Buoyed by low rates of interest for the final decade, many property markets have seen substantial price growth since 2010. Consultants warned that actual property bubbles—during which the worth of belongings moved up far past their intrinsic worth—had been forming.

The UBS World Actual Property Bubble Index analyzes the actual property market of 25 main cities throughout the globe and assigns them a rating between -0.5 to 2.0 to convey bubble threat. The upper the rating, the extra imbalanced the market is, with these above 1.5 in “bubble-risk” territory.

Within the chart under, Visual Capitalist’s Pallavi Rao visualizes the data within the above map, together with charting the actual property worth modifications within the final 12 months.

Rating Bubble Danger by Metropolis

On the prime of UBS’ findings is Switzerland’s monetary capital Zurich, with a 1.71 rating, placing town firmly within the bubble-risk zone. With its high-income earners and the nation’s low rates of interest, town has been steadily climbing the actual property bubble-risk rankings, fifth in 2021, to third in 2022, to the highest spot this 12 months.

In contrast to lots of its former friends within the dangerous territory, native costs tailored to elevated mortgage charges this 12 months, and have stayed elevated.

Right here’s the complete rankings for bubble threat in all 25 property markets:

| Rank | Metropolis | Index Rating | Score |

|---|---|---|---|

| 1 |  Zurich Zurich |

1.71 | Bubble-Danger |

| 2 |  Tokyo Tokyo |

1.65 | Bubble-Danger |

| 3 |  Miami Miami |

1.38 | Overvalued |

| 4 |  Munich Munich |

1.35 | Overvalued |

| 5 |  Frankfurt Frankfurt |

1.27 | Overvalued |

| 6 |  Hong Kong Hong Kong |

1.24 | Overvalued |

| 7 |  Toronto Toronto |

1.21 | Overvalued |

| 8 |  Geneva Geneva |

1.13 | Overvalued |

| 9 |  Los Angeles Los Angeles |

1.03 | Overvalued |

| 10 |  London London |

0.98 | Overvalued |

| 11 |  Tel Aviv Tel Aviv |

0.93 | Overvalued |

| 12 |  Vancouver Vancouver |

0.81 | Overvalued |

| 13 |  Amsterdam Amsterdam |

0.80 | Overvalued |

| 14 |  Stockholm Stockholm |

0.74 | Overvalued |

| 15 |  Paris Paris |

0.73 | Overvalued |

| 16 |  Sydney Sydney |

0.67 | Overvalued |

| 17 |  Milan Milan |

0.49 | Honest-Valued |

| 18 |  New York New York |

0.47 | Honest-Valued |

| 19 |  Singapore Singapore |

0.47 | Honest-Valued |

| 20 |  Madrid Madrid |

0.46 | Honest-Valued |

| 21 |  Boston Boston |

0.34 | Honest-Valued |

| 22 |  San Francisco San Francisco |

0.27 | Honest-Valued |

| 23 |  Dubai Dubai |

0.14 | Honest-Valued |

| 24 |  São Paulo São Paulo |

0.09 | Honest-Valued |

| 25 |  Warsaw Warsaw |

-0.28 | Honest-Valued |

Tokyo (1.65) is the second and last entry in the actual property markets with quick bubble threat. It is a lower from 9 complete cities in that class final 12 months.

Actually the opposite seven actual property markets which scored above 1.5 in 2022 have all seen important actual property worth drops, lots of them within the double-digits, which has moved them into “overvalued territory.”

These embrace: Frankfurt (-15.9%), Toronto (-14.7%), Amsterdam (-14.0%), Munich (-13.8%), Vancouver (-10.6%), Hong Kong (-7.1%), and Tel Aviv (-0.7%).

The important thing driver of those worth drops throughout the board are the aggressive interest rate hikes to counter rising inflation, which pushed many housing markets into unaffordability, forcing sellers to decrease their costs.

Nevertheless, just a few cities have seen actual property worth will increase, together with the aforementioned Tokyo and Zurich.

Right here’s UBS’ full rating of actual property worth modifications between 2022–2023.

| Rank | Metropolis | Actual Property Worth Progress (YoY) |

|---|---|---|

| 1 |  Dubai Dubai |

+14.6% |

| 2 |  Miami Miami |

+6.0% |

| 3 |  Tokyo Tokyo |

+3.6% |

| 4 |  New York New York |

+3.2% |

| 5 |  Madrid Madrid |

+2.9% |

| 6 |  Singapore Singapore |

+2.8% |

| 7 |  Zurich Zurich |

+1.5% |

| 8 |  São Paulo São Paulo |

+1.4% |

| 9 |  Geneva Geneva |

-0.1% |

| 10 |  Tel Aviv Tel Aviv |

-0.7% |

| 11 |  Milan Milan |

-1.9% |

| 12 |  Boston Boston |

-3.4% |

| 13 |  Los Angeles Los Angeles |

-3.7% |

| 14 |  Hong Kong Hong Kong |

-7.1% |

| 15 |  Paris Paris |

-7.9% |

| 16 |  Warsaw Warsaw |

-9.3% |

| 17 |  Sydney Sydney |

-10.5% |

| 18 |  Vancouver Vancouver |

-10.6% |

| 19 |  San Francisco San Francisco |

-10.6% |

| 20 |  Munich Munich |

-13.8% |

| 21 |  London London |

-13.9% |

| 22 |  Amsterdam Amsterdam |

-14.0% |

| 23 |  Toronto Toronto |

-14.7% |

| 24 |  Frankfurt Frankfurt |

-15.9% |

| 25 |  Stockholm Stockholm |

-22.1% |

A big outlier inside this group, Dubai, has registered double-digit development property worth development. This was fueled by increasing family incomes—because of an financial growth from oil costs—in addition to elevated immigration by wealthy individuals.

Ranked: Cities With Rising Rental Costs

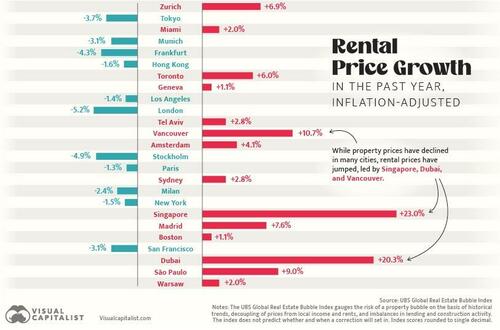

Nevertheless, whilst property costs have cooled within the majority of the analyzed actual property market, the rental market for a lot of cities, like Vancouver (+10.7%) and Toronto (+6.0%) has moved swiftly in the wrong way.

On this case, inflation is a key purpose as nicely—pushing up incomes, in flip resulting in rising rents. Moreover, owners-occupants with tenants search to cross on greater mortgage prices in an effort to scale back their monetary burden.

Loading…