JHVEPhoto

STMicroelectronics (NYSE:STM) is likely one of the main semiconductor corporations in Europe, manufacturing automotive chips, analog merchandise, and microcontrollers. They’re on the forefront of silicon carbide expertise, alongside three different main gamers, together with Infineon (OTCQX:IFNNY), ON Semiconductor (ON), and ROHM Semiconductor. The expansion of silicon carbide and semiconductor content material per car is a big driver for the automotive semiconductor business. I assign a “Sturdy Purchase” score to STMicroelectronics, as I consider its inventory is undervalued, and it stands as one of many prime semiconductor shares in Europe.

Silicon Content material Development in Automotive Finish-Markets

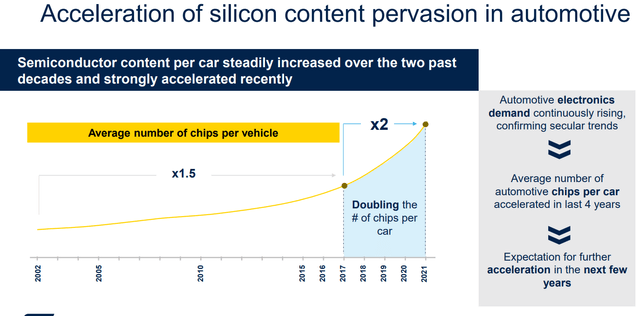

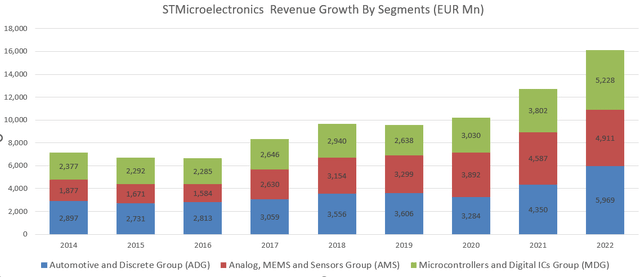

Automotive and Discrete Group (ADG) represents 37% of group income, and it grew 32.5% in FY21 and one other 37.2% in FY22. Together with the structural progress over the previous few years, their phase margin has been improved from an approximate 10% in FY19 to 24.6% in FY22. Their progress has been pushed by automotive electrification, ADAS system and 32-bit MCUs. STMicroelectronics administration expects the semiconductor content material per automotive additional acceleration within the subsequent few years pushed by extra applied sciences utilized on premium automotive and EVs.

STMicroelectronics 2022 Capital Market Day

I consider the expansion of semiconductor content material per automotive is essential to the automotive semiconductor business, and it might be a significant progress driver for all the chip business. Traditionally, automotive OEMs paid much less consideration to semiconductors, typically neglecting to construct their chip stock and treating semiconductor corporations as non-critical companions, based mostly on my analysis. Nevertheless, the worldwide provide chain disruptions through the pandemic served as a significant lesson for these automotive OEMs—a wake-up name. Since then, these automotive OEMs have begun to understand that semiconductors are mission-critical elements within the design and manufacturing of recent vehicles. With technological developments resulting in elevated electrification and security options, the demand for chips in autos continues to rise. I’ve little question that the typical semiconductor content material per automotive will proceed to develop over the following decade.

Main Silicon Carbide Expertise

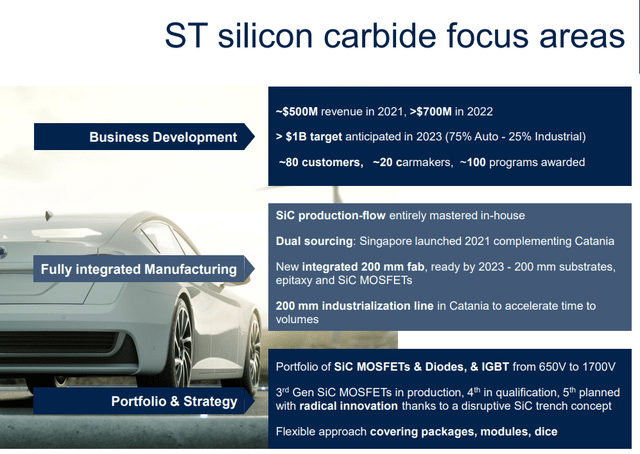

Together with Infineon, On Semiconductor, and ROHM, STMicroelectronics has the main expertise for silicon carbide, a brand new materials higher fitted to longer-range electrical autos. Silicon carbide’s benefits lie in its excessive system-level efficiencies, low energy loss, and elevated temperature operations. With silicon carbide materials, EVs can obtain longer ranges on shorter cost occasions and with smaller battery sizes for traction inverters.

STMicroelectronics is concentrating on greater than EUR 5 billion in income from silicon carbide by FY30, and their clients embody main automakers, similar to BMW (OTCPK:BMWYY), Tesla (TSLA), BYD (OTCPK:BYDDF), Renault (OTCPK:RNSDF), Hyundai (OTCPK:HYMTF), and so on.

STMicroelectronics 2022 Capital Market Day

Throughout Q2 FY23, STMicroelectronics introduced a three way partnership with Sanan Optoelectronics for a high-volume 200mm silicon carbide machine manufacturing facility in China. This three way partnership will manufacture 200mm silicon carbide gadgets for Chinese language clients in automotive electrification, industrial energy, and power functions. STMicroelectronics is concentrating on to start out manufacturing in This fall FY25 and obtain full operation by FY28. Their administration signifies that the Chinese language JV, and their persevering with funding in Italy and Singapore, would grow to be the key progress alternatives for attaining their EUR 5 billion income goal by FY30. I’m impressed with their constant funding in silicon carbide applied sciences, which I consider is essential for the worldwide adoption of electrical autos.

