Just like the observe of inserting digital property, yield-generating stablecoins and Polish have collected a big traction as a sophisticated mechanism for amassing cryptocurrency holdings and producing passive revenue via long-term holding intervals. Beneath you will see an analytical snapshot of the highest 5 stablecoin -reading swimming pools, organized by complete worth locked (TVL) and their corresponding annual share yields (APY), from 6 March 2025.

Decoding the rise of return-generating Stablecoin-Swimming pools in 2025

After the collapse of the ecosystem and anchor of Terra, an rising cohort of income stablecoins has risen to fame, fascinating contributors on the lookout for dependable returns in decentralized financing. A revenue-bearing Stablecoin represents a class Fiat-Pegged digital tokens that marries the steadiness that’s inherent in conventional Fiat currencies with potentialities for constructing passive revenue. Sure normal stablecoins, when deposited in in depth liquidity swimming pools, accumulate returns which are generated by the polish operations.

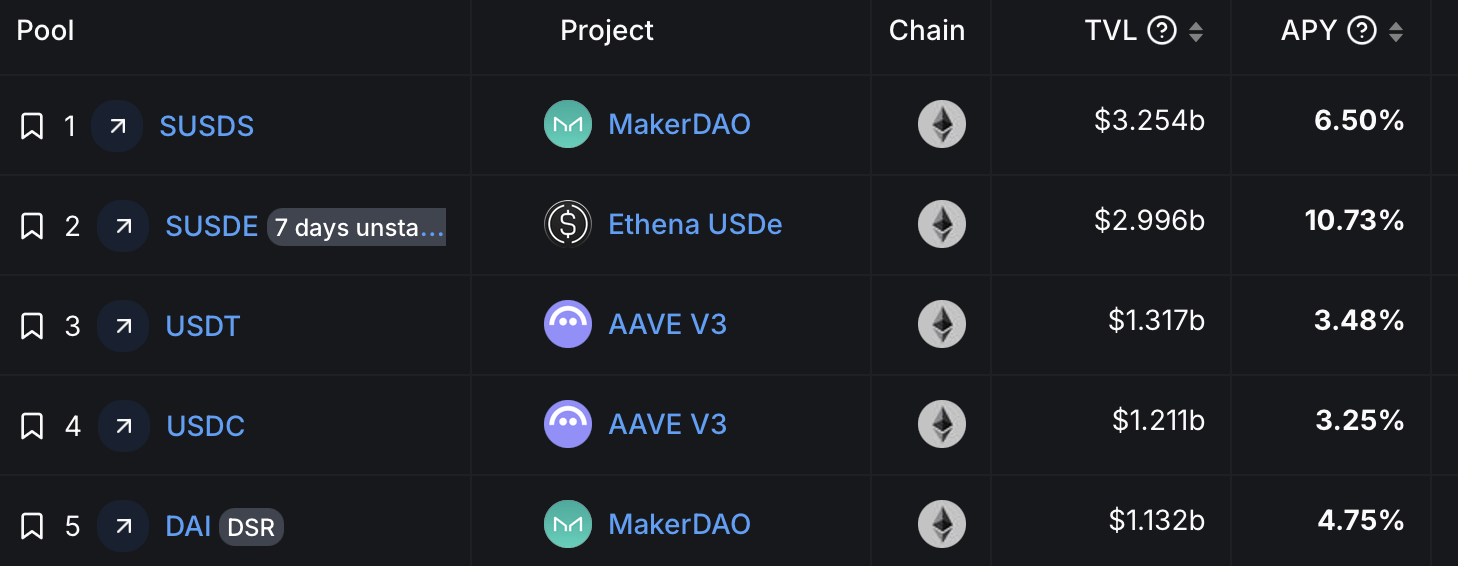

Capital assigned to those devices is normally channeled in liquidity swimming pools or comparable structured frameworks, which operate because the spine for producing returns via strategic protocols – together with the set up of digital property corresponding to ETH, decentralized loans or deploying capital about varied monetary automobiles. In accordance with the statistics collected by Defillama.com, the highest 5 Polish $ 8,699 billion from March 6, 2025.

Sky’s USDS leads the rankings in complete worth locked (TVL) to $ 3,254 billion. In accordance with Defillama.com, the USDS pool at the moment provides an annual share yield of 6.50% (APY). Ethena’s Susde Pool, who presents a superior yield of 10.73% APY, secures $ 2.996 billion in capital closed. Within the meantime, the Tether (USDT) Pool maintains a TVL of $ 1.317 billion on Aave model 3 and presents customers an APY of three.48%.

High 5 stablecoin -pools on March 6, 2025, by TVL with their corresponding annual share yields (APY).

Likewise, the USDC pool on Aave V3 yields 3.25% APY, coupled with a TVL of $ 1,211 billion. Utilizing Sky’s infrastructure (previously Makerdao), the DAI -Pool provides an APY of 4.75%, supported by $ 1,132 billion in firms. Outstanding additions to this cohort embrace USD0 ++ from USual at 11.56% APY, the SPDAI -Pool on Morpho Blue at 8.58% APY and USDS through Spark at 7.17% APY.

The allocation of capital to those Polish offers varied advantages, together with constant yield era, liquidity for seamless repayments and accessible entry factors for dangerous traders. Furthermore, they facilitate portfolio diversification and involvement in decentralized protocols with out making fingers vital.

Though revenue-bearing stablecoin-pools current seductive return views, they’re accompanied by significant dangers. Contributors should navigate potential risks corresponding to sensible contract vulnerabilities, short-term valuation abnormalities, embezzlement of property and Stabilein -resigning occasions.

The worsening of those issues are regulatory ambiguities and fraudulent laws inside Decentralized Finance (Defi), which enhance publicity to monetary instability. Cautious analysis and cautious technique are vital to cut back losses on this dynamic and rising ecosystem.