TERADAT SANTIVIVUT

By Tony DeSpirito

This autumn for the win? 2023 has supplied ample fodder for bears and bulls alike, with every quarter nudging towards the latter. Which can prevail within the yr’s last months? As This autumn begins, we see:

- A slim output hole arguing for continued prudence

- Wider gaps in profitability and valuation favoring selectivity

- AI fueling dispersion, disruption, and alternative

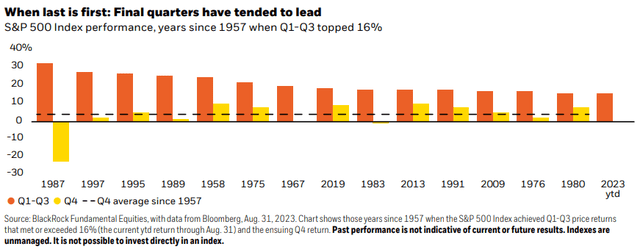

U.S. shares sometimes publish their finest returns within the last quarter of the yr. Our evaluation of S&P 500 efficiency for the reason that index’s inception in 1957 discovered a median This autumn uptick of 4%. (Q1 was subsequent finest at a median of two%.) In years when efficiency within the first three quarters got here in at or above the place we sit year-to-date, index strikes within the last quarter had been optimistic in all however three situations, with the October 1987 inventory market crash making that yr an outlier. See chart under.

We’re cautiously optimistic for This autumn 2023. The market has already defied expectations and the economic system is working on a slim output hole – which means all sources are working close to full potential. This argues for a continued concentrate on resilience in fairness allocations. Nonetheless, as a result of a lot of the market’s return this yr has been pushed by a handful of mega-cap shares within the “tech-plus” sectors, we imagine there is a chance to uncover these next-level shares which have but to be totally rewarded for his or her fundamentals.

We see smaller reward in making daring calls on the large image and far better potential from making good calls on particular person shares.

Tony DeSpirito, World Chief Funding Officer, Elementary Equities

Thoughts the (output) hole

Inventory markets turned decidedly extra upbeat in July as many strategists adjusted their projections away from recession and towards a “comfortable touchdown” state of affairs for the U.S. economic system. Whereas we don’t foresee a deep recession, we preserve our view that that is nonetheless a late-cycle investing atmosphere and, consequently, a concentrate on resilience continues to be warranted in fairness portfolios.

The output hole of the U.S. economic system, which represents the distinction between the economic system’s precise versus most potential output, could be very slender. The economic system is making very environment friendly use of its present sources to energy the move of products and providers, with little room to do extra and take off working. A key variable is the labor image, which is kind of tight. The unemployment fee stood at simply 3.8% as of August. Absent a burst of productiveness, the U.S. lacks enough further employees to extend the economic system’s output past present ranges with out risking inflation.

GDP figures have held in, inflation readings are coming down and the economic system has to this point managed to keep away from a recession. But we nonetheless see potential for waning extra shopper financial savings and the lagged results of the Fed’s rate-hiking marketing campaign to pinch financial development and make it tougher for corporations to develop earnings within the close to time period.

Late-cycle playbook

Towards this backdrop, we imagine it’s prudent to stay with the late-cycle playbook in equities, because the economic system has but to embark on a brand new cycle of post-recessionary development. This means diversifying danger exposures and specializing in corporations with strong stability sheets and sturdy enterprise fashions. The important thing, and the complication after the market’s robust run year-to-date, is to seek out them at engaging valuations. The excellent news is that the very slender market that had prevailed within the first half, with the seven largest shares dominating S&P 500 return, has began to broaden – a wholesome signal for the market and a great atmosphere for inventory choosing. 12 months-to-date, among the weakest performers with probably the most compressed valuations have been low-volatility, low-beta shares.

