HJBC

Right here on the Lab, STMicroelectronics (NYSE:STM) continues to be a high decide inside our EU protection, and we imagine (put up Q3 outcomes) restricted adjustments to Wall Avenue analyst consensus are more likely to convey short-term reduction to the inventory worth efficiency. Certainly, since our final replace in Q2, the corporate share worth has declined by 20% (Fig 1). Market sentiment stays pessimistic and questions the automotive incomes sustainability. Automotive & Discrete Group gross sales signify 46% of the corporate’s turnover. Nevertheless, our inside crew has a optimistic view of the EU auto trade, confirmed by our purchase ranking of Volkswagen, Renault, and Stellantis. That is based mostly on 1) deliveries nonetheless under pre-COVID-19 outbreaks and a pair of) the continuing EV revolution. The brand new auto will expertise extra chips in comparison with ICE vehicles. Due to this fact, we’ve got no cause to imagine in a phase slowdown.

Mare Previous Evaluation

Fig 1

Q3 outcomes

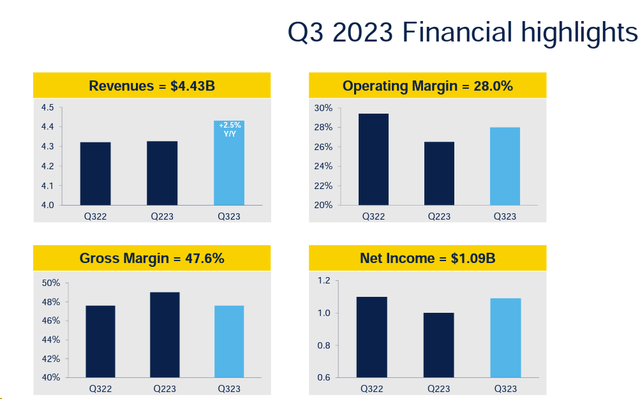

Cross-checking analysts’ expectations, STM’s core working revenue was 4% larger than consensus in Q3 2023, and based mostly on the corporate’s newest steering, it’s a single-digit under This autumn. Wanting on the quarter, STM delivered a strong set of outcomes. In numbers, top-line gross sales reached $4.43 billion with a GM of 47.6% and a core working margin of 28.0% (Fig 2). The corporate’s web income had been $1.09 billion, with an EPS of $1.16. Our obese ranking was derived with a 2023 EPS forecast of $4.28. Put up Q3 outcomes, we imagine the corporate is effectively on monitor to realize this efficiency. Extra importantly, trying on the divisional degree, STM development was pushed by the automotive phase, confirmed a 30% development on a yearly foundation, and additional accelerated quarterly with a plus 4%. Microcontrollers and Digital had been additionally up by +3% year-on-year, whereas Analog, MEMS, and Sensors decreased by 28%. A shopper slowdown within the smartphone atmosphere primarily impacted this division. Gross margin was ten foundation factors larger than consensus on larger utilization fee and higher product MIX.

STM Q3 Financials in a Snap

Supply: STM Q3 results presentation – Fig 2

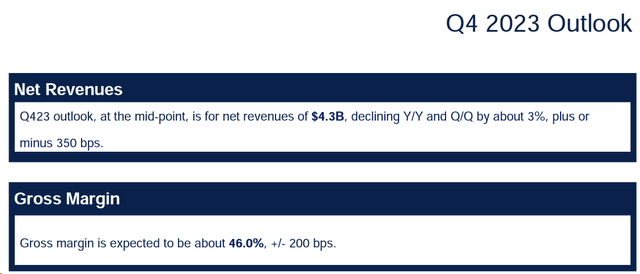

Wanting forward, in This autumn, the corporate expects web revenues of $4.3 billion as mid-guidance worth, with a lower of three% vs. final 12 months’s outcomes. Happening the P&L, the gross margin is anticipated to be round 46% (+/- 200 foundation factors). The outlook assumes an trade fee of $1.08/€1.0 (Fig 3). Due to this fact, STM full-year gross sales at the moment are at $17.3 billion, a plus 7% 12 months on 12 months, with a gross margin of round 48.1%.

STM This autumn Steering

Fig 3

Why are we nonetheless optimistic?

