cemagraphics

Final weekend’s article warned the S&P500 (SPY) was at “Danger of Collapse” primarily based on quite a few bearish technical alerts. Maybe “collapse” is not one of the best ways to explain what occurred subsequent, however the motion certain wasn’t bullish. Essentially the most watched chart indicator of all of them, the 200-day transferring common, has been convincingly damaged. Because the market saying goes: “nothing good occurs under the 200dma.”

I now have a minimal draw back goal of 4049 for the S&P500. However what in regards to the most? This week’s article seems to be at how low it might go and what to search for to sign a reversal. Numerous technical evaluation methods can be utilized to a number of timeframes in a top-down course of which additionally considers the main market drivers. The goal is to offer an actionable information with directional bias, vital ranges, and expectations for future value motion.

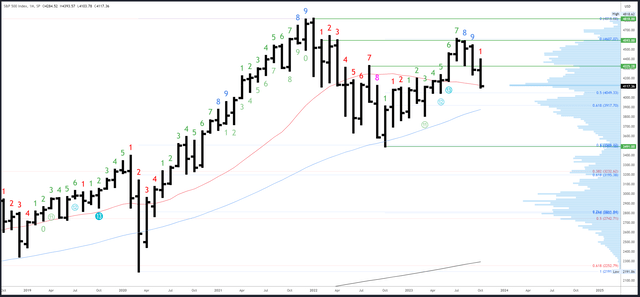

S&P 500 Month-to-month

With two classes left in October, the one method to nullify a bearish bar is for the S&P500 to rally again to the open at 4284 to create a “doji”. That is clearly unlikely and we would as properly chalk off a destructive month and give attention to how the November bar might both proceed or reverse.

Month-to-month help has now been examined within the 4130-40 space which is on the 20-month MA and the excessive quantity node. The latter is proven by the histogram on the proper of the chart which signifies 4130-40 is the place essentially the most quantity has traded over the past two years. In different phrases, merchants see this as a good value to purchase and promote. Really, this isn’t a conventional help degree (low quantity nodes displaying value rejection are higher) however value is prone to gravitate to this space.

Since help has been reached, the November bar might develop a reversal both by buying and selling an “inside bar” inside the October vary, and even higher, briefly check decrease after which get well again within the vary. This might point out a rejection of decrease costs.

The opposite choice is the November bar might proceed decrease. The subsequent good month-to-month help is 4049 which is a low quantity node and the April/Might double backside. Additionally it is the 50% retrace of the 2022-2023 rally.

The early phases of the November bar along with clues from the decrease timeframes ought to assist sign which state of affairs performs out.

SPX Month-to-month (Tradingview)

Month-to-month resistance is now the October excessive of 4393, then 4593-4607. 4325-35 should still be related in some unspecified time in the future, however has been chopped by a bit an excessive amount of to be a powerful degree.

The subsequent help is 4049 on the April-Might double backside in confluence with the 50% retrace. After that, the 50-month MA and 61.8% Fib are each round 3917.

The September bar accomplished a Demark upside exhaustion depend. That is having a transparent impact and the weak point can persist over a number of bars (months). November can be bar 2 (of a attainable 9) in a brand new draw back exhaustion depend.

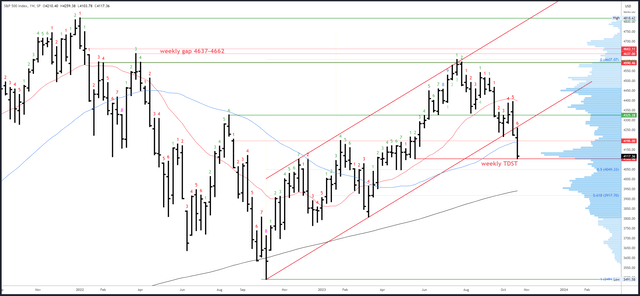

S&P 500 Weekly

The weekly channel has been convincingly damaged. Certainly, the rally within the early a part of this week turned again decrease at its underside and I commented on Tuesday morning, “…the bounce could be re-testing the damaged channel at round 4366.”

This gives additional proof the uptrend beginning on the October 2022 low is over and one other part is underway. There are quite a lot of potentialities for this stage starting from a brand new bear market focusing on 3280, to a a lot smaller drop ending at 4049 as a part of a sideways vary. At this level, I am leaning on another choice in the midst of these two extremes (for causes too prolonged to elucidate right here).