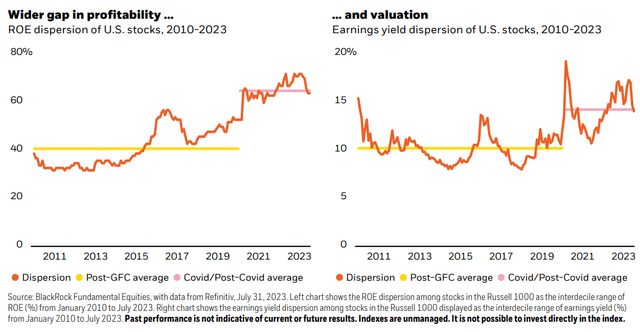

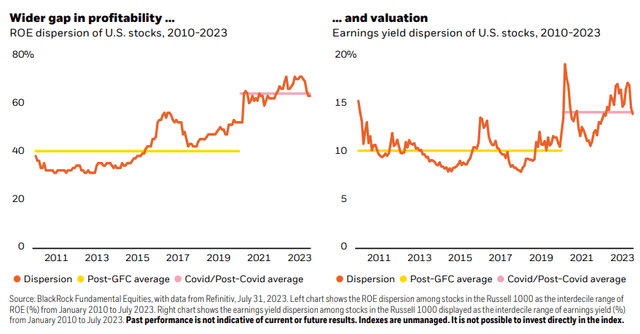

We additionally observe a development towards elevated market dispersion. That is evident in returns – a bigger hole between high and backside performers – however much more so within the return on fairness (ROE) and valuations throughout particular person shares, a phenomenon not remoted to the U.S. The charts under present the uptick in dispersion for the reason that interval of moderation (low charges, inflation, and volatility) after the World Monetary Disaster (GFC) and the brand new funding regime in formation for the reason that Covid disaster. Expert inventory pickers can capitalize on these rising gaps in searching for to determine and populate portfolios with shares of corporations that display the elemental wherewithal to ship rising earnings throughout time.

Generative AI necessities for traders

Generative AI (genAI) has commanded consideration and moved markets this yr, incomes comparisons to the web and smartphone for its transformative potential. We imagine genAI can also be setting as much as be a key contributor to market dispersion, because it has the potential to ship some companies hovering whereas disrupting or displacing others. We sponsored some inner debate on the subject and supply the next observations on this vital innovation:

Worthy of pleasure

Common utility

Not like different know-how improvements that had fleeting fame earlier than fading to the background, we see genAI having farreaching and lasting impression. Leaders of our know-how staff imagine its utilization is poised to be unprecedented relative to prior improvements with extra restricted scope (e.g., 3D printing, augmented actuality, metaverse). The important thing distinction: GenAI is a platform with components of humanlike intelligence that give it common applicability that may lengthen throughout industries, companies, and disciplines.

Firms promoting the “picks and shovels” of the AI gold rush are the preliminary beneficiaries. The early rewards for customers are prone to take the type of price financial savings – eliminating some jobs whereas making people extra environment friendly at others. Later within the AI evolution, we anticipate to see the emergence of recent revenue-generating enterprise fashions.

Funding alternative now – and for years to come back

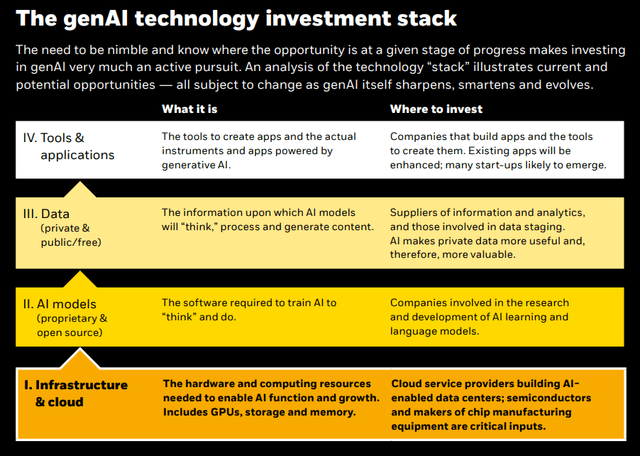

GenAI is evolving and the belief of its full benefit will take time, making this a multi-decade alternative. But corporations are spending actual cash on genAI now in an effort to harness its monumental potential. Within the constructing section, the funding alternatives reside primarily within the know-how house. The secret’s to know the place we’re within the AI lifecycle and what parts of the know-how “stack” could also be positioned to profit.

