pixeldigits

Introduction

In case you are searching for a high-yielding firm proper now that can also be increasing the underside line at a really respectable fee then The Financial institution Of N.T. Butterfield & Son Restricted (NYSE:NTB) appears fairly interesting. The yield is over 6% and I feel the payout ratio and observe report of development are taking part in into the palms of traders very effectively. NTB positive aspects from rising rates of interest as they earn extra NII. With a reduced p/e towards the sector, NTB reveals decrease draw back danger at the moment for my part.

I like the corporate’s present valuation and the market that it serves ought to proceed to develop. In addition to this, the monetary well being of NTB is strong and unlikely to trigger any vital dangers within the medium time period. Because of my bullish sentiment on the enterprise, I will probably be giving them a purchase ranking proper now.

Firm Construction

NTB focuses on catering to excessive and ultra-high-net-worth people, providing a variety of monetary companies together with residential mortgage lending, car financing, client financing, and bank cards. This financial institution holds the promise of investing in a well-established establishment with a powerful historic model presence, all at a lovely valuation.

Along with its companies for prosperous shoppers, the financial institution’s numerous choices make it an intriguing prospect for traders trying to capitalize on its well-recognized legacy and discover its potential for development and worth appreciation. Nevertheless, like several funding, it is essential to rigorously consider the related dangers and market situations earlier than making a call.

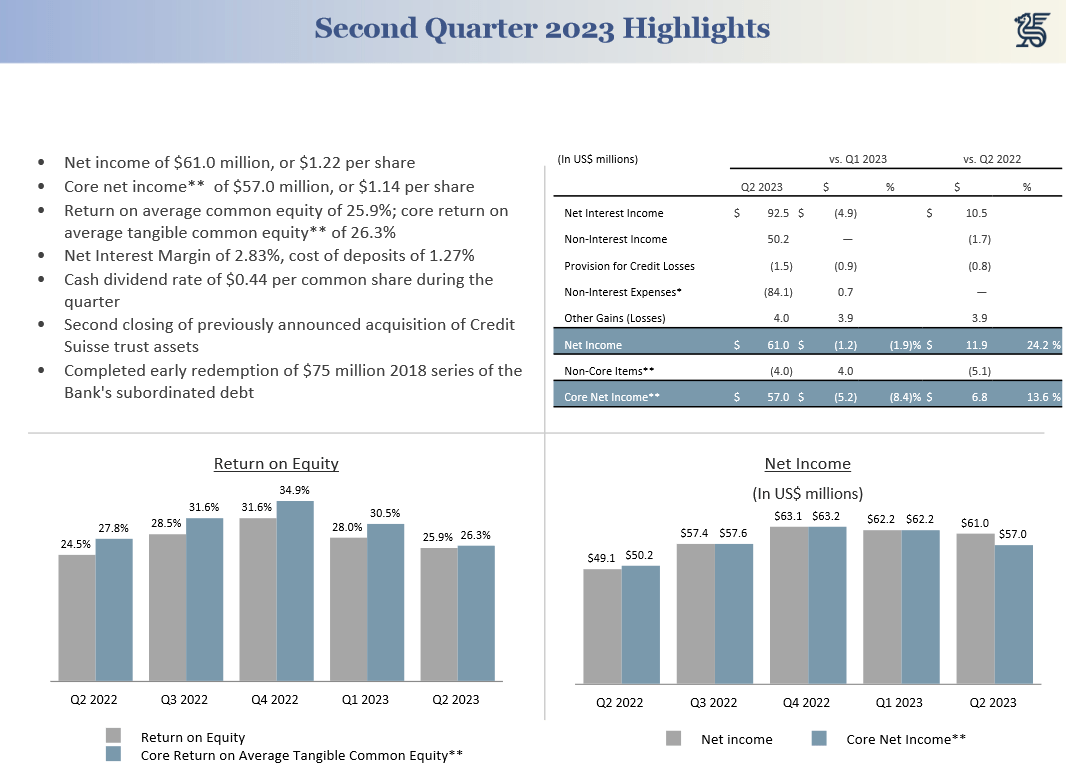

Firm Overview (Investor Presentation)

The corporate has had a final couple of actually strong quarters and this has lent them the flexibility to lift the dividend too. The ROE for instance is near among the highest ranges within the firm’s historical past, and at the moment beating out the sector at 26.3%. Serving a distinct segment set of shoppers and shoppers I feel NTB can cost a bit of bit extra for his or her companies with out risking shedding shoppers. They provide a various set of merchandise which might be in excessive demand inside these circles.

