What’s modularity anyway?

Modularity is the results of a curious experiment taking part in out in Ethereum as a response to the poor scaling properties of blockchains. To deal with this bottleneck, builders have taken the unconventional strategy of auctioning off core features of the principle chain to… different blockchains.

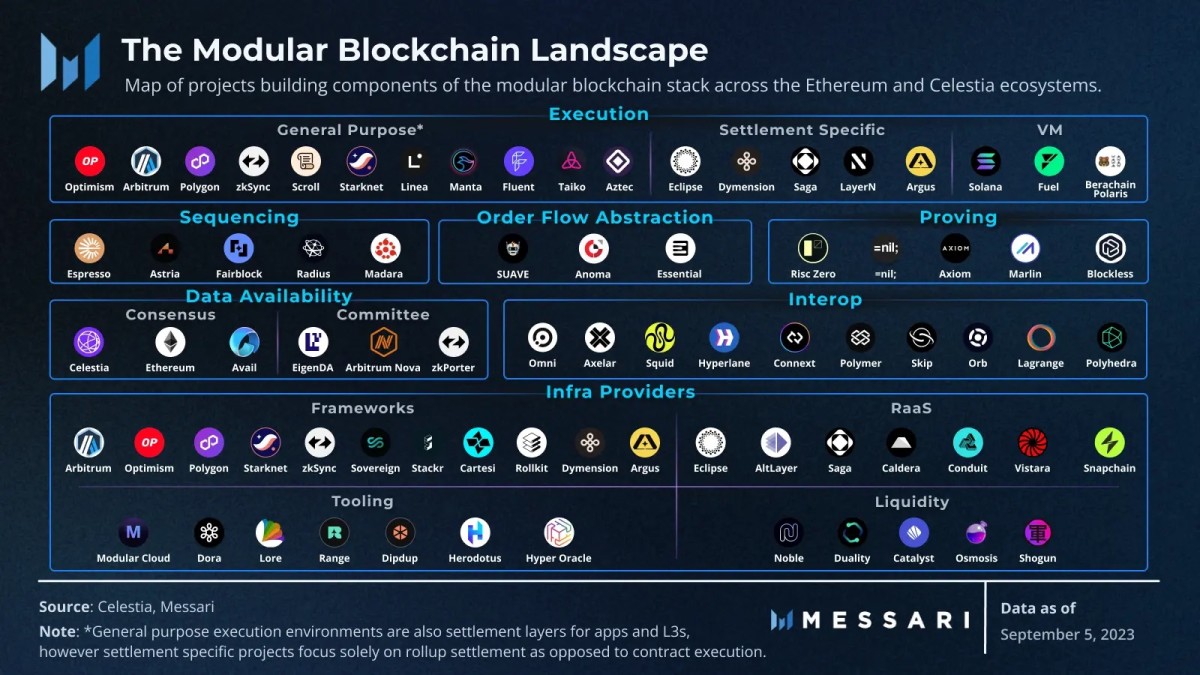

Centered round rollup expertise, this modular transformation has fully redefined how services and products are constructed on high of Ethereum. Breaking up each ingredient of the stack permits completely different architectures to be designed in line with their use circumstances. Understandably this has led to a proliferation of… blockchains.

I child you not. Everyone seems to be getting hilariously wealthy promoting blockchains, once more.

Whereas every new consensus protocol provides novel and fascinating scaling alternatives, in addition they introduce a bizarre coordination drawback. If customers turn into dispersed throughout completely different networks, how is the financial system made extra environment friendly? How can we synchronize everybody throughout this distribution? Possibly yet one more… blockchain?

It’s turtles all the way in which down.

This fragmentation of the ecosystem has had a number of apparent penalties. For one, customers are siloed and trapped between intermediaries. Whereas rollups have compelling trust-minimization properties, the inefficiency created by the switch out and in of these methods creates unreasonable prices for customers. It additionally exposes them to extra dangerous choices like bridges and centralized companies.

For builders, the absence of interoperability throughout platforms creates friction and fosters a aggressive slightly than collaborative surroundings. Each different day a brand new protocol is created for brand spanking new and current groups to compete over with one more copy of the identical purposes. In lots of circumstances, groups are opting to “wager on themselves”, spinning off into their very own ecosystem (learn: blockchain). It is essential to emphasise the enchantment of this mannequin, which permits for the customization and optimization of numerous elements for every utility. This versatile structure empowers anybody to contribute their distinctive frameworks and encourage new designs. The probabilities are infinite!