One living proof: The substantial funding within the present web, which is powered primarily by CPU chips, will transition towards GPUs (the graphics processing items which can be optimized for AI). We see the creation of an AI-supported internet driving years-long funding alternatives.

Not a tech-only story

Past the impacts and alternatives within the know-how sector are the eventual use instances for AI that can emerge all through the economic system. Name facilities will doubtless get replaced. Elsewhere, the makes use of could also be much less transformative and extra nuanced, reminiscent of an AI-powered co-pilot added to an present software program package deal. We see private and non-private funding alternatives from AI, with many early-stage alternatives maybe finest expressed via personal investments.

Warranting consciousness

Nice expectations

Given excessive valuations within the first a part of the know-how stack, some AI-related shares might be susceptible to disappointment, even from only a slowdown within the fee of development. A scarcity of vital chips (GPUs) has allowed corporations that make them to briefly earn an abnormally excessive margin, posing a danger as soon as provide catches as much as demand and competitors kicks in. Enterprise historical past is riddled with tales of provide shortages that ultimately turned to provide gluts.

Generally, the early levels of a know-how hype cycle embrace lots of pleasure and hypothesis, but improvements of their infancy are tough to worth. Fixed monitoring is required to evaluate whether or not expectations are aligned to the monetary and elementary realities. Questions across the unknown however inevitable regulation of AI globally additionally complicate the calculus.

Construct it and they’ll come?

In previous cycles, new applied sciences weren’t at all times totally utilized after the buildings to assist them had been constructed. AI’s universality might make this time totally different. One other vital ingredient to the functioning of AI for enterprises and organizations is knowledge. Whereas AI fashions might be skilled on public knowledge, that knowledge have to be enriched with the proprietary variety to make choices for a selected enterprise. That is an space the place many organizations are hamstrung attributable to inadequate, unorganized, or siloed knowledge, doubtlessly slowing or limiting AI uptake.

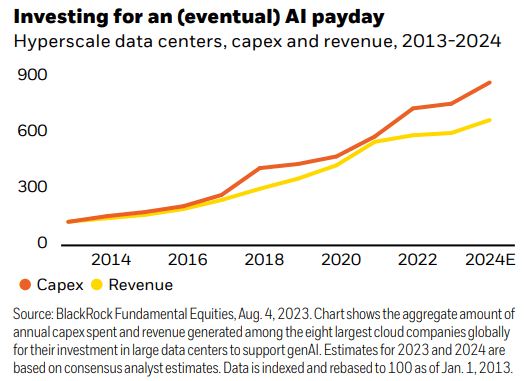

Capital chasing the unknown

Capital expenditures on genAI have elevated prematurely of the income it generates. See chart on the next web page. A key query is whether or not corporations will observe via and use the providers to maintain the wave of spending. A number of the early funding might represent FOMO (concern of lacking out) – corporations don’t wish to fall behind in the event that they fail to spend money on a successful innovation. However companies should assess whether or not AI, for the productiveness increase it gives, is value steady spend – investing much less on hype and extra on ROI (return on funding) calculations.

No matter whether or not there’s a near-term hiccup, the long-term potential for AI is shiny. As the quantity of information will increase and the price of processing it comes down throughout time, we anticipate AI will proceed to develop. But AI purposes will finally meet with various levels of success, suggesting genAI might contribute to dispersion throughout particular person corporations and their inventory costs.

Closing reflections

We see generative AI on an enchancment curve with prospects to rework companies world wide, very similar to the web has during the last quarter of a century. But it’s exactly as a result of genAI is new, thrilling, and evolving that we can not take a static strategy to the funding thesis. As fundamental-based inventory pickers, we’re regularly fact-checking the funding case because the cycle round generative AI advances from peak expectations to enlightenment and productiveness. The genAI story has solely simply begun and, we anticipate, shall be written for a few years to come back.

The event of AI is as elementary because the creation of the microprocessor, the private laptop, the Web, and the cell phone. Total industries will reorient round it. Companies will distinguish themselves by how nicely they use it.

– Invoice Gates, “The age of AI has begun,” March 2023

This post initially appeared on the iShares Market Insights.

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.