PhonlamaiPhoto

The bull market that has taken place since late October has been nothing in need of breathtaking. Just about all the things is increased, and the most important beneficiaries of the rally have been risk-on areas of the market. That’s typical for terribly bullish intervals, and as we glance into 2024, I see extra bullishness forward.

Nevertheless, we seem like in want of some consolidation and that’s very true for the semiconductors. I’ve been bullish on the semiconductors and stay so, however they’ve come too far, too quick for the time being. I just like the Direxion Every day Semiconductor Bull 3X Shares ETF (NYSEARCA:SOXL) for publicity to the semis. First, it does an excellent job of monitoring its index, and second, it presents leverage for capital effectivity.

On this article, I’ll preserve my bullish stance on the semis, however notice the place I believe it will be most advantageous to purchase SOXL, as I believe we’d like additional proof of a backside earlier than leaping in. Due to this fact, my purchase score is for the medium time period, whereas noting short-term warning. Let’s dig in.

What’s SOXL?

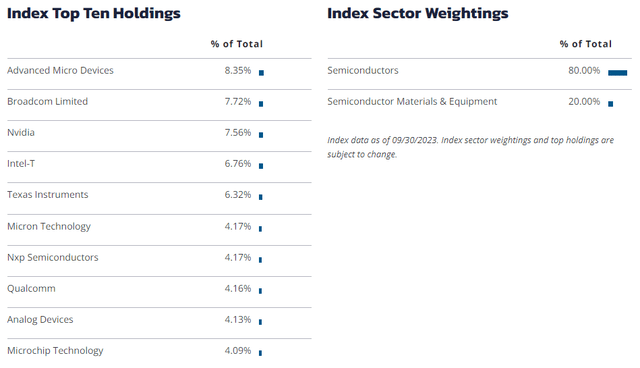

Briefly, SOXL is a 3X leveraged product that tracks the NYSE Semiconductor Index. That index is one which holds a mixture of semiconductor producers and those who make associated supplies and tools.

Fund web site

It’s a very good distance from being a diversified fund; it’s an especially concentrated wager on a particular subsector of know-how equities. That will increase threat, but additionally will increase potential reward.

Given SOXL is an ETF that seeks to return 3X the every day return of the semiconductor index, it’s extraordinarily unstable. Choices on SOXL for the time being have implied volatility of about 70, which is one thing like ~6X that of the S&P 500, only for some context on what we’re coping with right here.

For these causes, SOXL is a buying and selling car, not one thing you purchase and neglect about for years. It is a product that enables focused publicity for comparatively brief intervals of time as a way to maximize return on invested capital. Returns go each methods, nevertheless, and there is plenty of threat concerned.

Leveraged merchandise are riskier than their non-leveraged counterparts, so maintain that in thoughts as we undergo the setup right here. In case you’re searching for additional studying on how these merchandise work – and the dangers concerned – there are terrific assets out there. Each FINRA and the SEC have assets for buyers to arm themselves with data to commerce these merchandise. I am not going to undergo what’s within the linked posts however I simply need to make it clear there are enhanced dangers anytime leverage is employed.

With that out of the way in which, let’s take a look at the setup.

A bull run that wants a breather

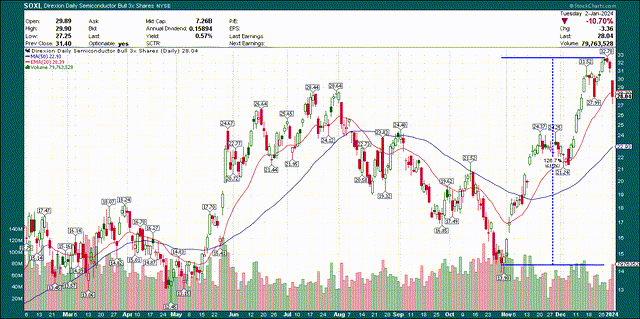

We’ll begin with a chart of SOXL itself, however do the true evaluation on the semiconductor index that SOXL tracks (or at the least a proxy for it).

StockCharts

SOXL rose 127% from the October backside to the height a couple of buying and selling days in the past, which is about on par with the final huge rally that began in Could of final yr. The issue is that this one-way motion has left the fund extraordinarily overbought an in want of a pullback and/or consolidation. We are able to see it’s already off nearly 15% from the excessive, together with an 11% beat down on Tuesday. I concern there could also be a bit extra draw back short-term given the way in which the index itself is buying and selling. Let’s now check out the index itself to see what kind of goal we must always place on SOXL.

