded Fund) selections to 2024 has stirred the pot within the cryptocurrency market.

Trade consultants see the delay as a strategic transfer by the SEC to bide time. This comes as a continuation of prior delays and evident congressional strain to expedite regulatory readability.

Bitcoin ETFs to Open the Floodgates for Institutional Capital

Seasoned crypto market individuals are unlikely to be shaken by the SEC’s transfer to delay Bitcoin ETF selections to 2024. They’re no strangers to the SEC’s ways, and the market has traditionally shrugged off such regulatory hesitations. Nevertheless, the importance of an eventual Bitcoin ETF approval can’t be overstated.

A US-based Bitcoin ETF might open floodgates for institutional capital, which has been sidelined, awaiting a regulated entry level into the crypto market. Lucas Kiely, chief data officer at Yield App, instructed BeInCrypto {that a} seal of approval for Bitcoin ETFs would set up a suggestions loop, escalating the legitimacy and the influx of investments concurrently.

“An authorised Bitcoin ETF has the potential to gas institutional funding and usher in a transformative period for crypto. Such an ETF would supply a regulated and acquainted funding car for institutional buyers, mitigating their issues about liquidity, custody, and regulatory uncertainty,” Kiely mentioned.

The push by monetary giants like BlackRock and Constancy to approve a spot Bitcoin ETF is a telltale signal of rising institutional curiosity. Their help speaks volumes, signaling readiness to combine Bitcoin throughout the conventional monetary material.

Such endorsements might sway the broader monetary group, heralding a brand new period of crypto investments upon regulatory greenlighting.

“Growing institutional curiosity holds important implications for the notion and validation of cryptocurrencies inside conventional monetary circles. The involvement of established monetary establishments lends credibility to the crypto market, which has lengthy been perceived as unstable and speculative,” Kiely added.

Learn extra: 4 Greatest Crypto Brokers for Shopping for and Promoting Bitcoin in 2023

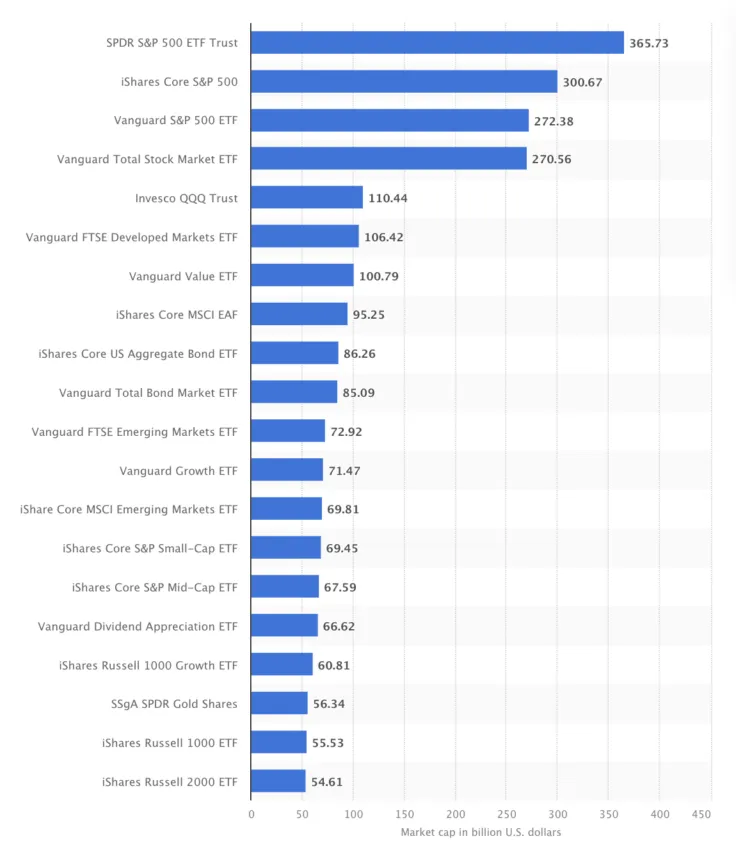

The US spot Bitcoin ETF market’s progress potential is staggering. Even Bloomberg Intelligence suggested it could burgeon into a $100 billion crypto industry. This progress might catalyze a considerable appreciation of Bitcoin’s worth. In flip, it could possible spill over into the altcoin market, precipitating an ecosystem-wide bull run.

The historic sample following Bitcoin’s value will increase has usually seen altcoins surge in its wake, suggesting a broad market uplift is probably going.

“When [BlackRock] filed [for a spot Bitcoin ETF], it was an entire totally different ballgame for my part. The actual fact is they typically wish to convey a gun to a knife combat. This can be a agency who doesn’t wish to lose, who is aware of what they’re doing, and so they should see one thing [in Bitcoin],” Eric Balchunas, an analyst at Bloomberg, emphasised.

