marchmeena29/iStock through Getty Pictures

Introduction

For the primary time this yr, I’ll write an article with a really brief introduction.

On this healthcare-focused article, I am going to stroll you thru my ideas as we focus on one of many largest tendencies in healthcare and an organization that appears to learn from it like no different.

That firm is Intuitive Surgical, Inc. (NASDAQ:ISRG). My most up-to-date article on the corporate was written on August 19, once I wrote an article titled Intuitive Surgical: A Considerably Undervalued Healthcare Gem.

On this article, we take one other take a look at the corporate, emphasizing why it’s in such an excellent spot to take care of excessive long-term progress and doubtlessly generate excessive shareholder returns.

So, let’s get to it!

The Want For Effectivity

Once I was nonetheless writing every day geopolitical analysis for a third-party analysis firm, I steadily learn web sites like Politico. The opposite day, I discovered one thing very attention-grabbing on their web site.

The article I learn was titled Harnessing innovation in robotic-assisted surgical procedure. Sponsored by Intuitive Surgical, the star of this text, the article highlighted vital tendencies in healthcare.

Politico

The corporate, which promoted its companies and robots within the article, highlighted an important facet of healthcare: the necessity for effectivity. That is one thing I spotlight in quite a lot of articles as one of many largest secular drivers of superior healthcare demand.

For instance, whereas I am nonetheless within the means of searching for a brand new insurance coverage plan, I do know I’ll pay way more in 2024, as healthcare premiums are more and more incorporating (interrelated) dangers like an growing older inhabitants, labor shortages, and inflation.

That is the place Intuitive Surgical, Inc. is available in.

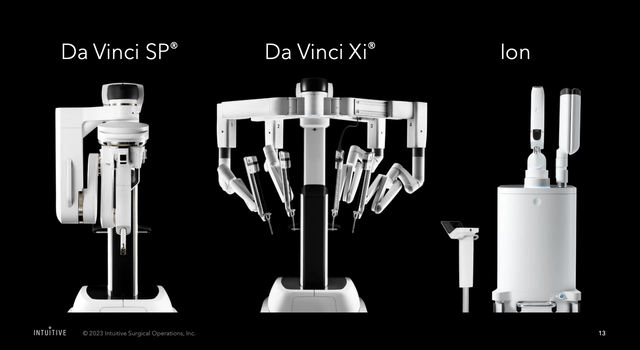

Because it wrote for Politico, its groundbreaking da Vinci robotic-assisted surgical system, launched 27 years in the past, has revolutionized minimally-invasive surgical procedure.

Intuitive Surgical

This method, carried out by surgeons utilizing computer-assisted methods via small incisions with wristed devices, has witnessed over 12 million procedures globally, proving its affect in urology, gynecology, colorectal, thoracic, basic surgical procedure, and extra.

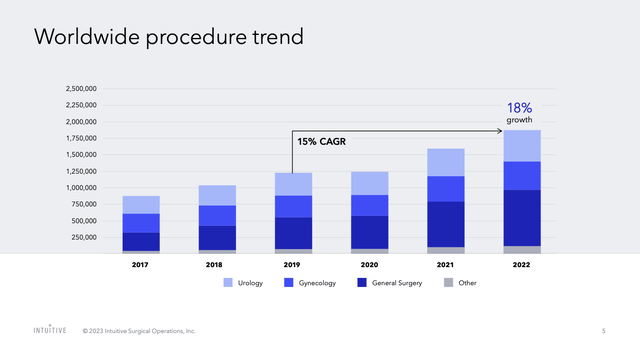

Since 2019, worldwide procedures have grown by 15% per yr!

Intuitive Surgical

Based on the corporate, Europe’s sturdy demand for modern expertise is clear within the set up of over 1,500 da Vinci methods.

Regardless of this, challenges like rising healthcare prices persist.

Intuitive goals to transcend offering a robotic-assisted surgical system, changing into a technology-enabled options companion. Collaborating with hospitals, they concentrate on optimizing effectivity, growing throughput, and enhancing the general high quality of care.

That is the place it will get actually attention-grabbing!

Why?

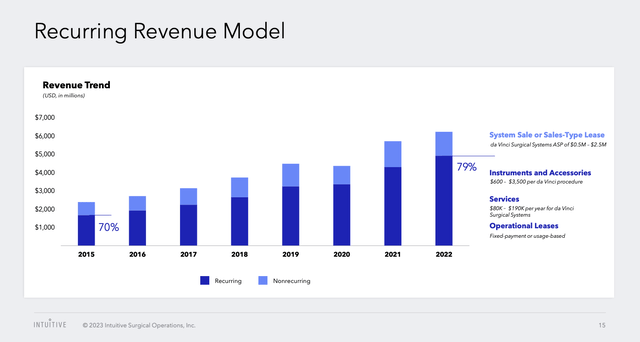

As a result of Intuitive is constructing a enterprise mannequin consisting of excessive recurring income.

