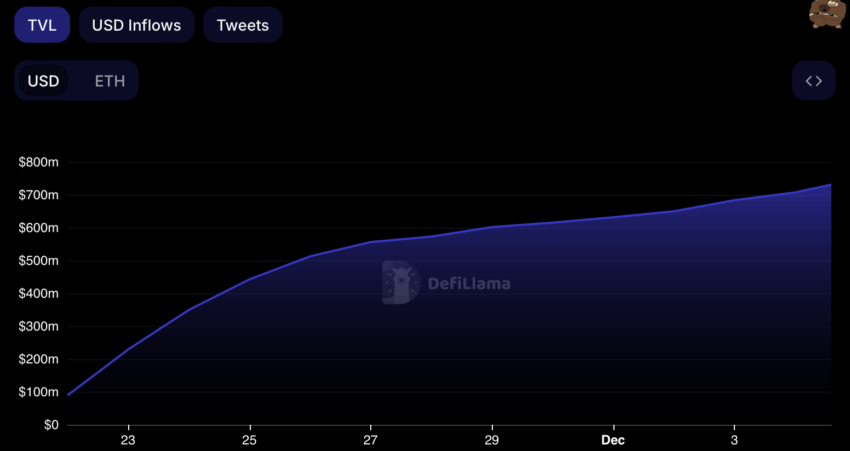

Final week, the world of decentralized finance (DeFi) welcomed the Blast Community. The protocol shortly reached a milestone of $400 million in whole locked worth (TVL) and $600 million in seven days.

Since then, the whole worth has risen to $722 million. A considerably shocking achievement, given the tirades in opposition to the centralization of the venture.

Blast scores $600 million TVL in largely staking deposits

Blast’s success story is instructed within the numbers. It achieved a TVL of $400 million in 4 days and $600 million in seven days, shortly rising right into a notable pressure in DeFi. TVL measures the worth of belongings locked, primarily by means of staking, in a DeFi protocol.

Complete worth locked on Blast Community | Supply: DefiLlama

The Blast Community provides returns on Ethereum and stablecoins. It’s profitable partially due to the excessive returns it provides to those that lock up their belongings for lengthy intervals of time. A excessive TVL additionally means that customers trust within the safety and robustness of a community.

Accusations of centralization

A powerful launch hasn’t deterred criticism that the Blast community is just too centralized. Jarrod Watts, a developer at Polygon Labs, tweeted about it earlier this month.

Watts thinks the flexibility to improve good contracts (items of code that carry out essential features within the decentralized finance sector) utilizing a pockets posed a safety danger. Stolen personal keys might give hackers entry to greater than $400 million in belongings on the community.

In response to Watts, Blast is just not a real Layer 2, a community that provides transaction pace and throughput to a different blockchain. Fairly, it’s merely a platform that accepts tokens for staking.

Learn extra: Tier 2 Crypto Initiatives for 2023: The Greatest Alternative

Blast countered, saying it’s pursuing decentralization. On their web site, the creators name it “the one layer two of Ethereum with honest returns for ETH and stablecoins.”

Blast customers can routinely reinvest their crypto. Stablecoin deposits are transformed into USDB, a stablecoin that’s routinely reinvested within the MakerDAO protocol, a decentralized autonomous group (DAO). MakerDAO mentioned in September that it will again its DAI stablecoin with U.S. Treasury bonds.

Learn extra: How is Ethereum leading the decentralized finance revolution?