Ilija Erceg

Direxion Day by day S&P 500® Bear 3X Shares ETF (NYSEARCA:SPXS) is among the hottest devices to brief the broad marketplace for buying and selling or hedging functions. Nevertheless, its each day -3X leverage issue is a supply of drift. It should be intently monitored to detect modifications within the drift regime. This text explains what “drift” means, quantifies it in additional than 20 leveraged exchange-traded funds (“ETFs”), reveals historic knowledge, and eventually concludes in regards to the present market situations. The evaluation can also be legitimate for the ProShares UltraPro Quick S&P500 ETF (SPXU), which tracks the identical index with the identical issue and has an nearly an identical habits.

The explanation why leveraged ETFs drift

Leveraged ETFs usually underperform their underlying index leveraged by the identical issue. The decay has basically 4 causes: beta-slippage, roll yield, monitoring errors, administration prices. Beta-slippage is the principle purpose in fairness leveraged ETFs. To know what’s beta-slippage, think about a really unstable asset that goes up 25% sooner or later and down 20% the day after. An ideal 2x leveraged ETF goes up 50% the primary day and down 40% the second day. On the shut of the second day, the underlying asset is again to its preliminary worth:

(1 + 0.25) x (1 – 0.2) = 1

In the identical time, the right leveraged ETF has misplaced 10%:

(1 + 0.5) x (1 – 0.4) = 0.9

It isn’t a rip-off, simply the conventional habits of a leveraged and rebalanced portfolio. A excellent news: in a trending market, beta-slippage could be constructive. If the underlying index goes up 10% two days in a row, on the second day, it’s up 21%:

(1 + 0.1) * (1 + 0.1) = 1.21

The right 2x leveraged ETFs is up 44%:

(1 + 0.2) * (1 + 0.2) = 1.44

Beta-slippage is path-dependent. If the underlying index positive factors 50% on day 1 and loses 33.33% on day 2, it’s again to its preliminary worth, like within the first instance. Nevertheless, the 2x ETF loses one third of its worth, as a substitute of 10% within the first case:

(1 + 1) x (1 – 0.6667) = 0.6667

With no demonstration, it reveals that the upper the volatility, the upper the decay.

Month-to-month and yearly drift watchlist

There is no such thing as a commonplace or common definition of leveraged ETF drift. Mine is straightforward and primarily based on the distinction between the leveraged ETF efficiency and Ñ instances the efficiency of the underlying index on a given time interval, if Ñ is the leveraging issue. More often than not, this issue defines a each day goal relative to an underlying index. Nevertheless, some dividend-oriented leveraged merchandise have been outlined with a month-to-month goal, largely defunct exchange-traded notes (“ETNs”) sponsored by Credit score Suisse and UBS: CEFL, BDCL, SDYL, MLPQ, MORL…

First, let’s begin by defining “Return”: it’s the return of a leveraged ETF in a given time interval, together with dividends. “IndexReturn” is the return of a non-leveraged ETF on the identical underlying asset in the identical time interval, together with dividends. “Abs” is absolutely the worth operator. My “Drift” is the drift of a leveraged ETF normalized to the underlying index publicity in a time interval. It’s calculated as follows:

Drift = (Return – (IndexReturn x Ñ))/ Abs(Ñ)

“Decay” means unfavourable drift. “Month” stands for 21 buying and selling days, “12 months” for 252 buying and selling days.

