Torsten Asmus

S&P 500 (NYSEARCA:SPY) was down for 3 straight days after the Fed’s assembly. Fed simply introduced their most up-to-date evaluation of the economic system, and we consider there are just a few factors that buyers ought to take into account for the administration of their portfolios in 2024.

1. Fed Shifts Consideration from Inflation to Unemployment

Whereas Fed Chair Powell states that combating inflation stays the first focus, the Fed’s up to date projections level to a possible shift in the direction of elevated vigilance on unemployment and GDP progress as nicely.

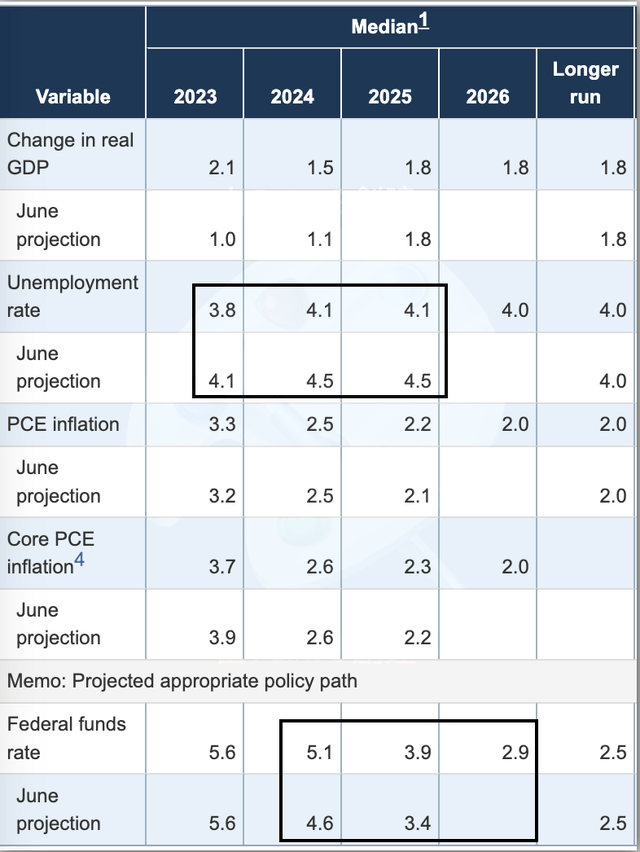

Within the Federal Reserve’s newest projections, they lowered their core PCE inflation forecast to three.7% for 2023 from a previous 4.3% estimate, whereas conserving their 2024 inflation outlook unchanged at 2.6%. Nevertheless, regardless of tapering near-term inflation views, the Fed considerably raised its federal fund’s fee path, now anticipating to maintain charges “larger and longer”. Particularly, the Fed elevated its 2024 Fed funds fee projection to five.1% from 4.6% beforehand and boosted its 2025 estimate to three.9% from 3.1% earlier than.

FED

This implies that the Fed is fearful that robust employment can increase GDP progress and thus “might” have a possible influence on inflation. Since they decrease and even preserve the core inflation forecast, we will assume it is simply the Fed’s precautious measure as their mannequin at the moment factors to larger GDP progress because of stronger-than-expected employment however not inflicting excessive inflation.

2. US Economic system Anticipates Vital Constraints in 2024

Based mostly on the Fed’s projection, actual GDP progress will decelerate or “ought to” decelerate in 2024 and see a rebound in 2025. We expect that this implies the Fed is prone to proceed to hamper GDP progress in 2024 and thus is prone to have a robust restriction impact on the US economic system. This additionally often is the driver behind the current inventory pullback after the Fed’s assembly.

