Faucet Protocol has accomplished a $4.2 million funding spherical led by Sora Ventures to strengthen its position within the Bitcoin ecosystem. This funding, with contributions from quite a few enterprise capital corporations and angel buyers, will allow Trac Techniques, the German firm behind Faucet Protocol, to attain vital progress.

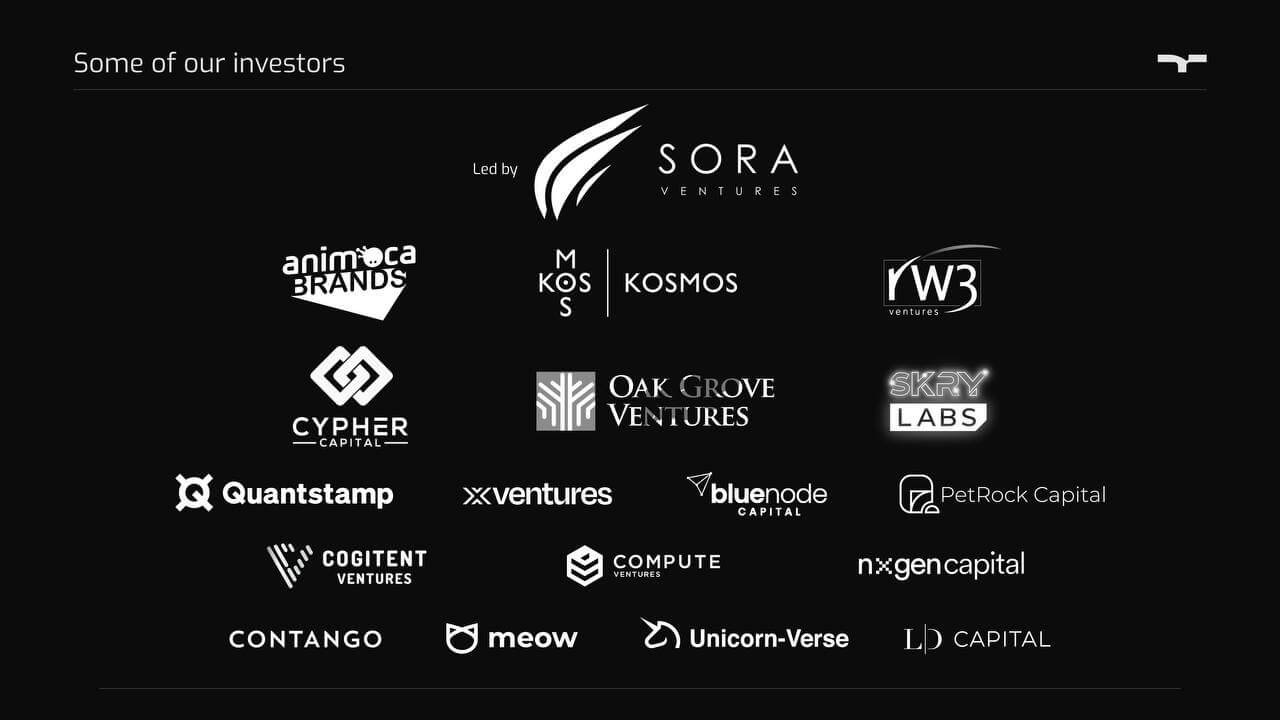

The funding spherical attracted notable enterprise capital corporations together with Cypher Capital, Rw3, Oak Grove Capital, Petrock Capital, Kosmos Ventures, New Tribe Capital, Cogitent Ventures, Compute Ventures and MSA Novo. This monetary assist was additional strengthened by investments from Animoca Manufacturers and Quantstamp managers.

Jason Fang, Founder and Managing Companion at Sora Ventures, highlighted Faucet Protocol’s essential position within the Bitcoin neighborhood, particularly in driving adoption. His optimism displays a rising perception within the transformative potential of Bitcoin and its related tasks.

“Faucet Protocol is without doubt one of the main developer communities constructing on Bitcoin. With the assist of the spherical, we’re excited to see how the workforce may also help scale the way forward for Bitcoin adoption.”

Following the fundraising, Trac Techniques is gearing as much as broaden its operations with a concentrate on hiring expert builders to advance the Bitcoin Ordinals-based protocol. Faucet Protocol has been a significant participant within the Bitcoin community, providing a spread of functionalities together with the fractionalization of Ordinals artwork and enabling decentralized monetary functions on Ordinals. The design of the protocol, which is appropriate for numerous gaming functions and options token redemption and multisend capabilities, underlines its versatility.

Pseudonym Benny the Dev, CEO of Trac Techniques, conveyed his enthusiasm in regards to the fundraising success. He highlighted the corporate’s willingness to innovate throughout the Bitcoin platform, leveraging Trac Core and TAP Protocol to discover new alternatives in tokenization, gamification and decentralized finance.

TAP protocol and OrdFi

The TAP protocol is designed to seek out and observe Ordinals, facilitating OrdFi functions with out complicated Layer 2 chains. This protocol introduces the TAP token normal and emphasizes simplicity and accessibility. The primary mechanism, tapping, streamlines transaction verification throughout the protocol. The TAP web site states:

“Trac’s decentralized API permits builders to create new issues for the Ordinals house. We have already performed the heavy index lifts and adopted all the pieces underneath the solar.

Primarily based on the basic ideas of BRC-20, a Bitcoin token normal, TAP stands out for its decentralized nature, permitting for steady enhancements and community-led integrations. To facilitate future connectivity with BRC-20 tokens, TAP has reserved particular ticker lengths of 1, 2 and 4 characters.

Constructing on the muse of BRC-20, TAP is distinguished by its independence from centralized entities, permitting for steady community-led enhancements and have integrations. TAP reserves particular ticker lengths (1, 2 and 4 characters) to allow future interconnectivity between BRC-20 and TAP tokens.

Externally, TAP mirrors BRC-20, which reportedly ensures simple integration with present marketplaces and wallets. This permits TAP tokens to be traded in the identical method as BRC-20 tokens. Internally, TAP presents distinctive functionalities similar to token staking, swaps, and a mass sending function. The neighborhood, which makes use of $TRAC tokens, controls these capabilities.

TAP consists of Token-Ship for environment friendly mass transfers, Token-Commerce for simplified textual content inscription-based buying and selling, and Token-Auth for third-party issuance of signed redemption inscriptions, which TAP says are useful in gamification and cross-transmission. chain marketplaces.

The TAP protocol represents the continued progress in Bitcoin Ordinals. It targets exterior marketplaces and inner customers, promising a flexible and community-driven future in Bitcoin-based token operations and rising dApps.

Transparency Disclaimer: Sora Ventures is an investor in Crypto.