Monetary and Development Outlook

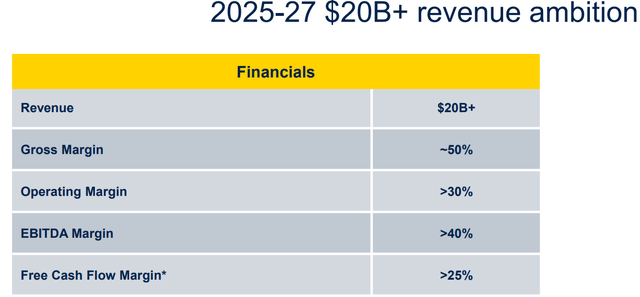

STMicroelectronics has an ambition to achieve EUR 20 billion in income, with over 30% of working margin and 25% of free money stream margin. I consider these monetary targets are sensible and align carefully with the long-term ambitions of most semiconductor corporations.

STMicroelectronics Q2 FY23 Presentation

Provided that they’re within the semiconductor business, income progress is kind of risky in nature. It’s higher to have a look at the 3-year or 5-year income compound annual progress price to know the long-term progress development. For STMicroelectronics, their previous 3-year income CAGR is roughly 19%, and the previous 5-year CAGR is round 14%. I might argue that their progress is kind of spectacular, as mentioned above, pushed by the rising demand for automotive semiconductors.

STMicroelectronics Annual Stories

In Q2 FY23, their income elevated by 12.7% 12 months over 12 months, with an working margin enchancment to 26.5% from 26.2% in the identical quarter of the earlier 12 months. Moreover, EPS grew by 15.2% 12 months over 12 months. The Automotive and Discrete Group income elevated by 34.4% 12 months over 12 months, with double-digit progress in each Automotive and Energy Discrete.

For his or her full-year steering:

Revenues are anticipated to be EUR 17.4 billion, plus or minus EUR 150 million, which represents progress of roughly 8% over FY22.

Gross margin is anticipated to exceed 48%.

Capital expenditure is estimated at EUR 4 billion.

Simply based mostly on their first-half 12 months precise earnings, it appears their income steering is kind of conservative, particularly contemplating their income progress of 19.8% in Q1 and 12.7% in Q2.

It is also price noting that STMicroelectronics maintains a strong steadiness sheet, with EUR 1.91 billion in internet money as of Q2 FY23. Their credit standing is effectively throughout the funding grade, with a Optimistic outlook from S&P and Moody’s. They generated EUR 209 million in free money stream in Q2, and their internet money from working actions elevated by 24.1% 12 months over 12 months.

Key Dangers

My greatest issues for STMicroelectronics relate to their excessive capital expenditures. They allotted 21.9% of whole income to Capex in FY22, 14.3% in FY21, 12.6% in FY20, and 12.4% in FY19. The rising capital expenditure has impacted their free money stream era. In contrast to most U.S. semiconductor corporations, STMicroelectronics invests closely in semiconductor manufacturing services.

As an illustration, in June 2023, GlobalFoundries (GFS) and STMicroelectronics announced the conclusion of an settlement to create a brand new, jointly-operated, high-volume 300mm semiconductor manufacturing facility in France. In keeping with their administration, the whole funding for this undertaking is anticipated to be EUR 7.5 billion, and it’ll profit from monetary assist from the French State, amounting to roughly 2.9 billion euros. I acknowledge that these capital investments in manufacturing may help STMicroelectronics higher management their provide chain and enter prices. Nevertheless, it is necessary to notice that these capital expenditures make their enterprise capital-intensive in nature.

Valuation

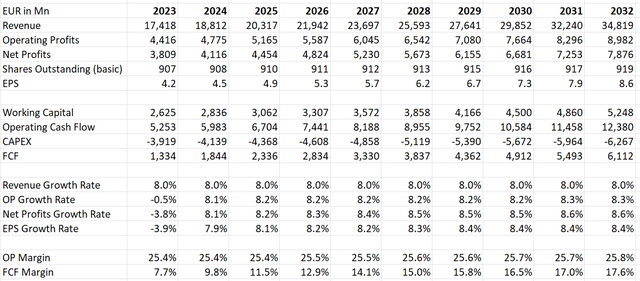

Within the DCF mannequin, I assume an 8% income progress for FY23, which is in keeping with their steering. For the long-term progress price, I would want to imagine a conservative income progress price, because the semiconductor business is extremely risky in nature. In keeping with Precedence Research, the worldwide automotive semiconductor business is anticipated to develop at a compound annual progress price (CAGR) of 11.5% from 2022 to 2030. Contemplating that STMicroelectronics additionally contains some lower-growth enterprise traces, I assume an 8% annual progress price for the corporate going ahead. Concerning revenue margins, I don’t anticipate vital margin growth over the following decade, as they’ve already earned very first rate margins, and so they must proceed investments in new chips and silicon carbide.

STMicroelectronics DCF – Writer’s Calculation

In abstract, based mostly on a ten% low cost price, 4% terminal progress price, and a 15% tax price, the DCF mannequin estimates an enterprise worth of EUR 60 billion, suggesting that the honest worth of STMicroelectronics’ inventory is roughly EUR 70 per share, in line with my calculations. This means that the inventory could also be undervalued at its present worth.

Closing Feedback

I believe STMicroelectronics’s progress will probably be pushed by silicon content material per automotive progress in addition to silicon carbide adoptions, and they’ll profit from the structural development of automotive electrification. For my part, the inventory worth is considerably undervalued right here, and I assign a ‘Sturdy Purchase’ score.