Overview

Canadian North Assets (TSXV:CNRI, FSE:EO0) is a mineral exploration and improvement firm advancing a crucial minerals mission in Nunavut, Canada. The Ferguson Lake property has, by way of the years, gone by way of greater than 200,000 meters of exploratory drilling and has confirmed crucial mineral deposits. Canadian North Assets is a comparatively new market participant with a decent shareholder construction and 65 p.c insider possession.

Nunavut is an rising main mining district in Canada that has obtained minimal consideration up to now. Miners have traditionally centered extra on Ontario, Quebec and BC, however Nunavut is now gaining extra consideration as new discoveries are made. The worldwide transition to scrub vitality is driving demand for crucial minerals and creating the necessity to safe home provide chains in secure jurisdictions. Nunavut is rising as a brand new frontier for exploration and mining of those crucial minerals.

Ferguson Lake is a historical asset relationship again to 1952, with C$160 million already invested within the mission since its inception. These investments embody infrastructure, metallurgy, drilling and exploration. The asset incorporates identified deposits of crucial minerals, together with copper, nickel, cobalt, platinum and palladium.

Canadian North Assets up to date Ferguson Lake’s historic 43-101 useful resource estimate in June 2022. The corporate efficiently surpassed its 20,000-meter drill program, finishing 21,126-meters in 2023.

With information from the final three years of drilling marketing campaign, Canadian North Assets plans to additional replace the 43-101 and take the inferred assets to the indicated class, all whereas transferring towards a pre-feasibility examine (PFS).

A seasoned administration group with experience all through the pure assets trade leads the corporate, with expertise in geology, metallurgy and worldwide enterprise administration.

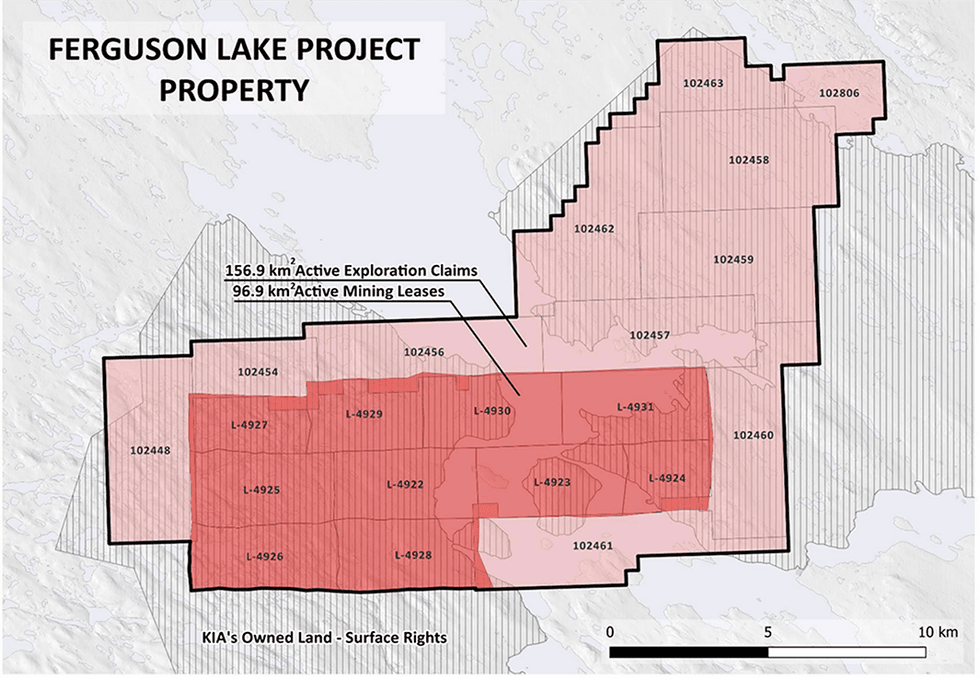

The corporate’s crucial minerals mission covers 253.8 sq. kilometers and consists of identified deposits of nickel, copper and PGM. Canadian North Assets is presently working in direction of extra drilling and testing because it strikes towards a PFS and, subsequently, a preliminary financial evaluation. As soon as full, the corporate will work in direction of bringing the asset to manufacturing.