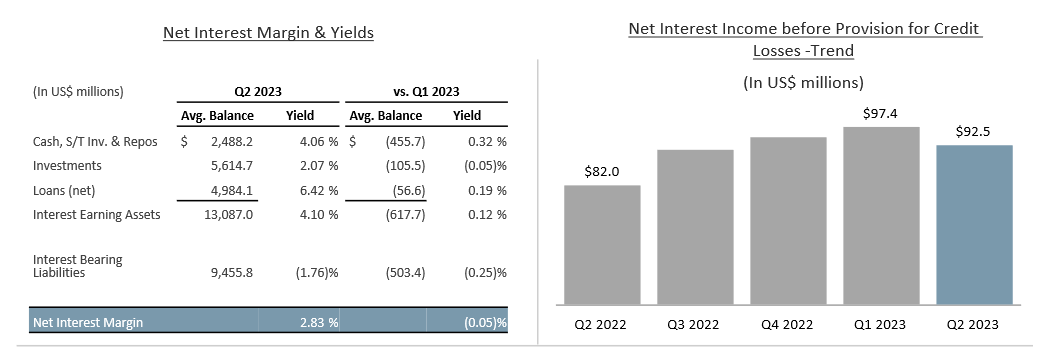

Internet Margins (Investor Presentation)

The rise in rates of interest over the previous couple of quarters has had a really constructive impact on NTB as we will see above right here. In Q1 2023 the NII landed at $97.4 million, which noticed a slight decline to Q2 primarily because of decrease steadiness sheet exercise and better deposit prices as effectively. I feel these are short-term points and can resolve and finally yield NTB a powerful FY2023 set of outcomes.

Earnings Transcript

Trying on the final earnings name that NTB held I feel the CEO Michael Collins had some very beneficial factors to make relating to the present market state of affairs and the way the corporate goals to place itself to sort out any coming challenges.

-

“Our TCE to TA ratio of 6.5% has improved the conservative finish of our focused vary of between 6% and 6.5%. Because of this, we have now been in a position to proceed with the execution of our balanced capital return technique accelerating our share buyback program within the second quarter with a repurchase of 723,000 shares within the quarter. We count on to proceed repurchasing shares all through 2023 topic to market situations”.

One of many key options of NTB I feel is the sturdy risk of shareholder returns over the long run. So long as NTB can keep a conservative ratio of TCE to TA then the buyback program will proceed and even enhance as effectively. To present some reference to this, since 2018 the shares excellent have decreased by about 10%, or 2% yearly. That along with the dividend and over 6% is yielding traders an excellent return proper now.

-

“I’m additionally happy that we accomplished the second closing of our deliberate acquisition of belief property from Credit score Suisse. To-date, 374 relationships representing $21.1 billion of property beneath administration have now transferred to Butterfield, considerably increasing our footprint in Asia”.

For some, these developments could also be a danger issue, however I feel that NTB has confirmed itself very able to correctly rising with none pointless risk-taking over time. The extra market publicity I feel will solely do the corporate good.

Valuation & Comparability

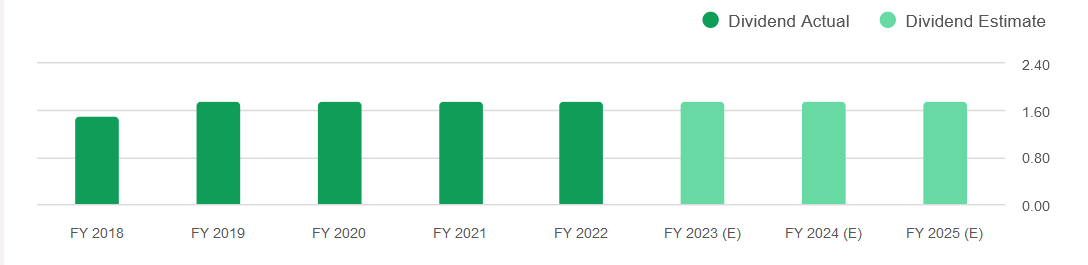

Dividend Estimates (In search of Alpha)

The dividends for NTB have largely remained the identical over the past a number of years. A yield of round 6% is what the corporate has proper now, however with extra capital being spent on shopping for again shares I feel NTB gives some good potential returns.

