- Analyst’s remarks hinted at Ethereum ETFs probably beginning on 2 July

- Bitcoin appears to be underperforming forward of ETH ETF approval

Following SEC Chair Gary Gensler’s promising remarks (“someday over the course of this summer time”) concerning the approval timeline for Ethereum [ETH] spot Alternate Traded Funds (ETFs), Bloomberg’s Senior Analyst Eric Balchunas is within the information immediately after he specified a possible begin date.

Balchunas prediction: Actuality or no?

In keeping with Balchunas, Ether ETFs may doubtlessly begin buying and selling in the US as early as 2 July. He stated,

“We’re shifting up our over/underneath date for the launch of spot Ether ETF to July 2nd, listening to the Workers despatched issuers feedback on S-1s immediately, and so they’re fairly mild, nothing main, asking for them again in every week.”

This information has sparked optimism throughout the cryptocurrency neighborhood, particularly concerning Ethereum’s upcoming market alternatives.

The truth is, the analyst additionally alluded to the truth that the aforementioned launch could also be timed to align as carefully as attainable with 4 July, the US’ Independence Day.

“Respectable likelihood they work to declare them efficient the subsequent week and get it off their plate bf vacation wknd. Something poss however that is our greatest guess as of now.”

Bitcoin ETF vs. Ethereum ETF

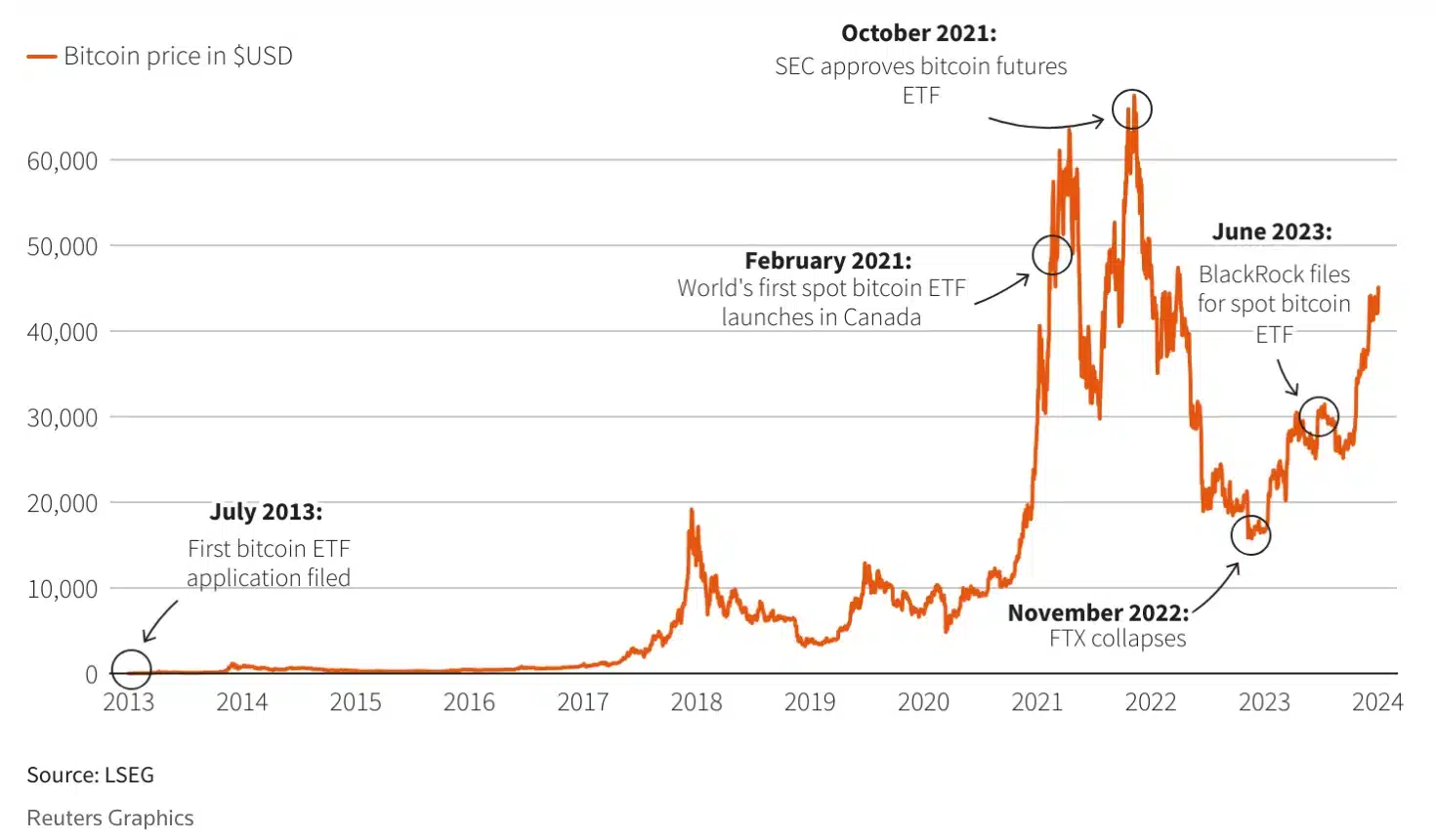

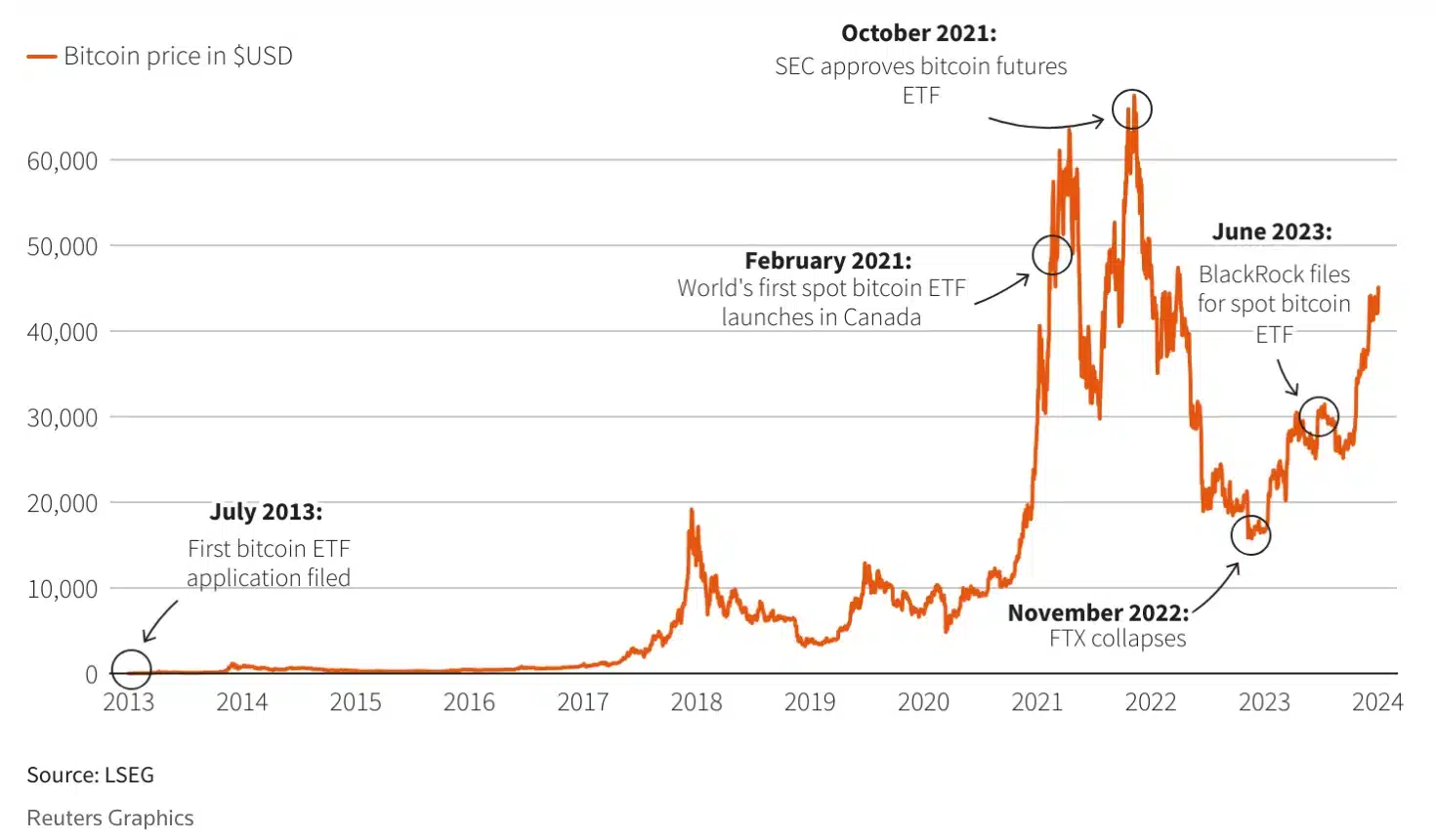

The delay in approving ETH ETFs stands nowhere near the prolonged journey of Bitcoin [BTC] ETFs’ approval course of.

All the best way again in July 2013, Cameron and Tyler Winklevoss, founders of the Gemini crypto trade, filed their preliminary utility with the SEC to determine a spot Bitcoin ETF.

Quick ahead to January 2024, after practically a decade of regulatory scrutiny and a number of functions, the SEC lastly accepted 11 Bitcoin ETFs.

Supply: Reuters

Drawing parallels between the approval processes of Bitcoin and Ethereum ETFs, it’s noteworthy that after the BTC ETF’s approval, Ethereum noticed a big rally, rising by 9.1% whereas Bitcoin underperformed.

And now, with the anticipation of the ETH ETF approval, Ethereum, the second-largest altcoin, stands out amidst a market downturn.

On the time of writing, Bitcoin and plenty of different cryptocurrencies had been flashing crimson candlesticks on their every day charts. Quite the opposite, Ethereum was within the inexperienced following a modest hike of simply over 1%.

