KanawatTH

Co-produced by Austin Rogers.

There may be all the time a number of noise within the monetary media in regards to the state of the economic system, however most of it’s, to cite Shakespeare, “sound and fury signifying nothing.”

So, let’s take a look at some knowledge factors to attempt to acquire readability on the state of the economic system and particularly the well being of the American client.

What we discover within the knowledge is a steadily softening economic system that has to this point managed to keep away from recession however is shedding its previous couple of remaining development drivers. The massive financial savings buffer constructed up throughout the pandemic years has steadily depleted for many Individuals, inflicting greater costs to more and more eat into client spending energy. The magnitude of those financial savings has delayed the recession, however we nonetheless view a near-future recession as extremely seemingly.

As we’ve got defined within the previous, we expect a recession can be a web profit to actual property funding trusts, or REITs (VNQ), as a result of it will virtually actually trigger rates of interest to fall.

The first explanation for REITs’ poor efficiency during the last 12 months or so has been rising rates of interest, so the reversal of charges’ trajectory from rising to falling ought to give REITs an enormous increase.

A Story of Two Customers

Listed here are some highlights to think about:

- The San Francisco Fed predicts that pandemic-era extra financial savings shall be totally depleted this month.

- Necessary funds on almost $1.8 trillion in scholar loans is about to renew in October.

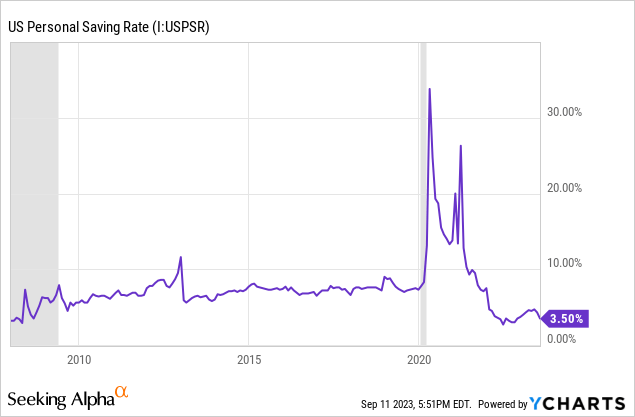

- The non-public saving charge is at its lowest stage since 2008.

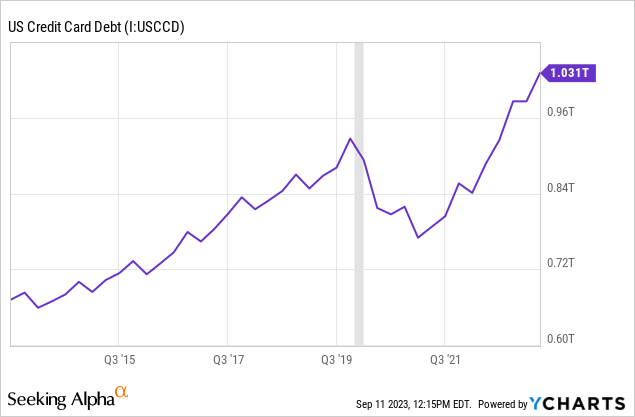

- Bank card debt is hitting new all-time highs.

- Barely over 60% of Individuals report that they’re dwelling paycheck-to-paycheck.

- A wave of retail theft is sweeping the nation.

Pundits within the monetary media typically assert that the buyer is robust, pointing to rising family web price from buoyant properties and inventory markets.

The issue with this considering is that it succumbs to the tyranny of averages. That’s, speaking in regards to the “common American client” ignores and downplays the broadly various monetary circumstances of various shoppers.

There are actually two primary classes of American shoppers:

- Prosperous

- Paycheck-to-Paycheck (P2P).

| AFFLUENT | PAYCHECK-TO-PAYCHECK |

| Spends totally on providers and sturdy items | Spends totally on important items |

| Ample financial savings | Little to no financial savings |

| Often capable of save from revenue | In a position to save little to nothing from revenue |

| Little to no client debt | Rising client debt, e.g. automotive cost, bank cards, and many others. |

| More likely to own residence | More likely to lease |

| Spends lower than 20% of revenue on housing | Spends over 30% of revenue on housing |

| Effectively-educated and related with profitable folks | Little training and disconnected from profitable folks |

| Straight or not directly owns shares | Little to no publicity to the inventory market |

| Scholar mortgage funds nonexistent or negligible, more likely to come from financial savings | Scholar mortgage funds more likely to eat into different spending |

There are in all probability different primary variations, however you get the concept.

