Margarita-Younger/iStock Editorial by way of Getty Photos

After I final wrote concerning the shoe firm Steven Madden (NASDAQ:SHOO) final April, there was good motive to anticipate a decline in share worth. Its efficiency was on the decline and the gloomy outlook (honest as it was, in hindsight) made issues worse. There would possibly nonetheless have been a Purchase case on the inventory had been it undervalued. It wasn’t. It was truly pretty priced in contrast with the buyer discretionary sector, prompting a Promote score.

Worth Chart (In search of Alpha)

The prediction got here to cross because the inventory touched its lowest in September 2023, with a decline of 15% from the time I wrote about it. Nonetheless, a lot has modified since. Come November, it noticed an uptrend once more, and even with a worth correction towards the top of the 12 months, it has now erased these losses completely.

Right here I check out why the value began rising in November and whether or not these good points may be sustained in 2024.

Why did the value rise?

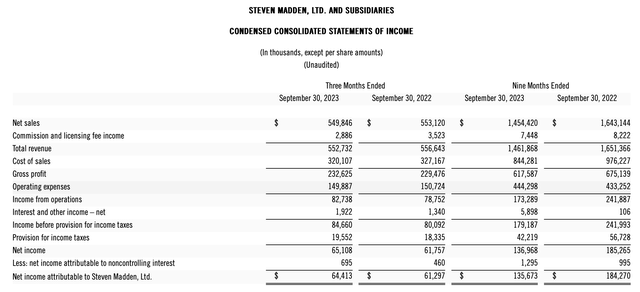

At first look, a take a look at its outcomes for the primary 9 months of 2023 (9m 2023) makes the value rise puzzling. Its revenues declined by 11.5%, which is way over the corporate’s expectation of a 6.5-8% decline in 2023. It carried out higher on the earnings per share (EPS) entrance, which got here in at USD1.81 for the interval. At this charge, it might make it to the full-year steerage vary of about USD2.40-2.50. My calculation signifies that it might find yourself with a USD2.41 determine.

Nonetheless, a more in-depth take a look at the standalone figures for the third quarter (Q3 2023) reveals the rationale for the optimism. First, income declined through the quarter, however it amounted to a small 0.7% decline, and second, all revenue classes improved, aided by precise declines in each value of gross sales and working bills.

Steven Madden

Whereas gross revenue grew by 1.4% year-on-year (YoY), working and internet revenue grew by 5.1% every. Notably, the working margin in Q3 2023 rose to fifteen%, appreciably larger than the 11.9% for 9m 2023. The web margin (for earnings attributable to the corporate) additionally crossed the ten% mark. It got here in at 11.7%, up from 9.3% for 9m 2023.

This was a transparent reflection of enhancing efficiency after a difficult first half of the 12 months for Steven Madden. Additional, by the point the earnings launch got here in, in November, the inventory was nonetheless buying and selling near its September lows. The inventory would have seemed notably enticing at a time when the S&P 500 Client Discretionary index was up by greater than 20% YoY.

Improved efficiency and dividends forward

There’s even higher information for Steven Madden because it readies for its full-year earnings replace due in February. Even contemplating that it expects a 7% income decline for 2023, in This autumn 2023, it’ll nonetheless see a ten% rise within the quantity. Additional, with the diluted earnings per share anticipated to come back in at USD2.35, the determine for the ultimate quarter will develop by 28.6%.

Additional, analysts anticipate the numbers for 2024 to be constructive as effectively, with revenues seen rising by 8.6% and EPS anticipated to rise by 13.3%.

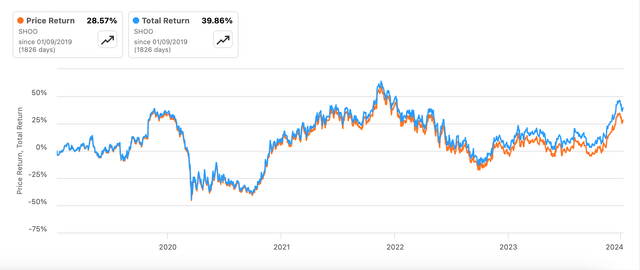

This additionally bodes effectively for Steven Madden’s dividends. Its ahead dividend yield is at 2%, which is a shade decrease than the two.2% for the buyer discretionary sector. Nonetheless, contemplating that its TTM dividend payout ratio is 38% there may be undoubtedly room for a rise right here particularly as its earnings are anticipated to develop. Whereas the inventory’s five-year returns are underwhelming, the addition of dividends has improved them (see chart under), making it a degree to think about.

Worth Returns and Complete Returns, 5y (In search of Alpha)

The draw back

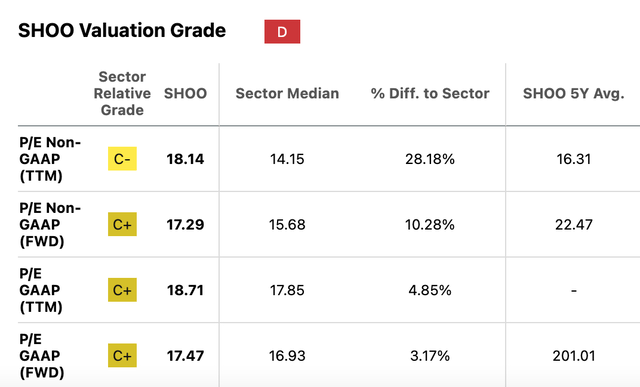

It isn’t like there will not be challenges forward for the inventory although. On account of its worth rise previously few months, its market multiples are forward of sector averages (see desk under), indicating restricted upside to the inventory, if not a correction.

In search of Alpha

The one exception is the soon-to-be TTM GAAP price-to-earnings (P/E) ratio for 2023, which is at 17.6x. That is barely decrease than the typical for the buyer discretionary sector at 17.85x. Nonetheless, even this does not indicate any important upside.

Additional, the macroeconomic situations won’t be beneficial both. The US financial system is anticipated to see a slowdown this 12 months. And whereas the fast easing in inflation charges over the previous 12 months has been constructive for the corporate’s margins, there are more likely to be restricted margin good points within the subsequent 12 months.

To my thoughts, this may put the 2024 forecast in danger. In its Q3 2023 earnings launch, firm CEO Edward Rosenfeld did level this out saying, “softer tendencies throughout the business since September have left us incrementally extra cautious on the near-term outlook.” He would not specify what near-term means, however it seemingly means no less than the early a part of 2024 since its outlook signifies constructive expectations for This autumn 2023.

What subsequent?

All mentioned, although, Steven Madden does look a lot better positioned now than it did final April. The corporate appears to have come out of the worst of the slowdown it noticed earlier final 12 months. From the ultimate quarter of 2023, it’ll seemingly see good progress and earnings enlargement as effectively. The forecasts for 2024 are encouraging too.

It is little surprise that the share worth has risen in tow, particularly contemplating that it was a laggard as shopper discretionary shares rose over the 12 months. Nonetheless, the inventory’s market multiples now counsel that there is little upside. And the corporate’s warning concerning the close to time period coupled with the anticipated slowdown within the US and restricted room for margin enlargement does point out that it won’t be completely out of the woods.

I consider the prudent motion proper now could be nothing. It is best to attend for its full-year 2023 outcomes due subsequent month to see how Steven Madden expects to carry out this 12 months and make an investing choice primarily based on that. What’s clear for now could be that it is now not a Promote. I am upgrading SHOO to Maintain.