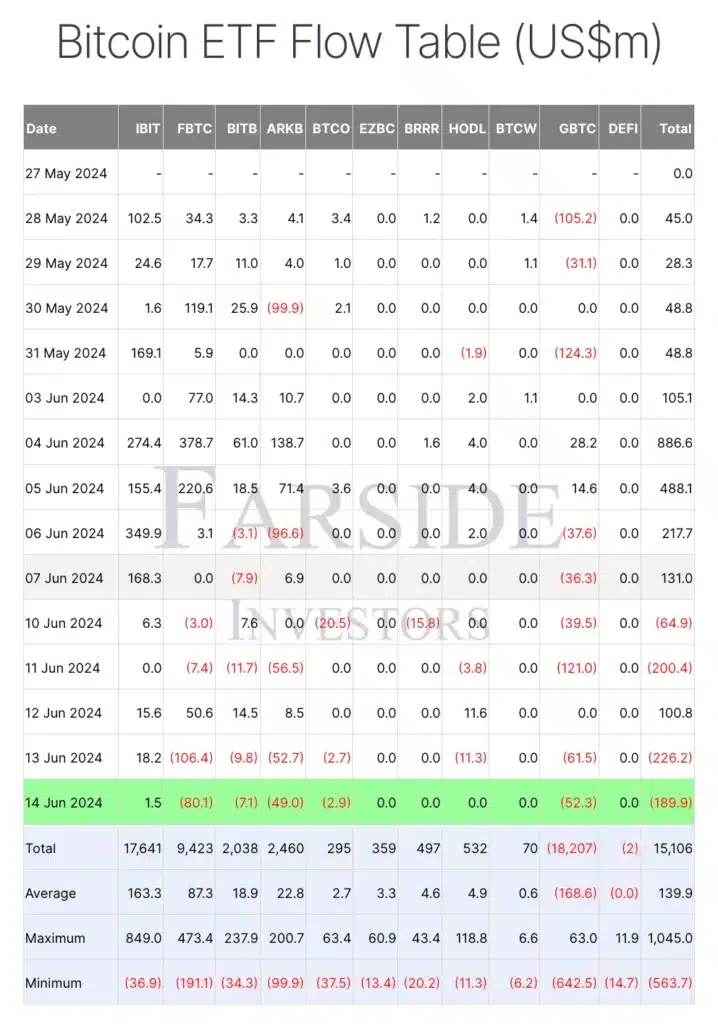

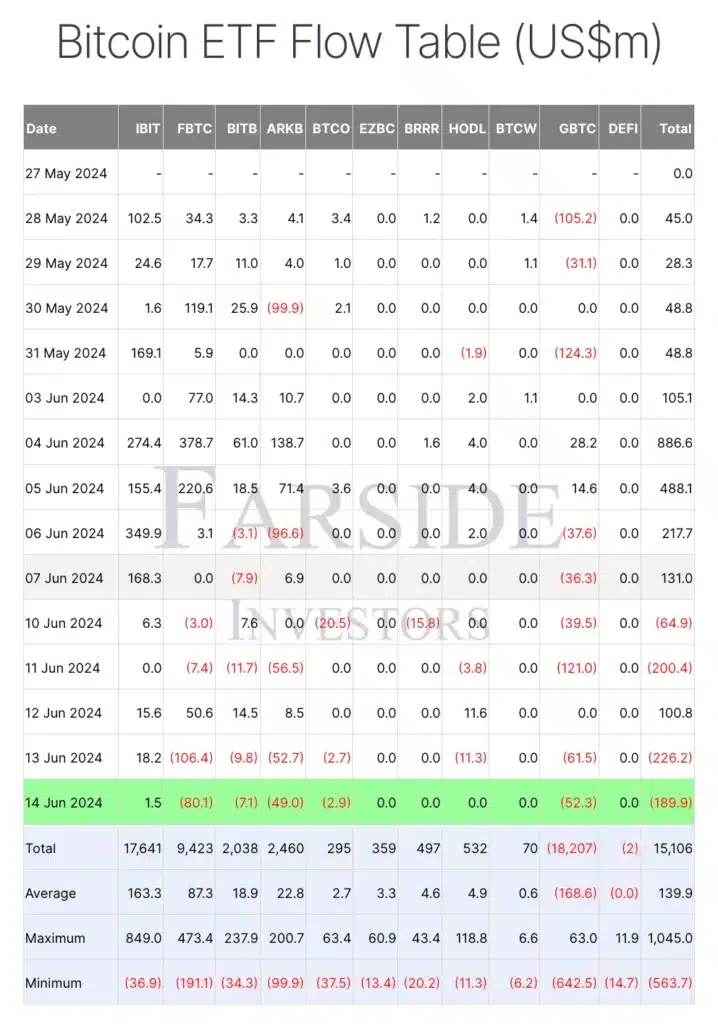

Moreover, in response to a current report by Farside Investors, spot BTC ETFs noticed two consecutive days of outflows on 13 and 14 June, totaling $416.1 million.

Supply: Farside Traders

Widespread analyst Willy Woo pitched in to remark too. He said,

Supply: Willy Woo/X

Future stays unsure

General, whereas the dynamics are constantly altering throughout the crypto market, it’s nonetheless too early to definitively conclude whether or not buyers are shifting away from Bitcoin in direction of Ethereum.

