sefa ozel

Overview

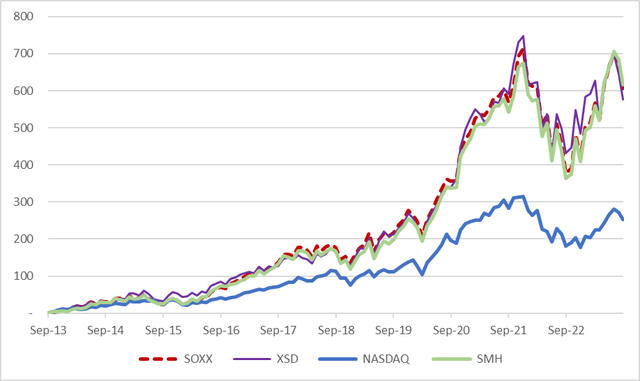

The iShares Semiconductor ETF (NASDAQ:SOXX) supplies broad publicity to the Semiconductor sector together with chip designers, producers, and gear provide chain. Efficiency has been very robust, up 500% within the final 10 yrs, outpacing the NASDAQ (NXP) and nearly similar to see ETFs.

As many traders could also be conscious, semiconductors are key constructing blocks within the digital age. Nonetheless, demand is cyclical, usually ebbing and growing with world GDP. There are various chip purposes from PC and smartphones, blockchain information crunchers, graphics chipsets to extra simplistic sensors which have impacted the auto makers and now AI information processing. Most firms are utility targeted, a number of firms, comparable to Nvidia (NVDA) have been capable of weave into new purposes. Then there are the producers comparable to TSM that construct chips for everybody else and eventually the gear suppliers comparable to ASML and LRCX.

This cyclicality is obvious in YE23, with many shares posting earnings declines. Some seem to rebound quickly in YE24, and others look fairly weak for longer.

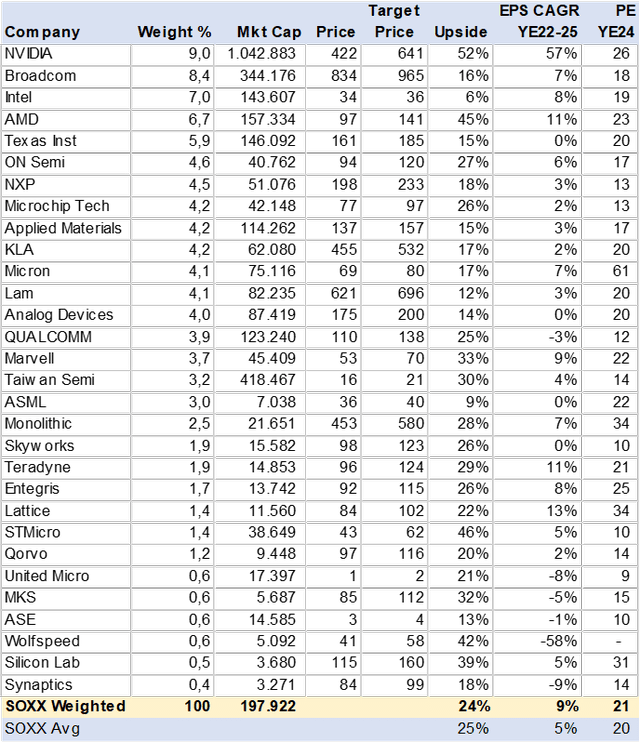

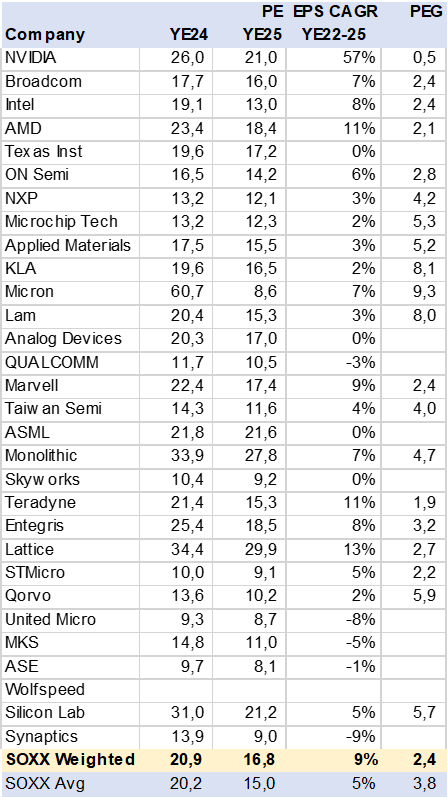

I calculated that the ETF weighted portfolio has 9% EPS CAGR (YE22-YE25) with a PE of 21x and upside potential of 24% on consensus estimates.

SOXX Vs Friends and NDX (Created by writer with information from Capital IQ)

Trying Underneath the Hood

I analyzed the 30 shares that make up the ETF. Utilizing consensus information; EPS, Value goal, Income, and Web debt. The weighted upside on consensus worth targets seems fairly interesting at 24% to YE24. Nonetheless, the EPS CAGR of 9% (YE22-YE25) is low for my part. This sluggish progress is a perform of excessive pandemic outcomes adopted by a cyclical decline put up pandemic.

