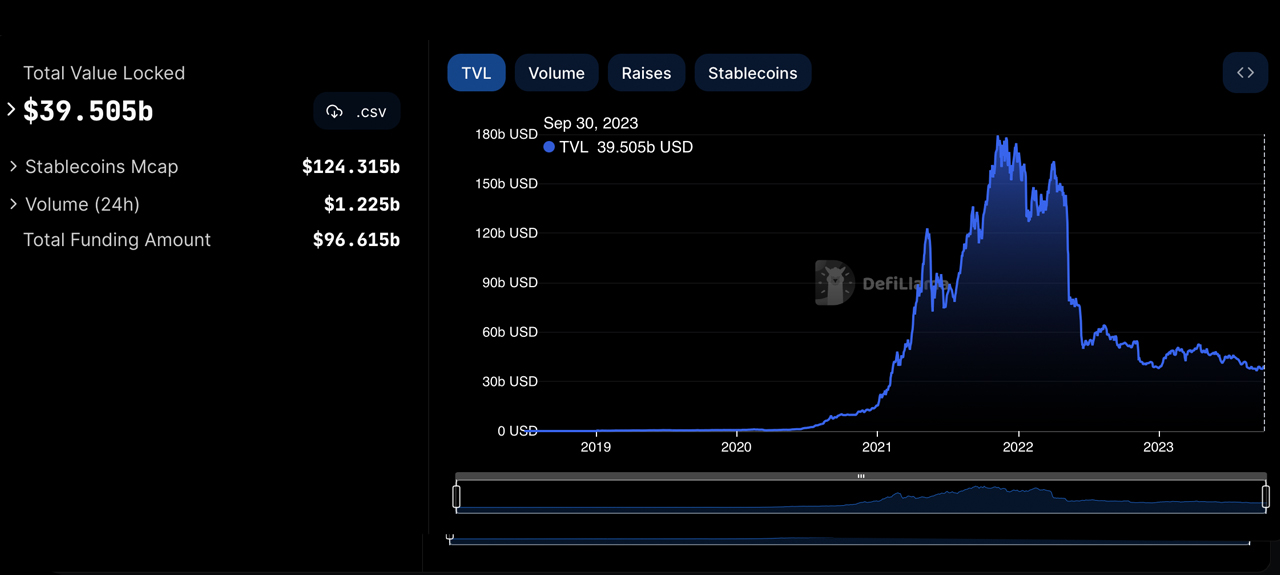

As of October 1, 2023, $39.50 billion has been positioned in decentralized finance (defi) platforms. Let’s check out the highest 5 classes, highlighting the various vary of defi protocols, the variety of functions, and the wealth they embody.

A take a look at 5 Defi classes that handle billions in crypto belongings

Defillama.com, a decentralized aggregator of the monetary (defi) trade, showcases a variety of defi protocols, their underlying blockchains and their values. It options about 35 distinctive classes of functions. The scene is dominated by liquid staking derivatives functions, 119 of which maintain $23.05 billion.

The entire worth is locked (TVL) in defi as of Sunday, October 1, 2023 at 8:00 PM Jap Time.

Liquid staking derivatives characterize tokens backed by staked belongings in blockchain networks, permitting customers to stay liquid whereas their belongings are staked. Primarily, they allow you to earn staking rewards with out tying up your belongings, by changing them into tradable tokens.

The entire worth locked (TVL) within the prime 5 classes in defi as of Sunday, October 1, 2023 at 8:00 PM Jap Time.

Lending, the quantity two in defi, contains protocols that enable customers to lend or borrow belongings. About 302 protocols fall underneath this credit score umbrella, collectively holding $15.14 billion in crypto belongings as of October 1, 2023. Carefully following, the decentralized trade (dex) class claims the third place with whole worth locked (TVL) of $11.82 billion throughout 1,026 protocols.

Dex protocols are platforms that enable customers to commerce crypto belongings straight with one another, with out the necessity for an middleman or central authority. Primarily, dexs provide peer-to-peer buying and selling, making transactions clear and safe on the blockchain.

Fourth within the defi panorama is the bridge class, protocols designed to move tokens between networks. These bridges act as important hyperlinks between numerous blockchain networks and at present handle $9.17 billion throughout 46 totally different platforms. Securing the fifth place within the defi hierarchy is the CDP class, or the collateralized debt class.

CDP defi protocols enable customers to pledge belongings as collateral, giving them the chance to borrow numerous belongings or tokens. At their core, they supply loans anchored to the worth of the pledged collateral, permitting customers to faucet into funds whereas preserving their major belongings protected. A exceptional 105 CDP protocols exist, amassing a mixed worth of $8.23 billion.

Following the ranks of liquid staking, lending, dex platforms, bridges and CDPs are protocols that concentrate on returns, real-world belongings (RWAs) and derivatives. Main the parade, Lido Finance is the highest canine in liquid staking, Aave reigns supreme in lending, Uniswap dominates the dex area, WBTC stands tall as the primary bridge, and Makerdao is the titan of the CDP realm.

What are your ideas on the highest 5 defi classes by way of the overall worth of those several types of protocols? Share your ideas and opinions on this matter within the feedback under.