imaginima

Servers: A Story of Ongoing Progress

AI, Networking, and the Hybrid Cloud

The server market sits on the tail finish of the worldwide semiconductor ecosystem. After fabless firms design chips and fabs manufacture them, it is on server OEMs and ODMs to include main know-how into marketable merchandise.

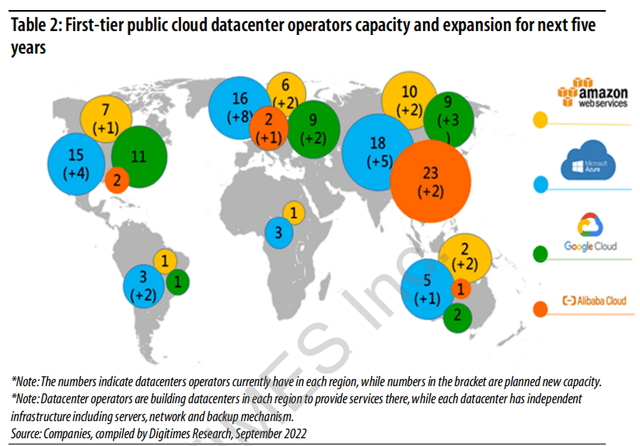

Servers are the computer systems that energy the cloud, telecom networks, and edge computing. With out high-powered servers, LLMs like ChatGPT and text-to-image turbines like Adobe Firefly could be not possible. The most important prospects of server suppliers are knowledge heart operators, primarily large cloud service suppliers (CSPs) Amazon, Microsoft, Google, and Alibaba. These CSPs, or hyperscalers, have constructed fairly giant knowledge heart networks thus far and have quite a few expansions deliberate.

Server market development has a number of key determinants. Knowledge heart enlargement, the tendency towards business requirements, and shopper branding preferences are key development drivers for this business. Knowledge facilities are the main prospects of server OEMs, business requirements present a lock-in impact and permit firms to construct moats, and branding permits for value and part flexibility.

Datacenter Expansions

Knowledge heart enlargement represents each brief and long-term development vectors for server firms. These expansions are due to this fact fairly bullish for server suppliers. New machines are bought right this moment and the bottom of present machines that can want servicing/{hardware} upgrades over time will increase. Here is a breakdown of present capability and enlargement plans, based on TechInsights:

DIGITIMES Analysis

Determinants of knowledge heart demand embody synthetic intelligence, the Web of Issues, autonomous driving, and customarily the enlargement of the digital world. The extra embedded the bodily world turns into in its digital counterpart, the extra demand there might be for computing energy.

Contemplating the tempo of innovation within the semiconductor ecosystem, {hardware} obsolescence is a critical danger for knowledge heart operators. {Hardware} that is even a number of years outdated may very well be orders of magnitude much less performant and/or environment friendly than newer {hardware}. There are robust incentives for knowledge heart operators to persistently improve full racks, networking interconnects, and cooling programs – particularly as Nvidia shifts in the direction of a bundling mannequin with the DGX and HGX programs. Knowledge heart operators are going through elevated complexity in ground planning, cooling, and networking necessities.

NVIDIA (NVDA), the golden little one of AI, is utilizing a bundling technique to extend pricing energy and develop into extra entrenched in knowledge heart infrastructure. The brand new GH100 AI chip isn’t the tiny chip we usually envision, it is a large computing unit. Transferring knowledge round knowledge facilities is now a major consideration for ground planning and design for operators. CPU and GPU racks have totally different networking and cooling necessities, so knowledge heart operators must make selections on the cut up between these racks.

