By Michael Each of Rabobank

“Wars with out Gun Smoke”

The important thing Fed launch yesterday was summed up by Philip Marey as “minutes of inactivity”: in brief, the Fed are on maintain, the decline in bond yields is because of tender information, and if these information warmth up once more, it will likely be yields shifting, not the Fed. The FOMC really feel they’re successful the warfare in opposition to inflation with out having to make use of extra ammunition due to the excessive (charges) floor which they management. But they’ll fireplace once more if wanted, and ready to win is a very completely different factor from giving up the excessive floor and beating their swords into ploughshares… or shares of any form. Markets blind-sided by Covid in 2020, inflation in 2021, warfare and inflation in 2022, and now extra warfare in 2023, are nonetheless failing to know that the world has modified even when they haven’t, and 2024 is just not going to be the ‘new regular re-run’ they suppose it’s.

ECB President Lagarde additionally reiterated it’s “too early to begin declaring victory” vs. inflation, and that she could be ready to hike charges once more if wanted; that’s regardless of Europe sliding into recession, and Germany into deeper structural dysfunction as its constitutional court docket kneecaps its capacity to borrow.

Even the place larger asset-prices are cherished, corresponding to Australia, the warfare vs. inflation isn’t over. The RBA is threatening that if wage inflation stays at 4% and productiveness stays a lot decrease, charges should rise once more. Now apply the identical logic to the remainder of the West, as everybody grapples with excessive nominal and, more and more, actual wage progress vs. ultra-low productiveness, UK information being the most recent terrible instance.

Furthermore, inflation additionally is determined by the geopolitics of a Chilly Warfare with sizzling flashes that encompasses the worldwide function of BRICS11 (10, excluding Argentina) commodities, plus Chinese language items made with them, vs. the financialised world of the US greenback. See the recent EBRD paper underlining the surge in using CNY for worldwide settlement for a lot of within the International South buying and selling with Russia. If Western central banks attempt to roll out giant charge cuts early in 2024, they are going to be shocked to seek out that every one they’ll seemingly get is far weaker FX, a brand new surge in commodity costs, then with Western companies utilizing their concentrated pricing energy to maintain margins excessive, after which larger wage inflation. We simply went by that, nothing has modified structurally for the higher, and far has obtained worse, and but some appear to have already forgotten the painful classes.

Extra clearly within the realm of geopolitics, at time of writing we have been on the cusp of an Israel-Hamas ceasefire and the discharge of not less than among the hostages being held. But the gun smoke will clear for some time, then return. Certainly, the US is near classifying Yemen’s Iran-backed Houthis as terrorists (making the administration’s previous push to finish Saudi Arabia’s warfare in opposition to them look awkward in hindsight), and has additionally said that Iran is finally liable for the seizure of the industrial ship within the Crimson Sea on the choke level of the Bab el-Mandeb on the finish of the Suez Canal. Once more, anybody pondering that is near a 2024 low-flation decision has a really low decision grasp of how this unstable area works.

In the meantime, the US has stepped up joint naval patrols alongside the Philippines, elevating tensions with China; and one in all China’s most trendy PLA-N vessels, the touchdown ship Longhushan, is on fireplace – so smoke with out weapons. We’re additionally a day nearer to the Friday deadline for submitting for Taiwan’s 13 January presidential election, and for now the KMT/TPP alliance continues to be off, that means the pro-independence DPP candidate, present vice-president Lai, is greatest positioned to win. Watch this area.

Relatedly, I need to share a latest paper from the journal Worldwide Safety titled ‘Wars without Gun Smoke: International Provide Chains, Energy Transitions, and Financial Statecraft’. It exhibits that whereas the traditional knowledge is that battle is very seemingly throughout an influence transition between declining and rising powers — the Thucydides Entice, although who fires first is disputed — international provide chains now present new financial weapons to wage these conflicts peacefully, and companies on the entrance strains could make it tougher or simpler for excellent powers to take action.

