Editor’s be aware: In search of Alpha is proud to welcome JH Asset Administration as a brand new contributor. It is easy to change into a In search of Alpha contributor and earn cash on your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to seek out out extra »

courtneyk/E+ by way of Getty Photographs

Funding Thesis

Earlier than the COVID-19 pandemic, The Youngsters’s Place (NASDAQ:PLCE) operated like a bond. Annually, the Firm generated ~$1.8B in annual gross sales, leading to ~$100M of free money movement that was routinely distributed to buyers in full. Starting in March 2020, this once-steady operation, together with many different retailers, was derailed by lockdowns and the following provide chain disruption. Moreover, rampant inflation coupled with stagnant wage development has harm the monetary situation of PLCE’s core client. Because of these occasions, PLCE’s earnings have plummeted together with its inventory value whereas debt has ballooned.

For these prepared to take a position with a multi-year time horizon, I consider that these current misfortunes have supplied a possibility to purchase into a really predictable enterprise, returning to its regular state, at a major low cost to intrinsic worth. Any considerations about leverage ought to be assuaged after the This fall earnings launch as a big working capital profit will likely be used to cut back debt by ~25%. Moreover, Administration has proactively taken steps to place the enterprise for future success by prioritizing its digital presence as early as 2017.

Firm Background

The Youngsters’s Place is a specialty retailer of youngsters’s attire, promoting by means of a mixture of bodily shops, its cellular app and web sites, worldwide franchises, and wholesale. In 2017, the Firm primarily offered by means of its ~1000 brick-and-mortar shops, which accounted for ~80% of gross sales, when Administration determined to prioritize its on-line enterprise. Since that point, digital has grown to account for ~60% of gross sales as of Q3 2023, whereas its retailer depend has declined to ~590 places. Remarkably, PLCE’s internet gross sales (that’s, internet of promotions) have remained virtually unchanged because the Firm has efficiently substituted in-store purchases with digital gross sales whereas remaining disciplined on advertising spend.

Sturdiness of Enterprise Mannequin

In addition to the valuation, the primary attribute that drew me to the Youngsters’s Place was the enterprise mannequin. Designing and promoting (PLCE contracts to fabricate) kids’s clothes like t-shirts, denims, and jackets is so primary that even a simpleton equivalent to I can say with confidence that it’s more likely than not that American mothers will nonetheless be shopping for these garments for his or her kids in not less than the identical mixture greenback quantity even a century from now. Nevertheless, it goes with out saying that kids’s attire isn’t precisely a quickly rising pie both.

Aggressive Benefit

Whereas not completely aggressive, the competitors in attire retail is fierce. There are a number of gamers with important scale (e.g., Goal’s Cat & Jack, Hole, Carter’s, and many others.), which has resulted in bouts of heavy promotions and advertising spend as gamers search to take market share from each other. Regardless of this, PLCE has been capable of efficiently generate ~$1.8B of internet gross sales yearly over the previous 10+ years, which is a transparent testomony to the Firm’s portfolio of manufacturers and its worth proposition to the buyer, for my part.

Low cost To Historic Earnings

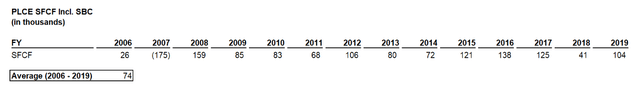

The aim of investing is to purchase possession pursuits in companies at valuations under their intrinsic worth, the discounted worth of future money flows. That’s the sport. With that in thoughts, under is a desk that illustrates PLCE’s monitor file of money movement era since FY 2006 (outlined as money movement from operations much less capex and stock-based compensation):

PLCE SFCF, Incl. SBC Exp. (Firm filings)

That’s pre-COVID earnings energy of ~$75M, by means of an financial downturn, relative to a market cap of simply ~$300M as of 12/27 for an eye-popping proprietor’s earnings yield of ~25% (in the event you consider PLCE will as soon as once more earn ~$75M in a extra benign setting for attire retail). Be aware that adjusting out stock-based compensation expense ends in common money earnings nearer to ~$100M.

Administration Group

Extra money era is necessary, however it’s equally necessary that your earned money isn’t squandered. Fortunately, Administration has traditionally allotted extra money movement merely – both returning it to shareholders or often funding investments very important to the energy of the enterprise (e.g., acquired Gymboree out of chapter, spent ~$50M to build out e-commerce channel, and many others.). Since 2006, Administration has returned roughly all extra capital again to shareholders, spending a mean of ~$90M per 12 months on share repurchases and briefly paying a dividend. Although this return of capital appears extreme in hindsight given the Firm is now tight on liquidity, I applaud Administration’s choice to return capital as kids’s attire is a low-ROI trade. Particularly, I feel CEO Jane Elfers, who has led the Firm since 2010, is a succesful allocator who will do proper by shareholders. On this level, it is price mentioning that she purchased ~$1M of PLCE inventory on the open market in July.

