A strategic partnership between Typical, EthenaAnd Securitize, the tokenization platform for the BlackRock USD Institutional Digital Liquidity Fund(BUILD), is reshaping DeFi by combining liquidity, yield, and composability.

What adjustments for customers?

- USDtb collateral integration: Within the coming weeks, the mixture of USDtb and BUIDL could be accepted as collateral for USD0, bridging TradFi-level stability with DeFi innovation. It can present the standard diversification of collateral and improve decentralization of USD0.

- Maximized income alternatives: USD0++ holders have entry to a 1:1 incentivized vault in USUAL and sats for sUSDe, unlocking greater returns by delta-neutral methods and absolutely sponsored rewards. These vaults are remoted and don’t have an effect on USD0++ help.

- Unparalleled composability: All these speaking layers present the true energy of DeFi. Typical and Ethena purpose to dramatically enhance the stablecoin panorama and supply customers with higher safety, composability, and profitability.

- Improved liquidityA seamless 1:1 swap mechanism between USDtb, USD0 and USDe reduces dependence on secondary swimming pools, making certain sturdy coupling and flawless liquidity as environment friendly capital flows between stablecoins and the remainder of the market.

- Diversification of returns and authorities bonds: Ethena will allocate a portion of its reserves to USD0++, driving adoption, rising TVL and rising income alternatives for customers. Typical’s collateral will diversify income sources by the combination of USDtb and BUIDL.

Within the quickly evolving panorama of DeFi, a brand new alliance is rising to redefine what is feasible. Typical, Ethena and the BUIDL fund, tokenized by Securitize – three of the quickest rising names of their respective domains – be a part of forces to create a breakthrough layer of liquidity, composability and return optimization. Collectively they type a ‘Holy Trinity’ designed to gas a DeFi and stablecoin renaissance, enhancing stability, maximizing yields and optimizing liquidity in each TradFi and DeFi ecosystems.

A sacred partnership constructed for development

This collaboration is not nearly aligning three powerhouses, it is about creating synergy at each layer of the ecosystem:

- BlackRock USD Institutional Digital Liquidity Fund (“BUIDL”), tokenized by Securitizeanchors this partnership by offering institutional-grade liquidity to DeFi. BUIDL offers safe, productive collateral that permits decentralized protocols to construct purposes backed by assets from conventional finance.

- Typical protocol bridges conventional and decentralized finance by providing an RWA-backed stablecoin designed to redistribute possession by use. Typical acts as a monetary infrastructure and offers a stablecoin backed by on-chain T-bills, making certain solidity and defending stablecoin holders from any counterparty danger. The aim is to diversify collateral, mixture on-chain T-bill liquidity and ship a steady, payment-ready asset. Customers can stake their stablecoin as a Liquid Staking Token to realize possession of the protocol by the USUAL token, which redistributes the worth created.

- Ethena Protocol enhances choices with delta-neutral methods and unparalleled configurability, giving customers excessive returns: Ethena is an artificial greenback protocol on Ethereum, offering a crypto-native various to conventional banking infrastructure and a globally accessible dollar-denominated reward instrument, the “Web Bond”.

Layered development for max impression

At each degree of the ecosystem, these three gamers create worth for customers by enabling higher composability and inherent liquidity in DeFi, whereas providing customers the very best yields:

- Unparalleled Composability: Bridging TradFi and DeFi in groundbreaking methods. By integrating BUIDL and USDtb as collateral, USD0 turns into an RWA stablecoin that unifies fragmented RWA liquidity. By enabling USD0++ holders to realize publicity to USDe, Typical permits customers to optimize their USUAL property whereas rising Ethena’s TVL in all market situations.