In different phrases, it advantages from an increasing put in base, which boosts complete income and recurring income progress.

Intuitive Surgical

By serving to clients to function extra effectively, the corporate creates a good stronger relationship, which makes it more durable for rivals to seize progress and permits Intuitive to penetrate the market even deeper.

Based on the corporate, central to its method is strong expertise coaching.

Their four-phase coaching pathway, accredited by The Royal School of Surgeons, emphasizes abilities and expertise coaching, fostering the event of the next-generation healthcare workforce.

With over 25 coaching facilities and partnerships throughout Europe, Intuitive is dedicated to steady innovation and evolution in coaching packages.

Waiting for 2030, Intuitive envisions a future the place European healthcare excellence is achieved by seamlessly integrating developments in robotic-assisted instruments, digital well being, and patient-focused innovation.

Talking of 2030, how a lot progress has already been priced in?

How A lot Worth Does ISRG Have?

Good issues not often come low cost.

That actually applies right here. In any case, the robotics pattern in healthcare is not top-secret anymore.

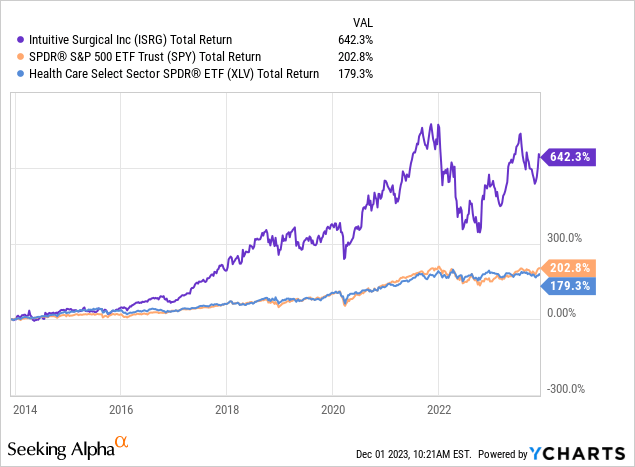

Over the previous ten years, ISRG shares have returned greater than 640%. That is greater than thrice nearly as good because the already spectacular 200% return of the S&P 500 (SPY)!

In different phrases, it isn’t sufficient to conclude that Intuitive Surgical is engaged on one thing spectacular.

We want a minimum of two issues to make the case that ISRG presents nice worth.

- We want affirmation that its progress continues to warrant a excessive valuation a number of. This consists of discovering out if the large image for robots nonetheless seems enticing.

- A valuation that is not too lofty. Paying an elevated worth for a progress inventory is ok, however there are limits.

Beginning with the primary level, the corporate continues to shine.

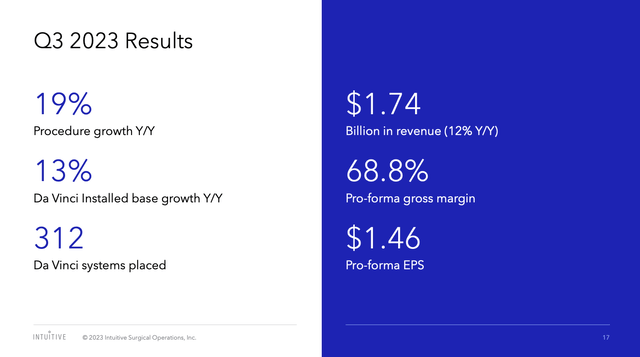

In its third-quarter earnings launch, the corporate reported that 312 methods have been positioned, reflecting demand for extra capability in multiport methods, continued greenfield curiosity within the Ion system, and a modest acceleration for placements of SP.

Within the prior yr’s quarter, the corporate positioned 305 methods.

Nonetheless, delays in tender processes in China associated to anticorruption efforts resulted in decrease system placements, with an expectation that this affect will persist into This fall.

- Process progress within the da Vinci program within the quarter was noteworthy at 19%. Power was noticed basically surgical procedure for benign situations, notably in the US, and there was broad regional progress with standouts in Germany, Japan, the U.Ok., and India. China’s process progress was according to the worldwide common.

- Ion procedures continued to point out power, with a exceptional 125% progress within the quarter.

- Da Vinci SP process progress accelerated with 54% world progress, primarily pushed by power in the US.

Intuitive Surgical

It is also vital to say that the companies that include these methods did properly.

