HABesen/iStock Editorial by way of Getty Photographs

Shares of State Road (NYSE:STT) rallied a bit on Wednesday after reporting better-than-expected earnings. Whereas shares are 7% larger over the previous 12 months, they continue to be greater than 20% under their early 2023 highs earlier than the collapse of Silicon Valley Financial institution. With a single-digit earnings a number of and 4% dividend yield, shares do display cheaply. State Road’s enterprise could be very mature and commoditized, that means development might be sluggish and a reduced a number of is prone to persist, although there’s about 10% upside if web curiosity revenue certainly bottoms subsequent quarter as I anticipate.

Searching for Alpha

Within the firm’s third quarter, State Road earned adjusted EPS of $1.93, $0.10 forward of consensus, whereas income fell by 9% to $2.69 billion. Income was distorted by $294 million as the corporate took some realized losses on its funding portfolio to reinvest in securities with larger yields, which is able to improve go-forward net-interest revenue; adjusting for this, income was flat. Excluding this merchandise, EPS rose 7% from final 12 months.

State Road’s major enterprise is being a custodian. Whenever you personal securities, money, shares, bonds, funds, and so on., they really should be housed someplace. Three gamers, State Road, Financial institution of New York Mellon (BK), and Northern Belief (NTRS) dominate the custody enterprise with different companies like Fifth Third (FITB) and JPMorgan (JPM) additionally having choices. It is a low-risk, comparatively low value-add enterprise and never what’s historically considered “banking” the place funds are lent to companies and customers.

As a substitute, STT primarily earns charges as its income. Whole price income rose by 3% final quarter, although this was flattered by a tax credit score as servicing and administration charges elevated by 1%. Servicing charges are about half of income at $1.23 billion. State Road has $40 trillion in belongings beneath custody, up 12% from final 12 months, primarily as a result of larger market ranges. At this run fee, its averaging servicing price per greenback of asset beneath custody is 1.2 foundation factors. There are different charges for software program licensing and securities lending, however nonetheless as famous, this can be a extremely commoditized, low-margin enterprise. On the optimistic aspect, the companies supplied by the massive three custodians are comparable, and the price of migration may be burdensome, so enterprise tends to be pretty sticky.

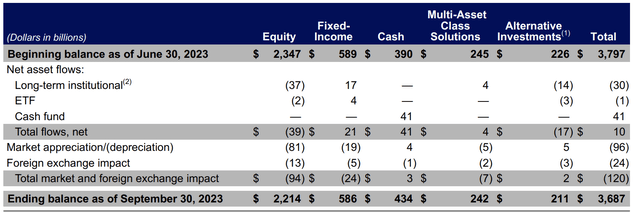

Along with its custodian enterprise, State Road has an asset administration arm, State Road International Advisors, which most notably has the SPDR ETFs, like SPY. Belongings beneath administration rose 13% to $3.69 trillion. Administration charges rose barely to $479 million. Charges listed here are comparatively low as properly, at about 5bps per greenback of AUM given a lot of the belongings are passive. As you may see under, final quarter, the agency noticed $10 billion in inflows whereas market declines brought on a $120 billion sequential decline in belongings.

State Road

One factor I’d notice is that the money fund noticed $41 billion of inflows; in any other case, STT had $31 billion of outflows. With cash funds providing 5+% yields, money funds have turn into an more and more engaging funding, significantly given unsure outlooks for different markets. When charges had been 0%, “TINA” (there isn’t any various) was a preferred phrase, however at 5%, money instantly is a viable various. Money funds are typically decrease price, so whereas inflows are at all times optimistic, a combination shift in the direction of money might be price dilutive on the margin.