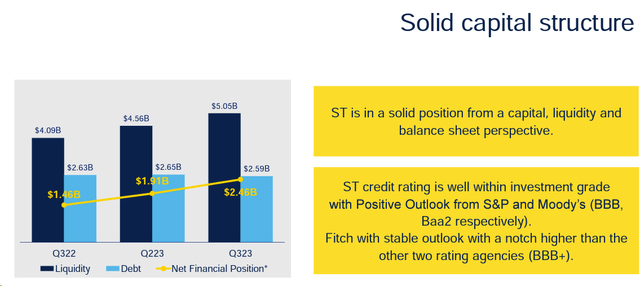

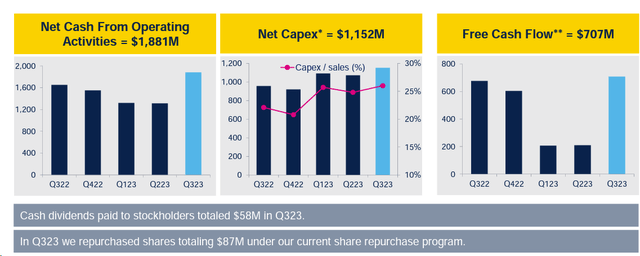

- After a money dividend of $58 million and a buy-back of $87 million, as of September finish, STM’s web monetary place was optimistic (Fig 4) and leaving unchanged the CAPEX plan aligned with the CEO remark, we arrived on the year-end place of $3.2 billion. We imagine that capital place flexibility is a plus on this momentum. Right here on the Lab, we’re forecasting a DPS enhance of 5% for 2024; nevertheless, there may be house for opportunistic M&A and a brand new CAPEX plan;

-

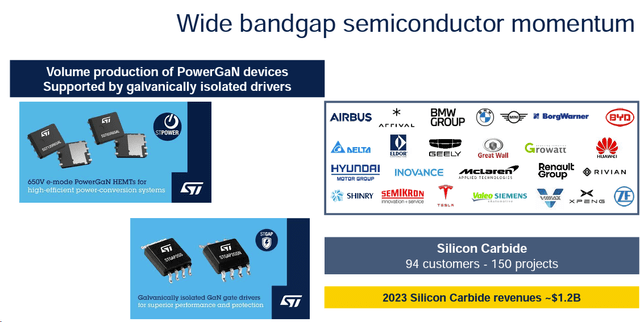

Associated to new investments, STM and Sanan Optoelectronics, a Chinese language semiconductor firm specializing in LED, signed an settlement to create a producing three way partnership to provide SiC carbide units. The brand new SiC facility is anticipated to start manufacturing in This autumn 2025. STM goals to assist China’s rising demand for automotive electrification, renewable vitality, and new energy purposes. In the meantime, Sanan will individually construct and function a brand new 200mm SiC substrate manufacturing plant to satisfy the wants of the three way partnership, utilizing its personal SiC substrate manufacturing course of. The CAPEX necessities are set at roughly $3.2 billion over the subsequent 5 years and shall be financed by native authorities assist. For STM, this can be a essential step to extend its international SiC manufacturing operations additional and is consistent with the corporate’s gross sales goal to realize $20 billion in gross sales in 2025-2027. STM is constructing momentum on SiC initiatives, and in 2023, the corporate exceeded the primary billion in gross sales throughout the phase (Fig 6). This isn’t the primary settlement that STM has signed; right here on the Lab, we’ve got already reported the new collaboration with Soitec;

- In early October, the corporate communicated a brand new silicon carbide facility in Italy for a complete funding of €730 million. This new lab will assist the EU’s rising demand for SiC units for automotive and industrial purposes. Intimately, the plant shall be constructed near the Catania website and would be the first of its form to provide 150 mm SiC epitaxial substrates. Based on the EU Commission website, STM will take subsidies of roughly €292.5 million.

STM capital construction

Fig 4

STM FCF

Fig 5

STM SiC upside

Fig 6

Conclusion and Valuation

Put up Q3 outcomes, we’ve got 2023 top-line gross sales of $17.4 billion with an EBIT of $4.7 billion. Because of the newest CAPEX plan, we see an upside within the present valuation, and we confirmed 2025 gross sales of $20 billion. STM has a mid-single-digit income development estimate (+7%) and assist from the EU Union. The Outdated Continent microchip manufacturing is around 9%, and there’s a plan to achieve 20% worldwide manufacturing by 2030. Decrease CAPEX, given the EU assist and strong profitability throughout the cycle, leads our numbers to derive a 2024 EPS at 4.57. As well as, the corporate has a surplus FCF and is already cash-positive. STM trades with an EV/EBITDA of 5.5x and a P/E of 8.5x and is a worldwide firm with a transparent upside within the EU because of a supportive framework. We imagine the corporate will proceed to expertise sturdy demand within the automotive and industrial sectors. We’re additionally inspired by the group’s gross strong margin efficiency, now forecast at round 46% in This autumn 2023. Regardless of a shopper slowdown, STM continues to handle the cycle effectively, with development in automotive and stability in microcontrollers. Wanting on the PHLX Semiconductor Sector performance, the index declined by 13%, whereas STM, which was already discounted, continues to have the next valuation discrepancy. STM is transferring away from Apple, being its largest consumer, and is diversifying by merchandise and areas. The corporate has a strong order backlog, and in our estimates, we arrive at a valuation of €60 per share with a 2023 EPS of $4.28 and an unchanged P/E of 16x. That is additionally supported by a median EV/EBITDA of 10x and a reverse DCF with a WACC of 9% and a long-term development fee of three%. Key macro threat elements are the weakening of the $/€ trade fee, decrease GDP development charges, and a slowdown in shopper electronics. On the micro dangers, we should always spotlight capability development from comps with an imbalance in provide/demand, expertise product life cycles (iPhone cycles), and utilization charges.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.