SOXX Consensus Value Goal (Created by writer with information from Capital IQ)

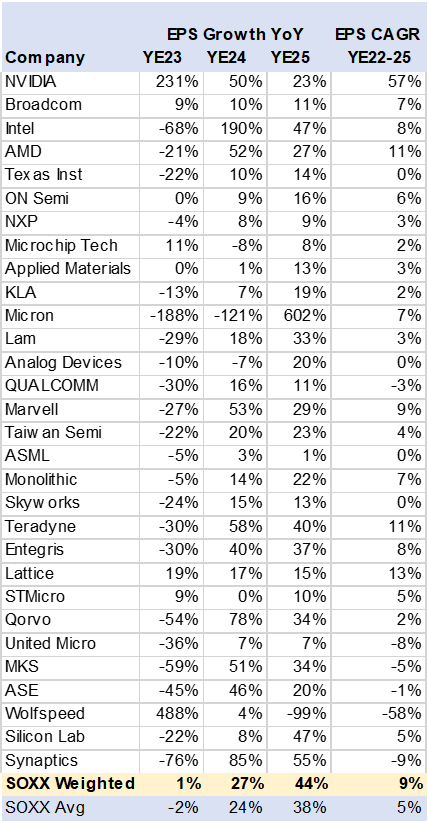

Vital Earnings Disparity Projected

Consensus year-over-year (YoY) EPS progress charges spotlight vital disparity among the many firms. The bulk have declining EPS estimates in YE23 which drives a weighted EPS progress fee of 1%. This disparity follows into YE24 estimates with EPS slated to develop 27%. Nonetheless, that is an optical phantasm, most firms won’t but return to YE22 absolute earnings ranges. Notably weak shares are Micron (MU) and Qualcomm (QCOM).

SOXX Consensus EPS YoY Development Charges (Created by writer with information from Capital IQ)

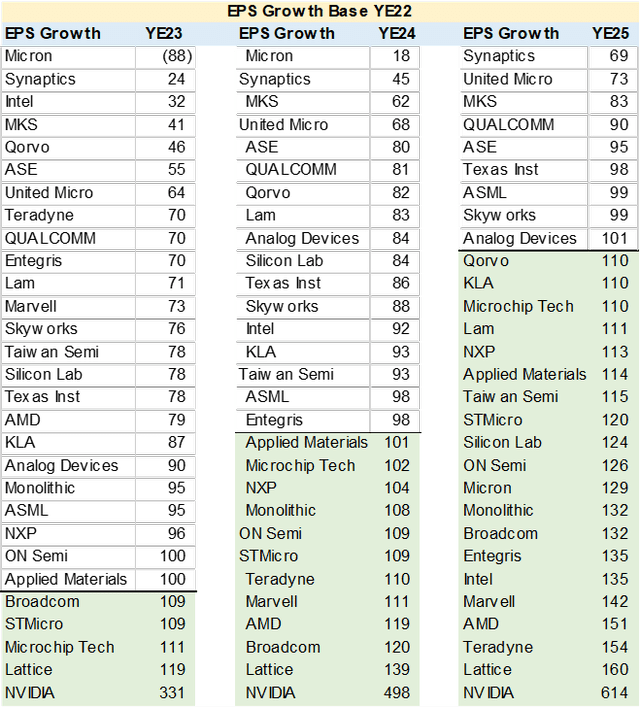

Structural Earnings Weak spot

To additional illustrate this structural earnings weak point, I rebased EPS to 100 in YE22. For example, Lattice (LSCC) estimated EPS grows to 119 in YE23, 139 in YE24 160 by YE25.

As will be seen within the desk beneath, I calculated that solely 5 shares have progress estimated in YE23 i.e., above 100. Whereas in YE24, simply 11 see optimistic earnings progress vs YE22. This erratic and/or cyclical earnings information means that the majority of the semiconductor sector “Over Earned” in the course of the pandemic and plenty of are seeing downturns by means of YE25 i.e., any inventory not above 100.

SOXX EPS Development Rebased to YE22 (Created by writer with information from Capital IQ)

Valuation

The PEG (PE/EPS Development) metrics ought to issue within the volatility of EPS consensus estimates in the course of the YE22 to YE25 timeframe. Many shares seem to expertise prolonged earnings contraction in absolute phrases from YE22 to YE25. This isn’t captured within the YoY EPS progress charges and distorts the earnings energy of many firms.

For instance, Intel (INTC) is anticipated to see a 68% EPS decline in YE23 after which a 190% acquire in YE24 however in absolute time period EPS continues to be beneath YE22 ranges. Is Intel low cost at 19x PE if long-term progress is estimated at 8%? I do not suppose so.

Utilizing longer-term EPS (consensus) CAGR from YE22 to YE25 I calculated a weighted PEG of two.4x, EPS progress of 9% vs YE24 PE of 21x. Whereas this isn’t horrible vs the SP500 (SPX) and even Nasdaq it appears to me that traders can discover higher choices.

SOXX PE & PEG Estimate (Created by writer with information from Capital IQ)

Conclusion

For my part, this ETF is unappealing from a progress and valuation standpoint. The YoY EPS progress estimates are an optical phantasm in lots of instances and signify recuperation vs precise progress as firms take care of a cyclical downturn. AI-driven demand appears to be relegated to some. As well as, the analyst worth targets and valuation don’t appear to coincide with long run earnings energy of this sector.