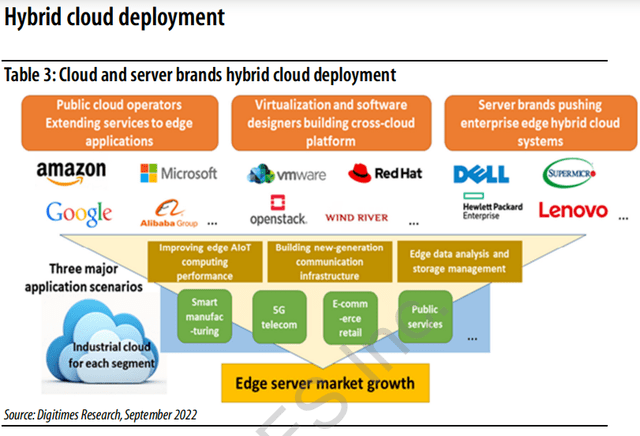

Knowledge facilities have a variety of key development tailwinds. Firms are digitizing at scale and shifting towards a digital-native strategy to enterprise. The cloud is crucial to realize this.

DIGITIMES Analysis

Hybrid Functions

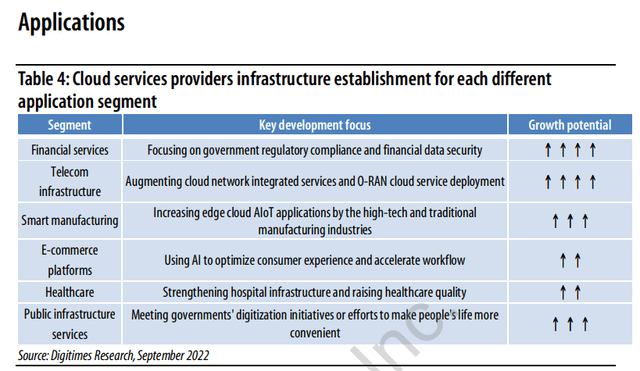

Alongside cloud clusters, the hybrid cloud is one other key development within the server market. A hybrid cloud combines the usage of private and non-private clouds. Hybrid clouds supply firms the chance to optimize their cloud infrastructure. Seasonality, variable necessities for knowledge safety, and price concerns are key to hybrid cloud demand. For instance, monetary providers firms, famous above as having high-growth potential, have a transparent use case for the hybrid cloud. Monetary providers corporations are required by regulation to take care of fairly a considerable quantity of buyer knowledge, which has differing ranges of safety necessities. It is a excellent instance of why a hybrid cloud mannequin is important. These corporations will search as a lot low-cost storage as attainable from the general public cloud whereas internet hosting all PII (Personally Identifiable Info) and most different KYC (Know Your Buyer) data on a personal cloud to make sure enough safety.

DIGITIMES Analysis

Business Requirements: O-RAN

The O-RAN normal will present sustained development in server demand. O-RAN, or Open Radio Entry Community, is a brand new means of designing and constructing wi-fi networks. It is primarily based on the disaggregation of various parts of a radio entry community, such because the radio unit (“RU”), the distributed unit (“DU”), and the central unit (“CU”). These parts talk by open and standardized interfaces. This fashion, totally different distributors can specialise in totally different elements of the community, and operators can customise tools based on their wants. O-RAN also leverages cloud-native principles and AI to allow extra versatile and environment friendly community administration and optimization.

DIGITIMES believes O-RAN might be a key development driver:

“Dell, HPE, and Supermicro may even make further efforts towards the Open RAN telecom tools market and work with telecom carriers (together with Vodafone, Dish, KDDI, and NTT Docomo) to introduce CU and DU servers or goal alternatives within the non-public 5G community market.”

Dell, HPE, and SMCI are all key gamers within the wi-fi networking market. Because the business shifts to the O-RAN normal for wi-fi networks, knowledge facilities will proceed to demand new networking tools for present and new knowledge facilities. AI & HPC and Networking are key development vectors for the server market. Other than O-RAN networking, networking tools inside knowledge facilities that join servers is one other SMCI proposition. Though NVLink is a transparent competitor to this proposition, NVLink is prohibitively costly for all however the richest of firms and even then represents substantial upfront dedication and lock-in to the Nvidia product stack. Huge CSPs might naturally go for unbranded, internally managed networking options supplied by server firms.