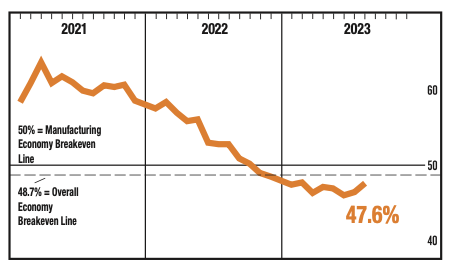

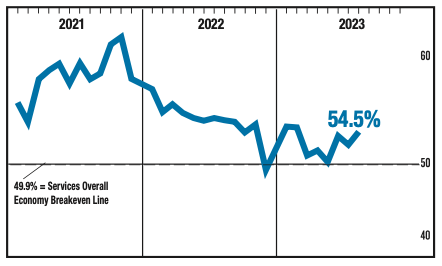

As well as, there are lagging results from the Fed’s excessive fee coverage, therefore Fed determined to observe and study. As proof, manufacturing PMIs turned adverse in late 2022 and have stayed under the 50 growth/contraction threshold in 2023. Service PMIs stay barely above 50 however are nicely off 2022 ranges.

Manufacturing ISM (ISM)

Service ISM (ISM)

With coverage impacts spreading by means of the economic system, the Fed appears intent on tamping down demand to fight residual inflationary pressures. This factors to appreciable financial restraint in 2024 till the Fed sees concrete disinflation and moderating wage and employment developments.

Traders ought to put together for a restrictive coverage surroundings in 2024 that can weigh on progress. The Fed is intentionally trying to cool the economic system by means of fee hikes and QT, suggesting significant headwinds at the same time as inflation moderates. Markets might have to reset expectations for the tempo of growth subsequent yr.

Valuation

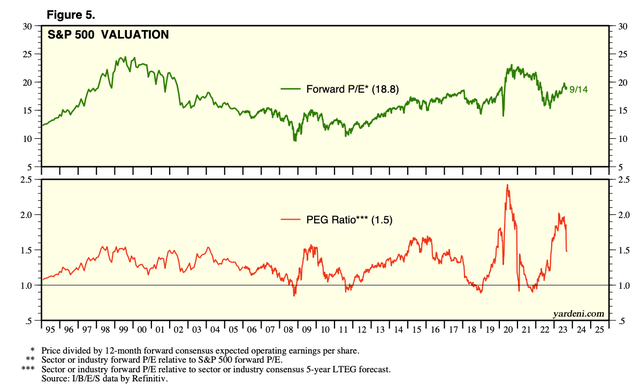

Present valuation ranges for the S&P 500 reinforce our view that lively inventory selecting will probably be essential in 2024 slightly than simply passive index publicity.

Yardeni Analysis

Particularly, the S&P 500’s P/E ratio is buying and selling across the median of its historic vary at roughly 19x. This means valuations are honest relative to historical past however not essentially low cost.

Moreover, the index’s PEG ratio has risen above 1.5x not too long ago, placing it close to the highest finish of its historic band. A PEG above 1x usually indicators weaker anticipated returns from an index as earnings progress is already priced in.

Given these metrics displaying the S&P 500 at round honest worth at greatest at the moment, we don’t see engaging risk-adjusted returns from broad passive investing within the index. The upside seems restricted with out a re-rating larger.