About 30-40% of Individuals are Prosperous shoppers, whereas 60-70% are kind of dwelling P2P.

From mid-2020 via 2022, each forms of shoppers have been flush with money from Uncle Sam and comfortable to spend it. This offered gasoline for the inflationary surge whereas additionally driving enterprise enlargement, job development, and demand for business actual property. Shopper inflation translated into lease development.

However in 2023, that scenario is altering. Prosperous shoppers are going again to their regular, pre-COVID spending patterns.

In the meantime, P2P shoppers are more and more feeling the pinch of inflation and depleted financial savings.

On common (together with each Prosperous and P2P), Individuals are solely capable of save 3.5% of their revenue, which is lower than earlier than COVID-19. In actual fact, it is the lowest stage since 2008.

YCHARTS

This common signifies that the Prosperous client is saving one thing north of three.5% of their revenue, whereas the P2P client is saving nearly nothing and even spending greater than their revenue (adverse saving charge).

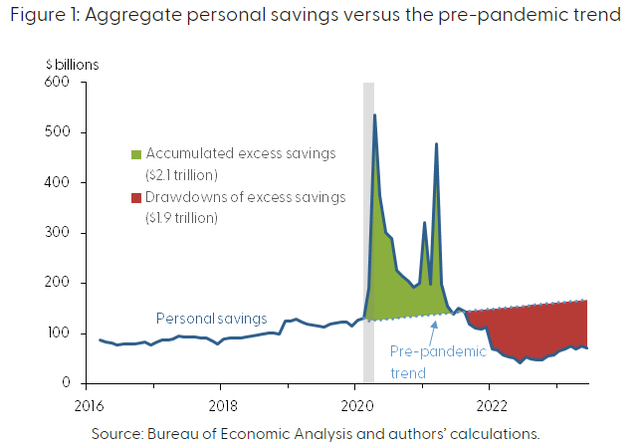

When complete private financial savings, we will see the large spikes in pandemic-era financial savings in 2020 and 2021, adopted by a steep drop in financial savings in late 2021 that continues to right now.

San Francisco Federal Reserve

Based on the San Francisco Fed, 100% of the pandemic-era extra financial savings shall be depleted by the tip of this month (September 2023).

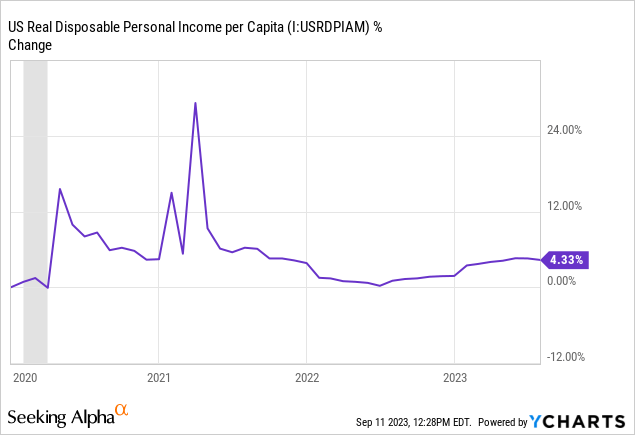

And now, reasonably than client spending being fueled by pent-up financial savings, consumption must be funded by development in disposable revenue. This has been minimal in an actual (inflation-adjusted) sense since authorities stimulus efforts led to 2021.

YCHARTS

For the reason that starting of 2022, actual disposable private revenue per capita has elevated a complete of 1.2% (lower than 1% on an annualized foundation).

Once more, it is helpful to distinguish right here between the Prosperous client and the P2P client.

Amid the extreme labor scarcity of 2021 and 2022, the lower-income employee noticed their wages soar greater as employers competed to fill jobs. However in 2023, that labor scarcity has develop into much less acute, resulting in smaller wage will increase. The labor power participation charge is now solely 60 foundation factors decrease than it was instantly previous the COVID outbreak, whereas combination demand has pulled again from its peak stage.

Thus, with out the advantages of extra financial savings or excessive wage development to behave as “shields” from inflation, the P2P client has quickly weakened this 12 months.

This explains a couple of main financial phenomena current proper now.

For instance, if “the American client” is so robust, why is bank card debt hovering to new highs?

YCHARTS

It is as a result of the P2P client beneficial properties little or no profit from buoyant dwelling and inventory costs. The overwhelming majority of dwelling and inventory worth is owned by the Prosperous, as are most different property.