Mission Highlights:

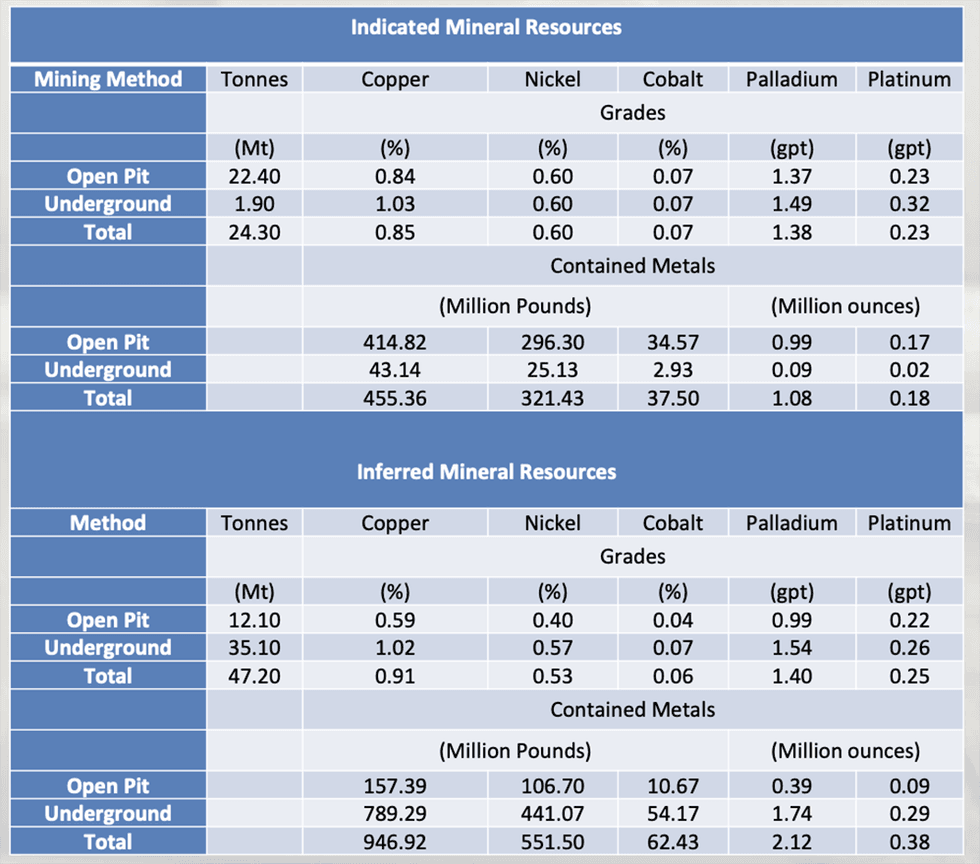

- Prolific 43-101 Useful resource Estimate: Ferguson Lake’s 43-101 compliant useful resource estimate describes prolific deposits all through the asset.

- Indicated 24.3 million tonnes of ore, together with:

- 455.36 million kilos of copper

- 321.43 million kilos of nickel

- 37.5 million kilos of cobalt

- Inferred 47.2 million tonnes of ore, together with:

- 946.92 million kilos of copper

- 551.5 million kilos of nickel

- 62.43 million kilos of cobalt

- Indicated 24.3 million tonnes of ore, together with:

The corporate has commissioned a brand new mineral useful resource estimation following Nationwide Instrument 43-101 Requirements of Disclosure for Mineral Tasks for its Ferguson Lake nickel, copper, cobalt, palladium and platinum mission to include the outcomes of 39,270 meters of latest diamond drilling in 145 holes accomplished by the corporate.

- Vital Historic and Current Work Accomplished: The asset has undergone many years of exploration and drilling and is now nearing manufacturing:

- Ferguson Lake was initially claimed within the Fifties and obtained 173 drill holes totaling 30,000 meters within the following many years.

- Between 1999 and 2012, an extra 158,528 meters had been drilled along with important exploration surveys and metallurgical take a look at work.

- Canadian North acquired the asset in 2013 and accomplished 18,144 meters of drilling in 2022, up to date the useful resource estimate, carried out extra exploration campaigns and commissioned NI 43-101 Technical Reviews.

- Potential to Increase Identified Deposits: Outcomes from a newly accomplished drill marketing campaign point out that identified useful resource deposits could be expanded, with 68 new holes hitting mineralized zones. These new outcomes can be included within the new information set for the up to date mineral useful resource estimate.

- 2023 Diamond Drill Program Assay Outcomes: Sixty-nine out of 78 holes intersected semi-massive to large sulphides containing nickel, copper, cobalt, palladium and platinum, and greater than 3,200 samples from the remaining 57 drill holes had been submitted to ALS labs. Results embody as much as 10 p.c copper, 1.81 p.c nickel, 8.65 grams per ton (g/t) palladium, 4.43 g/t platinum, 0.186 g/t rhodium, 2.19 g/t gold and 49 g/t silver.It additionally confirmed near-surface large sulfide zones of as much as 31 meters and beneath PGM-enriched low sulfide zones of as much as 36 meters. The 2023 drill program expanded the mineralized zone alongside the strike for 1,500 meters overlaying 800 meters within the West Zone and 700 meters within the East Zone.

