Wirestock/iStock through Getty Pictures

The AZEK Firm (NYSE:AZEK) manufactures constructing merchandise for industrial and residential markets. AZEK lately introduced robust This autumn FY23 and FY23 outcomes. I believe AZEK has a robust upside potential as a consequence of easing market circumstances and low valuation. In addition, its give attention to high-margin enterprise could be helpful for the corporate. Therefore, I assign a purchase ranking on AZEK.

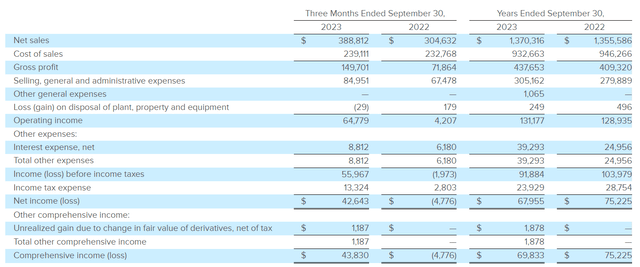

Monetary Evaluation

AZEK lately introduced its This autumn FY23 and FY23 results. The online gross sales for This autumn FY23 had been $388.8 million, an increase of 27.6% in comparison with This autumn FY22. The primary cause behind the rise was the power in its residential phase. The gross sales within the residential phase grew by 37.6% in This autumn FY23 in comparison with This autumn FY22. Sturdy demand for its deck and rail merchandise benefitted the residential phase. Its gross margin for This autumn FY23 was 38.5%, which was 23.6% in This autumn FY22. The numerous enchancment in gross margin was primarily as a consequence of materials deflation and manufacturing productiveness. The online earnings for This autumn FY23 was $42.6 million in comparison with a lack of $4.7 million in This autumn FY22.

AZEK’s Investor Relations

The annual gross sales development was additionally optimistic. The FY23 gross sales grew 1.1% in comparison with FY22, and the gross margins had been wholesome. Contemplating the antagonistic market circumstances in FY23, AZEK carried out fairly nicely. The corporate additionally offered its Vycom enterprise in October to give attention to its high-margin companies. Vycom was a plastic sheet manufacturing enterprise, and I consider it’s going to have an effect on the corporate’s gross sales within the quick time period, however in the long term, I believe specializing in its high-margin enterprise, like out of doors residing markets, could be helpful for the corporate. As well as, the enhancing market circumstances, just like the easing of inflation and the drop within the curiosity and mortgage charges, are optimistic for the corporate, and we would see them performing higher in FY24. So, easing market circumstances and the administration’s give attention to high-margin enterprise could be helpful for the corporate and its buyers.

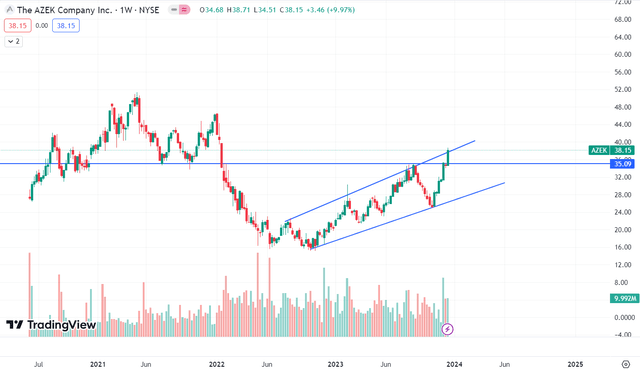

Technical Evaluation

Buying and selling View

AZEK is buying and selling at $38.4. The inventory began its downward trajectory in January 2022, and since then, it has been in a downtrend. The inventory worth fell round 65% until October 2022. Nevertheless, it looks like the downtrend might need been over, and there are two indicators that present it. After forming a base at $16, the inventory began to type the next excessive and better low formation, which is a bullish construction that may point out a possible up pattern. As well as, its most up-to-date weekly candle broke the channel it has been buying and selling in since August 2022 and the resistance zone of $35. So, the current candles are exhibiting lots of power, and the value breaking the channel and resistance zone could be the affirmation that the inventory may quickly begin a brand new upward rally. The inventory breaking the $35 stage was vital as a result of the final time it touched the $35 stage was in September 2023, and after touching the extent, the inventory worth fell round 25%. Therefore, I consider this inventory has lots of power, and we would see an uptrend in it quickly. So, I’m bullish on AZEK.

Ought to One Make investments In AZEK?

It seems to be just like the market has preferred the outcomes and the current change in focus of AZEK to high-margin enterprise. I consider this could be the rationale behind the current surge within the inventory worth. The inventory’s momentum seems to be robust, and it seems to be prefer it may proceed its upward trajectory. The rationale I’m saying that is due to the easing market circumstances and optimistic expectations for FY24. I do know there could be some near-term headwinds, just like the elevated bills and gross sales impression as a result of divestiture of its Vycom enterprise, however this may solely have an effect on them within the quick time period. The longer image of AZEK seems to be optimistic, and now, taking a look at AZEK’s valuation. AZEK is buying and selling at a P/E [FWD] ratio of 40.62x, which is barely over its five-year common of 40.02x. After trying on the P/E ratio, it seems to be like there is no alternative right here. Nevertheless, if we take a look at its PEG ratio, it’s round 1.07x, which is decrease than the sector ratio of 1.84x. So, AZEK is undervalued, contemplating the PEG ratio. So I consider there are a number of positives that recommend that AZEK could be a strong shopping for alternative, like robust outcomes, easing market circumstances, change within the focus of the corporate to excessive margin enterprise, and low valuation. As well as, it has a robust upward momentum, which I believe ought to be utilized. Therefore, I assign a purchase ranking on AZEK.

Threat

Legal guidelines and laws that both help or oppose house possession have an effect on the markets through which they function. Examples of those embody state and federal legal guidelines in america that had been handed in response to worldwide well being crises and provided owners varied types of help, primarily within the type of non permanent moratoria on foreclosures and evictions, rental help, and mortgage fee forbearance for these with federally backed mortgages. Though most of these reduction measures have expired, it’s nonetheless unclear how they’ll proceed to have an effect on the U.S. actual property market, the U.S. and world economies typically, and the way their enterprise, monetary situation and operational outcomes could also be materially and adversely affected. These reduction measures and comparable insurance policies applied in response to world well being pandemics and different occasions affecting the U.S. and world economies proceed to be unsure. Future modifications to legal guidelines or laws pertaining to those or associated points might lead to a decline available in the market for his or her merchandise and negatively impression their operations, monetary state of affairs, and enterprise operations.

Backside Line

AZEK posted robust outcomes, and the administration has shifted its focus to high-margin enterprise. As well as, the market circumstances are enhancing. I consider the market is exhibiting curiosity in AZEK, which we will see in its worth chart. The share worth of AZEK has surged in current occasions. I believe it has a robust momentum, and one ought to make the most of this chance as I believe it may be rewarding within the coming occasions. Therefore, I assign a purchase ranking on AZEK.