The authors argue that as a rival dominant energy and a rising energy strategy energy parity they face structural incentives to make use of financial statecraft to decouple their economies to both retain dominance or acquire it – which we see right this moment. The ensuing menace to companies’ income then modifications business-state relations. Logically, when companies assist their house state’s geostrategic targets, it turns into simpler for that state to sanction its adversaries or implement industrial insurance policies. However when a enterprise is at odds with its house state, it undermines the nationwide agenda. Enterprise-state relations –the diploma of cooperation between companies in international provide chains and the house state that has jurisdiction over them– subsequently have safety penalties as a result of they form the effectiveness of financial statecraft. Because the paper places it, “very similar to morale on the battlefield, cooperative relations are a pressure multiplier for financial statecraft and conflictual relations are a pressure divider.”

Crucially, the paper argues that high-value companies inside the dominant energy are inclined to oppose their state’s use of financial statecraft, whereas low-value companies inside the rising energy are inclined to cooperate with their state’s use of financial statecraft.

We’re given the instance of how the Metropolis of London stopped the UK from utilizing sanctions in opposition to Germany again, and even enterprise a small preventative warfare in 1905. We even have Norman Angell’s pre-war paeon to free commerce because the path to world peace, ‘The Nice Phantasm’, which he recanted after the warfare. Immediately, we will take a look at US Fortune 500 titans promoting items to impartial nations whereas pretending to not promote to Russia, and/or paying $40,000 a head to provide China a standing ovation. In the meantime, on the opposite aspect we now have group gamers for China, Inc., and echoes of the Lenin quote: “The capitalists will promote us the rope which we are going to use to hold them.”

This deserves a point out for markets as they stay up for 2024 in hope for 3 key causes:

- As a result of it implies imminent and everlasting Western decline, with an unlimited influence on each asset class far past myopic requires imminent charges cuts: the latter would seemingly speed up that worrying development in some key respects.

- As a result of resisting that historic/present decline suggests vastly extra coercive financial statecraft inside the West, with enormous implications for a lot of companies and asset lessons, as we’re incrementally seeing already: once more, 2024 charge cuts don’t match the invoice in isolation, or maybe in any respect.

- As a result of we all know what occurred in 1914, and will not be wanting flashpoints in the mean time.

Put that in your peace pipe and gun smoke it. On which word, it appears OpenAI and Sam Altman is likely to be doing precisely that, and he might not be a part of Microsoft in spite of everything. This whole farcical episode suggests somebody was smoking one thing.

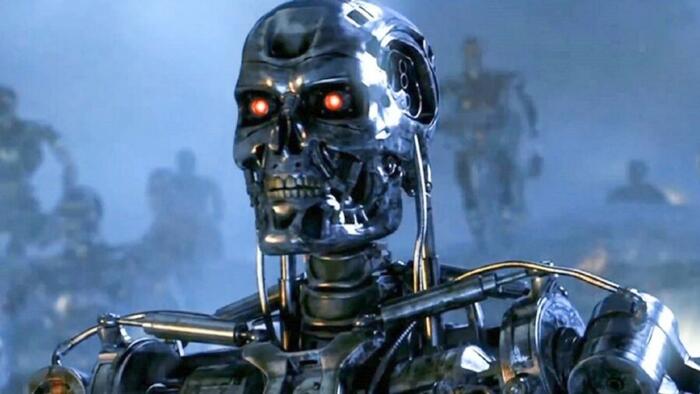

Extra so given some opinions that OpenAI isn’t just engaged on a ChatGPT that may exchange white-collar jobs writing experiences (Shock! Horror! For the individuals who spent many years writing experiences saying it was a good suggestion to do that to blue collar staff), however on an AGI (synthetic common intelligence) that’s Skynet from Terminator or the Machines from the Matrix. And that tech might perhaps now find yourself at a profit-maximizing agency that gave the world Home windows Vista. One way or the other that (tendentious but) potential existential menace additionally will get ignored by these interested by inventory costs and/or hoping for 2024 charge cuts.

I for one welcome our new Machine Overlords. Except additionally they begin speaking about charge cuts.

Loading…