Huge sulfide ore on the floor of the West Zone

Administration Staff

Lee Q. Shim – Chairman and Director

Lee Q. Shim is a Canadian entrepreneur and investor with over 36 years of expertise in companies working in Canada and abroad. In 1984, Lee based the Lee Li Group in Toronto, working as a meals distributor and wholesaler of premium meats. He later constructed state-of-the-art meals processing and beverage manufacturing vegetation to offer high-quality wholesome merchandise. Along with his dedication and imaginative and prescient, he repeatedly reinvested within the firms by automating services to maximise effectivity the place doable, improve service and help long-term stability and sustainable progress. His success has yielded long-term relationships with established firms and types similar to Walmart, Coca-Cola, Loblaws, KFC, Wendy’s, Sobeys, Metro, Costco, Minute Maid, Earth’s Personal, Sysco Canada and Gordon Meals Service.

All through his profession, Lee has diversified his portfolio with long-term investments in Canada, america, China, and Southeast Asia. His portfolio consists of high- and low-rise residential developments and industrial procuring facilities, medical infrastructure and services, medicare companies, meals and drinks manufacturing, chilly storage warehousing and distribution logistic facilities, and wooden veneer manufacturing. He’s a associate in a personal fairness agency and has served as a director (typically as a big shareholder) in non-public and publicly listed firms, capital funds in addition to in lots of profitable ventures. As a enterprise capitalist, he has raised important capital to fund initiatives all over the world. In July 2020, he was appointed a director of Enercam Exploration, a subsidiary of Angkor Assets.

Kaihui Yang – President, CEO, and Director

Dr. Kaihui Yang has over 30 years of expertise as an exploration geologist creating assets inside discovery, useful resource definition, feasibility and mining levels. Early in his profession, he was a analysis scientist within the division of geology on the College of Toronto and in addition served as a senior marketing consultant for Canadian mining firms (Barrick, Inco, Falconbridge, and so on.) and the World Financial institution Group.

Yang has been an unbiased marketing consultant and director for a number of main Chinese language gold firms and lots of Canadian mining and funding firms. He beforehand served as government vice-president of exploration and worldwide operations for the Zijin Mining Group, a diversified mining conglomerate listed on the Hong Kong and Shanghai inventory exchanges (greater than C$540 billion market cap). He additionally served because the chairman for the Sprott-Zijin Joint-Enterprise Mining Fund, an offshore gold mining fund centered totally on fairness and debt funding for valuable metallic and copper mining firms.

Yang was additionally a founder and president of a Canadian public firm that carried out mineral exploration in China and received the Prospection and Exploration Excellent Achievement Award from the China Mining Convention in 2011. He additionally served because the chairman and normal supervisor for a number of Chinese language-foreign joint ventures.

Yang studied geosciences on the College of Toronto, Chinese language Academy of Geological Sciences, and obtained his PhD in Geology in 1990 from the China College of Geosciences (Beijing). He has revealed quite a few articles and convention papers, many centered on large sulphides, metal-rich-magmatics, and regional valuable metallic potential and exploration. He’s energetic in associations such because the Society of Financial Geologists (Fellow), Australian Institute of Geoscientists (Fellow), and Prospectors and Builders Affiliation of Canada (Core Member).

Trevor Boyd – Vice-president, Exploration

Dr. Trevor Boyd is knowledgeable geologist with over 30 years of expertise within the mining trade working worldwide as a marketing consultant, certified particular person, officer and director with each non-public and public firms. Since 1987, Trevor has labored with quite a few mining firms for a wide range of commodities on initiatives in North America, Asia and Europe. His expertise consists of base and valuable metals, uranium, nickel-copper-PGM, and specialty metals initiatives together with tungsten, tin and indium. He’s a member of the Affiliation of Skilled Geologists of Ontario and the Northwest Territories and Nunavut Affiliation of Skilled Engineers and Geoscientists, and a professional particular person as outlined by Nationwide Instrument 43-101. Boyd has a PhD in geology from the College of Toronto (1996) and an MSc (utilized) MINEX diploma from McGill College (1988).

Carmelo Marrelli – Chief Monetary Officer

Carmelo Marrelli brings greater than 20 years of monetary reporting expertise, specializing in administration advisory companies, accounting, and monetary disclosure. Marrelli is the principal of The Marrelli Group of Firms that gives company, monetary accounting and reporting companies within the Canadian capital markets. Over his profession, Marrelli has been director and held senior monetary roles in non-public and publicly listed firms throughout many industries together with mining. He takes a value-based method as a chartered skilled accountant together with his experience spanning all phases of capitalization and progress. Since 1999, Marrelli has been a member of the Institute of Chartered Skilled Accountants of Ontario and has been a member of the Institute of Chartered Secretaries and Directors since 2000. He holds a Bachelor of Commerce from the College of Toronto.