This week’s drop bottomed at 4103.78 which was proper on the weekly TDST of 4103.98. TDST is a Demark derived help originating on the low of the previous exhaustion depend. A sustained break is unlikely and not using a restoration/consolidation first.

SPX Weekly (Tradingview)

Preliminary resistance is now on the 50-week MA and 4195 degree.

4103 is TDST help, with the 4049 month-to-month help under and the 200-week MA round 3950.

A draw back (Demark) exhaustion depend can be on bar 7 (of a attainable 9) subsequent week. Reactions usually occur on bars 8 or 9 so a possible exhaustion sign is shut.

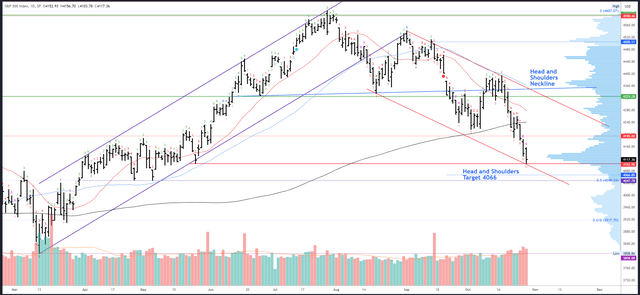

S&P 500 Every day

Friday’s weak shut is probably going undercut in some unspecified time in the future. Nevertheless, there are causes to search for a bounce (not a backside) within the 4100 space.

Channel help is in confluence with the aforementioned weekly degree.

A day by day Demark exhaustion sign accomplished on Friday. This will sluggish the decline however a sustainable backside possible wants weekly exhaustion which remains to be creating.

The day by day head and shoulders sample is nearing its goal of 4066 (not the 4093 I incorrectly labelled final week). Anybody brief this sample is probably going trying to cowl into weak point.

Quantity is choosing up however not fairly at capitulation ranges.

SPX Every day (Tradingview)

Resistance is 4186-89, then 4216 and the 200dma at 4240.

Assist is 4100-103, then 4049.

As talked about earlier. a draw back (Demark) exhaustion depend accomplished on Friday.

Drivers / Occasions Subsequent Week

Subsequent week can be a busy one.

Monday/Tuesday might see end-of-month re-balancing. If October closes close to the lows, November is prone to proceed the transfer down in some unspecified time in the future.

The FOMC assembly is on Wednesday, with information on ISM Manufacturing and JOLTS Job Openings additionally due for launch. Charges are nearly assured to be held regular regardless of inflation rising once more, a blow-off NFP quantity and GDP printing 4.9% this week. A lot for information dependency. Powell will at the very least try to sound hawkish and underline the “increased for longer” plan for charges.

Apple (AAPL) earnings are Thursday after the shut. Earnings season has been optimistic total with 3Q23 EPS gaining round 9% over 3Q22 figures. Nevertheless, the impact has been restricted and different drivers are at play.

NFP is on Friday. 182k is anticipated, down significantly from final month’s shock 336k. One other upside shock could be an actual headache for the Fed.

Possible Strikes Subsequent Week(s)

Mondays have been very sturdy in latest weeks. Certainly, this Monday’s decrease shut ended a 15-day streak of upper closes on Mondays, the longest ever. Even then there was a 66 level rally.

The percentages for one more sturdy Monday look first rate. With weekly and day by day help ranges already examined at round 4100-103, plus a day by day exhaustion sign, there must be stabilization and a bounce. A robust shut above 4118 ought to set the stage for 4156-70 into the FOMC assembly.

Nevertheless, any low made subsequent week is sort of actually not the underside. Even when the S&P500 had been to stage a multi-week rally by 4216 to as excessive because the 4400s, it might solely arrange one other leg decrease at a later date to a minimal of 4049.

If this massive bounce is to play out it actually wants to begin subsequent week. Any additional bearish value motion by 4100 would arrange a way more direct transfer decrease with smaller bounces from 4049 and 3917. The March low at 3808 may very well be the eventual goal.

A collapse by 3491 to 3280 is feasible, however I can not name to this point forward, but, and there are the explanation why I feel this would possibly not play out (the sample on the Dow Jones (DJI) being one in every of them). This state of affairs would come to the fore if the S&P500 crashes to 3800 instantly with negligible reactions at help.