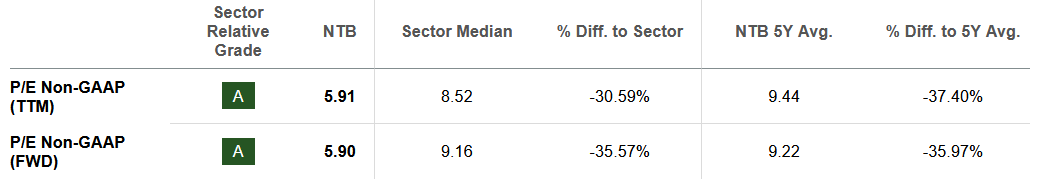

P/E (In search of Alpha)

Trying on the p/e of NTB it reveals a good low cost proper now. Compared to historic ranges for NTB it gives a 37% low cost and a 35% low cost to the sector. I feel the market is mispricing the corporate proper now. The upper rates of interest usually are not affecting the shopper pool of NTB as a lot as one may suppose. Excessive-net-worth people are sometimes very a lot in a position to hedge towards that. The marginally decrease volumes on the steadiness sheet could also be a purpose for the low cost, however in the long run, this looks like a small challenge and is not indicative of the particular shareholder potential for NTB. In my view, the draw back dangers are baked in and the upside is excessive sufficient to make NTB a purchase.

Danger Related

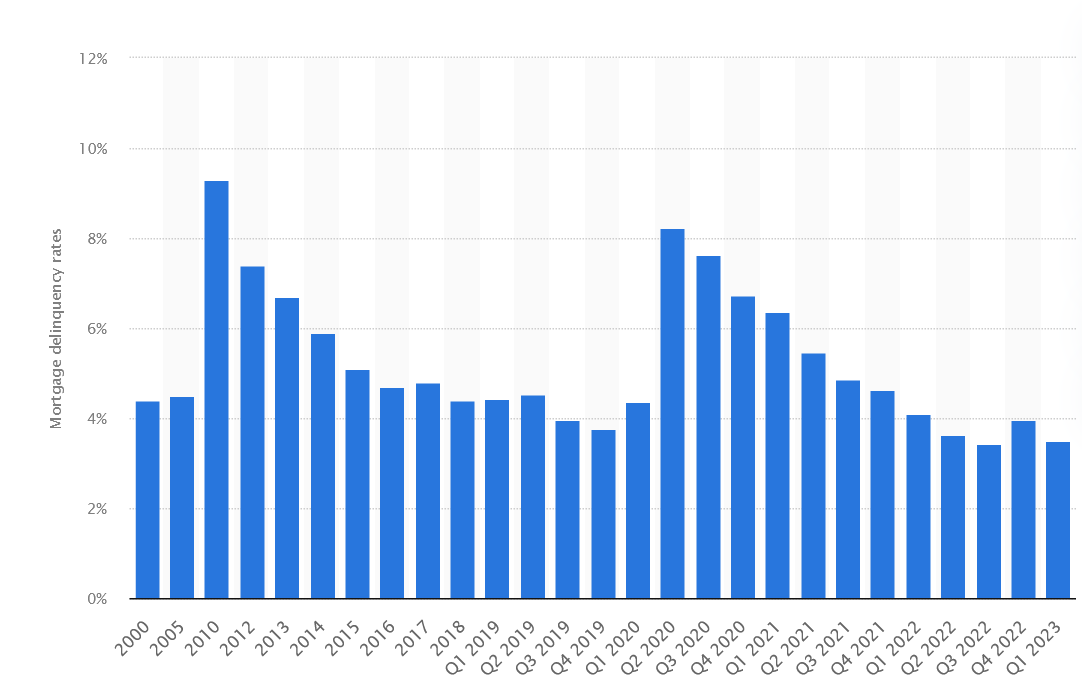

Within the occasion of an increase in rates of interest, there’s a potential for an uptick in mortgage delinquencies and defaults, which might elevate the danger related to NTB. Such a rise in danger might exert downward stress on the corporate’s share worth. Buyers want to observe this state of affairs carefully as rate of interest actions can considerably influence the monetary panorama for banks like NTB.

Mortgage Defaults (Statista)

The corporate might face challenges associated to regulatory scrutiny, significantly because of its operations being based mostly in offshore jurisdictions just like the Cayman Islands and the Bahamas. This geographical setup may increase considerations and doubtlessly hinder the corporate’s enlargement efforts in sure areas of america, because the origins of its operations could lack transparency or seem unconventional within the eyes of regulators and traders. It is essential to contemplate how regulatory components might influence the corporate’s development and market presence sooner or later.

Investor Takeaway

For these which might be searching for a secure and high-yielding dividend earnings firm then I feel NTB proper now gives a good quantity of worth. It could not have elevated the dividend that a lot previous couple of years, however the potential for it sooner or later is definitely there when the enterprise is producing an ROE of over 25%. Discounted share worth makes the draw back danger and, for my part, is leading to a positive purchase state of affairs at the moment.