Inventory Choosing (Alpha Investing) Set to Lead 2024 Funding Traits

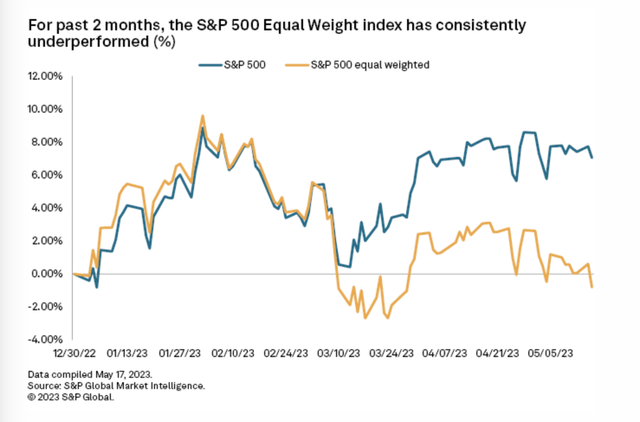

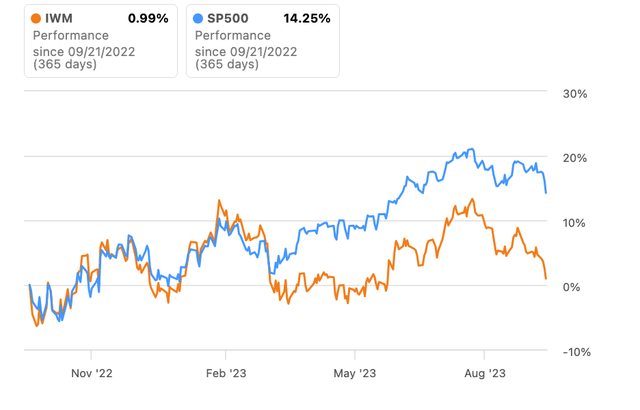

The divergent efficiency between the S&P 500 and the equal-weighted S&P 500 underscores that alpha era was essential in 2023 and we consider will probably be as vital for buyers in 2024.

S&P

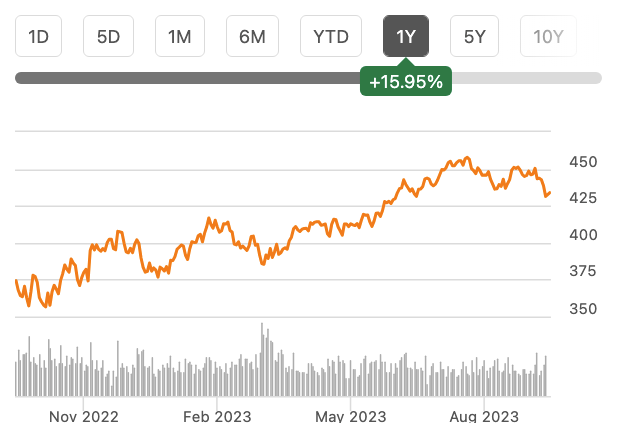

Looking for Alpha

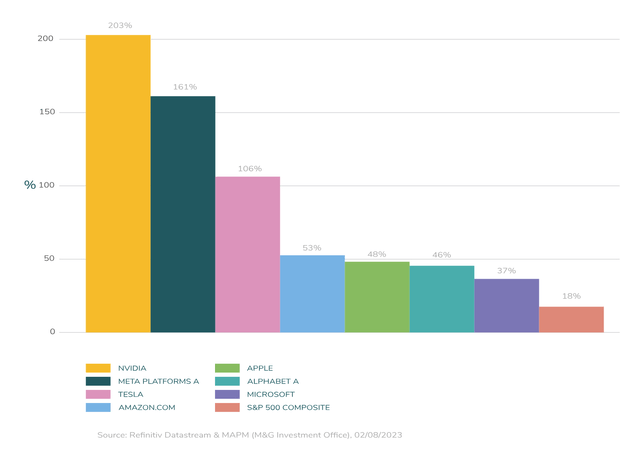

Redfinitive (Redfinitive)

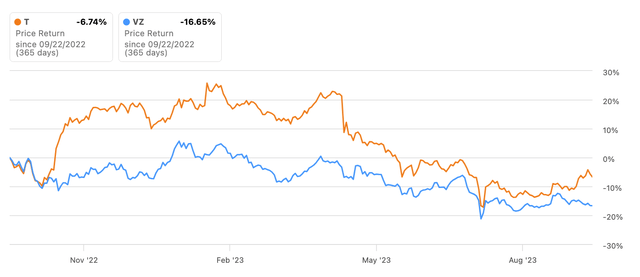

On this high-rate surroundings, sectors depending on low cost financing like telecom and housing are affected by demand destruction. AT&T(NYSE:T) and Verizon(NYSE:VZ) exemplify telecoms shedding progress prospects amid diminished leverage capability for buyback and dividends.