Based on the corporate, buyer use of digital instruments is rising, with SimNow surgical simulators put in at most buyer websites.

Intuitive Surgical

In the meantime, My Intuitive app utilization by da Vinci surgeons elevated by 140% year-over-year. Intuitive Hub media administration and telepresence system installations grew by 58%. Captured surgical circumstances elevated by 61%.

Moreover, throughout its earnings name, the corporate offered insights into ongoing scientific analysis initiatives, notably the FDA-approved examine on complicated colorectal procedures utilizing the single-port system.

The trial’s enrollment is full, involving 60 sufferers throughout 9 U.S. and Korean websites.

One other FDA-approved trial for speedy procedures in pulmonary lobectomy and thymectomy, additionally utilizing SP, accomplished enrollment with 32 topics throughout 6 U.S. facilities. The corporate believes its single-port expertise will improve thoracic surgical procedures.

Moreover, the corporate highlighted a major examine, the RAVAL trial, evaluating da Vinci and VATS approaches to pulmonary lobectomy.

The examine, sponsored by Dr. Yogita Patel of McMaster College, reveals greater well being utility scores within the da Vinci arm at 7 and 12 weeks post-procedure.

The da Vinci group demonstrates a acquire of roughly $11,000 per quality-adjusted life yr, with greater median lymph node examination, in comparison with VATS.

On account of sturdy progress and constructive developments, the corporate hiked its steerage, elevating the low finish of the forecasted process progress vary from 20% to 21%, now anticipating 21% to 22% progress for 2023.

How Costly Is ISRG?

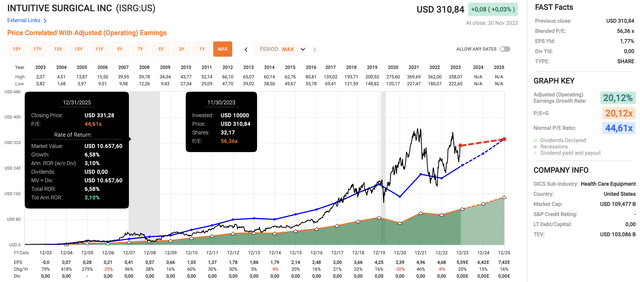

Buyers trying to purchase ISRG at present costs are shopping for the inventory at a blended P/E ratio of 56.4x.

Over the previous twenty years, ISRG had a normalized valuation of 44.6x earnings. That is the blue line within the chart under. The inventory had extended durations with cheaper valuations but additionally a number of years with costlier valuations.

Sadly, the final time the inventory was way more costly than that was after the pandemic. Since then, the overall return has been underwhelming.

The excellent news is that progress is anticipated to stay sturdy. This yr, analysts anticipate the corporate to develop earnings per share by 20%. Subsequent yr, that quantity is anticipated to stay elevated, with 15% progress in 2024 and 16% progress in 2025.

FAST Graphs

Though these numbers are clearly topic to vary, I believe it is truthful to imagine that the corporate has room to develop earnings by double-digits on a constant foundation, particularly if extra favorable funding situations down the highway permit healthcare corporations to spice up CapEx.

Sadly, when combining anticipated progress charges with a return to its normalized valuation, we get an implied annual return of lower than 4%. That quantity can also be seen within the chart above.

To ensure that the inventory to return 13% to 14% per yr, it must maintain a 55x EPS a number of, which is its five-year common.

That’s not unreasonable. Nonetheless, it could massively cut back the margin of security.

Having mentioned that, I keep on with a Bullish ranking. I proceed to consider that ISRG has the ability to return >10% per yr on a long-term foundation and outperform the healthcare sector.

The one downside I see is that some nice options commerce at a lot decrease valuations. Whereas Medtronic plc (MDT) has decrease progress expectations, it additionally invests in robots and is buying and selling at an inexpensive valuation. I lined MDT on this article.

I am not saying that to push traders into MDT, however to focus on that there are some good options available on the market, albeit with totally different progress profiles.

Takeaway

In a healthcare panorama marked by rising prices, Intuitive Surgical, Inc. stands out as a beacon of effectivity.

Their da Vinci robotic-assisted surgical system, revolutionizing minimally-invasive procedures, has witnessed a 15% annual progress in worldwide procedures since 2019.

Past the expertise, ISRG focuses on constructing a enterprise mannequin with excessive recurring income, creating a robust buyer relationship.

Regardless of its spectacular monitor file, traders ought to rigorously weigh the present valuation towards progress projections.

Whereas Intuitive Surgical, Inc. has the potential for over 10% annual returns, options with totally different progress profiles might supply compelling selections in a dynamic market.