To Model or Not To Model: White-box OEMs

The long-term development potential within the cloud business is evident, and the server business advantages from that. In accordance with DIGITIMES Analysis:

Within the international server market, the cloud knowledge heart phase reveals the strongest development momentum, which drives the expansion of white-box server shipments. White-box servers represented solely 43% of the worldwide server market in 2021. The share is anticipated to rise to just about 55% by 2027, buoyed by the sturdy development in giant cloud knowledge facilities. White-box server shipments, that are primarily for giant cloud knowledge facilities, are projected to develop at a CAGR of near 10% from 2022 by 2027.

Server shipments to US-based server manufacturers are projected to develop at a CAGR of solely 3% from 2022 by 2027 and their market share will decrease to just about 25% by 2027 as their prospects proceed to really feel stress from cloud service suppliers. The share of shipments to US-based server manufacturers will fall wanting 29% in 2023 as their enterprise prospects cut back their capital expenditures towards server purchases amid the weak international economic system.

White-box servers are constructed utilizing off-the-shelf parts or generic merchandise equipped by ODMs (authentic design producers). White-box servers are cheaper and extra customizable than branded servers. Branded servers are bought largely by name-brand firms like Dell (DELL) and HP (HPE). These are pre-built and do not supply as a lot flexibility as their unbranded counterparts. As cloud suppliers delve deeper into the cluster and hybrid fashions, the pliability of white-box servers will present sustained development for white-box suppliers. Tremendous Micro Laptop (NASDAQ:SMCI) is a number one white-box server supplier. SMCI has skilled robust value appreciation in 2023 on the again of AI hype and excessive expectations. Each DIGITIMES Analysis and Reports and Data have forecasted that white-box servers will acquire market share towards branded servers. These servers are extra customizable and higher fitted to hyperscalers to proceed constructing AI and HPC capability. Additional to that SMCI affords rack scale plug-and-play, a extremely customizable and easy-to-implement product, making them a transparent beneficiary of the aforementioned market share development.

The White Box Server Market is anticipated to outpace branded server development:

The white field server market income development is a results of the elevated demand for cloud computing. White field servers are rising in popularity amongst cloud service suppliers because of their affordability and scalability, which permit them to optimize their knowledge heart structure and save working prices. Moreover, the white field server market income development is a results of the rising demand for Hyper-Converged Infrastructure (“HCI”) options. White field servers can present the excessive stage of customization and suppleness wanted for HCI options.

As well as, the white field server market income development is as a result of rising want for Excessive-Efficiency Computing (“HPC”) options in sectors together with automotive, aerospace, and protection. Excessive processing, reminiscence, and storage capability are wanted for HPC programs, which may be supplied by specialised white field servers. The demand for flexibility and customization in HPC options is accelerating the uptake of white field servers.

The rising want for servers that use much less vitality is one other issue driving the white field server market income development. White field servers use commercially out there parts which have been tuned for vitality effectivity, so they’re made to be as energy-efficient as attainable. They’re thus a fascinating various for knowledge facilities looking for to chop again on their vitality use and environmental affect.

In the identical article, there is a dialogue of the rack and tower product class, which is the main product within the white field server market.

“By way of income, the rack and tower class dominated the worldwide white field server market in 2022. The flexibility of their designs, traits that make them easy to put in, and affordability are credited with the enlargement of the rack and tower market.”

Supermicro affords a extremely customizable, easy-to-operate rack scale product referred to as plug-and-play. The customizability of this providing will drive demand from ‘GPU Poor’ and ‘GPU Rich’ firms alike. The plug-and-play product line will present sustainable market-beating earnings development for Supermicro.

Relative Investability

Dell, HPE, and SMCI

SMCI has skilled a fabric value appreciation all through 2023 however remains to be a compelling development alternative. They just lately ran up above the $350 value level, adopted by a large drop to the present value under $250. This was pushed largely by ahead expectations supplied of their most up-to-date earnings launch. Regardless of nonetheless guiding for robust development, the market noticed that development as inadequate for the a number of at $350, resulting in a weeks-long drop in share costs. I lined this earnings launch, indicating that I am nonetheless essentially bullish on SMCI. The flat expectations are pushed by demand outpacing provide, which is hampered by the advanced superior packaging course of required for modern chips. Excessive bandwidth reminiscence, or HBM, is an advanced, costly, and well timed course of. Nonetheless, enabling AI coaching and inference at scale completely requires HBM to bus sufficient knowledge all through a chip for efficient and highly effective fashions to function.