Looking for Alpha

Nevertheless, corporations like Nvidia (NVDA) and Microsoft (MSFT) that may nonetheless develop earnings in a restrictive local weather have richly rewarded buyers. The mega-cap tech leaders benefited from power in two key areas in 2023 – each sturdy steadiness sheets to keep up spending whereas others reduce, and AI/cloud computing tailwinds. Inventory selecting has been key to outperform in 2023.

With the economic system and earnings outlooks stabilizing, lively choice of recovering cyclical progress/worth shares may lastly repay. Whereas main tech shares energy markets in 2023, buyers ought to deal with completely different themes and sectors in 2024 because the high-rate surroundings ought to have an uneven influence on completely different sectors/cycles.

Tech Product Class Growth and Penetration Price: The Twin Focus for Progress

Regardless of the consequences of interest-rate sensitivity influencing shopper spending, we consider that these sectors are nearing their lowest level. With sturdy employment, the diminishing provide is prone to align with the foundational demand. Nevertheless, within the coming yr progress prospects seem much less uniform throughout huge tech. Quite than routinely defaulting to huge tech in 2024, buyers ought to prioritize figuring out corporations that may ship progress in a restrictive surroundings. The flexibility to develop the person base will probably be a key separator.

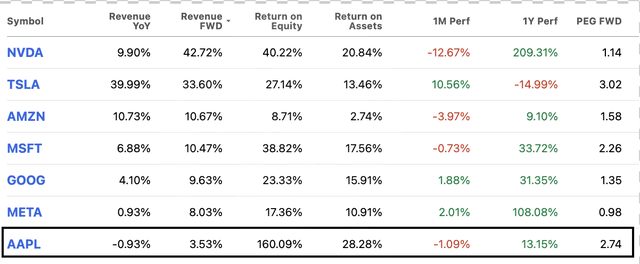

For instance, among the many mega-cap, we’re cautious about Apple (AAPL) heading into 2024, questioning its product and providers progress momentum as its valuation is comparatively costly.

Looking for Alpha

Amongst mega-caps, we stay constructive on Alphabet (GOOG) (GOOGL), Amazon (AMZN), Microsoft (MSFT), and Tesla (TSLA) primarily based on their alternatives in cloud computing, e-commerce/shopper, enterprise software program and vitality transitions, respectively. Nvidia is a wild card to us with its booming knowledge heart enterprise however dangers exterior core computing verticals.

With much less uniform outlooks, buyers must be selective in figuring out sturdy progress alternatives. As lots of the AI progress tales have been included in inventory valuation, we consider that giant tech product class growth and penetration fee are the 2 principal progress areas of focus.

Specializing in Buyer Progress: A Precedence for Struggling Small and Mid-Cap Corporations

Past mega-caps, chosen mid and small-cap shares additionally current alpha alternatives in 2024 as components of the economic system stabilize after a restrictive interval.

Looking for Alpha

Many smaller corporations struggled with progress and money flows within the larger fee surroundings of 2022-2023, inflicting small/mid-cap indexes to lag the S&P 500. Nevertheless, downtrodden valuations have created bargains.

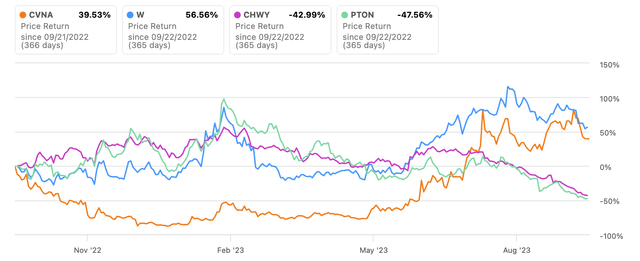

Astute inventory selecting can uncover smaller corporations seeing bettering buyer developments and money flows after right-sizing for weaker demand. For instance, we advisable shopping for Carvana(NYSE:CVNA) and Wayfair(NYSE:W) in April primarily based on early indicators of stabilization – each shares are up over 500% and 70%, respectively, since then.

