Marathon Digital, a pacesetter within the Bitcoin mining sector, on February 28 unveiled to the general public the design of the Anduro blockchain, a layer-2 resolution geared toward fixing the scalability problems with the world’s most well-known cryptographic community.

Conceptually much like the Lightning Community however on the identical time very totally different on a technical stage, Anduro is ready to develop into the best place for Bitcoin builders who wish to construct new profitable purposes and implementations.

In the meantime Marathon studies monetary outcomes above expectations within the final quarter, consolidating its place on the Nasdaq with MARA inventory costs up 300% in comparison with a yr in the past.

Let’s see all the main points beneath.

Marathon Digital declares the launch of Anduro, a layer-2 blockchain constructed to enhance Bitcoin scalability

Marathon Digital, an organization devoted to cryptocurrency mining, introduced on Wednesday, February twenty eighth that it has began work on Anduro, a layer-2 blockchain able to enhancing the efficiency of the primary Bitcoin community.

Within the firm’s weblog publish, we will learn that it’s a multichain resolution, designed to speed up the event and adoption of Bitcoin, providing builders a great place to construct the way forward for the chain.

At this time, we’re saying Anduro: a multi-chain, layer-two community on #Bitcoin. pic.twitter.com/kgEAlbJdto

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) February 28, 2024

Though at first look, Anduro could appear much like the Lightning Community, a secondary community of Bitcoin able to supporting financial and immediate transactions, it truly has very totally different traits.

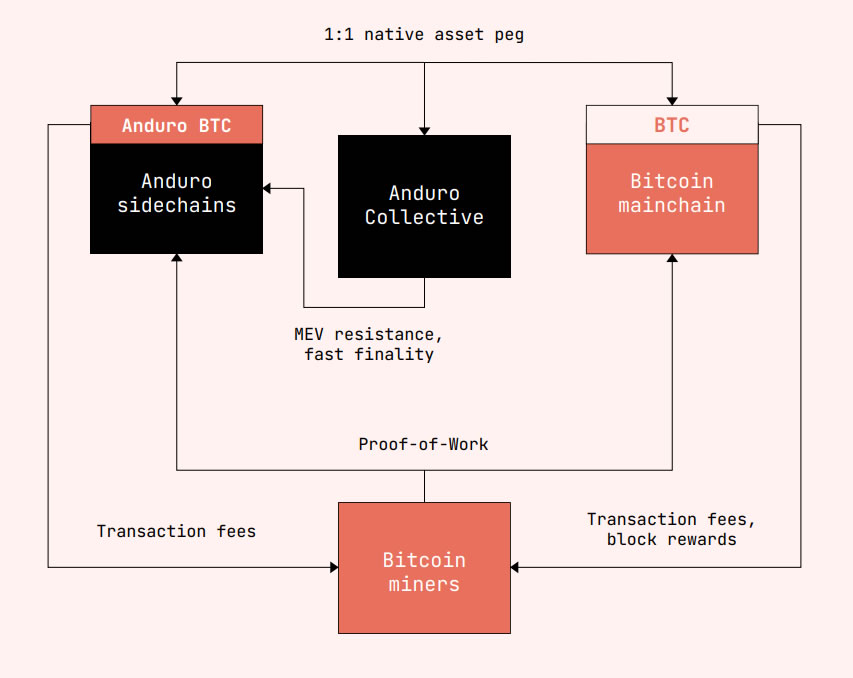

The creation of the enormous Marathon Digital was in actual fact designed primarily to assist the creation of a number of sidechains, able to differentiating and fragmenting the numerous weight of transactions on the first layer.

By the way in which, the miner is already working specifically on 2 sidechains, Coordinate and Alys, conceived respectively to supply a fertile floor for the proliferation of Ordinals and to permit compatibility with Ethereum and with the tokenization operations of institutional property.

In actual fact, this layer-2 was primarily designed to facilitate the work of builders and discover new connections with web3, earlier than enhancing the ultimate person expertise.

As written within the weblog, Anduro is programmed for:

“systematically combine decentralized governance, with the objective of turning into essentially the most dependable and developer-oriented layer-2 of Bitcoin”

It’s value noting how Anduro options an modern system referred to as “merge-mining“, which permits Marathon to earn concurrently from each Bitcoin mining and transaction charges of the brand new blockchain, all with safety in opposition to MEV assaults.

On the middle of the venture is the “Anduro Collective“, a kind of heterogeneous consortium composed of entities notably dedicated to Bitcoin, which can handle the governance of the chain

within the early phases of life and can step by step be deserted with different decision-making alternate options not based mostly on belief.