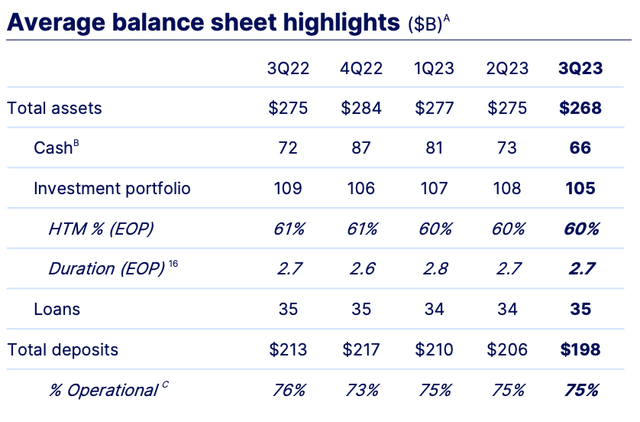

The ultimate income line merchandise is web curiosity revenue. That is the smallest, but it surely truly accounts for over two-thirds of State Road’s earnings over the previous 12 months, normalized for one-time gadgets. Web curiosity revenue of $624 million was down 10% sequentially and 6% from final 12 months. As with many banks, it has seen deposit outflow as buyers withdraw money from low-yielding deposits and transfer into treasury payments or money funds to earn over 5%. As you may see under, common deposits have fallen by $15 billion, or 7% over the previous 12 months, and this outflow has primarily been funded by letting STT’s personal money and funding portfolio slowly decline.

State Road

Non-interest bearing deposits have fallen from $61 billion in Q1 2022 to $36 billion this quarter. Whereas some balances should be maintained for working functions, as charges have risen, prospects have an incentive to reduce the stability they’re holding that earns zero, and so we have now seen a very aggressive decline on this class. The sequential drop was simply $1 billion, suggesting we could also be nearing a sensible ground right here.

STT is paying 3.13% on interest-bearing deposits, from 2.75% final quarter and 0.71% final 12 months. That 38bp sequential improve is slower than any quarter since Q2 final 12 months. Whereas State Road has seen a significant deposit outflow, which is why shares had been hit arduous earlier this 12 months when SVB’s failure brought on giant deposit churn, it does seem that almost all of the headwind is behind us.

Its funding securities are yielding 2.97%, up from 2.71% final quarter, as lower-yielding securities mature and as STT bought some at a loss to reinvest at larger yields. It’s notable that its securities portfolio now yields lower than it pays on interest-bearing deposits, a cause web curiosity revenue has been squeezed over the previous 12 months. Its $34 billion in loans are yielding 5.65% from 5.18% final quarter, serving to to offset this headwind considerably.

STT’s portfolio has a length of lower than three years, that means it has important near-term maturities, and so it ought to be capable of proceed reinvesting at larger yields to restrict additional web curiosity revenue attrition.

State Road reported an 11% frequent tier-one fairness ratio, which is wholesome given the low credit score threat nature of its enterprise. This was down from 13.2% final 12 months primarily as a result of buybacks. Its share rely is down 15% from a 12 months in the past, and there was a $1 billion buyback in Q3. Capital return goes to sluggish over the following 12 months as STT merely has much less extra capital, having paid out a lot over the previous 12 months. It’s notable that with EPS up 7% however share rely down 15%; precise earnings fell 12 months over 12 months, as a result of decrease curiosity revenue and a 3% rise in working bills.

I anticipate web curiosity revenue to fall subsequent quarter as we have now a full quarter of upper deposit charges applied throughout Q3, however in subsequent quarters, with deposit outflow pressures possible close to their completion, deposit pricing slowing, and reinvestment boosting yields, we might even see a slight enchancment in web curiosity revenue. On the identical time, I’d assume primarily no development within the custody and asset administration items, given their maturity and with modest expense will increase we may see margins be pressured a bit extra. With the flexibility to purchase again about 5% of shares on a sustaining foundation (i.e. preserving capital flat), STT has about $7.50-$7.80 in earnings energy over the following 12 months.

With little or no development and dependence on rates of interest for its earnings, I consider STT goes to structurally have a low a number of, particularly because the buyback tempo is probably going set to sluggish. Nevertheless, even at 10x earnings, shares can transfer into the higher $70s. State Road won’t ever be a “high-flying” inventory, however for buyers searching for a steady enterprise, safe dividend, and reasonable share worth appreciation, I consider STT can fit your wants.