Looking for Alpha

The keys had been slowing buyer losses and optimistic free money circulation, which shifted these shares from distressed to progress valuations. The sharp share value recoveries underscored how deeply pessimistic markets bought on sure cyclical names.

In distinction, in different examples, we had been optimistic about Chewy(NYSE:CHWY) and Peloton(NYSE:PTON). Nevertheless, their shares had been hampered as their buyer churn continued deteriorating, signaling fragile demand, regardless of each producing optimistic free money circulation once more.

Therefore, for small or mid-cap traded at distressed worth, buyer progress capabilities needs to be the highest criterion amid muted macro situations in 2024 as buyer progress can maintain the expansion story.

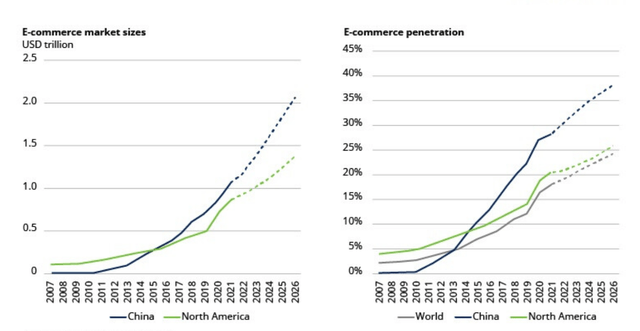

Persistent Rise in E-commerce Penetration

A key ongoing pattern is the continued penetration of e-commerce and non-store retailers, even in a rising fee surroundings. This theme underpins our curiosity in analyzing corporations like Carvana, Wayfair, Chewy, and Peloton.

Many buyers underestimate these unprofitable e-commerce platforms, assuming they can’t attain profitability. Nevertheless, the secular shift to on-line buying nonetheless has room to run in our view. In keeping with US census knowledge, even whereas different sectors suffered uneven growth in 2023, the penetration of non-store retailers confirmed an upward pattern.

US census, LEL

In comparison with the US, China has the next fee of e-commerce penetration. We expect it’s because there are fewer bodily retailer networks in China, which has sped up the adoption of e-commerce. E-commerce, nevertheless, is altering extra than simply how prospects purchase items and providers; it’s also remodeling how companies use data-driven insights to streamline operations. Therefore, E-commerce leaders ought to undertake these methods early as AI expertise advances, giving them a aggressive benefit. We due to this fact are optimistic for continued e-commerce penetration progress within the US.

Euromonitor

Conclusion

We consider 2024 will probably be one other yr that rewards lively inventory selecting over passive index investing methods.

The restrictive financial coverage surroundings is prone to have uneven impacts throughout sectors and firms. These in a position to maintain progress amidst headwinds will stand out.

Quite than counting on broader indexes in 2024, buyers ought to focus their analysis on figuring out particular person names with upside potential as market expectations readjust decrease.

Enticing alternatives are rising in recovering areas of the economic system after deep pessimism in 2022-2023. Being selective with cyclical worth exposures may repay.

Moreover, structural progress tales in areas like small or mid-cap e-commerce and expertise have been over-penalized as a result of downswing, offering an opportunity to purchase into secular developments at higher valuations.

With crosscurrents persisting, having publicity to the best shares and avoiding landmines issues extra than simply index publicity subsequent yr. We suggest buyers spend time researching alpha alternatives to verify their portfolio is positioned to outperform.

Given headwinds for passive investing, we’re impartial on the general S&P 500 index for 2024 and see higher risk-adjusted returns in inventory selecting slightly than broad publicity.