Supply: Litepaper Anduro

As highlighted by Fred Thiel, president and CEO of Marathon, the Bitcoin ecosystem wants a shake-up from an architectural perspective of the blockchain, able to supporting a brand new wave of innovation:

“We imagine in experimentation, iteration, and letting the market resolve which concepts are profitable. Anduro is a type of concepts that gives worth to Bitcoin holders and utility builders, whereas additionally strengthening the long-term sustainability of Bitcoin’s Proof-of-Work.”

The layer-2 is just not dwell but; at this stage Marathon is specializing in discovering “influential and aligned” business companions able to investing within the mainstream adoption of Bitcoin.

Marathon’s monetary efficiency and evaluation of the MARA inventory

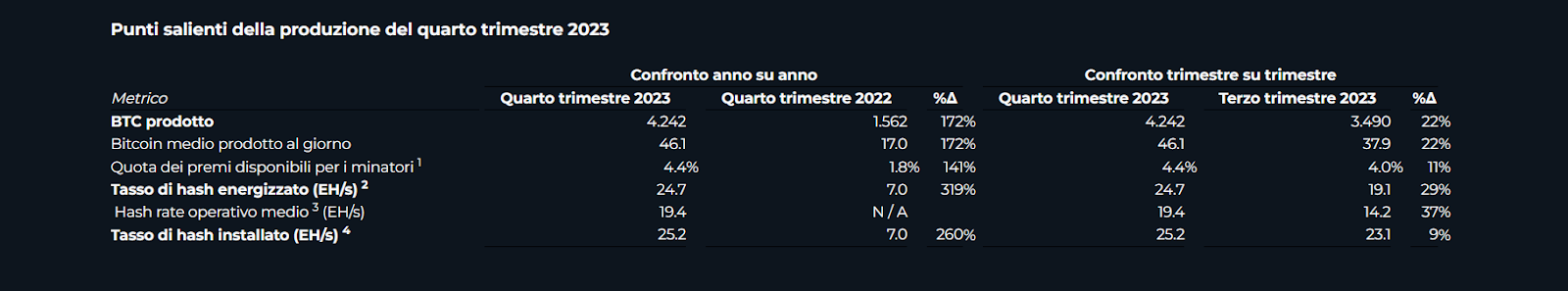

On the identical day because the announcement of the Bitcoin Anduro layer-2, the Marathon Digital miner celebrated the discharge of fourth quarter monetary outcomes recording knowledge in robust development in comparison with the earlier yr.

Particularly, the cryptocurrency miner reported a internet revenue of 261.2 million {dollars} (1.06 {dollars} per diluted share) which stands out from the online lack of 994 million {dollars} (6.12 {dollars} per diluted share) recorded within the final quarter of 2022.

The revenues elevated by 229% to $387.5 million in 2023 ranging from a base of $117.8 million in 2022.

Clearly, the superb efficiency is as a result of healthiness of the Bitcoin blockchain, the place the corporate bases its core enterprise: block manufacturing in 2023 for Marathon was greater than 210% increased than final yr, thus managing to mine extra cash that on the identical time boast an elevated worth on common of 101%.

The revenues of Marathon simply listed truly primarily come from the sale of the Bitcoins mined from the community, having liquidated about 74% of what was produced within the calendar yr.

The miner’s strong monetary place is confirmed by the info on the liquidity of the corporate, which as of December 31, 2023 held $357.3 million in unrestricted and equal funds in its stability sheet along with a stability of 15,126 bitcoins.

General, money and bitcoin quantity to 997.0 million {dollars}, able to be invested or used to reinforce your enterprise construction.

Beneath is a snapshot of Marathon’s mining manufacturing, with a year-over-year and quarter-over-quarter comparability.

For extra info you possibly can seek the advice of the press launch from the corporate the place all monetary knowledge are detailed.

In a context like this, made largely constructive by Marathon’s robust presence in Bitcoin mining, the MARA inventory can have fun a revived worth motion after a disastrous 2022.

Following a 95% drawdown from the highs of November 2021 to the lows of January 2023, the inventory listed on the Nasdaq studies an total worth development of 650% as much as the current day.

In comparison with March 1, 2023, the rise within the worth of MARA shares was as an alternative 300%, pushed by the restoration of the crypto market.

The worth motion so bullish of Bitcoin, has positively influenced the efficiency of the mining inventory, whose destiny depends upon that of the digital gold that the corporate extracts every day.

MARA even presents an elevated volatility in comparison with its underlying Bitcoin, with very evident temper swings within the midst of bull and bear market phases.

Presently costs are holding above the 50-week EMA and are battling the $30 threshold that separates the inventory from one other bullish leg up.

Though we’d count on a small correction for the inventory at this level, particularly if Bitcoin doesn’t carry out positively, the trail from right here to the subsequent few months for MARA is marked upwards.

Indicatively, we count on it to achieve a minimum of 50 {dollars}, particularly if Marathon manages to succeed among the many Bitcoin neighborhood with the launch of the layer-2 Anduro.

Weekly chart of MARA inventory worth