wacomka

Following our Stevanato initiation of protection (NYSE:STVN), we’re again to touch upon the corporate as we speak. Right here on the Lab, we positively view Stevanato for the next causes: 1) free float expansion to help liquidity, 2) Secular Tailwinds In Biologics Help Downstream Demand, 3) financial moat, and 4) margin growth supported by a well-diversified CAPEX plan.

Q3 evaluation

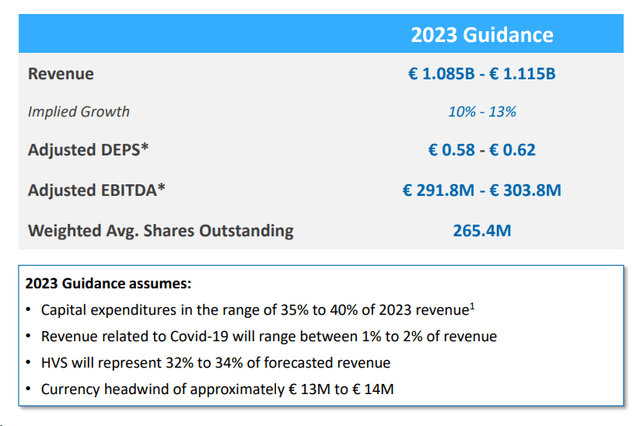

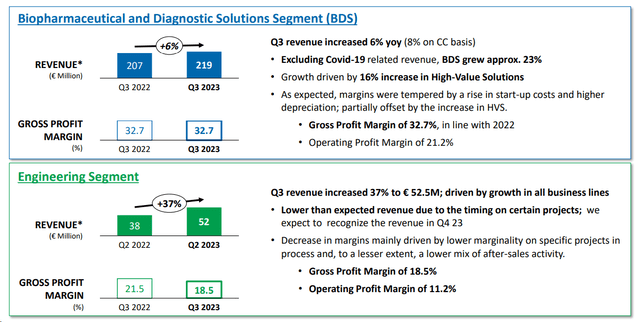

Q3 was not the anticipated quarter. The corporate reached €271 million in gross sales, lacking consensus expectations by 2%. In comparison with Q3 2022 outcomes, Stevanato grew by 11% (13% on a continuing foreign money foundation). Wanting on the divisional stage (Fig 1), the Biopharmaceutical and Diagnostic Options (BDS) section reached €219 million, with a plus 8% natural income development. Compared, the Engineering section reached €53 million, with a plus 37% natural income development. This might sound a very good consequence; that mentioned, the CEO emphasised that the Engineering section got here under expectations as a result of some tasks had been pushed into This fall. This was as a result of provide chain delays. Right here at the Lab, we consider this data would have been useful if this draw back had been flagged throughout the Investor Day in late September. Happening to the P&L evaluation, Stevanato’s gross margin was 30.5% and got here under Wall Avenue estimates at 31.7%. In our first publication, we analyzed how we anticipated larger start-up prices as a result of firm’s new manufacturing amenities. Regardless of that, the Engineering section reached a gross revenue margin of 18.5% vs. a 21.5% margin recorded in Q3 2022. The adjusted EBITDA totaled €75 million with a margin of 27.5%, and the EPS was at €0.15 (Fig 2).

Stevanato Group Q3 divisional outcomes

Fig 1

Stevanato Group Q3 Financials in a Snap

Fig 2

Why are we constructive?

-

Even when Stevanato missed its Q3 income, the corporate achieved strong outcomes. The miss was as a result of delays within the Engineering section; nonetheless, the division carried out a 37% yearly development. Wanting on the press launch, the company will “acknowledge income from these tasks within the fourth quarter of 2023“. As well as, in response to the CEO, tailwinds are rising, and development in biologics is driving demand for meeting traces and visible inspection;

-

Intimately, COVID-19 gross sales decreased by roughly 84% vs. final 12 months, representing 2% of the whole firm’s gross sales. This implies that natural gross sales ex-COVID-19 at fixed foreign money elevated by high-double-digit (25%). Right here on the Lab, we consider that many sell-side analysts are trying on the broader gross sales technology. Contemplating the pick-up in gross sales within the Engineering section coupled with BDS development, the corporate is about for a brilliant future. As well as, except for our supportive macro development on biologics development and ageing populations, there may be one other upside that we should always think about: the shift towards drugs self-administration. In line with research, the worldwide self-administered remedy is forecasted to surpass $200.5 billion by 2032 with a CAGR of 8.6%. The power illnesses help the self-administered remedy development developments improve, and Stevanato will doubtless reap the benefits of this macro development;

-

Submit Q3, we consider the corporate is okay with shopper stock administration. The entire backlog reached €924 million and was aligned with our expectations;

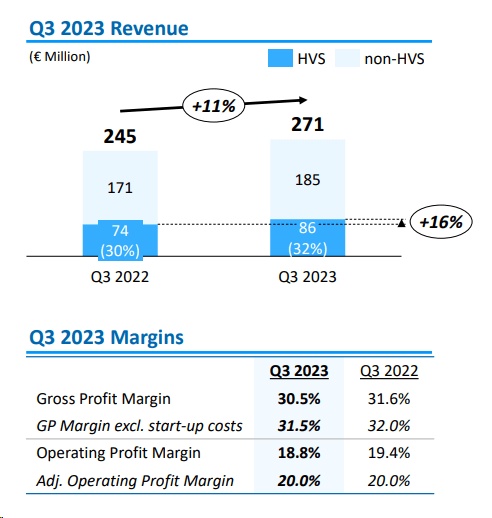

- Wanting on the ongoing CAPEX plan, the Latina facility growth is near producing its first industrial gross sales. Audits had been efficiently accomplished. The Fishers Indiana undertaking will produce and begin gross sales in mid-2024 (as deliberate). The corporate nonetheless plans capital expenditures within the vary between 35% and 40% of income, with acceleration in Western nations and deceleration in China;

- The corporate reiterated 2023 income, earnings per share improvement, and adjusted EBITDA steering. Stevanato gross sales are anticipated between €1.085 and €1.115 billion. As a reminder, that is nicely above the corporate’s inside estimates set on the IPO time (€955 million). Stevanato EPS is consistent with consensus in addition to the EBITDA vary. Wanting again, the corporate set a 2023 EBITDA of €251 million on the IPO time.

Modifications in Estimates and Valuation

Submit Q3 outcomes, we’re updating our income gross sales forecast. 2023/2024/2025 gross sales are estimated at €1.08/€1.21/€1.33 billion with an adjusted EPS of €0.61/€0.68/€0.73. With an unchanged CAPEX plan, we nonetheless forecast an EBITDA of €345 million in 2024. Regardless of that, we at the moment are decreasing our EV/EBITDA a number of from 25x to 24x. This is because of a decrease valuation of CDMO gamers, which fell to low-to-mid teenagers in 2024. Taking a look at Stevanato’s friends, West Pharmaceutical Providers (WST) trades at 24x EV/EBITDA. For that reason, we arrived at a valuation of $31.8 per share (from $35.5 per share), confirming a purchase score for the corporate. Extra dangers to our goal value embrace additional strain on BDS development and decrease order backlog.

Stevanato Group FY 2023 steering