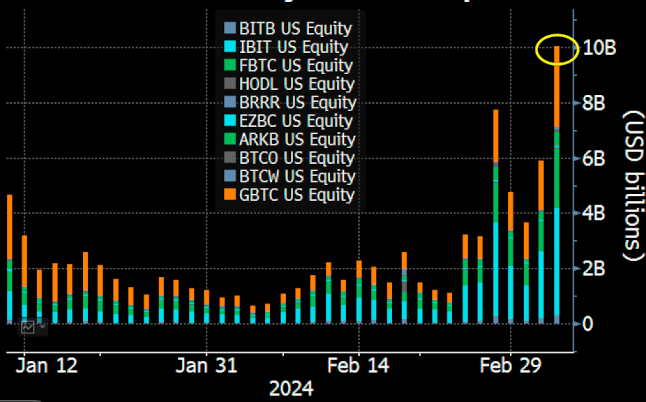

Spot Bitcoin ETFs have continued their record-breaking efficiency this week, recording over $10 billion in quantity on March 5 — the very best since their launch in January.

The earlier file was set on Feb. 28, when the ETFs recorded a collective buying and selling quantity of roughly $7.7 billion.

IBIT, FBTC retain the lead

Three spot Bitcoin ETFs made up many of the whole quantity. Buying and selling closed with internet inflows of $109.86 million throughout all ETFs.

BlackRock’s iShares Bitcoin Belief (IBIT) was chargeable for about $4 billion in quantity on March 5, whereas the Constancy Clever Origin Bitcoin Belief (FBTC) made up roughly $2 billion. Grayscale’s Bitcoin Belief (GBTC) recorded $3 billion in each day quantity.

Bloomberg ETF analyst Eric Balchunas wrote on X:

“These are bananas numbers for ETFs below 2 [months] previous.”

Earlier within the day, Balchunas predicted that spot Bitcoin ETFs would doubtless surpass their earlier file as the entire quantity reached $6 billion round 7:53 pm UTC.

Particular person ETFs break data

Balchunas famous that IBIT, FBTC, BITB, and ARKB all skilled file each day volumes.

He additionally noticed distinctive efficiency amongst a number of non-spot ETFs that permit for strategic funding. BetaPro Inverse Bitcoin ETF (BITI), the ProShares Bitcoin Technique ETF (BITO), and 2x Bitcoin Technique ETF (BITX) all noticed file volumes.

A number of Bitcoin ETFs had been among the many most lively ETFs basically. Information from Barchart signifies that IBIT and the BITO topped the record, surpassing the S&P 500 ETF Belief (SPY) and the Nasdaq QQQ Invesco ETF (QQQ). GBTC and FBTC additionally ranked among the many prime ten ETFs by quantity.

The New child 9’s outstanding efficiency has been a vital driver of Bitcoin’s latest value surge as demand outpaces provide. The flagship crypto hit a brand new all-time excessive earlier than the halving for the primary time in its historical past.

All volumes coincide with Bitcoin (BTC) costs reaching new highs. BTC briefly touched $69,324 on March 5, surpassing its November 2021 all-time excessive of $69,044, earlier than a brutal value correction.