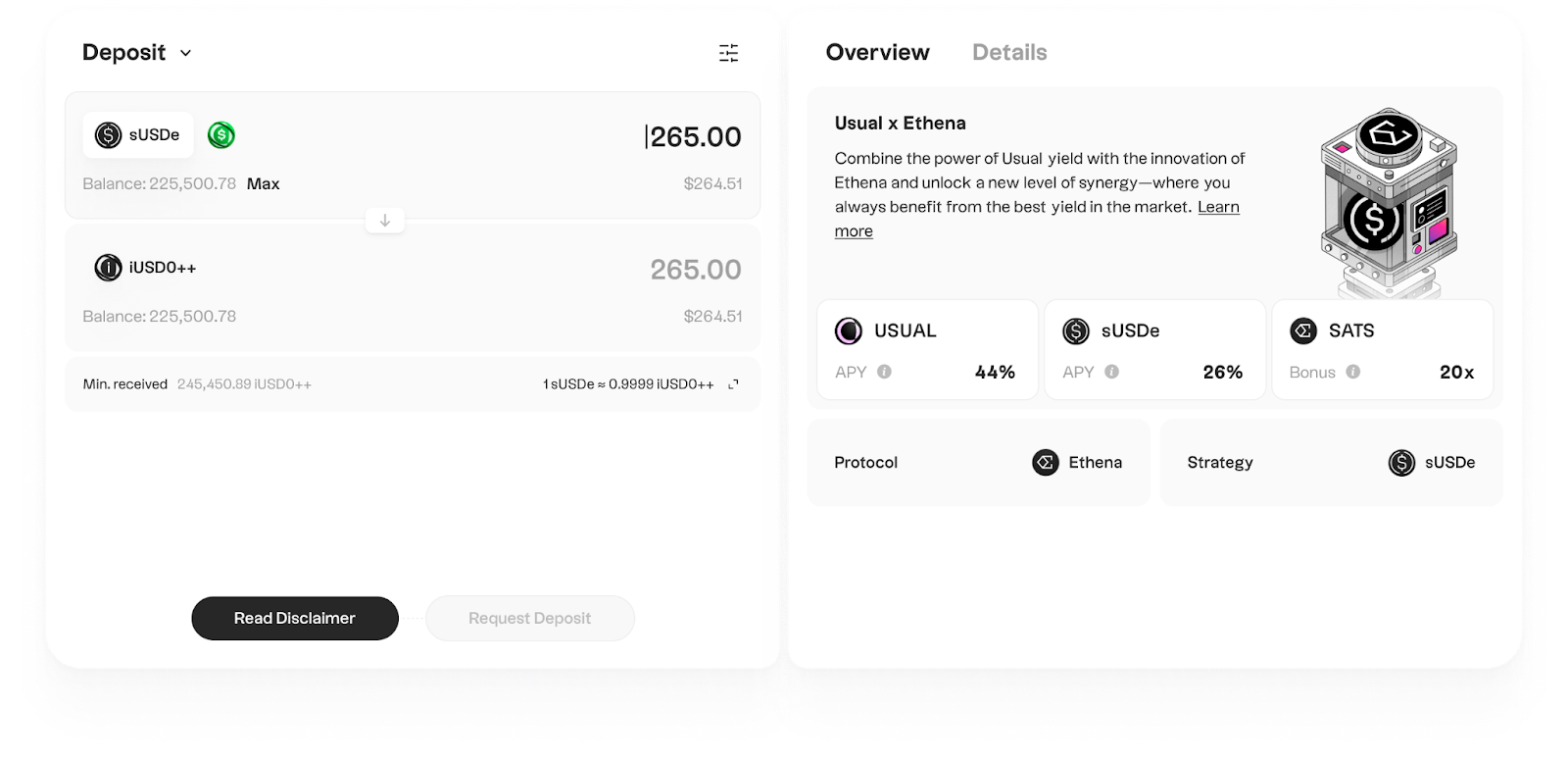

- Maximized income alternatives: By combining Typical’s Alpha returns with Ethena’s delta-neutral methods, customers can maximize returns in any market setting. They’ll take pleasure in a mixed return of sUSDe and USD0++.

- Improved liquidity: The seamless integration between USD0, USDtb and USDe creates a flawless liquidity layer, making certain low-slippage swaps and easy capital flows.

With this alliance Typical, Ethena and BUIDL, tokenized by Securitize, are reshaping the monetary panoramacombining the very best of TradFi and DeFi to ship the last word product: essentially the most liquid, composable and worthwhile layer in decentralized finance.

Unite to redefine your DeFi expertise

The strategic partnership introduces a transformative layer of innovation for customers, combining stability, returns and liquidity to bridge the hole between TradFi and DeFi. Here is what this groundbreaking collaboration means for you:

- USD0 Meets USDtb as collateral

The mix of USDtb and BUIDL is accepted as collateral for USD0. This partnership will bridge TradFi-level stability with DeFi innovation, offering sturdy and dependable collateral.

2. Maximized returns with USD0++ publicity to sUSDe

USD0++ holders get entry to a particular vault that gives 1:1 publicity to sUSDeEthena’s artificial greenback. This remoted and incentivized vault offers an unparalleled alternative for return maximization, with Typical absolutely subsidizing rewards till the sUSDe return equals or exceeds the Fed fee. Ethena additional strengthens this by offering incentives to the USD0++ sUSDe vault, making certain liquidity development and consumer engagement.

3. Unlocking most liquidity

A 1:1 change mechanism between USDtb, USD0 and sUSDe will simplify liquidity flows, lowering dependence on secondary swimming pools whereas sustaining optimum liquidity ranges. To additional strengthen these flows, each Typical and Ethena will drive vault participation and liquidity development within the secondary market.

4. Diversification of returns and authorities bonds

To strengthen the adoption of USD0++, Ethena will make allocations a major share of its unused reserves to help its integration. This transfer will unlock new layers of composability, encourage participation, gas liquidity development, and increase consumer choices throughout the DeFi ecosystem.