RiverNorthPhotography

Funding Thesis

My value goal was triggered a few days in the past, which is prompting me to have a look at T. Rowe Value (NASDAQ:TROW) once more to see how the corporate has developed since February of this yr and if it is an efficient time to begin a place or if will we see additional declines.

Belongings Beneath Administration

The final time I lined the corporate, it was coming off one of many worst years it had in latest instances. FY22 was very unhealthy for a lot of corporations in several sectors and asset administration was one which obtained hit fairly badly. Belongings below administration or AUM fell $413B from the top of FY21 and stood at round $1.27T on the finish of FY22. That was an enormous hit for the corporate. As I discussed in my earlier article, the drop coincided with the general destructive broad market sentiment that introduced down all the most important indices.

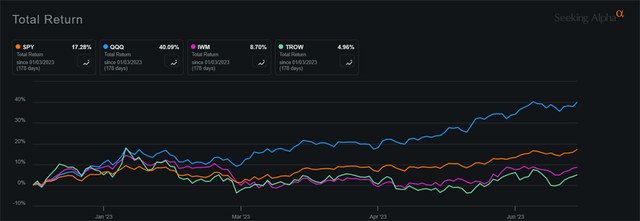

So, what has modified within the final 8 months? AUM has been growing from these lows seen on the finish of FY22 and now three months ended June ’23 stood at a mean of $1.36T, which is round a 7% improve. In my view, it is a little underwhelming contemplating that the most important indices have been performing spectacularly because the flip of the yr, with SPY and QQQ rising 17% and 40%, respectively within the 6 months ending June thirtieth.

Complete Return comparability (Looking for Alpha)

Outlook

Sadly, I want I might be a bit extra upbeat in regards to the financial system, nevertheless, I imagine that the macroeconomic headwinds are going to persist for much longer than I anticipated. Inflation appears to be persistent and really sticky, which can power the FED to extend rates of interest additional. With the payroll numbers popping out hotter-than-expected for September, this isn’t a optimistic signal that the FED will keep put with its curiosity raises. The unemployment charge additionally ticked up a bit bit within the report, however I do not suppose it’s going to be significant sufficient for J. Powell and we’ll see one other rate of interest hike within the the rest of the 2 classes of the yr. I count on much more volatility within the the rest of the yr and a minimum of the primary quarter of ’24.

Individuals are getting frightened but once more as they did in FY22, and preliminary outcomes present a internet outflow of $7.8B as of August thirty first. I imagine there can be additional internet outflows for the rest of the yr, and the corporate’s CEO just isn’t very optimistic on that additionally:

“If I take a look at the entire main indicators that I am seeing proper now, it suggests to me that we’re experiencing the worst of the stress on flows, which is one other means of claiming I would not count on the run charge within the again half of the yr to be better than what we noticed within the first half of the yr. And as we work our means by ’24, we expect we’ll see, as I say, noticeably much less in the best way of internet outflows. However once more, some issues need to occur when it comes to the business backdrop, when it comes to our funding efficiency, which we’re deeply targeted on, and I am inspired by, and once more, about execution towards all of our strategic initiatives.“

Within the brief time period, which is the following 3-6 months, I might count on numerous volatility in internet outflows and inflows, which can deliver additional share value deterioration, nevertheless, as we exit the macroeconomic headwinds someday in 2nd half of ’24, I might count on internet inflows to return, and the corporate’s place would enhance.

Briefly on Financials

As of Q2 ’23, the corporate had $2.25B in money and equivalents and nonetheless zero debt on books. The corporate continues to have loads of liquidity for no matter it needs to do with it, whether or not to pursue extra acquisitions sooner or later or reward shareholders through share buybacks or dividend will increase. The corporate is in an amazing place as a result of it would not have to fret about annual curiosity bills on debt, which frees up numerous capital for these kinds of initiatives that I discussed.

TROW’s present ratio continues to be very sturdy, which is an efficient factor and a nasty factor in my view. In keeping with Looking for Alpha, the present ratio stood at round 1.7 as of June 30 ’23, which is correct at that vary that I contemplate to be environment friendly. 1.5-2.0 present ratio in my view strikes a superb stability between the flexibility to repay short-term obligations and nonetheless have loads of liquidity for no matter could come sooner or later. It additionally means the corporate has sufficient liquidity to additional the corporate’s progress.

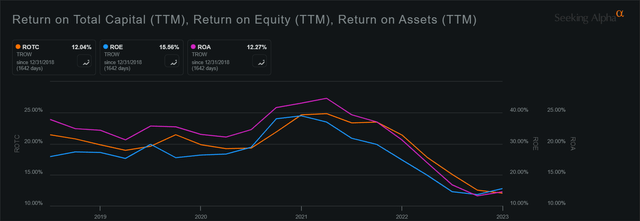

By way of effectivity and profitability, TROW’s ROE and ROA have been incredible through the years, and solely FY22 made them barely worse than its historic common. This tells us that the administration is using the corporate’s belongings and shareholder capital effectively.