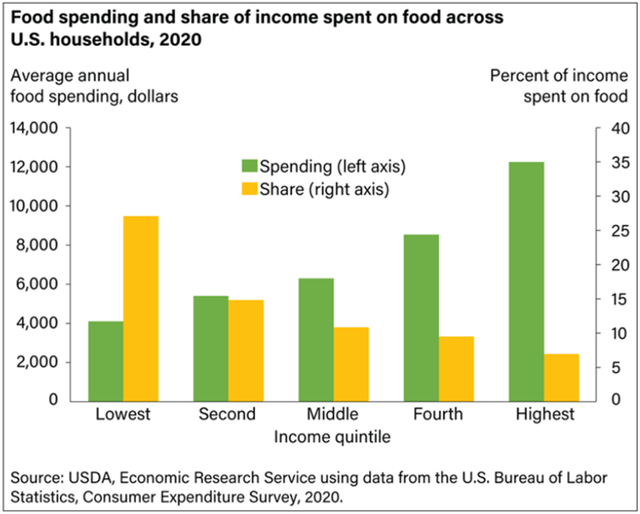

Apart from, regardless of spending more cash on important gadgets like meals than the P2P client, solely a minority of the Prosperous’s revenue goes towards spending on important gadgets, whereas a large chunk of the P2P’s revenue goes towards important gadgets.

USDA

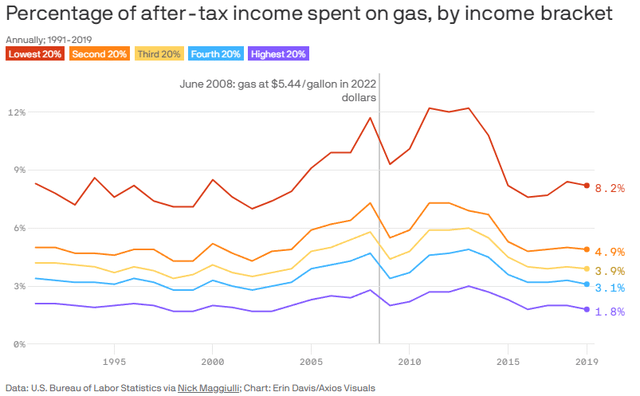

The identical holds true for gasoline:

Axios

That is solely changing into extra true over time, as Prosperous shoppers more and more drive electrical automobiles, spending $0 on fuel and little to no cash on common automotive upkeep whereas accumulating a $7,500 tax credit score from the federal government.

For essentially the most half, the surge in bank card debt is coming from P2P shoppers who not have financial savings buffers, don’t get as excessive of wage will increase, and may’t dip into retirement accounts to bridge the hole between their value of dwelling and revenue.

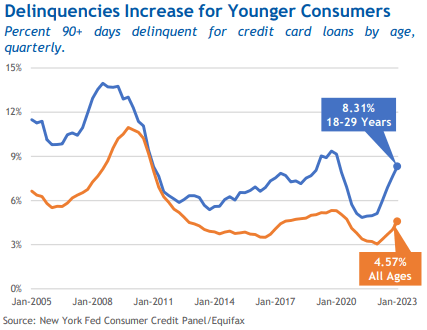

As one other knowledge level demonstrating this, contemplate that as of earlier this 12 months, the speed of bank card debt delinquencies has spiked much more for younger folks (18-29 years) than for older folks.

American Bankers Affiliation

Youthful individuals are much more more likely to be P2P shoppers, whereas older individuals are extra more likely to fall into the Prosperous camp.

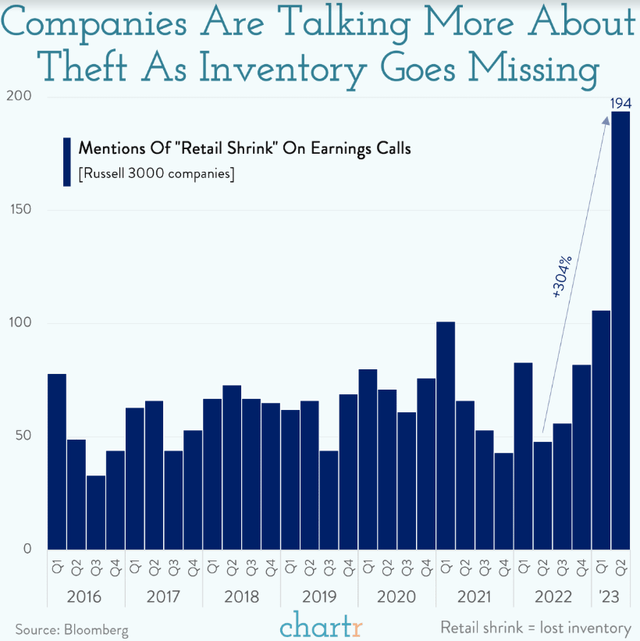

All the above goes a good distance in explaining the putting surge in retail theft.

