The launch of the Symbiotic restoration protocol introduced a brand new step within the restoration panorama, in response to IntoTheBlock’s “On-Chain Insights” publication. Symbiotic reached its liquid staking token restrict in lower than 48 hours, and its recognition is boosted by a $5.8 million funding from Paradigm and cyber.Fund.

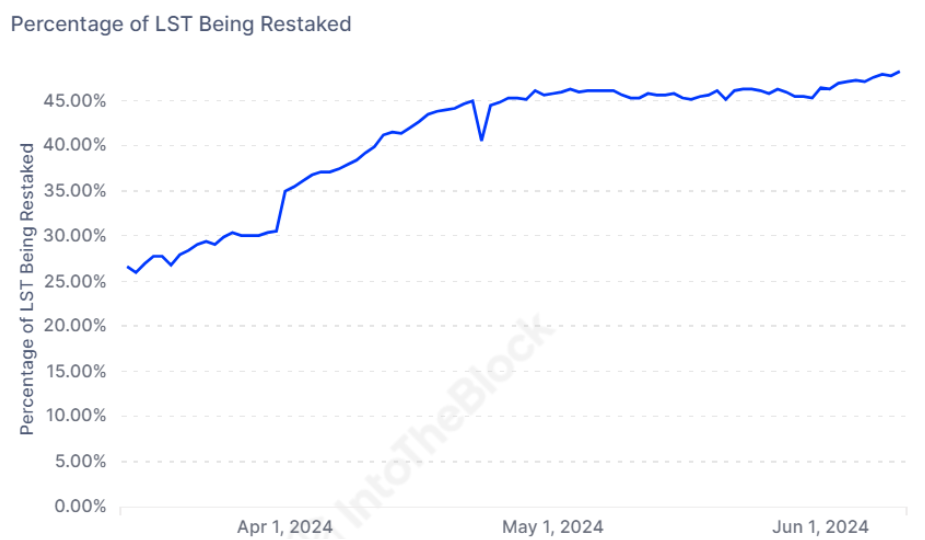

EigenLayer has seen 48% of all Liquid Staking Tokens (LST) redeployed inside its protocol, the best proportion up to now. It has additionally positioned limits on Lido’s sETH deposits, prompting some customers to switch their LST from Lido to EigenLayer looking for greater yields.

Restaking was popularized within the Ethereum (ETH) ecosystem by EigenLayer, consisting of a layer that makes use of staked ETH to supply particular safety for decentralized functions. Consequently, tasks don’t have to concentrate on creating their very own set of validators as they will benefit from layer re-creation.

Nevertheless, Symbiotic differentiates itself by accepting quite a lot of ERC-20 tokens for re-withdrawal, not simply ETH or sure derivatives, which displays Karak’s open re-withdrawal mannequin. The disclosing of the undertaking coincides with the beginning of the start-up part and the combination of redeployed collateral.

Moreover, Mellow, Symbiotic’s first fluid withdrawal platform, was launched concurrently with the protocol itself. Lido’s approval of Mellow suggests a potential shift of wstETH deposits from EigenLayer to Symbiotic.

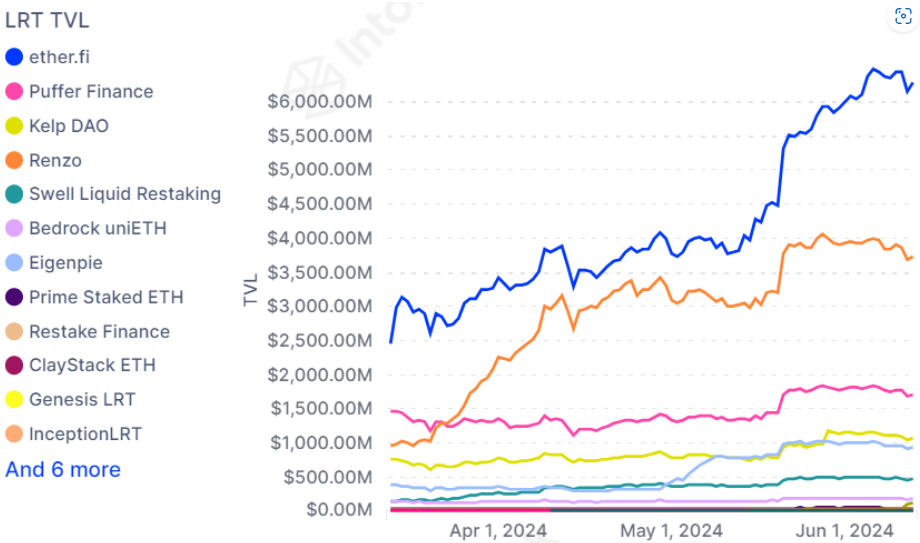

Moreover, the continued factors distribution part for each Mellow and Symbiotic, forward of their token launches, could entice airdrop farmers. Established LRT protocols comparable to Etherfi or Renzo could quickly collaborate with Symbiotic.

IntoTheBlock’s analysts imagine the fluid restoration protocol panorama is evolving, with the entry of Symbiotic introducing new capabilities that problem the established order, signifying a shift in direction of a extra numerous and aggressive surroundings.