Vertigo3d

The synthetic intelligence (“AI”) market stays sizzling for chip shares, however enterprise AI software program shares are nonetheless struggling regardless of rising deal flows. SoundHound AI, Inc. (NASDAQ:SOUN) is one other AI inventory with promising order stream, however a inventory caught on the lows with monetary outcomes not essentially matching the sector. My funding thesis is much extra Bullish on the inventory, buying and selling on the lows following the newest deal.

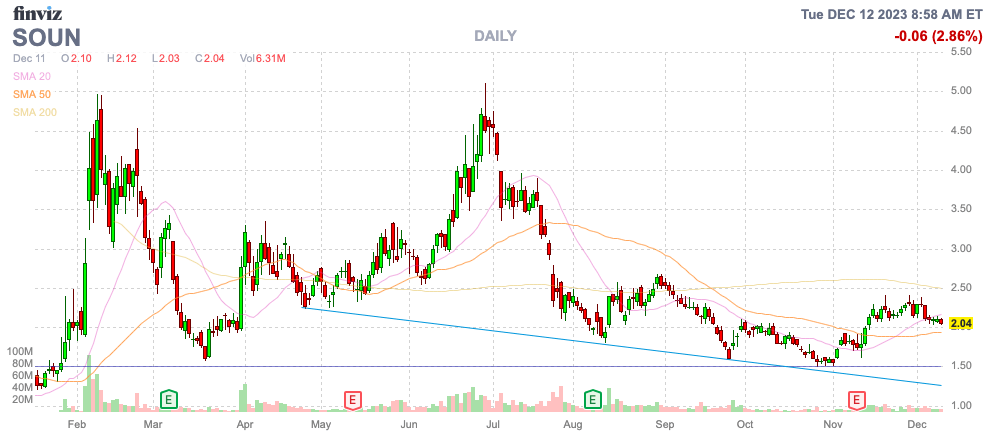

Supply: Finviz

AI Voice Push

SoundHound AI has plenty of promising offers within the automotive and restaurant area. The AI voice firm does not have plenty of revenues regardless of a backlog topping $341 million, although solely up 13% YoY.

Numerous the backlog is for automotive offers with contract phrases of as much as 10 years. The typical contract within the backlog has a time period of 6.5 years.

In essence, the backlog is not actually going to maneuver the narrative within the quick time period. The actually thrilling class is the push into AI voice ordering within the restaurant area.

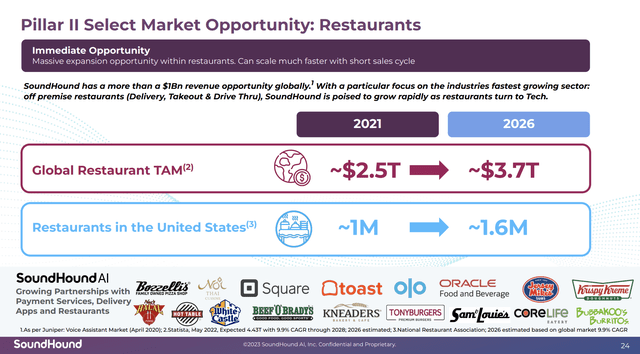

SoundHound AI introduced some large new restaurant offers not too long ago and a deal within the area of greater than doubling items below contract. The restaurant alternative is projected at greater than $1 billion, with home eating places sitting at 1 million potential clients.

Supply: SoundHound AI Q3’23 presentation

The voice AI firm had beforehand disclosed a take care of White Fort, and now Jersey Mikes and Krispy Kreme have been added to the combination. On the Q3’23 earnings name, CFO Nitesh Sharan highlighted the present potential within the area:

With solely the manufacturers we now have signed to-date, at scale and full deployment throughout these clients’ teams, we’d now have over 4,500 places and effectively over $25 million in ARR.

SoundHound AI introduced an extra push into voice AI for eating places with the current deal for SYNQ3 Restaurant Options for $25 million. The corporate now boasts over 10,000 restaurant places signed with a pipeline of 100,000 places.

The massive query is the income impression, with SoundHound AI projecting $25 million in annual ARR with 4,500 places signed and this deal greater than doubling the places. The corporate solely paid $25 million, suggesting the income potential might be far beneath the run price from SoundHound AI, with the same quantity of places signed to offers.

The deal is for 80% in inventory and 20% in money. That SoundHound AI would solely pay $5 million in money whereas the rest is in inventory is an effective signal that SYNQ3 shareholders see a possible upside within the public inventory.

Huge This autumn

SoundHound AI reported Q3 revenues of $13.3 million for a brand new report quarter quarterly quantity. Revenues solely grew 19% YoY from the height income stage of $11.2 million final Q3.

The corporate noticed income dip all yr till this September quarter. The secret is steering for This autumn income of between $16 to $20 million. SoundHound AI would take an enormous step ahead with such income progress, and the SYNQ3 deal might present the icing on the highest, with some further income thrown into the combination.

The inventory has a market cap within the $500 million vary and the funding story will get very attention-grabbing with the 2024 income targets at $70+ million. The corporate forecasts being adjusted EBITDA worthwhile within the present quarter, however the analyst estimates counsel a year-end income flush, with March revenues dipping once more.

SoundHound AI already has signed offers for $25 million in voice AI for eating places, and the SYNQ3 deal on the floor would counsel the quantity doubles to $50 million. Whereas the ARR from the acquisition is not clear and the $25 million deal worth suggests a decrease worth, SoundHound AI will nonetheless have the potential so as to add 10x these signed places and probably upsell the SYNQ3 places to increased worth service of Dynamic Interplay and Good Answering merchandise.

The largest threat to the story is the steadiness sheet and whether or not SoundHound AI can develop into adjusted EBITDA worthwhile throughout This autumn. The AI firm has reduce a ton of prices within the final yr, however the steadiness sheet solely has a money steadiness of $110 million. If administration cannot reduce money burn that hit $54 million YTD after Q3, shareholders will face further dilution.

Takeaway

The important thing investor takeaway is that SoundHound AI, Inc. is making plenty of progress on voice AI offers. The corporate is ready to report an enormous This autumn with a powerful pipeline. If the corporate can flip the brand new acquisition and the large restaurant pipeline into stable income progress, traders can be rewarded right here, with the inventory buying and selling on the lows of round $2.