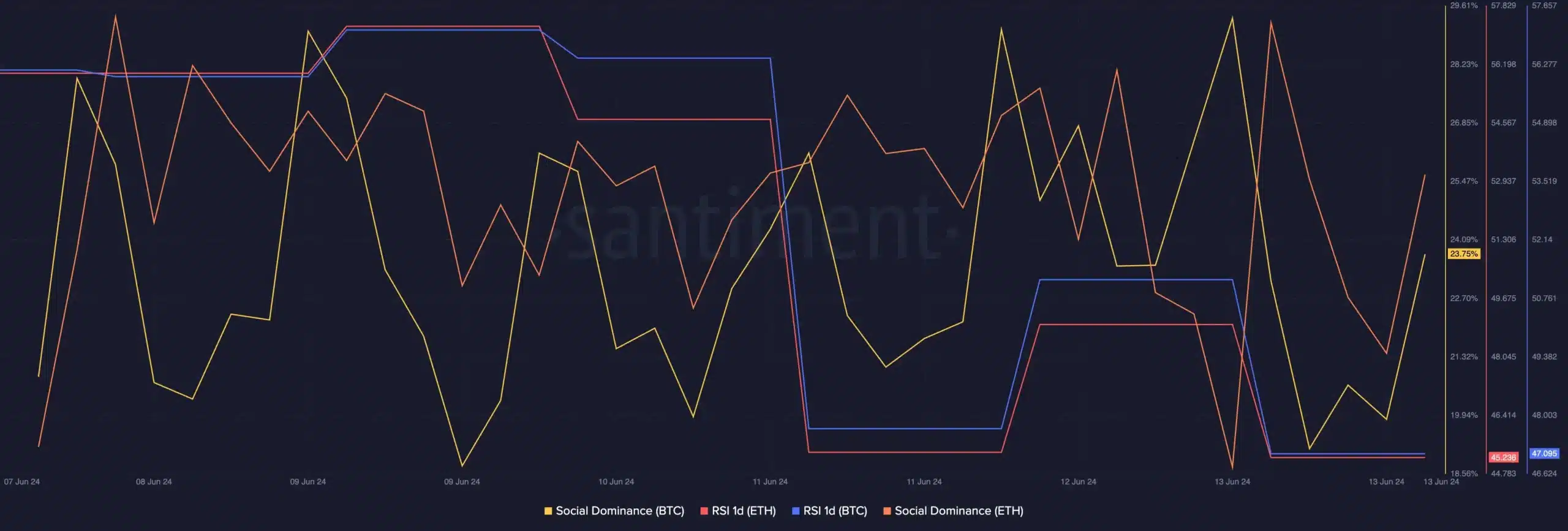

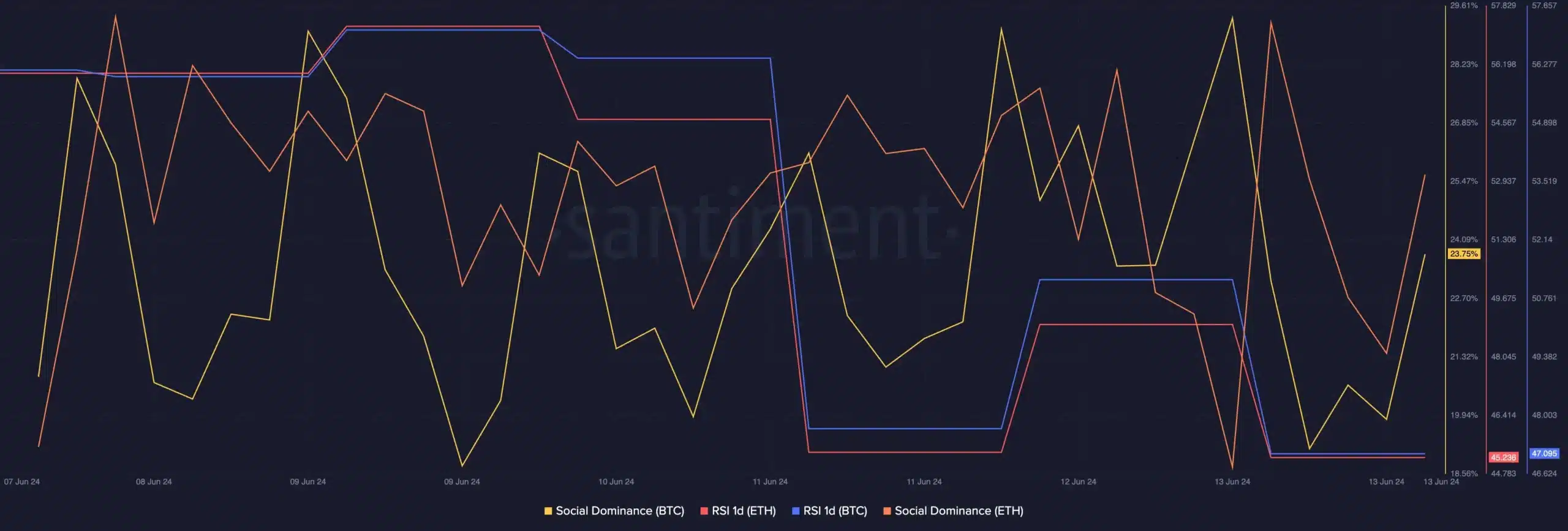

Value noting, nonetheless, that AMBCrypto’s evaluation of Santiment revealed that the social dominance metrics for each ETH and BTC had been shifting north. Regardless of this, the Relative Energy Index (RSI) remained flat, indicating no clear indicators of both bullish or bearish momentum.

Supply: Santiment