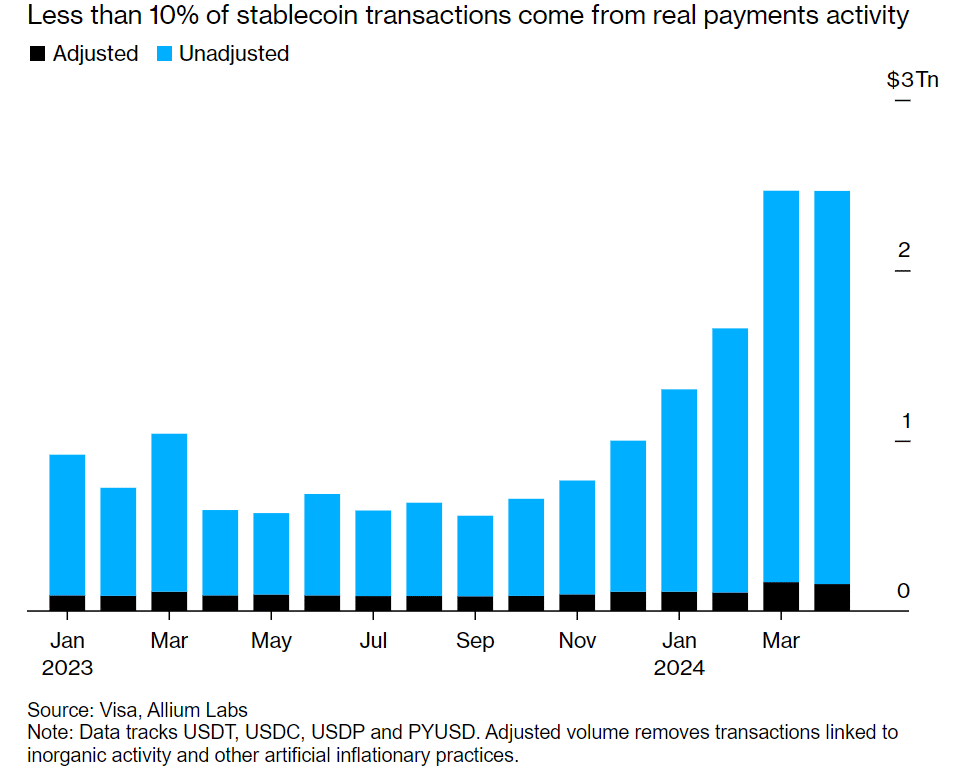

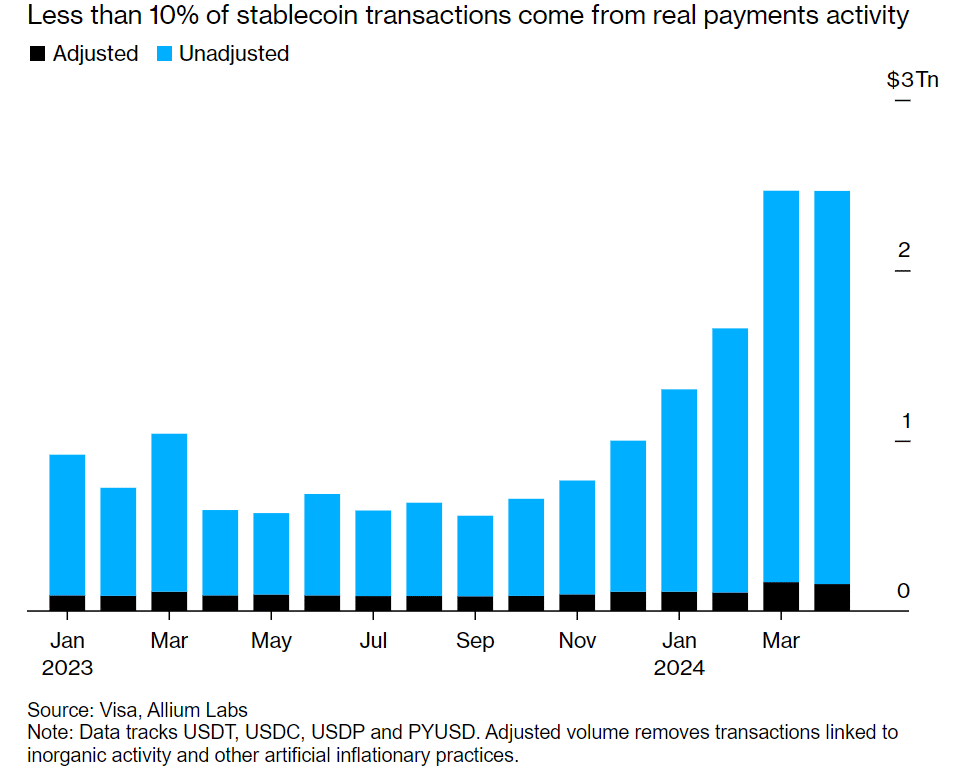

- Over 90% of stablecoin volumes are linked to bots and enormous merchants.

- The findings counsel that stablecoin funds haven’t hit mainstream adoption but.

Solely lower than 10% of the April stablecoin transaction quantity was linked to real customers.

In keeping with a Bloomberg report, which cited Visa Inc.’s newest findings, over 90% of quantity was linked to bots and large-scale merchants.

A part of the report highlighted that,

“Out of about $2.2 trillion in whole transactions in April, simply $149 billion originated from natural funds exercise”

Supply: Bloomberg

In comparison with the $150 trillion funds business, the report prompt that stablecoins had been removed from hitting mainstream adoption as a fee choice.

Stablecoin have an extended method to hit mainstream adoption

Paypal and Stripe are some conventional fee ecosystem gamers which have entered into the stablecoins area.

Visa, a significant conventional participant, dealt with $12 trillion in transactions final yr alone. Most market watchers view the worldwide mainstream adoption of stablecoin funds as a direct risk to Visa’s enterprise.

Nevertheless, some market watchers imagine that the market is in its early levels and mainstream adoption may happen in the long term, however within the brief or midterm, consideration ought to be on the fee rails.

One analyst, Pranav Sood, basic supervisor on the fee platform Airwallex, commented,

“The short-term and the mid-term focus must be on ensuring that present rails work significantly better.”

Within the meantime, the stablecoin market surged additional amidst market enchancment from large drawdowns in March and April.

Its market cap hit $160B, with DAI dominating notable development from blue-chip stablecoins.

On the month-to-month entrance, Ethena’s USDe and First Digital’s FDUSD registered double-digit development, DeFiLlama data confirmed. DAI, USDT, and USDC adopted carefully with single-digit development in that order.

A surge in stablecoin holdings, particularly by whales, may imply massive gamers positioning for discounted gives, inducing the markets.

At press time, Bitcoin [BTC] was again in its $60K—$71K vary, and an additional uptick in stablecoins may drive further market upside.