The $250 value level leaves a ahead earnings a number of of simply over 14. Here is a comparability between SMCI and the 2 main branded server suppliers:

| Knowledge as of October twenty seventh | SMCI | HPE | Dell |

| Market Cap (on the time of writing) | $13.44B | $19.41B | $46.67B |

| Present Value (on the time of writing) | $243.39 | $15.31 | $65.39 |

| EPS (FWD) | $16.66 | $2.13 | $6.30 |

| FWD P/E | 14.37 | 7.09 | 10.24 |

| Money available | $440.56M | $2.22B | $8.36B |

| Whole debt | $309.46M | $13.51B | $28.01B |

| Yield | 0% | 3.17% | 2.23% |

| Gross Margin | 18.0% | 34.6% | 23.4% |

| Internet Margin | 8.9% | 3.6% | 2.0% |

| Estimated market share | 4.80% | 16.80% | 17.20% |

Notice: Market share knowledge sourced from history-computer.com. All different knowledge from In search of Alpha.

Whereas SMCI instructions the next ahead a number of and would not supply any yield, each Dell and HP are debt-laden monsters with considerably extra debt than money. Dell and HP even have money distributions priced into their valuation, which leads them to doubtlessly under-invest in crucial future applied sciences for the sake of sustaining a dividend. Additional, their debt-to-market cap ratios are considerably increased than SMCI’s.

SMCI isn’t topic to a debt constraint, with more money than debt, which is able to enable it to proceed constructing new and higher merchandise and bringing them to market faster than rivals. Additional, as a result of SMCI incorporates new know-how faster than rivals, their merchandise have a tendency to supply higher vitality effectivity resulting in a decrease whole price of possession. Prospects get higher merchandise for comparatively cheaper with low lead instances. I lined this in additional element in a earlier article, exploring SMCI’s enterprise technique and product ecosystem.

Though SMCI has a a lot tighter gross margin, that is largely due to income breakdowns. 92% of SMCI’s income comes from their server & storage programs enterprise line. That is equal to Dell’s ‘product’ enterprise line, roughly 73% of income, which has a 17.5% gross margin. In the meantime, Dell is producing a loss from its AI & HPC product line, the enterprise line that almost all intently aligns with SMCI. So, whereas the gross margin profile appears to be like dreary at first, peeling a layer again and evaluating SMCI with ceteris paribus situations towards Dell and HP, we discover that SMCI has extremely aggressive margins for AI & HPC options. Additional, SMCI touts a a lot better internet margin, which must be a extra necessary issue for buyers.

Lastly, Reuters recently reported that American firms working in China could also be susceptible to Chinese language retaliation throughout a possible battle over Taiwan. Whereas SMCI was plagued with accusations of Chinese language spy chips all through the 2010s, administration made the troublesome choice to diversify a lot of the provision chain. At present, few of SMCI’s merchandise rely explicitly on China. In the meantime, Dell and HPE are at the moment within the strategy of diversifying. Provide chain diversification is sophisticated and dangerous, which may result in unexpected value will increase, effectivity losses, or margin compression. Within the present geopolitical setting, it is a lot safer to spend money on companies which have already diversified their operations and are working comparatively safer within the paradigm of potential East-West battle.

General, the server market affords a beautiful and secure funding alternative. Main server suppliers will proceed to take pleasure in development that outpaces that of the general economic system. White-box server firms look set to eat market share from their branded counterparts, and SMCI is the main white-box server firm out there in the marketplace right this moment. Whereas buyers have misplaced the chance to spend money on SMCI’s distinctive development alternative at an awe-inspiring valuation, long-term buyers can nonetheless participate on this development story. With a time horizon of round 10 years, I discover that SMCI is a particularly excessive conviction guess on market-beating returns.