Bet_Noire/iStock by way of Getty Photographs

The third 12 months of a presidential cycle appears to be like stronger for U.S. equities, in keeping with information by RBC Capital Market, printed on Monday.

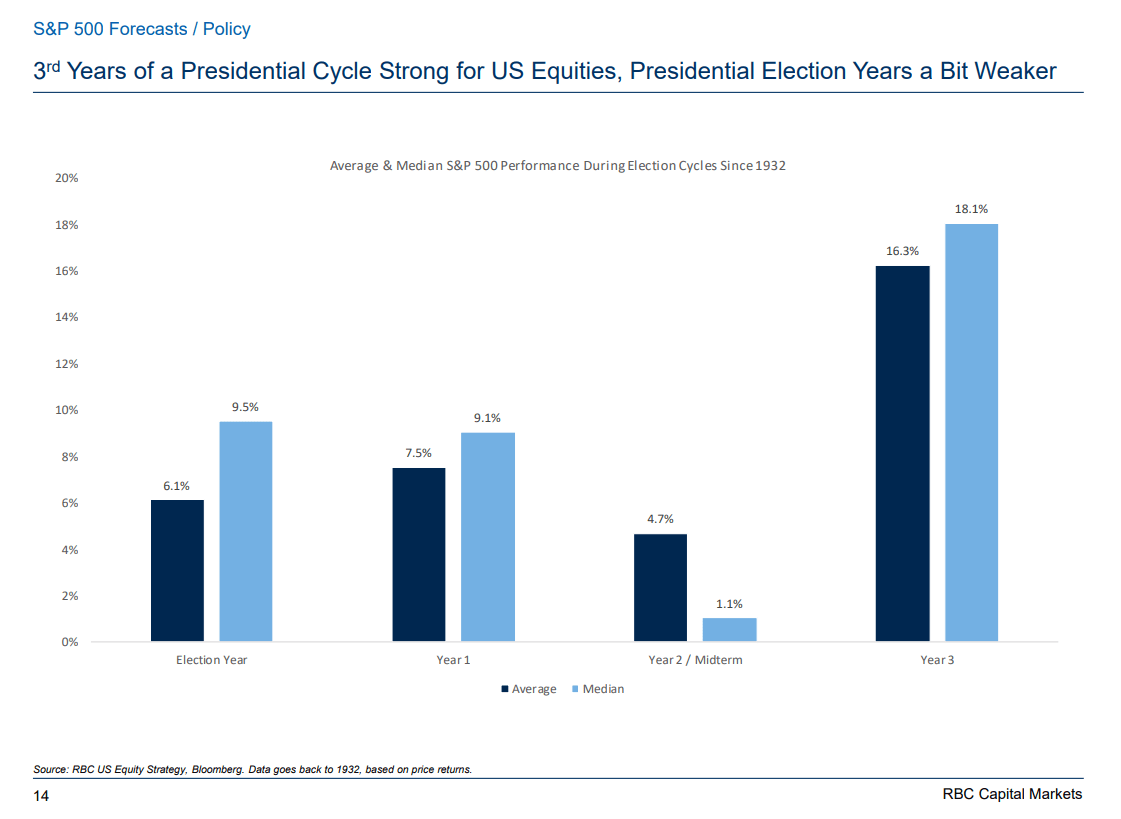

Knowledge of the typical and median S&P 500 efficiency throughout election cycles since 1932 confirmed that in the course of the first 12 months of a presidential cycle, U.S. equities carry out at 6.1% in common and 9.5% as a median.

Throughout the first 12 months of the presidential cycle, equities carry out at 7.5% on common and 9.1% as a median.

Throughout the second 12 months, or the mid-term, of the presidential cycle, equities drop to a mean of 4.7% and a median of 1.1%.

At 12 months 3, which is the one this presidential cycle is presently in, equities are likely to skyrocket to 16.3% in common, and 18.1% as a median.