What’s The Catch? Leverage

Administration is not going to be returning any money movement to buyers if the enterprise is bankrupt. Whereas that is actually not the anticipated final result, PLCE’s liquidity place is tight. PLCE has a revolver steadiness of $360M, a $50M time period mortgage excellent, and $14M of money and equivalents for internet debt of ~$400M. Along with money, PLCE has ~$30M of remaining capability on its revolver for ~$40M of complete liquidity. Relative to TTM 3Q 2023 money movement from operations of -$35M, this understandably appears troublesome.

Nevertheless, PLCE is anticipating a big working capital good thing about $100M by EOY, which it’ll use to cut back debt. If this proceeds as deliberate, PLCE may have ~$140M of liquidity obtainable getting into 2024. Moreover, not all debt is created equal, and the majority of PLCE’s borrowings are on its revolver, so fastened cost protection is much less of a priority. Lastly, now that the enter prices that plagued the Firm in 2022 / 1H23 are within the rearview mirror, I feel it is extremely doubtless that PLCE can function profitably if Mgmt. can stay disciplined on working capital administration.

Digestion of Q3 Outcomes

Gross sales

Gross sales have been ~5% under the historic common for the quarter however forward of expectations given the troublesome spending setting. Administration additionally expects This fall gross sales to be down mid-single digits from the historic common. Notably, stronger-than-expected digital gross sales development offset brick-and-mortar gross sales declines. Whereas that is actually a optimistic knowledge level for the digital technique, it additionally has implications for the gross margin, which brought about the bottom-line miss.

Gross Margin

Gross margin was 33.7% in Q3 vs. a 36 – 37% information and a pre-COVID common of ~40% (gross margin usually peaks in Q3). This distinction could seem small however PLCE has traditionally operated at a mean internet margin of ~4%, so even a 1% drop in GM with none offsetting financial savings can considerably scale back proprietor’s earnings. Because of this drop, the working margin was solely ~10% in Q3, and Administration guided to only a 2 – 3% working margin in This fall vs. expectations of a ten% margin for all of 2H23.

Administration cited 3 causes for the drop in GM, assigning roughly equal weighting when it comes to $ impression: 1. Delayed freight & achievement financial savings, 2. Larger labor prices (staff + third celebration logistics) because of larger than anticipated bundle quantity, 3. Decline so as greenback dimension.

Out of the three, I agree with Administration that solely the upper labor prices are everlasting because of larger wage charges whereas the remainder are transient for the explanations under:

Freight and Success Contract Financial savings – Per Administration, this profit is anticipated to kick in as early as This fall, however they’re rightfully prioritizing most financial savings vs. speedy advantages.

Larger Labor Prices – Taking the learnings from this expertise, Administration ought to be capable to do a greater job of appropriately staffing the distribution heart to match the anticipated quantity in the course of the back-to-school procuring interval going ahead. This can allow the Firm to keep away from paying out pointless time beyond regulation premiums. Moreover, PLCE will likely be much less reliant on its outsourced logistics supplier to fill orders, particularly when the enlargement of its distribution heart is accomplished.

Declining Order Economics – I feel it makes intuitive sense that general Common Greenback Sale (ADS) ought to rebound when PLCE’s buyer spending habits revert to the imply. Nevertheless, I’d say that this downside is a little bit of a query mark as it’s customer-driven, and the Firm has not supplied knowledge to help this attitude. Moreover, Administration talked about that ADS is far decrease on Amazon, which can dilute the general ADS as that channel grows. In the end, I’m trusting Administration in addition to my understanding of the present retail setting that this downside is cyclical and never structural. Plus, Administration has levers obtainable to handle this difficulty equivalent to implementing a minimal order dimension free of charge transport.

Working Capital

Because of provide chain issues and softening gross sales, PLCE’s stock place has constructed up. This may be seen within the agency’s days stock excellent, which has elevated considerably from pre-pandemic ranges. Now Administration is right-sizing their stock place to match comparatively weaker mixture demand. In Q3, Administration decreased stock by ~15% from the earlier quarter, leading to a money good thing about ~$75M that was offset by a paydown of accounts payable. For a similar purpose, PLCE ought to be capable to generate ~$100M in This fall to cut back its revolver borrowings as Administration is concentrating on a double-digit discount in stock from FYE ’22, which comes out to a minimal of ~$60M. If This fall gross sales fall according to Administration’s information, I see no purpose why the Firm cannot accomplish this aim given there’s substantial historic precedent. Along with the stock discount in Q3, the Firm made an analogous transfer in This fall of final 12 months, producing ~$100M from internet stock liquidation.

PLCE DIO, 2017 – 2024E (Firm filings, Writer’s estimates)

Past 2023, bringing stock according to the softer gross sales setting alone can present one other $100M+ working capital profit to tide the Firm over till the buyer strengthens. If PLCE can accomplish this, it might have ~$250M in obtainable liquidity between its money and revolver capability. Alternatively, Administration could determine to carry onto some extra stock in anticipation of a carry in gross sales. On this situation, the Firm can be even higher off, assuming that demand does inflect as anticipated.