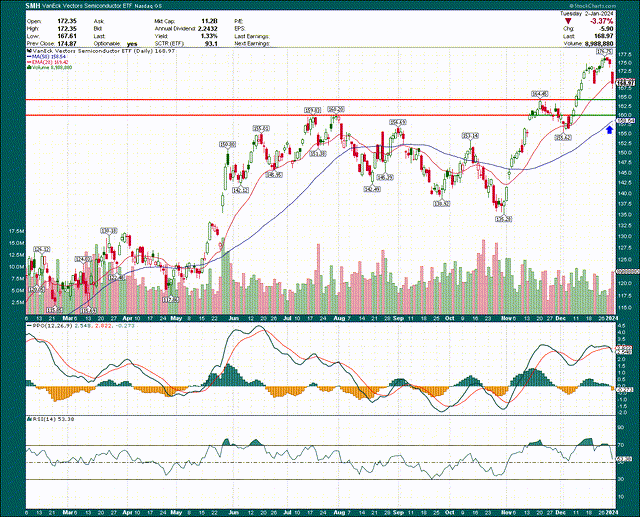

We’re utilizing the SMH ETF under as its correlation to SOXL could be very near 100%, so it’s a wonderful non-leveraged option to view SOXL’s prospects.

StockCharts

I’ve positioned help on the prior excessive of $164, in addition to the double prime from July at $160 as ranges to observe. The 20-day exponential transferring common failed yesterday and until it’s regained rapidly, my base case is a 50-day easy transferring common check.

The excellent news is that the 50-day SMA is $159 and rising, which signifies that when/if the index reaches that degree, we’ll not solely have main transferring common help, but additionally the 2 help ranges recognized above. That confluence of help ought to create a good spot for the bulls to make their stand.

Now, we’re speaking about one other 3% to six% in spherical numbers of draw back threat within the index, or about 9% to 18% in SOXL. Meaning I’m inserting my draw back goal at $23 to $25 on SOXL, and that’s the place I’m interested by longs. My view is that we’ll see the promoting take the fund all the way down to that space, after which we’ll see renewed shopping for exercise, in order that’s my plan.

Charges stay a tailwind

I’ve made it very clear in my items right here on In search of Alpha that I’m bullish for 2024, notably in tech shares. Semis are an enormous beneficiary of tech bull markets, and SOXL is 3X leveraged to that so the potential right here is big, in case you can correctly handle threat. I’ve hopefully made it fairly clear not solely that SOXL inherently has plenty of threat, but additionally the place you’ll be able to contemplate taking a place to reduce your threat and increase the percentages of a good return on capital.

Now, let’s check out an enormous tailwind that I believe will assist renew this bull transfer within the comparatively close to future.

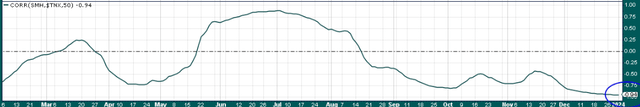

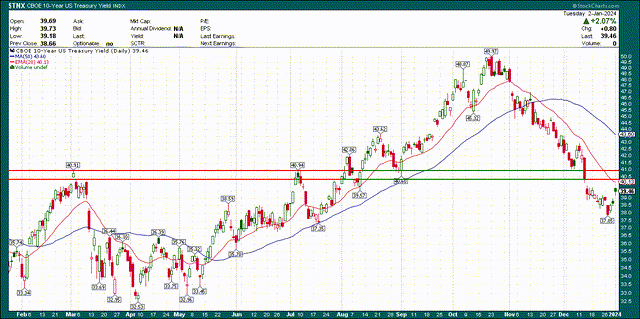

Beneath we now have the 50-day rolling correlation of the semiconductor index to the 10-year Treasury yield, and we will see it’s -0.94. Meaning charges and the semis transfer nearly completely inversely to one another.

StockCharts

That means that we will take a look at charges as a secondary clue as to the place the semis could commerce, given we will fairly count on charges and the semis to maneuver reverse one another. Let’s now check out charges to see what we will study.

StockCharts

The large uptrend in yields that ran from Could to October was decisively damaged and hasn’t even come near recovering. It isn’t a coincidence that equities behaved roughly reverse of this chart in 2023, as equities are likely to carry out the very best when charges are low and/or falling. That’s notably true of tech shares, and positively true of the semis.

My view on charges is that as long as the 10-year stays under that vital degree of about 4.00% to 4.10%, it’s an excellent factor for equities. The ten-year is arising towards the rapidly-declining 20-day EMA proper now, which itself is just under that vital degree famous. To my eye, which means this current bounce is probably going very close to its finish, and when/if the bounce in charges ends, we’ll see risk-on equities begin to outperform as soon as extra.

The underside line

This all traces up very properly for my part, and that’s why I believe we now have the potential for some short-term continued weak point within the SOXL. This weak point, I consider, can be measured in days and never weeks, and that when a brand new relative low is fashioned, we’ll be off to the races as soon as extra.

If we sum all this up, I see SOXL as an effective way to reap the benefits of what I consider can be a continued bull market in semiconductor shares in 2024. There may be nice threat in proudly owning any leveraged fund, and SOXL isn’t any exception, so be prudent together with your cease losses and place sizing, in case you determine to make use of it in any respect.

My goal draw back for this present promoting on SOXL is about $23 to $25, and I see it as a robust purchase at these ranges. This promoting ought to abate within the coming days as I consider rates of interest are going to make an area prime earlier than persevering with their downtrend.