- Helius Labs’ exec raises considerations about huge companies being prime Solana validators.

- Nonetheless, one among Solana’s native validators is amongst the tremendous minority group.

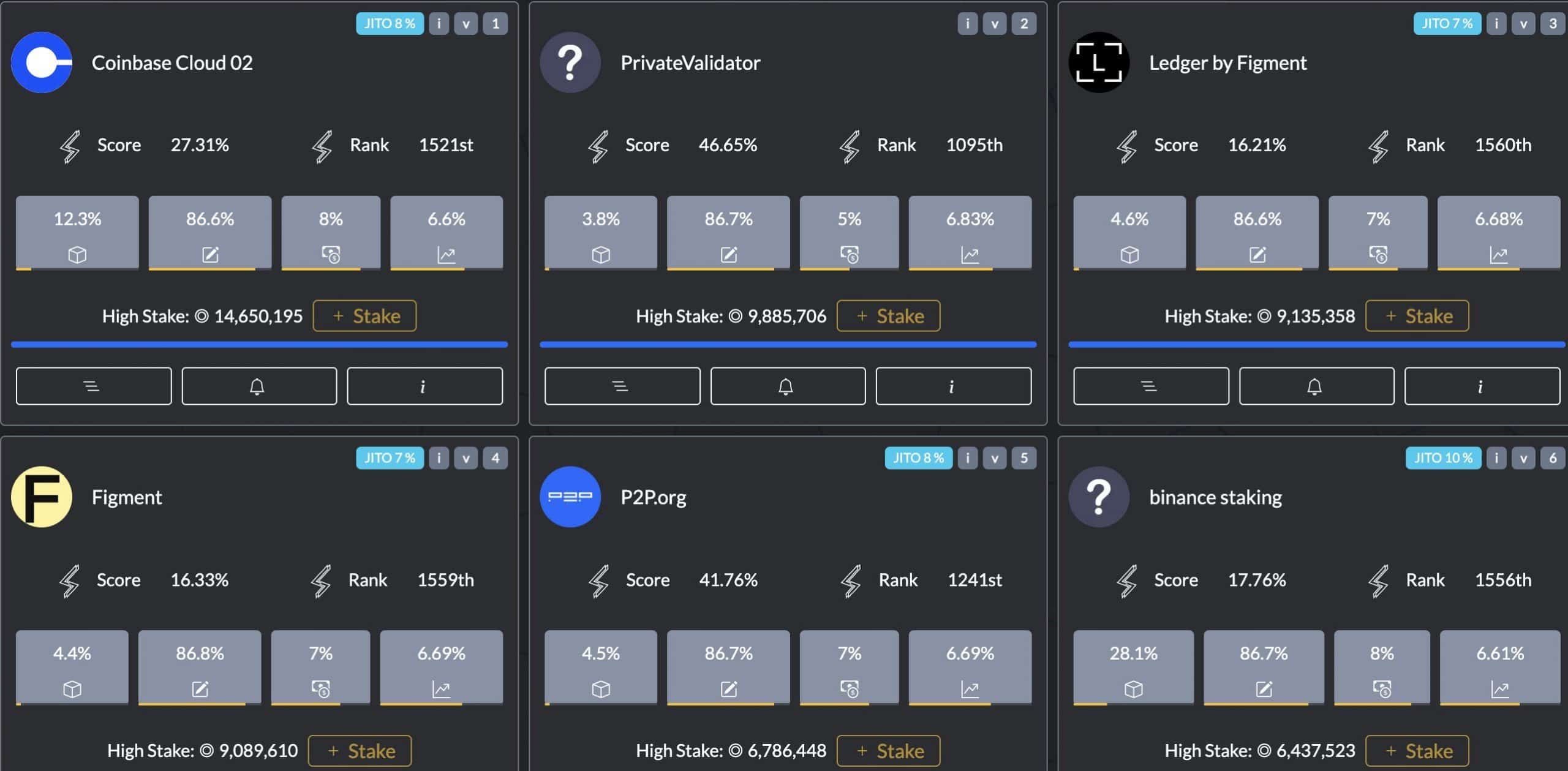

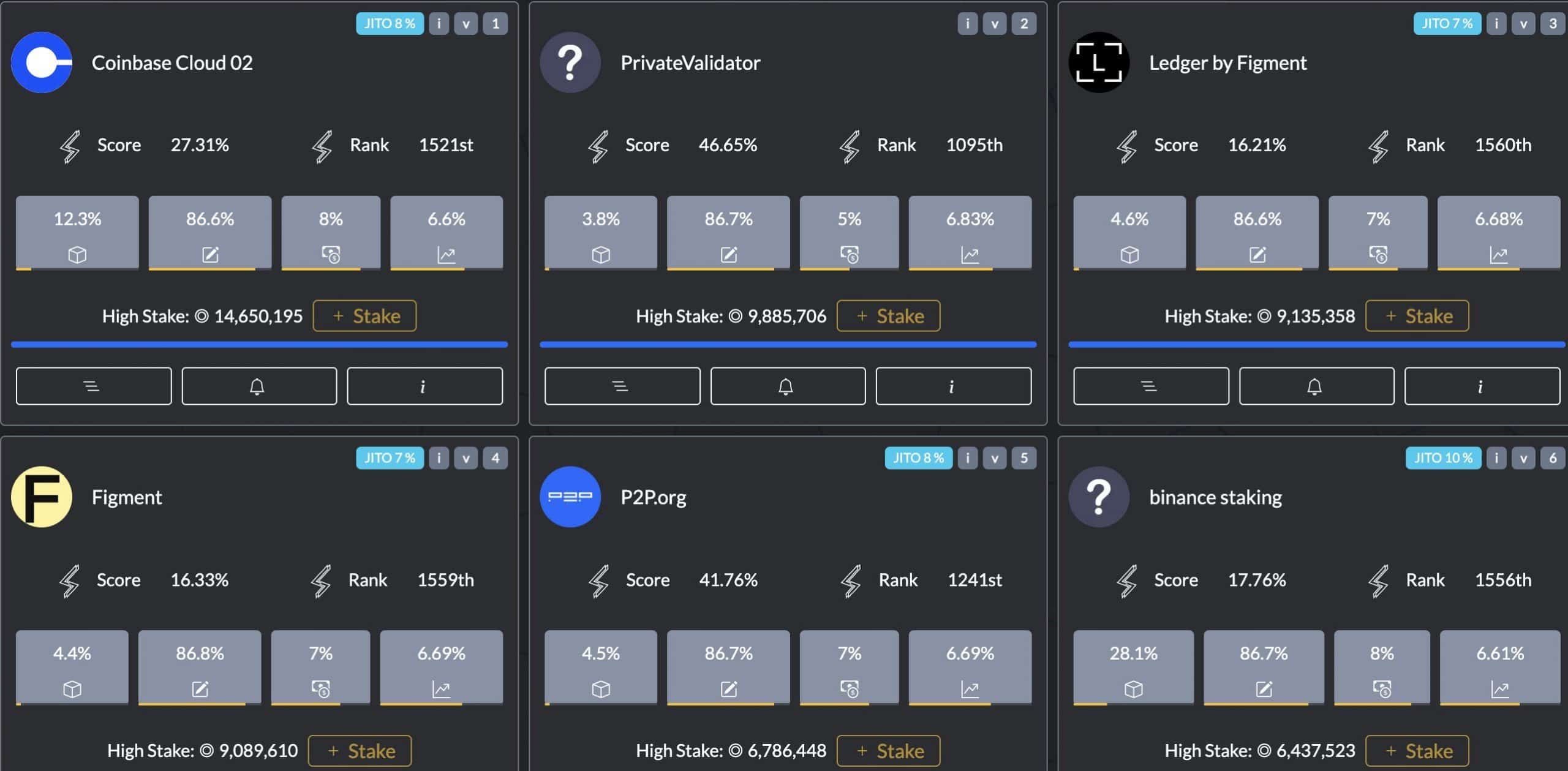

Large companies like Coinbase and Binance [BNB] largely dominate the Solana [SOL] validator ecosystem. There are over 1700 Solana validators, with 22 controlling over 33% of the whole staked SOL (superminority).

Mert Mumtaz, Co-founder and CEO of Helius Labs — a Solana developer platform for crypto traders, has raised considerations about this dominance.

Taking a swipe on the large company’s false “belief,” “safety,” and excessive charges, the Helius Lab government has called for customers and traders to think about staking with Solana native groups.

“Massive companies usually offer you some false sense of belief and safety. Belief me once I say that Solana is complicated sufficient {that a} Solana-native crew can navigate uncertainty a lot better than any large company.”

The issue with prime Solana validators

In response to Mert Mumtaz, the highest six large companies working Solana validators cost an 8% fee. It is a excessive payment when there are alternate options, per Mumtaz;

“Actually don’t like that the highest six validators on Solana are large companies as a substitute of Solana-native crew, want to vary this. And so they cost as much as 8% fee. Stake with native groups, you’re paying an excessive amount of in charges”

Supply: X/OxMert

The exec tipped Solana native crew validators like Cogent, Laine, and Overlock. He added that,

“You get a a lot increased yield with most Solana-native groups, so it’s actually safer, a greater funding into the community, and a greater return .”

Apparently, based on Solana Seashore data, Laine (Laine stakewiz.com), one of many groups Mumtaz tipped, is amongst the highest 22 validators.

Which means it’s a part of the super-minority that may theoretically censor the community in the event that they collude—a crucial centralization danger. That appears counterintuitive to what Mumtaz goals to attain, particularly on the “safety” entrance.

Within the meantime, SOL reversed its post-network improve rally and traded at $133 at press time.

On the upper timeframe charts, $130 was a vital assist degree for bulls. So, a drop under it might provide bears extra leverage.