Aier Wang – Director

Aire Wang is the founding father of Guangdong Grandee Funding Group. and is presently the chief director of the group. Since Wang began her personal enterprise in 1991, she has successively based Dongguan Loyal Woods Trade, Guangdong Hopson Wealth Monetary Leasing, Dongguan Golden Valley Credit score Funding Consulting, and Guangdong Grandee Actual Property Growth.. Grandee Group was based in 2011 by integrating all the businesses based by Wang. Grandee Group focuses on funding administration in actual property, industrial actual property, finance, well being and the wooden trade.

Wang has been accountable for the administration of household companies together with Dongguan Xingye Finance Assure and Kanghua Renkang Hospital. Wang has greater than 20 years of expertise in funding administration of actual property, industrial actual property, finance, well being and the wooden trade. Wang holds an government grasp’s diploma in enterprise administration from Solar Yat-sen College.

Rick Brown – Director

Rick Brown has spent over 30 years within the monetary capital markets in North America the place he efficiently accomplished quite a few financings, mergers, acquisitions, and divestitures. Presently, Brown manages the China desk at Sprott Capital Companions in Toronto, the place he’s accountable for international and institutional consumer investments within the useful resource sectors throughout the Americas and Europe.

In 2001, Brown co-founded Osprey Capital Companions, a mid-market agency helping mid-sized firms in all varieties of fundraising and M&A actions. Earlier than this, Brown frolicked with Scotia Capital Markets in New York, the place he labored on a few of the largest M&A and financing transactions at the moment.

Brown holds a bachelor’s diploma in economics and a grasp’s diploma in finance.

Michael Weeks – Director

Michael Weeks has over 25 years within the energy era and useful resource industries. Mike was a founder, president and CEO, and is presently a director and government VP of operations of Angkor Assets Corp. He has an engineering background and holds a First Class Energy Engineering Certificates. Over his profession, he has spent greater than 14 years negotiating with governments, communities, and stakeholders in creating and implementing pure useful resource concessions.

In creating international locations and communities, Weeks is instrumental within the implementation of coaching packages for native labor pressure improvement, abilities {and professional} accreditation, and has made important strides in self-sustaining neighborhood progress and enhancement. He was a founding director of a petroleum coaching firm in addition to two monetary service firms.

He has an engineering background and holds a First Class Energy Engineering Certificates. He has managed main initiatives in Canada, Asia, Africa, and Europe, together with a number of main manufacturing services in North Africa.

Xian Jian Guo – Technical Advisor

Xian Jian Guo has over 35 years of expertise in course of improvement, plant operation, optimization, engineering, and mission administration within the mining and mineral trade.

He has efficiently managed a lot of massive worldwide mining/mineral initiatives with multi-billion greenback investments overlaying mission analysis, engineering, development, and commissioning.

As a Canadian {and professional} engineer, Guo was a director at Hatch in Ontario and senior scientist on the Noranda Know-how Heart in Quebec. He has held a number of worldwide positions, together with technical director (for China) at Hatch Ltd.; and chief engineer of Zijin Mining Group.; vice-president of Ramu NiCo Administration in Papua New Guinea; and director of the Metallurgical Division at Beijing Analysis Institute for Nonferrous Metals. He’s presently a senior advisor with the Zijin Mining Group.

Guo obtained a PhD in Metallurgy from Kunming College of Science and Know-how in China (1989) and accomplished postdoctoral research at Mackay Faculty of Mines on the College of Nevada in Reno, USA.

Stephen du Toit – Advisor

Stephen du Toit has over 30 years of expertise spanning government, strategic, tactical, and transformational and operational initiatives for manufacturing, product provide, and facility operations. His roles as EVP, VP, COO and in different government positions embody multinational operations in Canada, Saudi Arabia, Russia and different international locations.

Earlier than becoming a member of Coca-Cola in 1999, du Toit spent over a decade within the client items trade with Diageo, Penguin Meals, SAB Miller, and Lever Brothers (Unilever). He joined Coca-Cola as supervisor of Nation Provide Chain in Saudi Arabia and in 2000 was director, the Center East Regional Provide Chain. From 2005 to 2011, as VP he headed up the Commonwealth of Impartial States Cluster Procurement, Planning & Provide. In 2011, he turned VP, of Manufacturing in Canada, lead Minute Maid Canada (2013 to 2015), then turned SVP of Product Provide System, and is presently EVP and COO for Coca-Cola Canada Bottling Restricted a newly created, unbiased bottler.

du Toit holds a Bachelor’s Diploma in Commerce specializing in accountancy, statistics and pc science from the College of Pretoria. He’s additionally a licensed Chartered Administration Accountant (CMA) and a Fellow of the Procurement Institute of Europe.