The corporate’s Return on complete capital has additionally been effectively above the minimal of 10% that I search for in an funding, which tells us the administration is sweet at discovering initiatives which have nice returns. This additionally tells us that the corporate could have a good moat and aggressive benefit. We are able to additionally see the underside set in on the finish of FY22, so that could be a optimistic if we proceed to see the uptrend sooner or later.

Effectivity and profitability (Looking for Alpha)

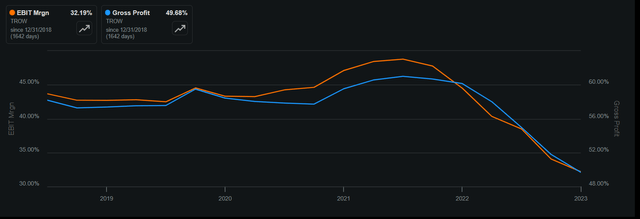

Margins (Looking for Alpha)

Total, I see a powerful firm that may proceed to climate the uncertainty quite simply given its liquid place. Slight fear about margins, nevertheless, as I discussed it is a short-term downside and I would not fear an excessive amount of.

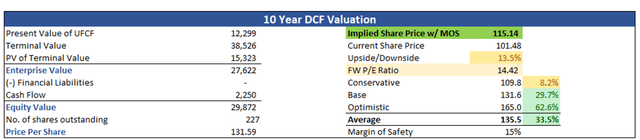

Valuation

My parameters have modified since February barely, so I am going to give a short rundown of it right here. I am protecting my income assumptions on the conservative finish for that additional margin of security. For the bottom case, income will see a progress of round 3.5% CAGR over the following decade, which is about half of what the corporate managed to realize within the final decade. For the optimistic case, I went with 5.5% CAGR, whereas for the conservative case, I went with 1.5% CAGR by FY32.

By way of EPS, I modeled $7 a share for FY23 and $7.3 for FY24, and after that, the corporate will see round 7% CAGR in EPS till FY32 for the bottom case, 9% CAGR for the optimistic case, and 4% for the conservative case.

On prime of those estimates, I’ll add a 15% margin of security for additional cushion. The corporate’s stability sheet could be very liquid and robust, so I imagine 15% is adequate. With that stated, TROW’s intrinsic worth is $115 a share, which suggests the corporate is buying and selling at round a 13% low cost to its truthful value. This additionally reveals how my assumptions up to date over time, and now that the corporate reached my earlier PT of $100, I imagine the corporate is a purchase at these ranges.

Intrinsic Valuation (Writer)

Dangers

After such a rally that the indices noticed throughout ’23, I might be very cautious of people that obtained in on the proper time and need to money out every time there’s going to be some risk to their short-term good points. Outflows could speed up if the macroeconomic state of affairs will get worse. This may occasionally deliver TROW’s share value additional down, nevertheless, I believe that it will be an amazing alternative so as to add on such weak point in case you are a long-term oriented investor.

The corporate’s fund could underperform the broad index, which can be a misplaced alternative in the event you invested in TROW and never an ETF like SPY or QQQ, which have been outperforming TROW by fairly a bit as I discussed earlier.

Many economists and different professionals predict that there’ll nonetheless be additional rate of interest hikes, which can herald additional short-term volatility. Moreover, the rates of interest could keep increased for longer and that will result in the corporate’s share value to proceed its underperformance.

Closing Feedback

I can be opening a place very quickly, seeing that it hit my PT only a few days in the past, nevertheless, the corporate is because of report ends in lower than 3 weeks, so I believe I’ll begin a small place in a few days and see what the administration is saying in regards to the the rest of the yr and what sort of tone the administration can have for the following yr, if they’ll present such an outlook. If I like what I hear, I’ll attempt to develop a decent-sized place. Plus, the dividend yield could be very engaging at these costs.

The volatility could current a fair higher entry level, which I’ll take as a chance so as to add extra shares if the outcomes show to be optimistic. I additionally imagine there can be many alternatives over the following few months to begin a long-term place as a result of I do not see macroeconomic sentiment altering for the higher any time quickly.

I imagine that the danger/reward could be very engaging right here for the long-term investor, coupled with a good dividend yield, there isn’t any cause to panic throughout these tumultuous instances when the macroeconomic path is unsure. In the long run, it can move and 5 years from now, I see TROW going a lot increased. Even with my conservative estimates, the corporate looks as if a worth play to me that may repay nice sooner or later.

Editor’s Be aware: This text was submitted as a part of Looking for Alpha’s Finest Worth Concept funding competitors, which runs by October 25. With money prizes, this competitors — open to all contributors — is one you do not need to miss. In case you are taken with changing into a contributor and participating within the competitors, click on right here to search out out extra and submit your article at this time!