Monetary Forecast And Valuation

Attempting to foretell PLCE’s future gross sales in any exact approach is a idiot’s errand as this could require the information of the longer term discretionary expenditures of hundreds of thousands of PLCE customers when in actuality, they doubtless do not even know the way a lot they plan to spend. Happily, the disconnect between PLCE’s present market worth and any type of a return to the Firm’s former state is so extensive that shareholders are sure to nonetheless do properly if the Firm recovers.

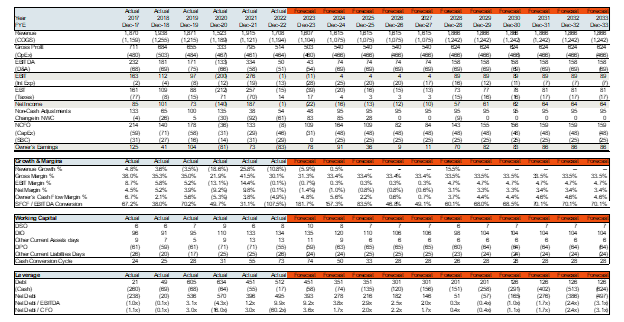

PLCE Monetary Forecast, Restoration In 2028 (Public filings, Writer’s estimates)

Even in a situation the place PLCE’s gross sales stay muted till 2028 and general gross margin by no means recovers to its pre-COVID common, my evaluation means that PLCE is probably going nonetheless undervalued by as a lot as 100% on a reduced money movement foundation utilizing a set low cost charge of 10% and 0% terminal development with the monetary forecast within the desk above. For income, this case pessimistically assumes a run charge of 2023’s gross sales by means of 2028 when income returns to the pre-COVID common. Equally, I’m assuming an enchancment to gross margins from 2023 ranges now that enter value pressures have abated, however they’re nonetheless decrease than the pre-COVID common of 36.5%. With a run charge of 2023 SG&A, this means a breakeven working margin by means of 2028. To cowl curiosity expense and capex and scale back debt on this situation, I’d count on Mgmt. to additional tighten controls on stock purchases and proceed to cut back its stock place.

Whereas this situation is starkly bearish, it serves as an example that even a restoration within the distant future may doubtless nonetheless generate an IRR of ~14% (a double in valuation over 5 years) for buyers so long as the Firm can merely face up to the downturn. On the flip facet, I’d not be shocked to see returns of 300%+ within the occasion of a larger restoration in 2024 or 2025, which is actually within the realm of chance.

Dangers

Laborious Touchdown

Given clothes is a considerably discretionary expense, PLCE’s gross sales and margins can be negatively impacted by a recession or basic decline in consumption. PLCE navigated the Nice Monetary Disaster with only one 12 months of working losses and recovered pretty rapidly however a chronic downturn will surely harm.

Rise In Enter Prices

2022 and 1H23 uncovered that PLCE is prone to losses from spiking enter prices, notably because the Firm was loading up on costly stock. Accordingly, buyers ought to control the worth of cotton and freight prices; nevertheless, Mgmt. appears far more cautious about stock purchases within the present setting, so I’d not count on the identical magnitude of a decline in margins.

Everlasting Decline In Unit Economics

With out query, the gross margin miss in Q3 has spooked analysts and buyers concerning the future profitability of PLCE as a digital-first retailer. Whereas Mgmt. believes that many of the impression was transient, there’s a threat {that a} everlasting decline in ADS will offset any financial savings from retailer closures. Whereas there could also be some reality to this, I are inclined to suppose that the majority of the drop in ADS stems from the present spending setting. Plus, Administration is working to handle extra labor prices, which exacerbated the impression.

Lack of ability To Additional Cut back Stock Stability

Beneath circumstances the place PLCE can not function profitably, Mgmt. should fund fastened expenses and generate extra money by decreasing its stock steadiness available and working with much less stock going ahead. Nevertheless, inefficiencies at its distribution heart and shops could power the Firm to carry extra stock for longer, tying up capital that might in any other case be used to pay curiosity and canopy capex.

Lack of Market Share To Rivals

On condition that PLCE operates in an trade with excessive competitors and low limitations to entry, there’s all the time a threat that the Firm can lose market share to rivals. This might negatively impression PLCE in a number of methods together with forcing PLCE to extend promotions, decrease costs, enhance advertising spend, and many others.

Conclusion

On condition that PLCE has returned to profitability and plans to cut back borrowings within the ballpark of ~$100M, I’d say that Q3 was a profitable one although Administration revealed some new challenges that the Firm should grapple with transferring into subsequent 12 months. Happily, practically all of those points ought to be mitigated by near-term operational enhancements and the inevitable restoration of PLCE’s core shopper. Due to this fact, I feel time is on the facet of PLCE shareholders who will in the end be rewarded for his or her endurance and continued optimism for the way forward for the enterprise.

Writer’s Be aware: Shoutout to Kingdom Capital Advisors, The Bulls Bay, The Small Cap King, Eagle Fang Capital, and lots of others who’ve been protecting PLCE longer than I’ve. I extremely advocate that you simply try their work as properly.