The Distinction Between Spot and Futures-Based mostly ETFs

Spot Bitcoin ETFs have the sting over futures-based ETFs, providing direct publicity to the real-time value of Bitcoin. Therefore resonating with the market’s precise provide and demand. John Glover, chief data officer at Ledn, instructed BeInCrypto that spot Bitcoin ETFs enhance the accuracy of value monitoring, simplify funding processes and scale back charges for retail and institutional buyers.

The decrease price construction is especially enticing because it might shift substantial capital into the crypto market, beforehand deterred by the excessive prices related to conventional crypto buying and selling platforms.

“Spot ETFs observe the precise market value of Bitcoin and keep away from the upper buying and selling charges that include common exchanges and the necessity to handle your individual property. They provide a extra correct and easy highway for retail buyers and establishments to get direct publicity to Bitcoin. Futures ETFs, then again, can fall out of sync with the market and sometimes include annual charges,” Glover mentioned.

Learn extra: What are Perpetual Futures Contracts in Cryptocurrency?

Furthermore, the speculated liquidity shift from futures to identify Bitcoin ETFs would possibly result in a reconfiguration of market dynamics. This might doubtlessly improve the steadiness of Bitcoin and dampen its infamous volatility. As institutional buyers usually have interaction in much less speculative, long-term funding methods, their participation might add a stabilizing affect in the marketplace.

This aligns with the vision Leo Melamed, chairman emeritus of CME Group, had in 2017 earlier than the agency launched the futures contract of Bitcoin.

“We’ll regulate, make Bitcoin not wild, nor wilder. We’ll tame it into an everyday kind instrument of commerce with guidelines,” Melamed mentioned.

The broader acceptance of cryptocurrencies might catalyze innovation and progress throughout the trade. As cryptocurrencies acquire legitimacy, an inflow of capital will foster new initiatives, platforms, and functions. Subsequently driving the trade to new heights.

“As cryptocurrencies change into extra legitimized, it means extra gamers will become involved. Many who’re watching from the sidelines might determine to take the leap. This doesn’t simply imply extra capital, but in addition extra innovation, extra initiatives surrounding crypto, and extra merchandise consequently,” Glover added.

How Elevated Institutional Demand Will Impression BTC Worth

The approval of a Bitcoin ETF might have a profound impression on Bitcoin’s value. That is primarily because of the inflow of institutional capital it could convey.

“We count on US regulated ETFs to be the watershed second for crypto and we count on a SEC approval by late 2023/Q1, 2024. Publish halving, we count on the Bitcoin spot demand by way of ETFs to outstrip miner promoting by 6-7 instances at peak. We count on Bitcoin ETFs to be equal to 9-10% of spot Bitcoin in circulation by 2028,” Gautam Chhugani, International Digital Senior Analyst at Bernstein, mentioned.

Institutional buyers, with their huge monetary sources, can considerably transfer markets. Their entry into Bitcoin by way of a regulated ETF might drive up demand and, consequently, push the worth of Bitcoin right into a bull run.

Certainly, the approval would sign regulatory acceptance that would additional improve investor confidence, driving up demand and value.

“The approval of the primary Bitcoin Futures ETF in October of 2021 did come simply earlier than the earlier market all-time highs the following month. Nevertheless, it could be too far to say that the ETF was the one issue driving value motion. Nonetheless, it’s possible that the announcement of the approval of a number of spot ETFs would assist enhance sentiment and, due to this fact, shopping for within the days, weeks, or months that observe,” Glover affirmed.

Learn extra: Why the Crypto Market Has But to Notice the Bullish Potential of Spot Bitcoin ETFs

Traditionally, approving ETFs in different asset courses has usually elevated asset costs. For example, the gold market witnessed a major appreciation in value following the approval of the primary gold ETF. Equally, a Bitcoin ETF might unlock a wave of liquidity, propelling Bitcoin to new value highs.

The brand new heights may very well be sustained by the improved legitimacy and the extra sturdy, diversified investor base {that a} Bitcoin ETF would foster.

“Making use of these historic precedents to a possible Bitcoin ETF approval means that it might form costs within the crypto market considerably. If authorised, an ETF would supply institutional buyers an accessible and controlled avenue to spend money on Bitcoin, leading to important value actions,” Kiely concluded.

Whereas the SEC’s choice hangs within the steadiness, the crypto market awaits what may very well be a watershed second. The approval of a Bitcoin ETF stands as a beacon of mainstream acceptance, promising a possible bull run fueled by institutional capital, enhanced market stability, and a brand new period of progress and innovation within the trade.

Disclaimer

Following the Belief Undertaking tips, this characteristic article presents opinions and views from trade consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially replicate these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with knowledgeable earlier than making selections primarily based on this content material.