CHATR

In fact, theft has elevated essentially the most in jurisdictions wherein native and state governments have chosen to not prosecute petty crimes, together with shoplifting below sure limits.

However this has merely created the chance. The want for retail theft has clearly grown, as exemplified by the growing theft of important grocery gadgets like bread, meat, child system, and over-the-counter medication. Even when shoplifters are largely reselling this stuff, there’s clearly demand for lower-priced important gadgets at flea markets and on-line resale web sites.

In brief, the pandemic-era financial savings glut has been totally depleted, there doesn’t look like a wage-price spiral forming, and P2P shoppers appear to be hurting.

If you happen to consider the U.S. economic system will keep away from recession and that development will quickly reaccelerate, ask your self this: what would be the subsequent catalyst of development?

Over the previous few years, financial development has been fueled by cash-rich shoppers, each Prosperous and P2P. However that period seems to be over.

Main Financial Indicators Nonetheless Level To Coming Recession

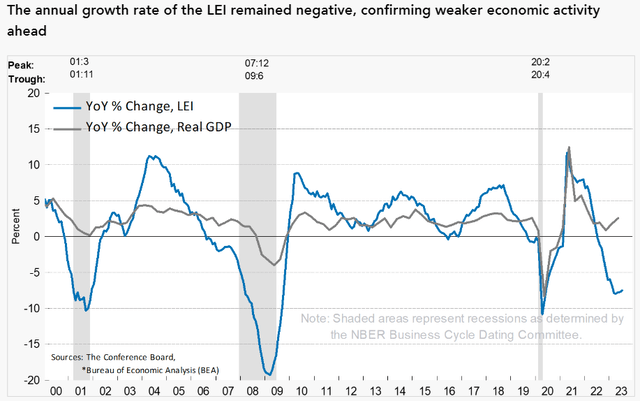

The Convention Board’s Main Financial Indicators index continues to point out a deeply adverse studying, indicating {that a} decline in financial exercise is extremely seemingly within the coming months.

The Convention Board

Discover that within the quarters main as much as the recessions in 2001 and 2008-2009, the LEI was deeply adverse even whereas actual GDP development held up. The identical holds true right now. This does not imply that the economic system is reaccelerating or that we are going to positively keep away from a recession, simply that no recession has proven up but.

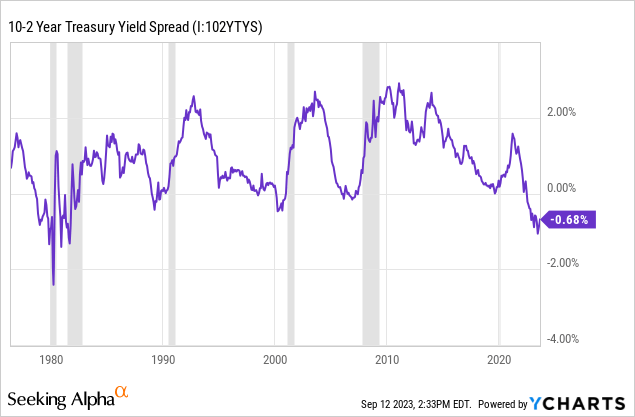

Maybe the clearest ahead indicator of an oncoming recession is the inverted yield curve. This refers back to the uncommon situation wherein the 10-year Treasury rate of interest (US10Y) is decrease than the 2-year Treasury rate of interest (US2Y).

YCHARTS

In each case of a significant inversion of the 10-year and 2-year Treasury yields, similar to we’ve got right now, a recession has adopted.

And also you would possibly discover that the official beginnings of recessions do not come on the most inverted level however reasonably somewhat bit after the curve has begun to un-invert. In actual fact, recessions have a tendency to start because the yield unfold hits zero and even after it has already steepened somewhat above zero.