Sadly, these incentives have resulted within the fragmentation of the community impact. If nothing that’s constructed matches collectively, customers will consolidate in the direction of solely a handful of competing networks. In consequence, financial exercise turns into concentrated into fewer permissioned methods.

This model of modularity has introduced individuals farther from the objective when it shouldn’t. Utilizing completely different interfaces to work together with the consensus protocol is a superbly legitimate concept. Nevertheless, Ethereum’s technique proves problematic; it regards interoperability extra as an non-compulsory function than a foundational design precept. So long as Ethereum continues to pursue scalability by multiplying blockchains, the talk will persist, offering ample alternatives for rivals to take advantage of these divisions and encourage discord. Divide and conquer.

Bitcoin’s alternative

On Bitcoin, a distinct structure is rising that favors a essentially completely different design. Utilizing Lightning because the interoperability spine, builders are slowly coalescing in the direction of a expertise stack a lot nearer to Bitcoin’s peer-to-peer mannequin.

Relatively than try to duplicate international shared states, protocols like Cashu or Fedimint are optimizing for native and permissionless interactions. Monetary companies can now be deployed throughout completely different financial hubs and stay related by the Lightning Community.

Liquidity suppliers, atomic bridges, and ecash mints. A novel monetary community all sharing the identical settlement layer.

Nostr’s arrival supplies the social abstraction that ties all of it collectively. A social community based mostly on related rules as Bitcoin, it supplies a easy algorithm engineered to maximise interoperability. By avoiding being prescriptive in regards to the features it permits, Nostr is unleashing a Cambrian explosion of open innovation.

As we speak, completely different initiatives are starting to discover methods to facilitate Bitcoin commerce by making Nostr a local element of the Bitcoin consumer expertise. The general public key infrastructure underlying the protocol is a pure match for wallets and different fee purposes, permitting them to speak with one another and securely alternate messages. This communication layer can join customers with others with numerous companies made obtainable by the community. Requirements like Nostr Pockets Join are creating new alternatives for Bitcoin purposes to interface with Nostr’s rising ecosystem.

A case examine

Initiatives like Mutiny completely embody the variations on this Bitcoin modular imaginative and prescient. Customers can concurrently join with companies like Nostr Relays, Fedimint federations, and Lightning Service Suppliers (LSPs). Every of those grants entry to a rising variety of options and purposes. Utilizing Nostr as a discovery service, we’re empowered to leverage our social community to establish and natively entry purposes and companies endorsed by our friends. This web-of-trust introduces an fascinating different to so-called trustless methods. Contributors can start counting on market incentives to have interaction in additional environment friendly exchanges that aren’t encumbered by the tradeoffs required of extra decentralized methods.

Finally, marketplaces will emerge for liquidity suppliers, ecash mints, lenders, and coinjoin coordinators to promote their companies by the Nostr. Decentralized order books initiatives Civkit may seamlessly combine with Mutiny and permit customers to have interaction in peer-to-peer trades. Each integration is designed round permissionless participation in order that customers can keep full sovereignty over their interactions.

Platforms vs. protocols

Bitcoin’s modular story just isn’t with out its personal dangers. Elementary items of the puzzle akin to LSPs contain important capital necessities that may create economies of scale between competing suppliers. The expansion of ecash mints could also be hindered by regulatory considerations and operator fraud. Nostr relays have already proven centralization tendencies and it stays unclear how the community topology will play out.

The success of this strategy rests on market optionality and it’s important that the limitations to entry into these companies stay low. Quite a lot of completely different efforts are being deployed to that finish. For instance, a number of Lightning firms are at the moment collaborating on a specification that may enable any market actors to implement their very own LSP.

It’s in all probability too early to forecast how any of these architectures and protocols will evolve. As each worlds proceed to collide, it’s possible that rollups discover their place inside the Bitcoin ecosystem. Utility particular designs akin to alternate rollups or zkCoins don’t require international state and will maybe be made to be interoperable with Lightning.

The strain between each strategies is considerably harking back to the early days of the web. Industrial curiosity could favor platforms that enable them to seize parts of the community impact with a purpose to monetize it. It may take longer for extra open and permissionless protocols to really get off the bottom. The web supplies a cautionary story with reference to the consolidation of companies and purposes into gatekeeping walled gardens. Hopefully, the present Bitcoin growth path resolves right into a future that prioritizes interoperability and permissionless entry over monetary silos.