|

Index |

Ñ |

Ticker |

1-month Return |

1-month Drift |

1-year Return |

1-year Drift |

|

S&P 500 |

1 |

SPY |

9.13% |

0.00% |

17.30% |

0.00% |

|

2 |

SSO |

18.26% |

0.00% |

26.25% |

-4.18% |

|

|

-2 |

SDS |

-15.30% |

1.48% |

-21.49% |

6.56% |

|

|

3 |

UPRO |

28.11% |

0.24% |

34.23% |

-5.89% |

|

|

-3 |

SPXS |

-22.54% |

1.62% |

-33.98% |

5.97% |

|

|

ICE US20+ Tbond |

1 |

TLT |

9.92% |

0.00% |

-7.24% |

0.00% |

|

3 |

TMF |

29.40% |

-0.12% |

-36.38% |

-4.89% |

|

|

-3 |

TMV |

-25.21% |

1.52% |

21.37% |

-0.12% |

|

|

NASDAQ 100 |

1 |

QQQ |

10.82% |

0.00% |

39.53% |

0.00% |

|

3 |

TQQQ |

33.83% |

0.46% |

114.97% |

-1.21% |

|

|

-3 |

SQQQ |

-26.18% |

2.09% |

-65.20% |

17.80% |

|

|

DJ 30 |

1 |

DIA |

9.15% |

0.00% |

8.49% |

0.00% |

|

3 |

UDOW |

28.12% |

0.22% |

7.83% |

-5.88% |

|

|

-3 |

SDOW |

-22.21% |

1.75% |

-13.92% |

3.85% |

|

|

Russell 2000 |

1 |

IWM |

9.20% |

0.00% |

0.08% |

0.00% |

|

3 |

TNA |

26.31% |

-0.43% |

-20.83% |

-7.02% |

|

|

-3 |

TZA |

-24.58% |

1.01% |

-6.06% |

-1.94% |

|

|

MSCI Rising |

1 |

EEM |

7.79% |

0.00% |

5.38% |

0.00% |

|

3 |

EDC |

23.25% |

-0.04% |

-4.11% |

-6.75% |

|

|

-3 |

EDZ |

-19.78% |

1.20% |

-11.84% |

1.43% |

|

|

Gold spot |

1 |

GLD |

2.53% |

0.00% |

15.99% |

0.00% |

|

2 |

UGL |

4.25% |

-0.41% |

22.30% |

-4.84% |

|

|

-2 |

GLL |

-4.13% |

0.47% |

-19.94% |

6.02% |

|

|

Silver spot |

1 |

SLV |

10.25% |

0.00% |

18.25% |

0.00% |

|

2 |

AGQ |

20.55% |

0.03% |

22.54% |

-6.98% |

|

|

-2 |

ZSL |

-18.48% |

1.01% |

-35.66% |

0.42% |

|

|

S&P Biotech Choose |

1 |

XBI |

14.03% |

0.00% |

-5.57% |

0.00% |

|

3 |

LABU |

41.91% |

-0.06% |

-41.41% |

-8.23% |

|

|

-3 |

LABD |

-36.65% |

1.81% |

-15.27% |

-10.66% |

|

|

PHLX Semicond. |

1 |

SOXX |

16.11% |

0.00% |

41.76% |

0.00% |

|

3 |

SOXL |

53.09% |

1.59% |

96.07% |

-9.74% |

|

|

-3 |

SOXS |

-37.68% |

3.55% |

-75.96% |

16.44% |

The most effective and worst drifts

- The leveraged bull ETFs in actual property (TNA) and gold (UGL) have the biggest, however average, month-to-month decays of this record: -0.43% and -0.41%, respectively.

- The leveraged bear biotechnology ETF (LABD) reveals the worst 12-month decay: -10.66%.

- The leveraged bear semiconductors ETF (SOXS) has the best constructive drift in a single month: 3.55%.

- The leveraged bear Nasdaq 100 ETF (SQQQ) reveals the best 12-month constructive drift : 17.80%, in a big loss.

- SPXS has a constructive drift in each time frames: 1.62% in a single month, 5.97% in 12 months.

Constructive drift follows a gradual development within the underlying asset, regardless of the development path and the ETF path. It means constructive drift might include a acquire or a loss for the ETF. Unfavourable drift comes when each day returns skip between constructive and unfavourable values (“whipsaw”).

Concentrate on SPXS historical past

Since inception on 11/5/2008, SPXS has misplaced 99.99% of its worth, via many reverse splits. Nevertheless, hedging with SPXS has labored fairly effectively in lots of circumstances. For instance, within the first week of the 2020 market meltdown (2/21 to 2/28/2020), it has gained about 40%, considerably greater than SPY’s return (-11%) multiplied by the leveraging ratio (-3). Then, I’ve issued a warning on 3/10/2020 in opposition to leveraged fairness ETFs. A couple of weeks later, SPY had misplaced 17.5% and SPXS gained about 16% in the identical time: lower than by shorting SPY with out leverage. Then, the month-to-month drift has oscillated between constructive and unfavourable values, and the 12-month drift was unfavourable till February 2021. It grew to become constructive once more and spiked in April 2021. Final 12 months’s bear market put it again in unfavourable territory in April 2022. It’s barely constructive now.

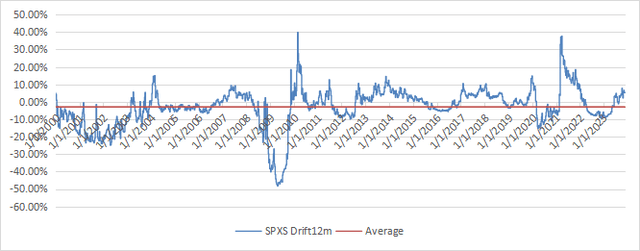

The subsequent chart plots the 12-month drift since January 2000, utilizing actual costs from November 2008, and artificial costs primarily based on the underlying index earlier than that. The historic common is unfavourable: -3.03%.

Twelve-month drift of SPXS, simulated earlier than inception date (chart: writer; knowledge: Portfolio123)

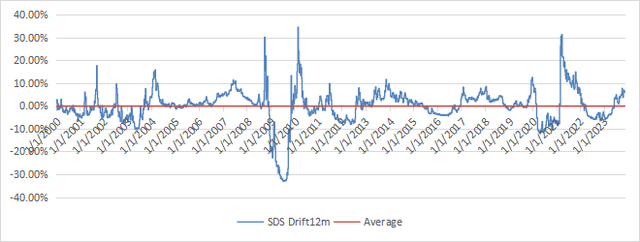

Direxion Day by day S&P 500® Bear 3X Shares ETF is an environment friendly hedging instrument in opposition to sharp corrections in a bull market. Furthermore, the price of hedging is sort of low-cost in contrast with different derivatives. Nevertheless, it suffers a big decay when the S&P 500 has alternatively constructive and unfavourable days. The VIX index (implied volatility) could also be a warning, however it’s not mathematically associated to decay. In unstable instances, ProShares UltraShort S&P500 ETF (SDS) incurs a lesser danger of decay, as plotted on the following chart. The historic common is near zero (-0.09%).

Twelve-month drift of SDS, simulated earlier than inception date (chart: writer; knowledge: Portfolio123)

Moreover, shorting an asset or shopping for an inverse ETF implies a further decay attributable to inflation and magnified by the leveraging issue.

In conclusion, leveraged ETFs are designed for seasoned merchants understanding the implications of leveraging and the inflation bias. Most traders ought to keep away from them.