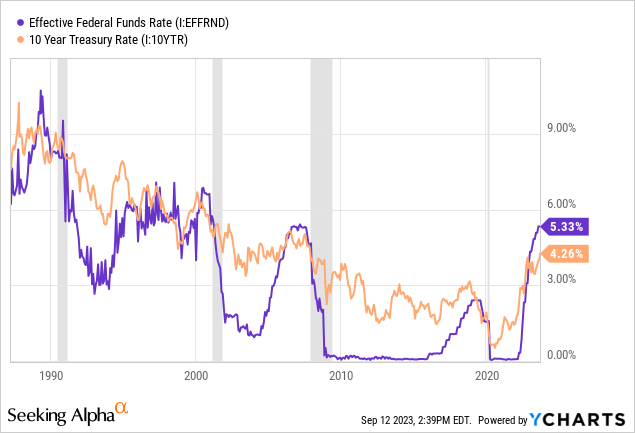

We are able to see this starkly when evaluating the Fed’s key coverage charge — the Federal Funds Charge — with the 10-year Treasury yield. Except for a short occasion within the late Nineteen Nineties, each occasion in current historical past of the Fed Funds Charge climbing above the 10-year Treasury yield has resulted in a recession inside a 12 months or so.

YCHARTS

That inverted yield curves have traditionally preceded recessions is not merely correlation. There’s causation right here too.

The economic system merely does not operate correctly when short-term rates of interest are greater than long-term rates of interest.

For instance, the banking enterprise mannequin breaks down. Depositors transfer their cash into greater yielding automobiles, elevating banks’ value of funds to such a level that they’re unable to earn a ample risk-adjusted unfold on loans. Thus, credit score circumstances tighten, and banks pull again on extending loans to companies and shoppers.

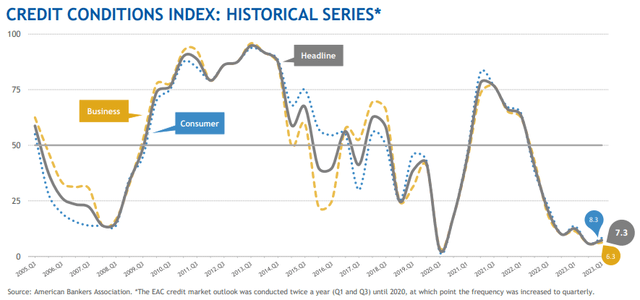

Once more, we see this present up within the knowledge. The American Bankers Affiliation’s Credit Conditions Index for Q2 2023 exhibits a tighter credit score setting for each companies and shoppers than at any time since simply earlier than the Nice Monetary Disaster (with the only real exception of the start of COVID-19).

American Bankers Affiliation

A studying of “50” signifies that credit score circumstances are neither tight nor free. Readings under 50 imply that financial institution economists count on credit score circumstances to weaken within the subsequent few quarters. Readings deeply under 50 point out that credit score circumstances are anticipated to get considerably worse.

Plus, contemplating the upper debt hundreds in each the non-public economic system and the federal authorities, there’s a robust case to be made that greater curiosity funds will steadily crowd out different, extra productive makes use of of assets.

For instance, in Q2 2023, US federal authorities curiosity funds reached 3.62% of GDP — the highest level since 1999.

Whereas this by no means stopped the federal authorities from spending, the identical factor is occurring within the company sector. Curiosity bills are rising for companies of all sizes, which is able to trigger (and already has prompted) a pullback in spending as companies prioritize deleveraging over development.

The Convention Board expects a light recession to start in This fall 2023 and proceed via Q1 2024. That appears to align with the American Bankers Affiliation knowledge.

Backside Line

Whereas we nonetheless foresee a recession within the close to future, we’ve got no cause to consider presently that it is going to be a extreme one, particularly so far as most sectors of economic actual property are involved.

Bear in mind: REITs usually have a wider and deeper array of capital sources than nearly another form of actual property proprietor.

- At-the-market fairness issuance

- Ahead fairness choices

- Privately negotiated working partnership models

- Unsecured bonds

- Secured mortgages

- Money-out refinancings

- Time period loans

- Credit score revolvers

- Most well-liked inventory

- Property tendencies

- Retained money movement

- And so on.

What number of different forms of actual property buyers have this breadth of entry to capital? None.

That is why we view REITs because the #1 greatest option to profit from the eventual restoration in business actual property.

Will a near-future recession harm many REITs? Sure, in all probability.

However the decrease rates of interest {that a} recession would deliver with it will greater than offset any potential deleterious results from the recession itself.

That is why, on the web, when you think about each optimistic and adverse results, we expect a possible oncoming recession can be excellent for many REITs. It might flip the REIT bear market right into a REIT bull market as buyers anticipate decrease rates of interest and it might lead to important upside potential.

Even blue-chip REITs like Realty Earnings (O), Alexandria Actual Property (ARE), and Crown Citadel (CCI) have crashed and now supply 50%+ upside potential to our estimates of their honest worth.