Kate Smith

As soon as once more, the fairness market seems to be betting on a Fed pivot. The market has been front-running Fed pivots from earlier than the Fed even started elevating charges. This latest model of the Fed pivot is that the Fed will lower charges by 100 to 125 bps in 2024, which is considerably greater than what the Fed was projecting within the September Abstract of Financial Projections of 5.1%.

This concept of price cuts appears a little bit of a fantasy, as inventory costs have once more moved sharply increased in hopes of price cuts. At this level, there isn’t any motive for the Fed to sign that aggressive price cuts are coming in 2024, and it is extra probably than not going to disappoint the market with the discharge of the December Abstract of Financial Projections.

Inflation Is Nonetheless Too Excessive For The Fed

Whereas holding no main surprises, the most recent CPI report exhibits that inflation stays sticky and is sluggish to come back down, particularly within the core and tremendous core readings, which accelerated in November. Given the CPI report and the roles report final week, one must marvel what makes the market assume that the Fed will sign chopping charges as aggressively as it’s pricing in.

It appears probably that the Fed will lower charges in 2024, because the September SEP projected. The December SEP is also more likely to recommend the Fed lower charges in 2024, and my thought is that the median dot for 2024 is more likely to be unchanged as a result of there hasn’t been a significant sufficient decline in core inflation charges for the reason that September assembly, whereas the labor market has remained robust.

Slicing charges as inflation charges fall is smart as a result of if the Fed would not lower charges as inflation falls, the actual rate of interest rises, tightening financial coverage additional, regardless that the nominal in a single day price stays unchanged.

Too A lot Hope

However the market’s pricing of price cuts appears to be in higher extra than what could be applicable for the Fed to sign, based mostly on what the Fed has mentioned and talked about of maintaining charges sufficiently restrictive for a while. The market’s view as of Dec. 11 was for the Fed funds price to fall to 4.33% in 2024, assuming the Fed’s PCE expectations of two.5% stay, which might push the actual price under to round 1.8%. That might be considerably lower than the two.6% actual price the Fed modeled in September when it protected a 5.1% fed funds price on the finish of 2024.

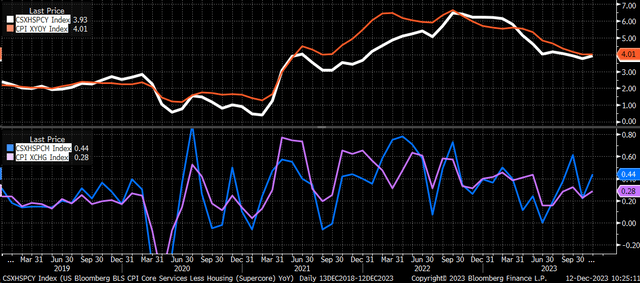

Sufficient hasn’t modified within the three months for the reason that Fed’s September assembly to warrant such an abrupt and sudden change to the Fed’s price outlook. Core CPI and tremendous core CPI seem to point out indicators of flattening year-over-year. In distinction, on a month-over-month foundation, core providers and core CPI appear to be accelerating after a transparent path decrease within the first half of 2023, making it too quickly for the Fed to sign extra aggressive price cuts.

Bloomberg

Extra Deflation Want To Account For Excessive Companies Inflation

To get the Fed to chop charges as aggressively as what the market is pricing in, in a way that is smart, would contain getting inflation to be at 2% by the top of subsequent 12 months. Possibly that occurs, however core inflation measures are caught at these increased ranges. The one approach we will proceed to see inflation on the headline drop is to see power costs fall as a result of providers inflation, ex-food and power, continues to be at 5.5%. As compared, core items inflation has hit 0% and would in all probability have to show to deflation.

Bloomberg

This is not to say that the Fed will not lower charges aggressively sooner or later over the following 12 months, however what it appears to recommend is that the market is simply too far out in entrance of the Fed within the rate-cutting cycle, and that will show to harm the market as soon as once more, this time round.